Summary:

- Rivian investors are bracing themselves for more pain as the EV maker’s dismal performance persists.

- Investors are on high alert as the market grows increasingly anxious about the profitability trajectory of the company following its recent $1.3B fundraising efforts.

- Rivian’s operating efficiency is expected to be significantly worse than Tesla’s at the 50K production milestone, sparking concerns about its ability to compete.

- Amazon’s underwhelming order of just 10K EDVs for 2023 is poised to exacerbate Rivian’s already precarious position, raising more questions about its ability to scale up production.

- A perfect storm of headwinds has battered Rivian, hammering RIVN to new lows and leaving investors to consider whether Rivian could turn it around.

Justin Sullivan

Rivian Automotive, Inc. (NASDAQ:RIVN) has continued to underperform EV leader Tesla (TSLA) since November 2022. While TSLA remains well above (76%) its early January lows, despite the recent pullback, RIVN has dropped to a new low this week.

We believe EV investors have rotated out of RIVN over a myriad of factors, including weak execution, heightened competition, relatively low manufacturing efficiency, and further dilution fears.

Accordingly, Rivian announced its fundraising of $1.3B (up to $1.5B) through green convertible bonds to shore up its balance sheet. We discussed in our previous article that Rivian is expected to raise more cash even though it expects sufficient liquidity through FY24.

Therefore, some investors could have been spooked by the attempt by Rivian to raise funds now (interest rate of 4.625% p.a., payable semi-annually. It will mature on 15 March 2029), given elevated interest rates.

In addition, given its massive cash burn in 2022, investors could have questioned whether the company sees a longer path toward reaching its gross margin forecasts.

Moreover, the EV climate could worsen further, threatened by potentially deteriorating economic conditions, prolonging the much-needed ramp in Rivian’s production scale.

Does it make sense?

In a recent commentary, Morgan Stanley (MS) discussed that Rivian’s operating performance could be worse than Tesla’s at a similar production scale. Analyst Adam Jonas highlighted that Rivian expects to spend “nearly 2x the CapEx + OpEx spend compared to Tesla at [the] 50k unit milestone.”

Rivian’s slow ramp in reaching the 150K annualized capacity of its Normal facility has come home to roost. Therefore, we believe it demonstrates the inherent operating inefficiencies of Rivian’s business model, worsened by elevated Lithium prices and tougher competition.

With Tesla joining the fray with its potential volume production of its Cybertruck in 2024, the window of opportunity for Rivian to stake its market share is narrowing.

Moreover, the recent confusion over its 50K production guidance and the media reports indicating an internal 62K possibility likely didn’t convince investors. Reuters reported:

Rivian Automotive Inc said it was sticking to its official production forecast of 50,000 electric vehicles in 2023 after a Bloomberg news report said its executives had told employees it could possibly produce as many as 62,000 this year. The 62,000 figure was said in an internal meeting and was taken out of context, the Rivian spokesperson said. Bloomberg later said that the figure was given at an all-hands meeting as part of a “production master plan” for the year. The Rivian spokesperson declined to comment on the context in which the number was given or about a company master plan. – Yahoo Finance

Is management confident that it can meet 62K? If it does, it should communicate clearly to the market, as short sellers are riding on the possibility that Rivian might underperform again.

Because even a 62K target is still far below its Normal facility production capacity. Hence, we don’t think investors will be elated even if management upgraded its forecasts.

Whatever the case, management needs to communicate clearly, and not allow confusion to take root, giving different metrics and confusing the investing community.

Furthermore, it was also hobbled by the news that its top shareholder Amazon (AMZN) decided to purchase only 10K EDVs out of the 100K it “is committed” to purchasing through 2030.

Rivian doesn’t have time to wait until the bulk of orders arrives later, as it “desperately” needs to scale to improve its cost of goods sold or COGS per vehicle, as we highlighted previously.

Rivian’s sub-scale production ramp is hurting investors’ confidence. Earlier-than-expected fundraising (amid high-interest rates) also didn’t help, compounded by Amazon’s relatively small EDV order.

The critical question is whether RIVN could turn this around? Have the buyers returned to stamp the avalanche of sell orders?

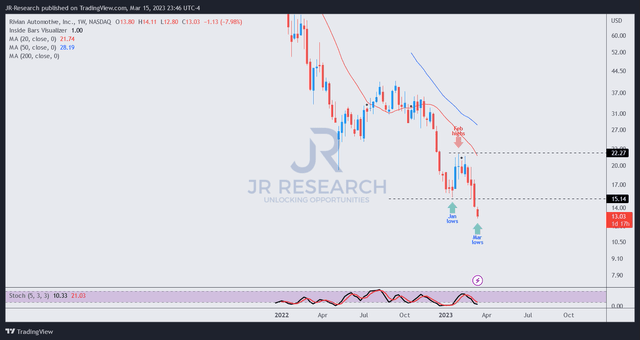

RIVN price chart (weekly) (TradingView)

As seen above, the recent selloff unleashed significant selling pressure that broke down its previous January lows.

However, we have yet to observe an abatement of selling pressure, as buyers stayed away.

Despite that, the extent and speed of the pullback should support a subsequent consolidation phase if buyers return, which is a big if for now.

Given the challenges outlined earlier, we believe the battering is justified, seemingly hitting RIVN all at once.

Investors looking to buy now need to have high conviction that Rivian can ramp confidently in 2023. Otherwise, the pain might not be over.

Rating: Speculative Buy (Reiterated).

Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. Our cautious/speculative ratings carry a higher risk profile. They are only intended for sophisticated investors/traders. We urge new or inexperienced investors to avoid relying on such ratings. Moreover, investors must exercise prudence and devise appropriate risk management strategies, such as pre-defined stop-loss/profit-taking targets, within a suitable risk exposure.

Disclosure: I/we have a beneficial long position in the shares of TSLA, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!