Summary:

- RIVN and LCID have been volatile stocks.

- LCID made the news with the announcement of large-scale layoffs.

- Both companies are losing billions of dollars.

SimonSkafar

Article Thesis

The last year hasn’t been easy for electric vehicle stocks, including Rivian Automotive, Inc. (NASDAQ:RIVN) and Lucid Group, Inc. (NASDAQ:LCID). Both stocks are down a lot over the last year and generate substantial losses while seeking to ramp up production.

In this article, we’ll compare the two companies in terms of their execution when it comes to ramping up production while also looking at their cash flow picture and recent news.

A Volatile Week For RIVN And LCID

Both companies are down massively over the last year, and down even more badly relative to the respective all-time highs. Over the last year, Lucid and Rivian have dropped by 72% and 74%, respectively.

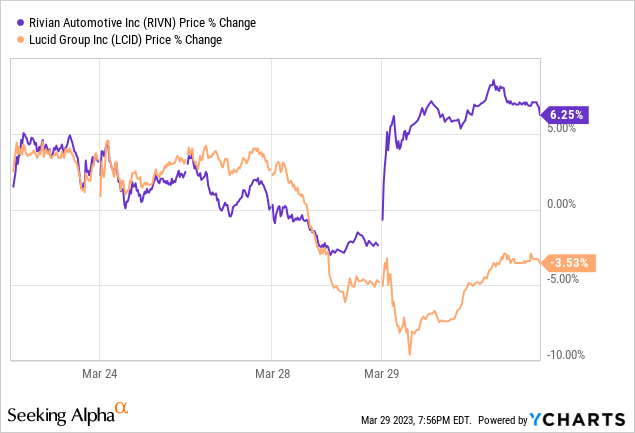

Over the last week, however, the two stocks moved in different directions, although both were volatile:

While Rivian has risen nicely, along with the broad market, Lucid Group underperformed, falling considerably over the same time frame. There’s a reason for that: Lucid announced that it would lay off 1,300 workers in a move that might allow the company to save $100 million per year. While cost-saving measures aimed at improving efficiency are mostly seen positively by the market, this case is different. Lucid is a still-small company that aims to grow massively over the coming years. The fact that it still decides to fire workers — 18% of its workforce — was seen as a bad sign by the market. There are two potentially bad interpretations:

– First, Lucid’s growth momentum could be weaker than expected, in this case the company does not need as many workers as previously thought. But if growth is weaker than expected, that’s a problem for a not-yet-profitable company that is priced for a lot of growth.

– Second, Lucid might have been recklessly overspending in the past. If growth remains healthy and the company still has too many employees, thus allowing for a workforce reduction, then LCID’s hiring practices in the past seem questionable.

While there may be other interpretations regarding LCID’s decision to reduce its workforce, these two interpretations seem to have driven down the share price, as the workforce reduction announcement was generally viewed negatively by many market participants — otherwise, the share price wouldn’t have reacted the way it did.

LCID Versus RIVN: Scaling Up Production

Both companies have started to sell their vehicles towards the end of 2021, but the performance has been uneven since then. While there is a similarity — both companies had to reduce their forecasts as they realized that their plans had been too optimistic — RIVN still outperformed LCID when it comes to increasing production.

Lucid plans to produce 10,000 to 14,000 vehicles this year, or 12,000 at the midpoint of the guidance range. That’s a solid improvement of 67% versus the 7,200 vehicles that the company produced in 2022. On the other hand, the midpoint of the guidance range implies that production rates might be lower this year relative to the Q4 2022 pace, as the company built 3,500 vehicles (or 14,000 annualized) in the most recent quarter. Of course, it’s possible that Lucid’s Q4 was especially strong due to an end-of-year push, but this is nevertheless a theme that investors should keep an eye on. After all, growth investing only works when the company is generating attractive growth.

Rivian’s production outlook is better, but not especially great, either. The company plans to produce 50,000 vehicles this year — roughly 4x as much as Lucid, but only about 2.5% of what Tesla (TSLA) will be producing this year. Chinese EV startups such as NIO (NIO) are also targeting significantly higher production levels this year. Still, if RIVN is able to hit its goal, that’s a little more than 100% growth versus 2022, which is quite attractive and stronger than LCID’s expected growth.

Both companies argue that COVID lockdowns in China, global supply chain issues and disruptions, and other macro problems have impacted their growth negatively. And this is, in fact, an argument that has also been made by some other EV players, including NIO, XPeng (XPEV), and so on. The two largest companies in this space, by far, Tesla and BYD (OTCPK:BYDDY), seem to have executed better when it comes to securing and safeguarding supply chains — despite much larger production volumes, they seem to operate more smoothly.

LCID Versus RIVN: Cash Burn And Balance Sheet

Both Lucid Group and Rivian Automotive aren’t profitable, and that’s not an issue per se. Tesla wasn’t profitable for many years, either, and most other EV startups are also generating losses. Since scaling up production is costly and since a sufficient size and scale need to be reached for a fixed-asset-heavy company such as an automobile producer, early losses are not necessarily a reason for concern. Of course, the size of these losses matters.

