Summary:

- Tesla continues to lead the EV market with the most competitive vehicles in terms of price, performance, reliability, and access to its Supercharger network, beating any “pure play” EV carmaker.

- Rivian, though somewhat competitive with its product lineup, struggles to keep pace with Tesla’s advancements and is far from profitability. The company’s long-term viability is questionable in my opinion.

- Lucid follows an outdated strategy, while Fisker warned its own investors about bankruptcy risk, and NIO has a confusing product strategy and limited presence outside China.

- All four companies face significant financial hurdles, including cash burn and the likelihood of shareholder dilution in my opinion. I believe they offer no compelling investing story.

RoschetzkyIstockPhoto/iStock Editorial via Getty Images

I covered my bull case for Tesla, Inc. (TSLA) in a recent article. A few readers reached out, asking if I see any potential upside in other Electric Vehicle (EV) carmakers. In this article, I will cover four of the main “pure play” EV automakers — that is, companies exclusively producing EVs. I will particularly focus on Rivian Automotive, Inc. (NASDAQ:RIVN), as I believe it has the most potential to compete with Tesla from a product standpoint.

Thesis: The EV car market will be dominated by Tesla and traditional automakers. Rivian and other EV Startups will struggle to survive

Today, Tesla has by far the most competitive EVs in terms of price, performance, reliability and access to a still unique Supercharger network. This is true when compared against traditional automakers, but especially valid when compared to “pure play” EV automakers.

In my opinion, Rivian is the only “pure play” EV automaker that can be taken seriously. It has a competitive product on the market and plans to release cars that, on paper, look even more competitive. However, Rivian still struggles to compete with Tesla’s current models, even when some of them date back to 2015. The company might struggle to compete in the future as Tesla continues to update its lineup.

Lucid Group, Inc. (LCID) is late to the game, copying Tesla’s 15 years old strategy and focusing on an ever-slimmer EV luxury sedan car market. The company has addressed its liquidity issues thanks to an investment from Saudi Arabia’s Public Investment Fund (PIF). Fisker Inc. (OTC:FSRN) is on the brink of bankruptcy and its products have received abysmal reviews. NIO Inc. (NIO) does not sell to the US, and I think it has a confusing product strategy that will never truly be appealing outside of China.

Tesla is also the only profitable carmaker among “pure play” EV companies, and it is using industry-leading margins to aggressively price competitors out of the market. Unprofitable EV startups that can barely produce half-competitive products will struggle to survive in a market dominated by Tesla’s superior offerings.

Product strategy comparison: Tesla vs. Rivian vs. others

When I invest in a company, I do so only if I am willing to hold on to the stock for at least 10 years. Therefore, my analysis begins with comparing product strategies. In my view, financial metrics are meaningless in the long term if a company lacks a winning product or a plan to bring competitive products to market.

Rivian: a decent product line up, but it won’t be enough against Tesla

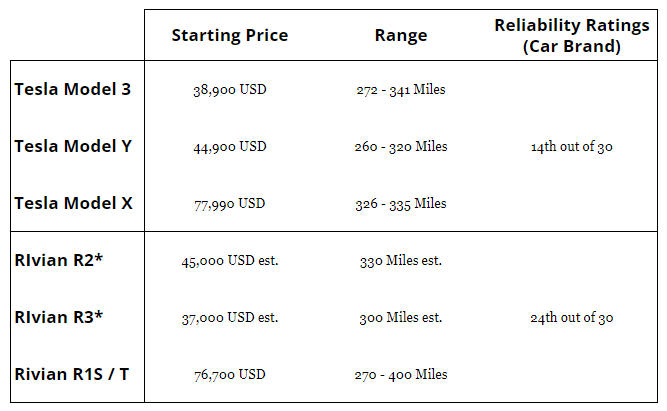

Rivian vs. Tesla Product Comparison (Author’s elaboration of data from Tesla, Rivian, ConsumerReports.com)

Note: I am excluding Tesla’s Model S from the above chart as I believe it does not compete against Rivian’s current and planned product line. It does compete directly against Lucid, as I will detail in the next section.

I see Rivian as the company that is the best positioned of the four automakers in terms of product line-up. This is also why I am mostly focusing this article on Rivian.

Rivian’s only production car at the time of writing, the R1S / R1T, is somewhat competitive with Tesla’s offering. The R1S starts at a very similar price than Tesla’s Model X and is similar in size. However, the car has less range than the Tesla. Reviews put the two cars head to head, suggesting there is no clear winner when looking at the product only.

