Summary:

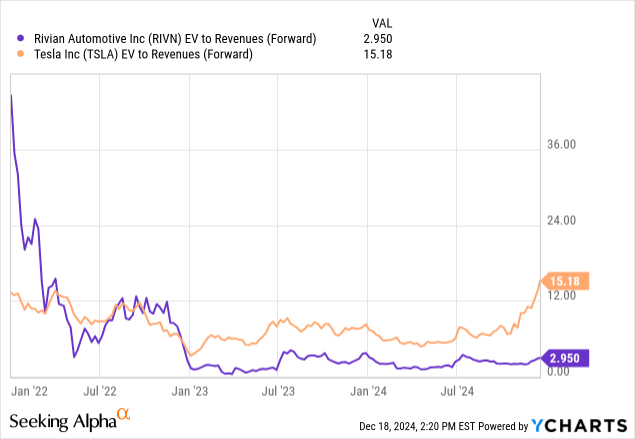

- Rivian presents a far more attractive risk-reward profile than its core U.S. rival Tesla. Rivian trades at roughly 1/5 of Tesla’s revenue multiple.

- I’m upgrading Rivian to a strong buy rating, especially ahead of the company’s plan to hit gross margin profitability in Q4.

- The company is stepping up production of Amazon delivery vehicles, on top of ongoing cost improvements in the second-gen R1 vehicle.

- The upcoming 2026 R2 vehicle is expected to have a 45% lower cost than R1, while also currently slated to retail for only 40% less than R1.

Sundry Photography

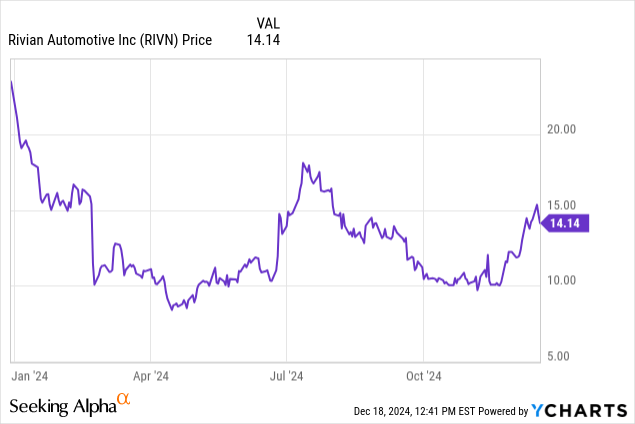

The story of Tesla (TSLA) and Rivian (NASDAQ:RIVN) in the stock market this year is a tale of two opposites: and an industry that has been surprisingly been supercharged by political affiliations as well. Tesla, the world’s largest EV company, has seen its share price roughly double year to date, with the majority of the year’s gains coming after Trump’s re-election win. I recently wrote a note on my decision to sell Tesla after several years, noting that the “Trump bump” and investors’ hope that Musk’s proximity to the White House will tremendously benefit the company has pushed Tesla to unsustainable valuations.

Rivian, however, is a different story. The stock is still up post-election, but it has traded in a very choppy fashion. Investors are skeptical that the company will be able to hold on to a $6.6 billion conditional loan granted by the Biden administration’s Department of Energy, which the company is relying on to build out manufacturing capacity in Georgia. Amid production hiccups this year as Rivian rehauled its production plants, shares of the automaker have dropped ~30% year to date. It’s a ripe time, in my view, for investors to shift their holdings from Tesla and into Rivian.

I last wrote a bullish note on Rivian in September, pre-election and when the stock was still trading lower in the ~$11 range. Since then, Rivian has rallied in sympathy with the broader markets: but amid the hope for rising production capacity and unit sales, as evidenced in the company’s recent Q3 shareholder letter, I think Rivian has plenty of gains ahead. Driven by the increased widening in valuation gap between Rivian and Tesla, I’m upgrading Rivian to a strong buy.

Looking ahead to R2 and expected cost efficiencies

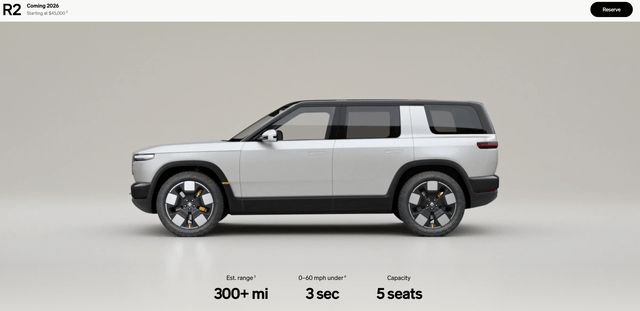

As a reminder for investors who are newer to the Rivian story, it’s not just Tesla that has a highly anticipated new model due for release. Rivian is set to dramatically expand its addressable market by releasing its R2 model in early 2026, with a starting MSRP of $45,000. This is substantially lower than the company’s current R1T ($70k) and R1S ($76k) models, and finally pushes Rivian’s affordability to the mass market.

