Summary:

- Rivian shares dropped over 3% after Q3 production and delivery figures revealed supply chain issues, leading to a reduced 2024 production forecast.

- The company produced 13,157 vehicles and delivered 10,018 in Q3, missing street delivery estimates by nearly 1,800 vehicles.

- Rivian’s 2024 production guidance was cut to 47,000-49,000 vehicles, and its annual delivery forecast indicates minimal growth.

RoschetzkyIstockPhoto

Last Friday, one of the market’s losers was Rivian (NASDAQ:RIVN). Shares of the electric vehicle company finished down more than 3%, even after erasing much larger losses earlier on, as the company reported its Q3 production and delivery figures. The stock took a hit as management reported a problem in its supply chain, causing this year’s production forecast to be cut. This is the latest struggle for Rivian, which finds its shares only a couple of dollars from their all-time low currently.

Previous coverage on the name:

It was back after the company’s second quarter results that I last covered the name, where I suggested selling into strength. At that time, I was worried about a lack of unit sales growth at the company, along with its tremendously large losses and cash burn. While Rivian was making some progress on its longer-term goals, things in the short term did not show a ton of promise.

At that time, Rivian was the third most expensive name in the EV space on a price to sales basis. I thought another capital raise could be needed to get the name to its 2026 launch of its next-generation vehicle. Since I didn’t see any near term positive catalysts that could spark any upside, I thought shares could move lower. That has certainly happened since, with Rivian losing more than 22% of its value since, despite a more than 7.6% gain in the S&P 500.

Q3 production and delivery report:

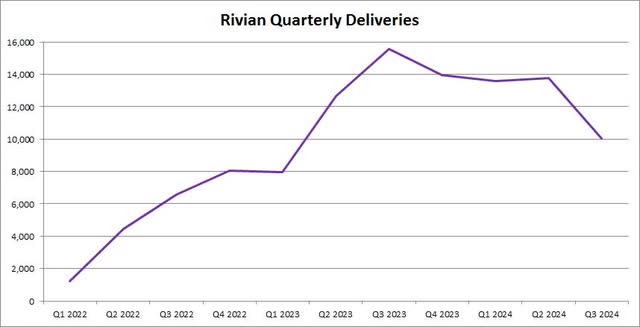

Rivian was expected to see a bit of a softer quarter in Q3, after it shut down its plant in Q2 for some major upgrades. Last Friday, management announced that it produced 13,157 vehicles at its manufacturing facility in Normal, Illinois and delivered 10,018 vehicles during the same period. As the chart below shows, this was the lowest delivery number since the first quarter of 2023.

Rivian Quarterly Deliveries (Rivian Investor Relations)

In the press release linked in my opening, Rivian management stated it is “experiencing a production disruption due to a shortage of a shared component on the R1 and RCV platforms. This supply shortage impact began in Q3 of this year, has become more acute in recent weeks, and is continuing.” We don’t know how much this impacted things in Q3 on a total unit basis, but as EV watcher and Rivian investor Gary Black tweeted out Friday, the quarterly delivery figure missed the average street estimate by almost 1,800 vehicles.

The 2024 production guidance cut:

Rivian’s forecast for this year had been 57,000 total vehicles of production, although Gary Black said the street was only expecting about 55,300. With the component shortage still ongoing, management is now calling for production in the range of 47,000 to 49,000 vehicles. However, the annual delivery forecast for low single digit growth compared to 2023 was maintained, with guidance being for 50,500 to 52,000 vehicles.

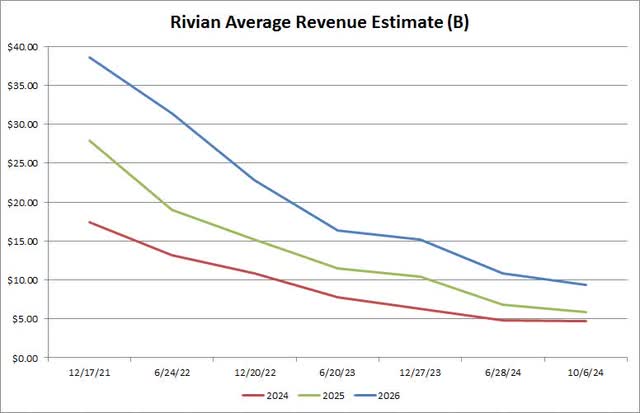

This lack of unit growth is a key reason why I was not bullish on the name a few months back. While I understand the company has a long-term plan and had to shut down the factory, we’re just not seeing the growth that had been previously expected. As the chart below shows, analyst revenue estimates for this year and the next two continue to drop quite sharply. The cumulative number for this three-year period is now less than a quarter of what it was back in late 2021.