What really tilts the balance in favor of Tesla, in my view, is Tesla’s superior reliability and access to Tesla’s superchargers. Rivian is a new brand, and it is not scoring well in reliability tests – an issue that is common in new production cars.

Additionally, consider that the Tesla Model X is fundamentally an old project that has been revamped multiple times and is likely nearing the end of its lifecycle. The first Tesla Model X was released in 2015, almost 10 years ago. The fact that Rivian, starting with a blank slate, was barely able to produce a competitive product in 2022 does not bode well for the company, in my opinion.

This brings me to Rivian’s future plans. The upcoming R2 and R3 do seem to be very competitive with Tesla’s current products on paper. That said, Rivian is not planning to release these models in production until 2026 and 2027. By then, Tesla might have released the infamous Model 2, and/or have revamped its line-up once again.

I believe Rivian will struggle to stay competitive in the EV space. The company is far from being profitable (something I will cover in the next sections) and is only just managing to plan for new cars that might compete with Tesla in the coming years.

Lucid: copying Tesla’s product strategy, 15 years too late

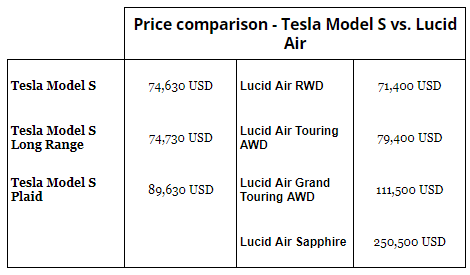

From a product standpoint, I believe that Lucid is following Tesla’s old playbook, but with over a decade of delay. Tesla began by producing high-end vehicles targeting affluent consumers, with its first mass-market products being the Tesla Model S and Model X, both starting at over $70,000. This strategy allowed Tesla to gain experience in mass-producing cars, eventually enabling the company to expand its lineup to include more affordable models.

This strategy barely worked for Tesla, back in the 2010s – the company was about a month from bankruptcy during Model 3 ramp, according to Elon Musk himself. Lucid is copying Tesla’s old strategy in 2023, and I do not believe this will work well for the company.

Price Comparison, Lucid vs. Tesla (Author’s elaboration of data from Tesla, Lucid)

Lucid currently has only one vehicle in production, although it is offered in various variants at different price points. The Lucid Air is designed to compete against the Tesla Model S, and to be fair to Lucid, it is a competitive car.

The issue here is that this represents a niche product targeted at an ever shrinking customer base. Lucid is targeting the launch of a new car, the Gravity, that will compete against Tesla’s Model X. However that in itself is again not a mass car, but rather a model targeting the luxury SUV segment.

Tesla has become profitable and has seized the EV car market since the launch of the Model 3 and Model Y. Lucid does not seem to be in a position to enter the mass EV market for the foreseeable future.

The company might survive, and eventually even manage to launch cars appealing to the broader public. After all, Saudi Arabia seems determined to keep backing it. However, from a shareholders’ perspective, I do not see Lucid as an appealing proposition.

In my view, the best case for Lucid shareholders is that the Saudis might decide to take the company private. They already have a 60% stake in the company, and bringing the company private would allow it to better focus on the long-term plan.

Fisker and NIO: not competitive

I decided to mention Fisker and NIO in this article to provide a comprehensive overview of “pure play” EV automakers and their product strategies. However, the reality is that neither of these two brands currently offer any real competition to Tesla, Rivian, or other carmakers in the EV space.

Fisker has warned investors of the risk of bankruptcy around 1 month ago. The company has also very recently closed its Manhattan Beach Headquarters in a last effort to avoid it. The next few weeks will prove crucial to determine whether the company will survive.

From a product perspective, the Fisker Ocean has received terrible reviews, to the point that it sparked controversy when a famous tech reviewer called the car “the worst” he ever reviewed. The Fisker Ocean is not competitive with Tesla’s Model 3 neither in price nor in range or in technology. And that is without considering the risk of after-sales support from Fisker, should the company experience troubles in its future operations due to a bankruptcy.

NIO is not selling in the US at the time of writing. The company did expand in selected European markets, but results so far are very questionable – the company is managing to only sell a few tens of cars in Germany every month.

Even in China, NIO is not performing as well as it did, having seen sales decline in Q1 and a mere 30,000 units shipped. The reality is that NIO seems to be losing the EV car race to more established competitors like BYD.

