Summary:

- Rivian raised its production target for FY 2023, suggesting supply chain issues are easing. New production outlook implies 214% Y/Y growth.

- Rivian’s Q2 earnings report also showed improving cost trends and narrowing operating losses.

- Rivian has a strong balance sheet with a cash position of $10.2B, but its high valuation remains a concern.

- Given the raised production outlook, narrowing losses and easing supply chain headwinds, I am upgrading Rivian to hold.

hapabapa

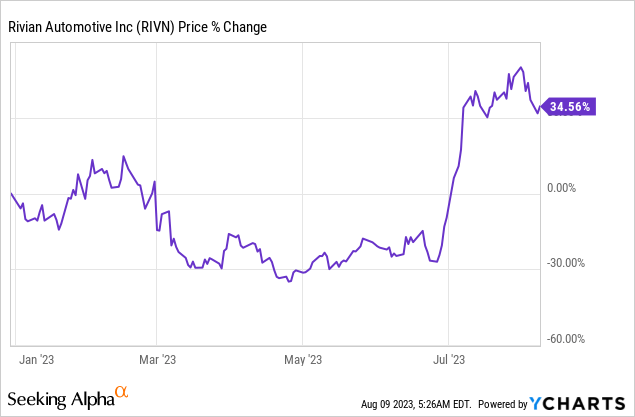

Electric vehicle company Rivian Automotive (NASDAQ:RIVN) reported a narrower than expected loss for the second-quarter on Tuesday and raised its production target for FY 2023… both of which are good reasons for me to raise the EV company’s rating from sell to hold. Rivian Automotive has seen a lot of skepticism with regard to its production ramp, following a guidance cut in FY 2022, but it appears that the situation is now slowly improving. The raise in Rivian’s FY 2023 production guidance suggests that supply chain headwinds are easing and that the electric vehicle company is slowly moving towards profitability… which I expect to be an inflection point for Rivian. What prevents me from issuing a buy rating at this point is Rivian’s P/S valuation which remains one of the highest in the U.S. electric vehicle market!

Previous rating

I am upgrading Rivian from sell to hold due to the EV maker raising its production outlook for FY 2023 and narrowing operating losses. Rivian’s high valuation is still a concern for me, however.

Rivian raises its production outlook for FY 2023

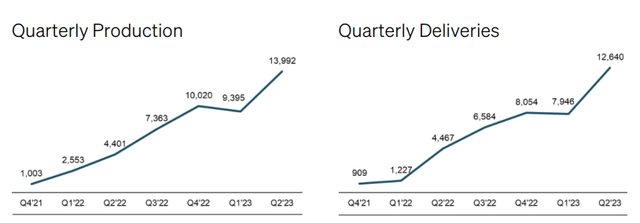

For the first time in a long time Rivian managed to deliver a positive surprise with respect to its production outlook. Rivian guided for an annual production volume of 50,000 electric vehicles prior to its Q2’23 earnings release, but on Tuesday Rivian raised its production target by 2,000 units to 52 thousand EVs (Source). Rivian produced 24,337 electric vehicles in FY 2022, suggesting investors can look forward to seeing 214% year over year production growth in FY 2023.

The revised production forecast implies that Rivian will be able to sustain its Q2 production momentum which is reducing uncertainty around Rivian’s R1T and R1S ramp. Rivian produced nearly 14 thousand EVs in the second-quarter and the production volume increased 49% compared to Q1 as the supply chain became less clogged. Improving supply chain conditions are the key reason behind Rivian raising its production target for FY 2023.

Source: Rivian

While in the last couple of years EV makers were largely valued based on their prospects for delivery growth in their end markets, I believe this could change going forward. With competition in the EV market heating up, more electric vehicles being available to consumers than ever before and pricing pressures increasing as a result, I believe we could see a situation in which investors prefer those electric vehicle companies that have strong balance sheets and have a clear path towards profitability.

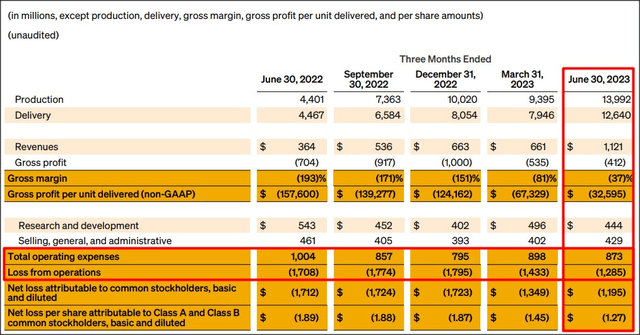

Narrowing losses, improving cost trends

There were a couple of things that stood out with Rivian’s second-quarter earnings report, including improving operating cost trends and narrowing losses for the EV maker. Of course, Rivian is still losing a lot of money and the company again posted negative gross margins for Q2’23, but the trend overall is improving.

