Summary:

- My first bearish thesis about Rivian Automotive did not work well since the company significantly outperformed the broader market since early May 2023.

- The competition is intensifying significantly in the EV trucks field, and my analysis suggests that Rivian is less prepared to fight than its giant competitors.

- Under fair revenue growth assumptions, my valuation analysis suggests the stock is overvalued.

Mario Tama

Investment thesis

My first bearish thesis regarding Rivian Automotive (NASDAQ:RIVN) stock did not age well since the stock rallied more than 80% since May 2. The Rivian frenzy occurred due to multiple-fold YoY revenue growth, but we should not forget that comparatives are low, which makes it easier to demonstrate crazy growth. It is also crucial to remember that the company is still far from turning profitable, and the competition is intensifying with Tesla’s (TSLA) Cybertruck expected to be released this year. All in all, I reiterate my “Sell” rating for Rivian Automotive.

Recent developments

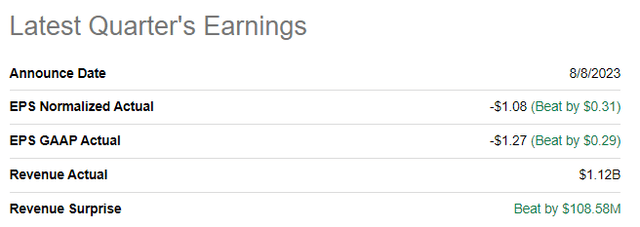

The company released its latest quarterly earnings on August 8, when Rivian topped consensus estimates. Revenue grew 208% YoY, and the adjusted EPS followed the top line by expanding from -$1.62 to -$1.08.

Seeking Alpha

The gross margin has improved significantly YoY. While it was almost -200% last year, the latest quarter’s gross margin was at -37%. It is still far from zero, but I must acknowledge this notable improvement. The operating margin has also improved YoY, but it is still very far below zero at -115%.

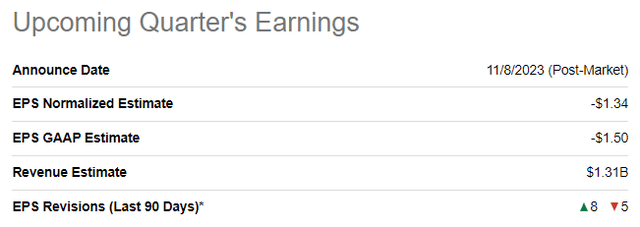

The upcoming quarter’s earnings are expected to be released on November 8. Quarterly revenue is expected at $1.31 billion, indicating a 143% YoY increase. Despite massive revenue growth, the adjusted EPS is expected to improve not that significantly, from -$1.57 to -$1.34.

Seeking Alpha

While the company demonstrates jaw-dropping YoY revenue growth, it is important to remember the company’s relatively small scale and easy-to-beat comparatives. The company started generating revenue only two years ago, and triple-digit revenue growth is not something we have ever seen from companies at their early stages of development. It is also crucial to emphasize that the upcoming quarter’s revenue of $1.31 billion means a moderate 17% growth, a substantial deceleration compared to 47% sequential revenue growth in Q3 of 2022.

I see unfavorable factors for Rivian speaking against the ability to sustain above-the-industry growth over the long term. Intensifying competition in the EV trucks field looks like the biggest threat to Rivian, in my opinion. Tesla’s Cybertruck delivery event looks close, and there are several videos on Twitter where Cybertrucks are driving in the U.S. cities. Tesla has a strong brand and Cybertruck is a highly-anticipated product, which recorded about 1.5 million pre-orders in late 2022. Looks massive compared to Rivian’s 13 thousand deliveries in Q2. However, the competition in the EV trucks market is intensifying not only because of the expected Cybertruck release. The American symbol and the best-selling car over the past half a century, the Ford F-150, has its electric brother, the EV “Lightning” version. While the scale of Ford’s electric truck is still small, it is gaining impressive momentum, and its strong brand makes it well-positioned to capture a substantial portion of the market in the long term as well. The electric version of another favorite truck for American people, Chevrolet’s Silverado, is also expected to start retail sales in 2024. Silverado has also consistently been one of the best-selling cars in the U.S. over the long term, meaning it has a strong brand and fan base. This will also add solid competition to Rivian. All in all, I expect the competition in the EV trucks field to intensify significantly in 2024, and Rivian has much fewer resources and weaker brand recognition than its giant competitors.

Another challenge in the upcoming years will be Rivian’s production capacity. While the current 150,000 vehicles per year capacity looks more than enough compared to quarterly deliveries, if the company meets its aggressive revenue growth plans, it will face a capacity shortage in the next few years. Capacity expansion is very costly and time-consuming and might disrupt revenue growth if the company fails to complete expansion on time. While Tesla’s massive Gigafactories expansion in recent years looked easy, building new production facilities is complex and risky. Apart from apparent risks related to high capital intensity, there are always risks of budget overruns and lagging behind the construction schedule. To conclude this part, Rivian’s future in the horizon of the next couple of years looks highly uncertain.