R2 specs and pricing (Rivian website)

The new R2 also enjoys a lower bill of materials and substantially lower production costs than the current low-volume models (which I liken to Tesla’s earlier Model S and X products), and the higher scale that Rivian can achieve by this new product’s affordability can help vault Rivian to gross margin profitability.

Importantly, the company disclosed in its Q3 earnings release that it’s 85% complete with the sourcing of the bill of materials for the R2 vehicle, which will enter into production next year. This gives the company a high degree of visibility on cost. It’s currently expecting the material cost of an R2 AWD Large vehicle to be 45% lower than the equivalent R1 model today.

Meanwhile, we note that the starting price of an R2 ($45k) is only 41% lower than the entry-level R1S ($76k), versus a 45% reduction in cost. On top of our expectations for manufacturing line efficiencies from higher volumes of the lower-priced model, we highly anticipate R2 to be a big gross margin tailwind for Rivian.

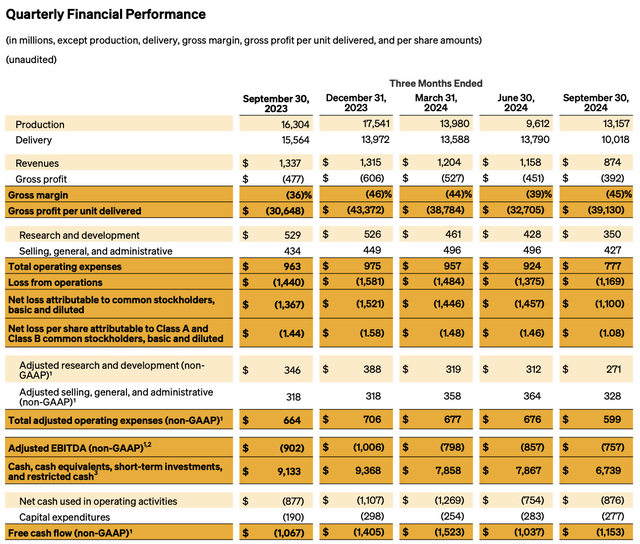

Q3 impacted by production challenges, but Q4 expected to post positive gross margin

Now, it’s important to note that Rivian’s performance this year has been impacted by several production challenges. As a reminder, during Q2 (the June quarter), the company temporarily slowed production to re-tool its manufacturing facilities to produce the second-generation R1 model, which is the direct precursor to the 2026 R2. The second-generation R1 has a 20% lower bill of materials than the first-generation R1 variants, while maintaining the same consumer price (the company’s last price drop was ~$3k in February 2024 on the first-generation variant).

Q3 was additionally hit by a component supply constraint in the company’s in-house Enduro motor system. As a result, production units fell -19% y/y to 13.2k units; while deliveries fell -36% y/y.

Rivian Q3 results (Rivian Q3 shareholder letter)

Still, in spite of the short-term hiccups, the company affirmed its full-year production outlook of 47-49k vehicles, and its full-year deliveries of 50.5-52k vehicles. I encourage investors to look ahead rather than focusing on short-term delivery and production metrics (how material were Tesla’s early Model S and X metrics, relative to the company’s scale today, which is ~90% comprised of its Model 3/Y line?)

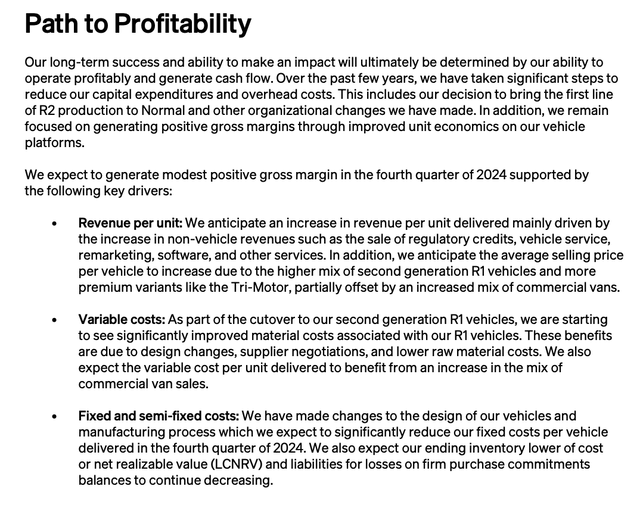

In particular, Rivian is expected to hit a major milestone in Q4: gross margin profitability. Even a breakeven (zero) gross margin would represent 45 points of sequential improvement and 46 points of y/y improvement, and help to substantially reduce the company’s cash burn (~$1-$1.1 billion of FCF per quarter, versus $6.74 billion of cash and short-term investments left on Rivian’s latest balance sheet).