What is even more worrying about NIO, in my view, is the company’s unclear business and product strategy. NIO’s entire proposition back when it launched was about battery-swapping technology.

Today, because of the ever-evolving landscape of duties on Chinese EVs, NIO is pivoting to a more traditional product strategy. NIO is launching a new, low-cost brand and will mostly leverage that to go head-to-head with Tesla and other carmakers. This in my view makes its strategy confusing and weaker. Being the only automaker bidding on battery swapping technology made NIO unique. Now, it is just the last of a plethora of Chinese automakers that are launching their products in Europe and the US.

Ultimately though, there is simply not enough data for me to judge NIO’s product offering. The company is not selling in the US and has barely any sales outside of China.

Financials: bleeding cash

Unlike Tesla, neither of the four EV automakers mentioned in this article is profitable.

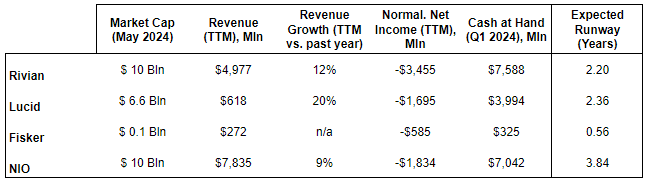

Financials at a glance (Author’s elaboration of data from Seeking Alpha)

To be fair to these companies, I believe focusing on traditional financial metrics such as EPS or even Revenue Per Share can be misleading. These are all companies that are focusing on launching new cars. The car industry is very capital intensive, and it is to be expected that significant cash is going to be burned to launch new models.

The financial metric that I find the most interesting in the context of this comparison is what I am calling “Expected Runway”. This is the last (negative) Normalized Net Income reported by the company divided by the cash at hand of the company. The result is an indication of how many months or years the company has until it runs out of cash. It is important for potential investors to have this data in mind, since it might directly influence whether the company will opt to dilute them by issuing new shares and raising more capital. I will cover this in the next section.

Other financial metrics that I believe are relevant to the analysis here are the revenue growth and absolute revenue in the last 12 months. These are all relatively early stage companies in the context of the car industry. Being able to grow revenue at a significant pace is essential for these companies to gain the size they need to reach economies of scale and, eventually, become profitable.

The overall picture emerging from these financial metrics is dire, in my view. Excluding Fisker, these four companies only have enough cash to survive between 2 and 4 years. I wouldn’t be worried about this – as negative net incomes are to be expected from early-stage companies in a capital intensive industry – if it wasn’t for the fact that neither can seem to be able to bring to market a competitive EV car.

In my view, their poor product strategy is reflected in the revenue and growth these companies are experiencing. Lucid has sales of just a bit more than half a billion dollars, which is striking for an unprofitable company valued at $6 billion. This is because of the focus of the company on the niche of luxury sedan cars. In that context, its 20% growth is not striking.

Rivian is the only company under examination with somewhat considerable revenue, just below $5 billion, and a respectable revenue growth rate of 12%. However, this is not particularly impressive given how far the company is from profitability. These companies are operating in a rapidly maturing EV market that is unlikely to experience the high-growth rates of a decade ago. This presents a strong headwind for these automakers. While Tesla faced similar issues years ago, it benefited from a rapidly growing EV market at the time. Rivian and other EV automakers do not have this advantage today.

Shareholders’ dilution is likely to happen, especially for Rivian

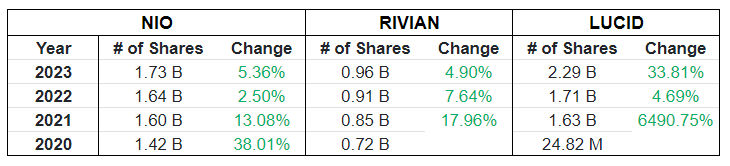

From a potential investor’s perspective, it seems very likely that these EV companies, and especially Rivian, will recur to diluting shareholders to raise cash. I am excluding Fisker from this analysis because the company has warned shareholders about a possible bankruptcy according to its 2023 10K report.

Outstanding shares count, NIO, RIVIAN, LUCID (Author’s elaboration of publicly available data)

In the past, Rivian, NIO and Lucid have all resorted to issuing new shares and increasing the total shares outstanding count as a result. This effectively dilutes existing shareholders.

