Summary:

- Rivian is set to announce its financial results for the first quarter of 2024 tomorrow, May 7, after market close.

- Competition from Kia’s EV9 poses a threat to Rivian’s R1S. Let’s look at a detailed spec by spec comparison.

- I share the two reasons why I’m not optimistic about Rivian’s future, and the one financial metric that I deem most important for tomorrow.

tumsasedgars

Rivian Automotive, Inc. (NASDAQ:RIVN) will announce its financial results for the first quarter of 2024 on May 7 after market close. This article presents my earnings preview along with the indicators that I will be watching on Tuesday.

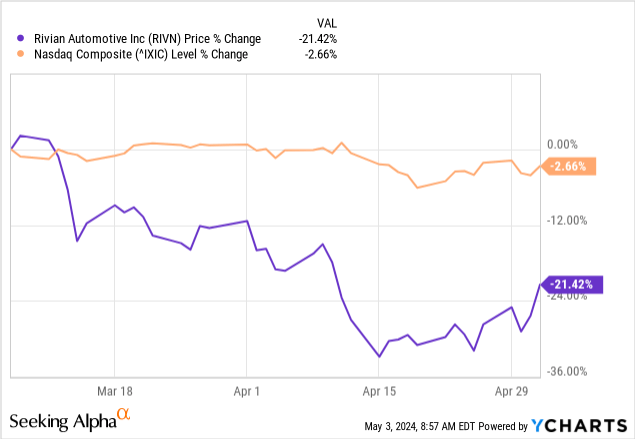

I last reviewed the company in my article, “Rivian: Sell Into Hype,” in which I compared the Rivian R2 to the Tesla (TSLA) Model Y, discussed how likely price declines for the Cybertruck would impact Rivian’s products, and analyzed the financial challenges that Rivian faces in the coming months. Since my article, the Rivian stock price declined by 21 percent, underperforming the NASDAQ index by 19 percent, as the following graph illustrates:

Next, I review recent data regarding Rivian’s two existing products, the R1T, the mid-size, light-duty truck, and the Rivian R1S, the full-size SUV.

Rivian’s Resale Values Continue To Decline

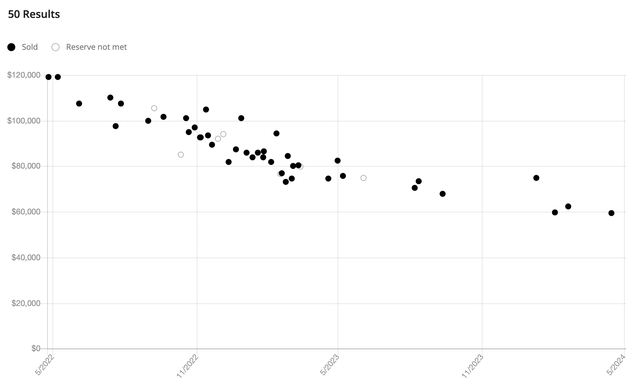

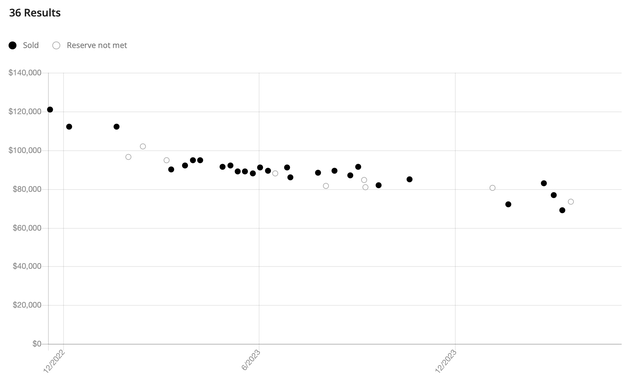

I periodically review automotive resale values as a proxy for demand trends across the industry, and the following two charts show the ending prices of recently closed auctions for the Rivian R1T and the Rivian R1S, respectively:

The above chart for the R1T shows a relatively consistent decline of 50 percent in the two years from $120,000 in May 2022 to $60,000 in April 2024.

