Summary:

- Rivian Q1 results come in mixed.

- Company reaffirms yearly guidance.

- Shares looking to rebound from yearly lows.

Mario Tama

After the bell on Tuesday, we received first quarter results from Rivian (NASDAQ:RIVN). The electric vehicle startup is working intensely on the second year of its major production ramp for its R1 platform, but shares have tumbled thanks to numerous growing pains. While the overall report wasn’t as great as it could have been, Rivian is making improvements that hopefully will help shares move higher when growth really takes off.

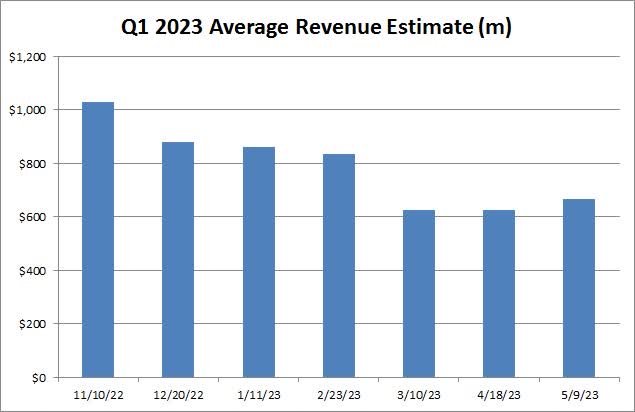

Over the past six months, we have seen expectations come down a bit when looking at the revenue picture. The company did give a very conservative forecast for 2023 production back at its Q4 report, causing analyst estimates to come down quite a bit. As the chart below shows, the street average did come up slightly recently once we got production and delivery figures, but the average Q1 2023 revenue estimate went into Tuesday’s report at half of what it was when Rivian’s ramp was really starting in early 2022.

Q1 2023 Average Revenue Estimate (Seeking Alpha)

The Q1 analyst average was just a hair above what we saw Rivian report in Q4, despite deliveries ticking down sequentially by just over 100 units to 7,946 vehicles. As it turned out, the recent tick up in estimates above was important, as Rivian reported Q1 revenues of $661 million, missing street estimates by $4 million. This was a sizable increase in percentage terms over the prior year period, which saw less than $100 million in revenue.

For Rivian this year, the goal is to basically double production and work on getting the cost base in line. As the graphic below shows, margin percentages continue to improve, but the company is still losing a lot of money. Rivian’s cost of goods sold is still well above revenue levels, but hopes are that gross profitability can be reached sometime next year. The company lost about $1.35 billion for the period on a GAAP basis, but that was actually an improvement of nearly $250 million over Q1 2022. The non-GAAP earnings per share loss of $1.25 was 34 cents less than the street was expecting.

Rivian Key Financials (Company Earnings Reports)

The one item that has separated Rivian from the rest of the electric vehicle startups in recent years has been its cash position. Thanks to a very large IPO, Rivian has been able to withstand some significant cash burn, including another $1.8 billion in Q1 2023 alone. During the first quarter of 2023, the company issued green convertible senior notes which generated proceeds of approximately $1.5 billion, which explains why the cash balance shown above was only down a few hundred million on a sequential basis.

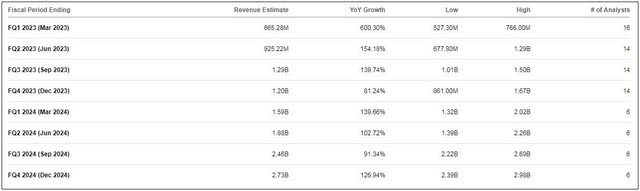

When it comes to guidance, there weren’t any big surprises. Rivian maintained its forecast for 50,000 units of production this year, although as I’ve noted in the past, there are internal hopes for a bit more than that. Adjusted EBITDA is expected to be a $4.3 billion loss, and $2 billion in capital expenditures are forecast. As production ramps throughout the year, deliveries should increase nicely from Q1 levels. In the graphic below, you can see the revenue growth that the street currently expects through the end of 2024.

Rivian Average Revenue Estimates (Seeking Alpha)

As for Rivian shares, they went into the earnings report around $14, which is well off its all-time high and just a stone’s throw from its public trading low. The average price target on the street is currently more than $26, so analysts see shares nearly doubling from here. However, that valuation figure is down about $4 in the last four weeks alone, and let’s not forget that the street saw this name as worth around $140 when it went public.

In the end, Rivian reported Q1 results that were good enough to help the beaten-down stock jump about 7% in the after-hours session. Revenues did miss street estimates that had popped a little recently, but the adjusted net loss was a lot less than was expected. The company is definitely making strides on production growth and margins, but is still losing a lot of money and burning a significant amount of cash. There could be some upside in shares if execution really starts to improve in the coming quarters, but this is going to be a very competitive space and a recession in the US could certainly impact vehicle sales later this year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.