Rivian Q4 path to profitability (Rivian Q3 shareholder letter)

To utilize its production capacity at a time when its consumer-facing vehicles are facing a supply, choke, the company is tilting its production mix in Q4 toward its open balance of Amazon delivery vehicles. As a reminder, Amazon has an open long-term order for 100,000 electric delivery vehicles from Rivian; per a November update from Amazon itself, it has rolled out only 20k of these vehicles.

Per Rivian’s note in its Q3 shareholder letter, Amazon has stepped up its orders for Q4 deliveries:

We expect to produce more Tri-Motors and commercial vans as a mitigating factor to the supply constraint, with Amazon increasing its delivery order of vans in the fourth quarter of 2024.”

Valuation is substantially below Tesla

All in all, Rivian has a lot of near-term gross margin tailwinds to look ahead to: a higher production mix of Amazon delivery vehicles, ongoing cost savings from a ~20% BOM reduction in the second-generation R1 vehicles, and the upcoming R2 line to be released in early 2026.

In spite of this, the market remains lukewarm on Rivian. Since it’s still in early stage and not generating profits, an earnings-based valuation for Rivian is tough. But we note that Rivian trades at less than 20% of Tesla’s revenue multiple:

Risks, offsets and key takeaways

Of course, this sharp valuation discount is a reflection of Rivian’s early-stage execution risks. Investors should take stock of the following risks:

- Tough macro environment, especially for big-ticket purchases. Consumer spending is still weak, and Rivian cited a weaker consumer environment for weaker Q3 deliveries and bookings. Priced above $70k, a Rivian is still a “luxury” car – and many luxury companies have reported weaker demand this quarter in the wake of an inflation-pinched economy.

- Increasing competition from Tesla’s entry-level launch. Tesla’s upcoming Model Q (scheduled for a 2025 release) will beat Rivian’s R2 to market, which likely means Rivian will lose market share in the near term. If the Rivian brand loses consumer mind-share while we wait for R2 to come to market, the company could see more tepid demand for its next-gen launch.

This being said, there are offsets to these risks. In particular, there is wide speculation that Musk’s influence in the Trump administration will lead to a better chance of killing off the $7,500 EV tax credit, which Musk has said will hurt Tesla, but its competitors more.

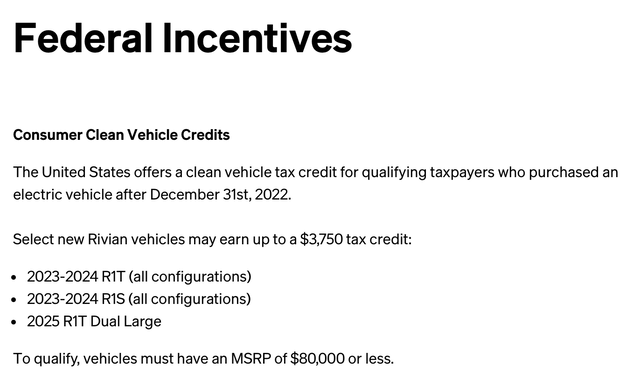

Meanwhile, no Rivian vehicles currently qualify for the full $7,500 credit, and only vehicles with an MSRP below $80k qualify for the limited $3,750 credit, per Rivian’s website:

Rivian tax credits (Rivian website)

So the same is true of Rivian: the ending of federal tax credits will hurt the small subsection of Rivian customers who qualify for the limited credits, but on the whole, the net price gap (after credits) between Rivian and lower-priced vehicles would shrink substantially if these subsidies are ended.

All in all, I continue to see a very attractive risk-reward profile in Rivian as it trades substantially below its major U.S. rival. Ongoing cost initiatives (the lower-cost second gen R1 and increased Amazon production) are expected to help tilt Rivian to profitability in the near term and bridge the gap until the 2026 launch of R2. Stay long here and use any near-term dips as a buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.