In contrast, the below graph for the R1S shows that its resale value decline from $120,000 in November 2022 interestingly paused in Q2 2023, and prices hovered just above $80,000 throughout the six-month period including the summer and fall of 2023, and resale values recently resumed their decline with four of the most recent five auctions ending below $80,000:

The distinction is important because here’s what RJ Scaringe, Rivian’s Founder and CEO, said about resale values on the company’s Q3 2023 earnings call:

As it pertains to R1, of course, you can see in the numbers for Q3, we continue to maintain an extremely strong market share position at the price points at which the R1 platform operates. So as you think about volume of vehicles, electric vehicles sold, let’s say, at over $75,000 price point. We’re a very significant market share player, that the brand is connected incredibly well with consumers. And we’re seeing that translate to not only continued excitement for the brand, but we see that really manifest as really strong residual values and in particular, really strong used vehicle pricing. So Google search of used Rivian R1S will just reveal just how robust the pricing and therefore, the demand for these products are.

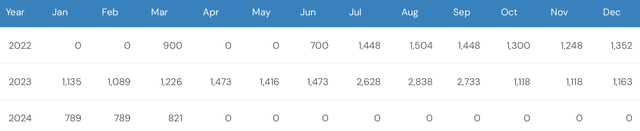

RJ Scaringe made that comment on November 7 of last year, but following the recent decline in the resale values of Rivian vehicles, I expect to see a shift in management’s tone regarding demand, especially for the R1S, from positive to relatively cautious. Further, I believe a significant drop in the sales of the R1S is in the cards for future quarters, just like what happened to R1T sales once the company worked through the R1T backlog, as the following table shows:

According to monthly estimates provided by GoodCarBadCar and shows in the above table, Rivian R1T sales have declined by 71% from 2,838 in August of 2023 to 821 in March of 2024. I expect R1S sales to also decline throughout 2024, in part due to new competition in the segment, as I discuss in the next section.

Rivian R1S Faces Intensifying Competition

Kia started the production of its three-row, electric SUV, the EV9, last year, and following a period of production ramp, Kia this week announced that the sales of the EV9 reached an all-time high of 1,572 units in April, leading to a 144% year-over-year increase in Kia’s EV sales.

For the purposes of my article and based on a U.S. News article and other sources, I reviewed all relevant spec data, created the following comparison table by category, and selected the winner for each category:

| Category | R1S | EV9 | Winner |

|---|---|---|---|

| Starting price | $74,900 | $54,900 | Kia |

| Warranty | 8yr/175K miles | 10yr/100K miles | Tie |

| Seats/comfort |

7-seat layout Tight third row |

6 or 7-seat option Spacious third row |

Kia |

| Interior quality | Luxury |

Premium |

Rivian |

| Cargo space | 104 cu ft | 82 cu ft | Rivian |

| Acceleration | 0 to 60 in 3 sec | 0 to 60 in 5 sec | Rivian |

| Range | Up to 352 miles | Up to 300 miles | Rivian |

| Ride & Handling | Air suspension | No air suspension | Rivian |

| Safety | 5-star Euro NCAP | Tie |

Based on the data I presented in the table, I conclude that the Rivian R1S is the relatively better vehicle. Having said that, I believe the Kia EV9 compares well to the Rivian R1S in terms of significant value provided at a $20,000 lower starting price; therefore, I expect the Kia EV9 to take market share from the Rivian R1S in the coming periods. Further, the Kia EV9 is currently imported to the US from South Korea, so it is not eligible for any non-lease federal EV tax incentives, but according to this InsideEVs article, “Kia expects the EV9 to qualify for the full credit by 2025,” which further supports my prediction.

With that backdrop in mind, let’s turn to the upcoming earnings release.

