Summary:

- Rivian Automotive, Inc. stock surged after Volkswagen’s investment, settling around $14, above moving averages.

- The Volkswagen deal validates Rivian, reduces risks, and aids in production expansion and distribution.

- Investor day highlighted cost reduction focus, production goals, and potential for selling puts as an investment strategy.

Sundry Photography

I wrote my first article on Rivian Automotive, Inc. (NASDAQ:RIVN) back on March 28, 2024. In that article, I suggested the stock was worth buying at around $10, after it had plunged from about $179 per share. A lot has happened since then, and particularly so with the announcement that Volkswagen (OTCPK:VWAGY) (“VW”) will invest in Rivian and also enter into a joint venture deal, the total of which could be valued at around $5 billion.

In addition, Rivian recently had an investor day. This was another reason why I wanted to take a closer look at this company to get an updated view and refine my investment and potential buying strategy going forward. With this in mind, let’s take a look at a number of new developments and some strategies I am considering going forward:

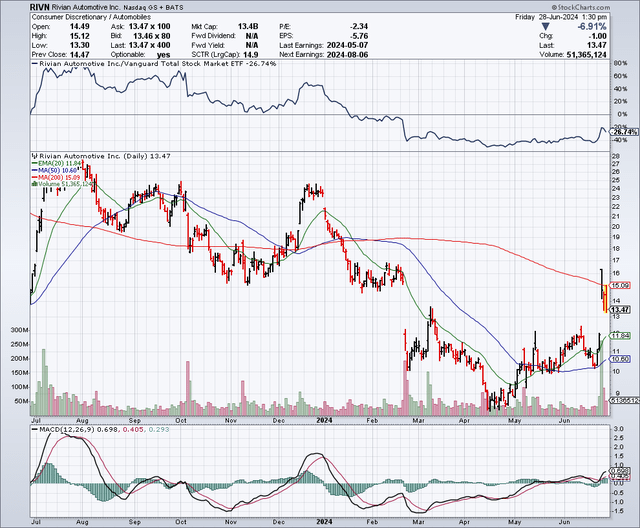

The Chart

As the chart below shows, Rivian shares recently surged from about the $10 level, to just above $16 per share, thanks to the newly announced deal with Volkswagen. These shares have settled in the $14 range, which is just below the 200-day moving average of $15.14 and well-above the 50-day moving average of $10.51.

The VW Deal Is A Game Changer

The deal that was announced with VW is so much more than just about the money. I view the VW investment in Rivian as a validation of this company and its vehicles from one of the world’s oldest and largest automakers. The cash infusion helps reduce uncertainty for shareholders and reduces risks, plus it gives Rivian capital that it needs to expand production to bring the R2 and other potential products to the market in 2026, and beyond.

VW will now have a vested interest in the success of Rivian, and it can help with manufacturing. I would also expect that it could help Rivian in terms of distribution of the upcoming R2 and other products in Europe thanks to its vast resources, capabilities and dealer network within Europe and other continents, including South America, for example.

I also believe that VW’s investment and joint venture deal with Rivian could help lower production costs as well as speed up production timelines. A Reuters article details some of the positives that are expected to come with this up to $5 billion deal with Rivian which include helping the company turn cash flow positive sooner, and it states:

“It will also help Rivian, known for its flagship R1S SUVs and R1T pickups, turn cashflow positive. The company will license its existing intellectual property to the JV, and the R2 will be the first vehicle using software from the JV. Volkswagen vehicles, including its Audi, Porsche, Lamborghini and Bentley brands, will follow.

“Any cash infusion like that is huge. Getting the support of Volkswagen Group certainly really strengthens their story toward Europe and toward Asia eventually,” said Vitaly Golomb, managing partner at Mavka Capital, a Rivian investor.”

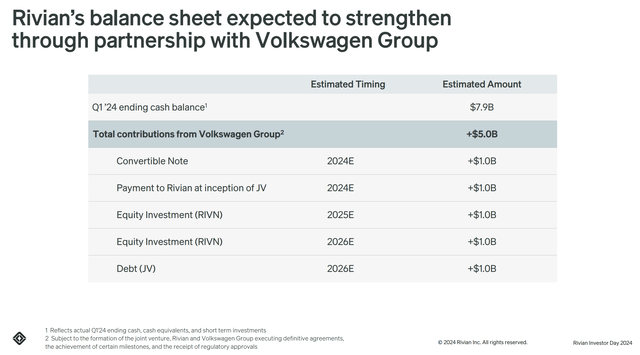

Just in terms of size, this VW deal for up to $5 billion is very significant. To put this into perspective, Rivian has a current market capitalization of just around $14.67 billion. As for the balance sheet, it has about $4.98 billion in debt and around $7.86 billion in cash. All of these numbers indicate that the VW deal is not just a game changer in terms of accessing VW’s vast capabilities, but also in terms of the financial boost it will create for a company of this size.

Short Sellers Helped Fuel The Rally After The VW Deal

According to Shortsqueeze.com, about 132,600,000 shares are currently short. This represents about 18.48% of the float, which is very significant. The VW deal was a definite positive that appears to have caught many short sellers off-guard. Because of the high short interest, and the good news announced with VW, I believe part of this recent rally was fueled by short sellers who either needed (because of margin calls) or wanted to cover their short positions. I also believe that the short covering rally might not be totally sustainable after some of the excitement about the VW deal fades a bit.