Rivian Annual Revenue Estimates (Seeking Alpha)

One of the biggest goals for Rivian this year was to get to positive gross margins in Q4. We’ll have to wait until November 7th’s earnings report, to see if management changes that forecast. As a reminder, the Q2 plant shutdown was part of a major effort to improve the cost structure, as gross margins were nearly minus 39% in Q2. Even if the cost of goods sold comes down enough to get gross margins into positive territory this quarter or in early 2025, the company will still be reporting large operating and net losses when you account for all of the other expenses at the firm.

2026 can’t come soon enough:

Currently, Rivian sells a luxury EV pickup truck and SUV. It’s going to be at least another 18 months until the company hits the mass market, and closer to 2 years before volume production comes for its more affordable vehicle. There doesn’t seem to be too much room for growth of current models, perhaps outside of the delivery vehicle, unless Rivian lowers its prices a bit.

We’ve seen Tesla (TSLA) luxury model sales struggle quite a bit in recent years. The EV leader will be launching lower priced variants of its Cybertruck in the coming quarters, perhaps taking further aim at Rivian. Ford (F), Chevy, and General Motors (GM) are also selling electric pickups and SUVs, with GM looking to significantly increase its electric SUV market share in the coming quarters. We also could see some new offerings from Tesla as early as this week at its robotaxi event. I don’t know if Rivian management will give any guidance for 2025 at its November report, so I hope analysts will ask if nothing is in the shareholder letter.

Looking at EV valuations currently:

Since a majority of the electric vehicle names are not profitable, price to sales is the best valuation metric to compare them on. In the chart below, I looked at each name’s market cap in relation to its current street estimate for 2025 revenues. My comparison group includes Tesla, Lucid (LCID), VinFast (VFS), XPeng (XPEV), NIO (NIO), BYD (OTCPK:BYDDF), and Polestar. As a reminder, traditional US automakers trade at about 0.30 times their expected sales.

EV Price to Sales (Seeking Alpha)

While Rivian comes in middle of the pack here, there is a bit of a caveat. At 1.78 times, it looks a bit undervalued compared to the average of the rest, which sits at 2.51 times. However, if we were to take out Tesla, which is the clear leader of the EV group currently, the average of the rest drops to just 1.79 times, essentially where Rivian is now.

If you are looking for upside, there are two scenarios at play currently. The first is that this supply issue is just a bump in the road, and production and deliveries start rising again in 2025 with vastly improving margins. The second is that the partnership with Volkswagen (OTCPK:VWAGY) expands later this year or into 2025, perhaps taking away the need for another external capital raise (not counting VW as “external”). If VW really wants to make a move here, it could perhaps eventually buyout Rivian, but I don’t see that as very likely in the short term, given Rivian’s struggles.

The biggest risk for those betting against the name has to do with those improving margins. If Rivian can cut its operating losses to a reasonable level in the next year, it could potentially reduce its cash burn enough to the point where it doesn’t need another capital raise. Part of the bear thesis is based on more dilution or another debt raise with additional interest expenses, so removing that overhang could get me to consider a hold rating in the future. A much better-looking income statement could also chase away a number of short sellers. At the latest update from NASDAQ, a little more than 11% of Rivian’s outstanding share count was short.

Final thoughts and recommendation:

In the end, it was another round of disappointment for Rivian last week. The company announced weak Q3 delivery figures, while noting that a supply chain issue has forced management to cut its 2024 production forecast. While we don’t have an update yet on whether or not the company can hit positive gross margins in Q4, analysts have continued to cut their revenue estimates for this year and moving forward.

Until Rivian can really get its act together, I’m going to maintain my sell rating on the stock. The company just hasn’t been able to get any sustainable growth going here, and the high end of the EV space is not very large to begin with. 2026 remains quite far off for Rivian’s mass market plans, with others like Tesla and GM likely boosting their product portfolios by then. Should we get another meaningful capital raise from Rivian or a decent 2025 forecast, I will take a look at my rating again then.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.