Watch Rivian’s Operating Margin

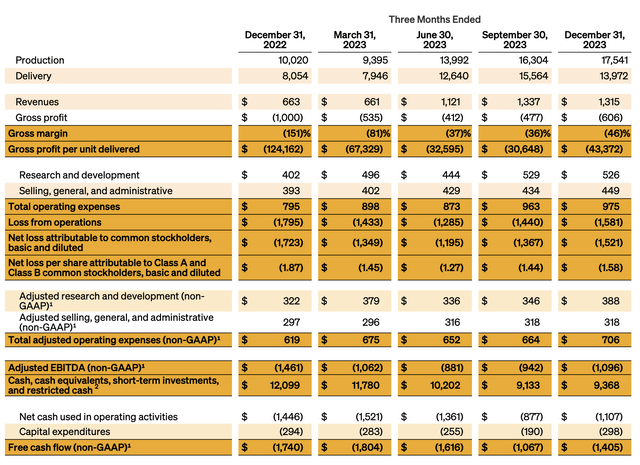

The following table included in Rivian’s Q4 2023 Shareholder Letter illustrates the company’s quarterly performance in each of the last five quarters:

Even though Rivian does not show its operating margin in the investor letter, I believe that the company’s operating margin and free cash flow are the more relevant metrics to forecasting Rivian’s future rather than its gross margin, which excludes operating costs that have continued to rise in recent quarters. If management forecast of “modest gross profit in the fourth quarter of 2024” comes at the cost of rising operating expenses and capital expenditures in future periods, I would not expect the market to view that outcome positively.

Critical to Rivian’s future, I included my take on how the Rivian R2 compares to the Tesla (TSLA) Model Y in my previous article titled, Rivian: Sell Into Hype, so I won’t rehash it here, but I do recommend that you read it to fully appreciate the competitive challenge that Rivian faces in the coming periods.

Upside Risk For Rivian Stock

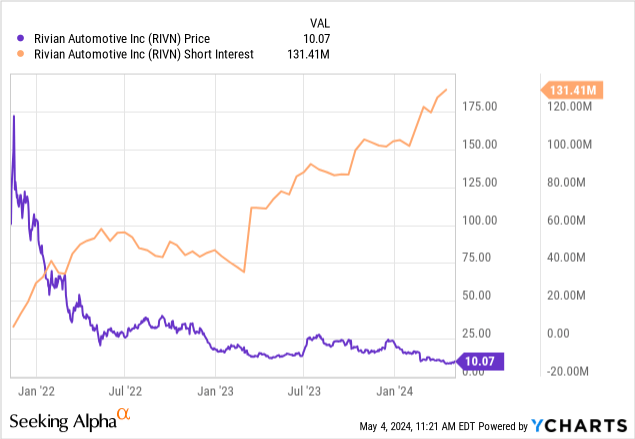

The short interest in Rivian stock has more than tripled since early 2023:

As a percentage of shares outstanding, the short interest in Rivian has reached 19% with five days to cover, meaning there’s a material probability of a short squeeze in the Rivian stock if the company announces positive results. I’d like to share two possible scenarios that could lead to a short squeeze.

First, Rivian shut down production at its factory in Normal, Illinois, between April 5 to 30 to retool for a minor refresh of its vehicles, and Chris Hilbert, a Rivian investor that I follow to understand the bull side of the debate, expects to see some cost savings coming out of this shutdown. If Rivian can slash its production cost of R1T and R1S materially, then RIVN could react positively.

Second, Rivian enjoys strong customer loyalty, according to Chad Moran, another Rivian investor that I read to understand the bull side of the debate. If Rivian’s strong brand loyalty translates to higher R1T and R1S sales even as Kia EV9 production increases, then RIVN stock could react positively.

Before submitting my article, I asked RIVN investors to share with me any positive developments that I may have missed, and you may read their replies to my post on X. I’m actively involved in the comments below my articles because I’d like to interact with my readers to quicken the feedback loops and address head-on any disconnects in discourse as soon as possible. So if you have any feedback, questions, or comments for me, please leave a reply below this article.

The Bottom Line

I believe that Rivian woke up to the urgency of its financial situation too late and that it’s doing too little to change it, especially in the face of growing competition. Until Rivian substantially improves its operating profitability, which I will be watching on Tuesday, I maintain my Sell rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.