New Product Launches And European Sales Expansion In 2026

Rivian revenues are expected to surge in the coming years, and this will likely be fueled by new vehicle launches such as the R2. The R2 is a mid-sized electric SUV which is expected to be priced at about $45,000. Since the original offerings from Rivian, such as the R1, are priced in the $70k+ range, the R2 could be a game changer in terms of having a vehicle with mass-adoption potential due to the much lower cost. The other reason why revenues are expected to surge is that Rivian has significant potential to expand sales overseas. As this article suggests, the R2 is expected to start selling in Europe in 2026 and then possibly in the U.K. in 2027.

The Rivian R3 is an even smaller SUV (when compared to the R2) which is expected to launch as a 2027 model, starting at just around $37,000. This would make it the most affordable Rivian and serve as another potential growth driver for the company, providing it with yet another model that could have mass-adoption potential. This model could also be extremely popular in Europe and other parts of the world, where smaller vehicles seem to be preferred.

Key Takeaways From The Investor Day Update

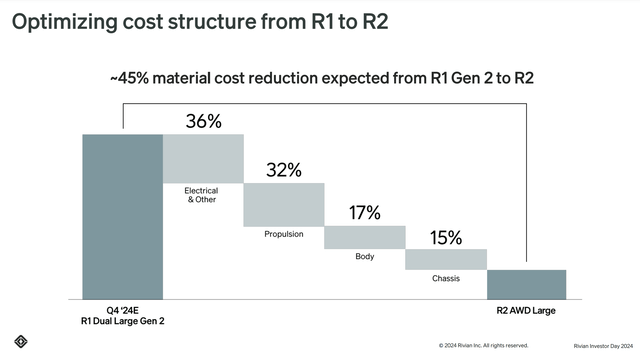

After reviewing the investor day presentation which was held on June 27, 2024, I saw a number of positives for investors to consider. Of course, one was the cash infusion and joint venture deal with VW, but the other was its strong focus on reducing production costs. As shown below, Rivian believes it can reduce costs by about 45% when comparing the 2nd generation of the R1 to the upcoming R2.

In the presentation, the company also reiterated guidance for the production of around 57k vehicles, and the goal to achieve positive EBITDA in 2027. Rivian is projecting it can achieve gross margins of 25%, and 10% free cash flow, with an adjusted EBITDA margin in the high teens. The capital infusion from VW is expected to help Rivian ramp up production of the R2 at its factory in Illinois in 2026, and I believe this reduces the risks of delays that could have come if the company was short on capital.

I also think this will help to accelerate the timeline for many goals this company has set including the expansion into other markets such as Europe. Company management stressed the need for urgency in terms of reducing costs and reaching profitability, which I view as another positive.

Here’s My Updated Investment Strategy

I view the VW deal as great news, which obviously sparked a rally, part of which I see as having been fueled by short sellers who needed or wanted to cover. However, I think short sellers will continue to lean into this stock with a negative view, and that could mean the recent gains might not be completely sustainable in the short term. So, I think there is a possibility for Rivian shares to give back a portion, but not all the recent gains as some of the excitement wears off in the coming weeks. Therefore, I would not add to positions immediately, but rather wait for at least a partial pullback. Based on the chart, I believe it could trade back down to around the $12 range, and that is when I would consider adding more shares.

For some investors, selling puts on Rivian with an out-of-the-money strike price could be a very attractive investment strategy. For example, I would be interested in buying more shares, but only if this stock settles down a bit from the recent rally. So, I could sell the $13 put options with (for example) a July 18 expiration date for about $50 per contract. This could position me to either keep the option premium if this stock does not drop below the strike price of $13, or if the stock does drop below $13, I would be put the shares for $13. After factoring the option premium I received, my net cost would only be $12.50 per share. That is attractive to me with the share trading in the $14 range today.

Potential Downside Risks

There are many potential downside risks to consider. As we know, there are much larger automakers with greater resources and the scale to produce vehicles at low prices. Many investors are concerned by a potential flood of low-cost EV’s that could come from China and spoil the market in Europe and the U.S.

Rivian is expected to continue posting losses for the next couple of years as it tries to ramp up production. The VW deal and an already relatively strong balance sheet helps to alleviate this potential downside risk; however, the history of losses and continuation of losses for now, must be considered by investors.

Even the most experienced automakers suffer from product liability lawsuits and recalls. A major recall due to a defect is another potential downside risk to consider.

I believe a recession is becoming increasingly likely, and this is making me more cautious on buying stocks. There are a few recent signs that suggest a potential economic slowdown is coming. This includes a drop for the third month in a row in the Consumer Sentiment Index. This, along with a slowing job market could indicate tougher times ahead. If this is the case, vehicle sales could suffer in the future and present a potential downside risk for Rivian investors.

In Summary

I think it is becoming more clear that Rivian is here to stay. I believe the VW deal validates Rivian and its products and also greatly reduces the risks for shareholders. Furthermore, I also see this company as having a strong chance to reach profitability in 2 to 3 years, thanks to cost-cutting, as well as the launch of promising new products, since these upcoming vehicles could significantly boost revenues.

The expansion into Europe and other parts of the world could be additional growth drivers. The launch of the R2 and R3 could be big growth drivers for this company. However, in the near-term, the stock could be poised to give back some of the recent gains, which I would wait for, or I would consider selling put options to participate with an opportunity to either collect the option premium or buy the shares at a price that is lower than the current market price.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.