Valuation update

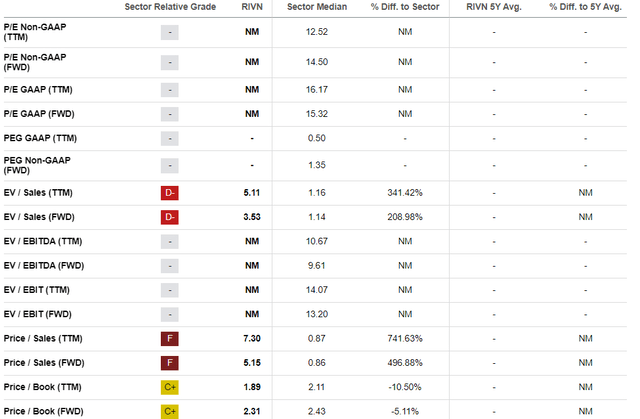

This year, the stock outperformed the broad market with a 35% year-to-date rally. Seeking Alpha Quant assigns the stock a “D+” valuation grade, which indicates overvaluation. One of the most notable ratios for growth companies, price-to-sales, is multiple times higher than the sector median. Based on multiples, I cannot say the stock is attractively valued. It is also important to underline that several valuation ratios are still unavailable due to losses.

Seeking Alpha

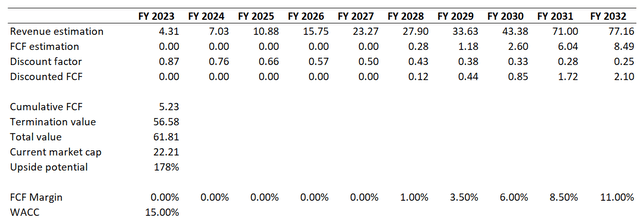

Now, let me update my DCF simulation. I will simulate different scenarios because revenue consensus estimates with a 38% CAGR over the next decade look too optimistic. Even if I use a very high 15% WACC for discounting and assume the FCF margin turns positive only in FY 2028, the stock has more than 200% upside potential.

Author’s calculations

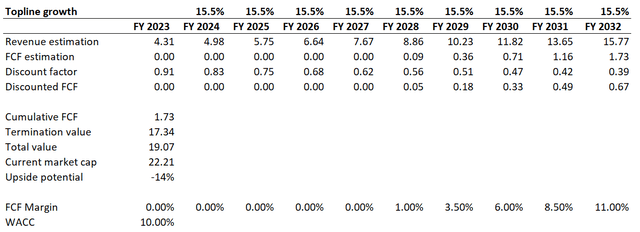

Now, let me simulate DCF with revenue growth assumptions that would look more reasonable, in line with the expected EV market growth. According to Global Market Insights, the U.S. EV market is projected to compound at 15.5% over the next decade, which is more than two times slower than consensus estimates expect for Rivian. If I implement this CAGR and use a moderate 10% WACC, the stock now is about 15% overvalued.

Author’s calculations

It is highly unlikely that any company will be able to more than two times outpace the EV industry in the U.S. over the decade. Of course, optimists might argue that between 2013 and 2022, Tesla’s revenue increased from $2 billion to $81 billion, which means a 50% revenue CAGR. But the EV industry was different in 2013, and Tesla was one of the pioneers. Less than 100,000 electric vehicles were sold in the U.S. in 2013, and the competition was far less intense ten years ago. That said, my second DCF scenario looks more realistic to me.

Risks to my bearish thesis

Risks to my thesis are worth considering. While I believe that over the next decade, the company is unlikely to increase sales by almost twenty times, it is important to acknowledge that in the near term, the company will continue demonstrating solid growth in percentage terms. Given the relatively small scale and easy-to-beat comps, it looks highly probable. This solid revenue growth, particularly in the closest quarters, could attract continued optimism from the market.

Let us also not forget that Amazon (AMZN) is the largest shareholder of Rivian. Amazon has deep pockets and a rich history of smart moves and disruptive strategies. Being a logistics giant, Amazon has all the resources to support Rivian in various ways, which can ultimately unlock growth opportunities for the EV maker. While I have multiple concerns about Rivian’s fundamentals, Amazon’s support and potential synergies could present counterbalancing solid factors.

Bottom line

To conclude, I reiterate my bearish thesis with a “Sell” rating. The company demonstrated impressive revenue growth and profitability metrics improvement recently, but there are multiple unfavorable factors to me. First, long-term revenue estimates look unrealistic, with consensus expecting the company to more than two times outpace the overall U.S. EV market growth. This looks unrealistic to me amid the intensifying competition within the EV trucks segment. Second, while financial performance has improved substantially recently, the company’s operating margins are still far below zero at -115%. Revenue growth might look impressive in percentage points, but it should not be surprising given very low comparatives. My valuation analysis suggests that under reasonable revenue growth assumptions, the stock is overvalued.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.