Rivian generated an operating loss of $1.3B in the second-quarter which was down $423M compared to the year-earlier period. Going forward, Rivian can increase production volume and lower operating expenditures in order to further narrow its losses and drive the company towards profitability. Rivian’s operating costs fell $131M year over year in the second-quarter to $873M, in part because Rivian laid off workers earlier this year. Rivian cut 6% of its workers in the first-quarter due to growing competition and cost pressures.

Source: Rivian

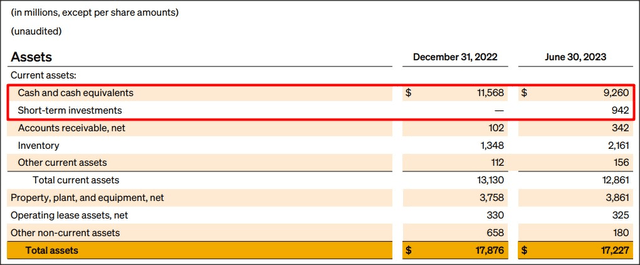

A look at Rivian’s cash situation…

Rivian once again submitted a strong balance sheet for the second-quarter that included a cash position, including short term investments, of $10.2B. This implies that Rivian burned through about $1.4B of cash since the start of the year which is not that bad considering that the EV maker produced about as many electric vehicles in the first six months of FY 2023 as it did in the entire FY 2022 (the YTD production total was 23,387 EVs vs. a FY 2022 production total of 24,337 EVs).

Source: Rivian

Rivian’s valuation vs. EV rivals

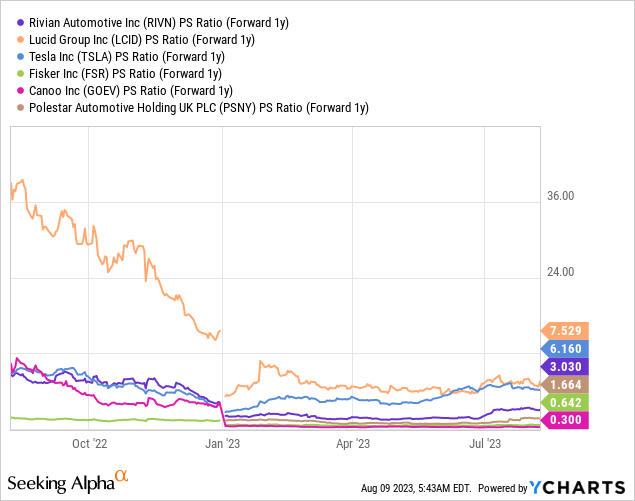

A key concern for me when it comes to Rivian is the company’s valuation which I am just not very comfortable with. Rivian continues to trade at one of the highest P/S ratios in the industry and the company is still years away from reaching profitability: based off of consensus estimates, Rivian is expected to be profitable in FY 2028, possibly a bit earlier if the R1T and R1S production ramp goes well.

While Rivian is not the most expensive EV stock that investors can buy, it is still expensive nonetheless: Rivian’s potential in the EV market is currently valued at a price-to-revenue ratio of 3.0X compared to a P/S ratio of 6.2X for Tesla (TSLA) and 7.5X for Lucid Group (LCID). Smaller EVs companies with less volume and revenue tend to trade at lower multiplier factors.

Based off of consensus estimates, Rivian is projected to grow very quickly going forward: between FY 2023 and FY 2028, Rivian is projected to see an annual average top line growth rate of 48% compared to 21% for Tesla, as an example.

Risks with Rivian

The biggest risk for Rivian is the R1T and R1S production ramp which exposes the EV company to timeline risks. Rivian has delivered multiple disappointments with regard to its production growth in the past… which has been the main reason for the company’s valuation decline since 2021. What I also consider to be a risk for Rivian and other EV makers is a deteriorating pricing environment which poses a challenge to gross margins. Since Rivian still reported negative gross margins in Q2’23, declining pricing power is set to have an immediate and negative impact on Rivian’s profitability situation.

Closing thoughts

I am rating Rivian as a hold after the company reduced a significant amount of uncertainty surrounding its production outlook and actually raised its production target to 52,000 electric vehicles in FY 2023. By raising its FY 2023 production guidance, Rivian signals confidence in its R1T and R1S manufacturing ramp and at the same time eases concerns about the supply chain… which has messed up Rivian’s production growth in FY 2022. Considering that losses are also narrowing and Rivian stands to more than double its production this year, I am upgrading the EV company to hold. What prevents me from issuing a buy rating, at this point, is the company’s valuation which continues to be one of the highest in the EV market!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.