I do not expect this to change for the foreseeable future, since these companies are all in need of cash. This is yet another headwind for potential investors. Were these stocks to experience a bull run because of strong EV adoption or any other external factor, management would be tempted to issue more shares to allow for raising much-needed capital. The fact that we are currently beyond the era of Quantitative Easing (QE) and Zero-Interest-Rate Policy (ZIRP) exacerbates the risk of shareholder dilution as a means of raising capital.

I see Rivian as the most likely of these EV automakers to dilute shareholders in the upcoming months. That’s because it is the one with the worst expected runway (only just above 2 years at the time of writing). Additionally, the company does not have as strong an investor as Saudi Arabia’s PIM is for Lucid.

Stock performance and alternative plays in the car industry

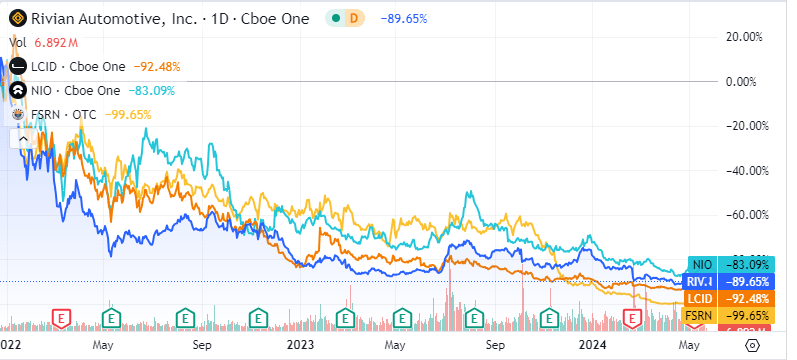

Stock performance 2022 to date, RIVN, LCID, NIO, FSRN (Seeking Alpha)

Rivian, Lucid, NIO, and Fisker all have terrible track records in rewarding shareholders. Their stocks are currently sitting at in between 80% to 99% down from their peaks in 2021 and 2022. The narrative that emerges from this history is one of the companies going public at high valuations that have not proven to be realistic in time.

While past performance is no guarantee of future results, I personally would discourage investing even at the current significant “discount” relative to their past. That’s fundamentally because of their poor product strategy, rather than mere financials and lack of profitability.

The most obvious alternative to these four stocks is Tesla. However, I would also look into traditional automakers, and especially at Stellantis (STLA). I have recently published an article exactly on how I see Stellantis as a complementary play to Tesla, because of their portfolio, strengths and weaknesses.

Risks to my thesis

The main risk to my thesis has to do with the stock performance of Rivian and the other three automakers relative to Tesla. Tesla’s stock is undoubtedly pricey, with a P/E of over 40 at the time of writing.

Tesla’s stock might underperform to the point that Rivian, Lucid, Fisker and NIO might manage to beat it. The market is already discounting Tesla to be the leading EV automaker in the future. Any significant change in that expectation can make Rivian or other ‘pure play’ EV automakers look enticing relative to Tesla.

Another key risk concerns potential acquisitions. If these companies struggle to survive, it’s reasonable to assume that an acquisition might be on the horizon. A traditional automaker could see significant benefits in acquiring one of these companies to bolster their position in the EV market. If such an acquisition were to occur, the premium paid for Rivian or another pure-play EV company could result in considerable rewards for shareholders.

In the case of Lucid, there is also the potential risk that their Saudi investor might decide to take the company private. If this were to happen at a significant premium to the current stock price, it could provide substantial rewards for shareholders.

Conclusion

In comparing the product strategies of Rivian, Lucid, Fisker, NIO and Tesla, I often found myself having to take into consideration products that do not exist yet or have not launched in the US market.

Perhaps, this is the main issue with these four ‘pure play’ EV automakers. They are scrambling to launch new car models that will eventually be competitive with Tesla’s current products. The problem is, Tesla is already offering very competitive EVs and will keep updating its line-up in the future. Add the significant competitive advantage of Tesla’s Superchargers network, and I do not see how these automakers can ever catch up with Tesla and offer truly competitive products.

The situation, from the perspective of a potential investor, is even worse when considering the financials at play. Traditional automakers at least have a profitable core Internal Combustion Engine (ICE) business they can leverage to slowly enter the EV market. This is not the case with Rivian or other ‘pure play’ EV automakers. These companies are bleeding cash, and the most optimistic scenario for good shareholders’ returns concerns Lucid being taken private by its largest Saudi investor. The more realistic scenario involves continued shareholders’ dilution and struggling to stay competitive with Tesla.

For the above reasons, I do not recommend entering a position in Rivian, nor in the other three EV carmakers mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.