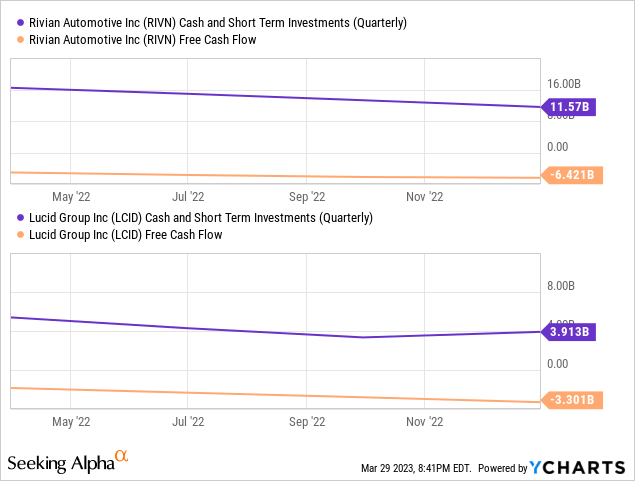

Both LCID and RIVN have been generating massive losses in 2022 and have been burning through billions of dollars of cash. While both companies have sizeable cash positions, it seems questionable whether those will be sufficient to bring the two companies to profitability.

Looking at the cash positions (including equivalents and short-term investments) and the 2022 free cash burn rate of the two companies, we see the following:

Rivian has, by far, the larger cash pile right now, at $12 billion, versus $4 billion at Lucid. On the other hand, Rivian also burned through almost twice as much cash last year, with a negative free cash flow of $6.4 billion, versus $3.3 billion for its peer.

At the 2022 burn rate, Rivian has cash that will last for the next 1.8 years, or through August 2024. Lucid, meanwhile, would run out of cash by February 2024 if its cash burn rate remains at the level it was at in 2022. It’s not known yet whether the cash burn rate of the two companies will remain similar to 2022 in 2023, or whether it improves or worsens. A lot will depend on the success of the two companies when it comes to ramping up production and improving efficiency. No matter what, I believe it is unlikely that the current cash positions of the two companies will be large enough to last until RIVN and LCID will start to generate positive free cash flows.

It thus seems likely that new shares will be issued over time, while the placement of debt or convertible debt would be another option. LCID, with its Saudi Arabia backing, should not have a hard time accessing new funding. Rivian, being backed by Amazon (AMZN), could possibly also access additional funding from a deep-pocket player, although that is less certain, I believe. Overall, I wouldn’t be surprised if the share count of both companies rises considerably. Share-based compensation will be responsible for some of that, but the two companies’ need for additional funds could also result in additional share issuance.

LCID Versus RIVN: Valuation

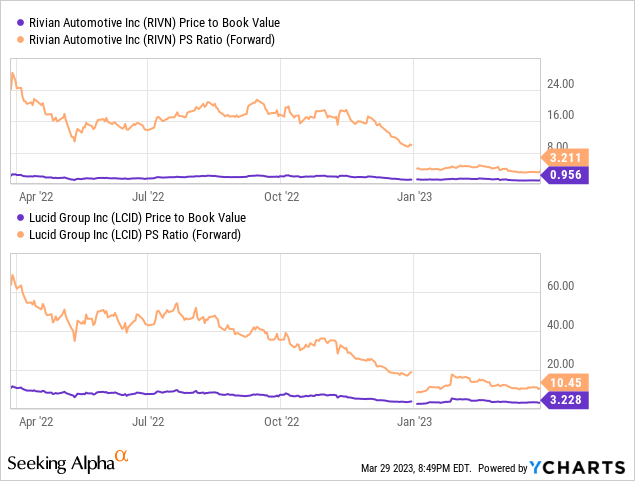

Neither of these EV players is profitable, and they also don’t generate positive cash flows. In fact, they don’t even generate positive EBITDA. Using the standard valuation approaches is thus not possible here, but we can look at their sales and book value multiples:

Rivian trades at 3x book value and at around 1x this year’s expected sales. Lucid’s valuation is roughly three times as high today, for both metrics.

It should be noted that both companies will likely report major losses this year, which will reduce their book value, all else equal. At constant share prices, the book value multiple would thus expand throughout the year, as book value diminishes. The sales multiple might thus be the better metric to look at, as it will not be influenced by this development — instead, it reflects the ongoing production ramp-up that is expected for both companies.

At 1x sales, Rivian is pretty cheap for an EV company. Most EV players are trading at way higher sales multiples — EV king TSLA trades at 6x this year’s expected sales, for example. Of course, Tesla is profitable and generates positive cash flows, while that can’t be said about Rivian. Still, with 100%+ expected production growth this year and a large backlog, I do believe that RIVN’s valuation is rather undemanding today.

Lucid is more expensive, despite having a weaker balance sheet and growing at a slower pace. Of course, speculation about a potential takeover by Saudi Arabia’s Sovereign Wealth Fund is an important factor to consider here. Since such a takeover bid by the current majority owner can’t be ruled out, it is possible that LCID will continue to trade at a premium relative to RIVN.

Takeaway

Both companies produce vehicles that seem attractive from a tech and style perspective. At the same time, both companies are burning through billions of dollars trying to ramp up their production.

Since Rivian seems to be executing better when it comes to the production ramp, and since RIVN also is considerably cheaper while having a stronger balance sheet, I’d say it’s the fundamentally stronger company today. That being said, the potential for a Saudi takeover bid for LCID could keep Lucid’s shares at an elevated level (from a valuation perspective relative to Rivian). Since there are significant uncertainties when it comes to future cash needs and eventual profitability levels, I do not own shares in either company today.

Disclosure: I/we have a beneficial long position in the shares of BYDDY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!