Summary:

- Rivian is releasing two new mid-size offerings, namely the R2 and R3/ R3X are designed to penetrate the mass consumer market.

- Apart from the new product launches, management is also attempting to make its current R1 production more efficient.

- There are warning signs that US consumers may have turned against EVs in general. High levels of industry competition and cheap Chinese EVs are also substantial headwinds.

- Rivian would have to execute its operations perfectly to be fairly valued, which makes it a risky proposition.

hapabapa

Investment Thesis

Electric vehicle manufacturer Rivian (NASDAQ:RIVN) could be turning a corner towards profitability as it tightens up its operations and prepares to enter the mass consumer markets with new vehicle launches. The company’s cars seem to be well received overall indicating future success. However, the electric vehicle industry has gotten crowded in recent years and consumer excitement for EVs in general is not as strong as it was in the past. Rivian would have to execute its plans flawlessly just to get its current valuation to be close to the stock’s current price. Furthermore, the company could see itself facing liquidity issues thus having to issue more shares to raise capital. Therefore I would have to pass on Rivian stock.

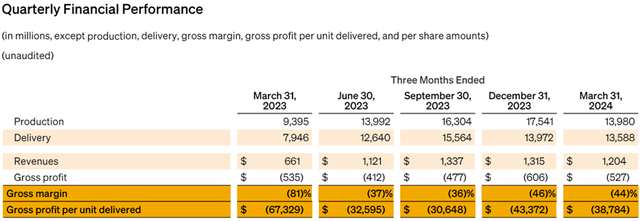

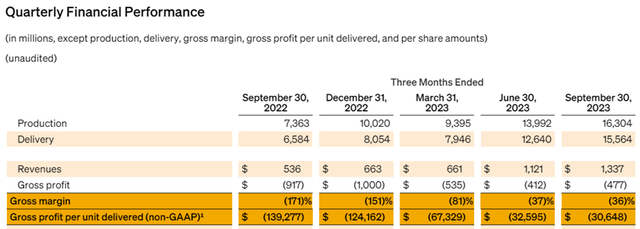

Rivian Q1 2024 Was More of The Same

Rivian’s stock saw a bit of a jump post Q1 2024 as the company guided for “modest gross profit” by the end of the year. The company saw revenues of $1.2 billion for the quarter representing the delivery of 13,588 vehicles. As a relatively new car company in the electric vehicle space, it is not surprising to see that Rivian is still losing money on every car sold. The company generated negative Gross Profit for the quarter of -$527 million for a loss of $38,784 for every car sold. This is half of the $67,329 loss per unit at the same time last year and is in between the results of $30,648 and $43,372 in the previous two quarters.

The company reported a loss from operations in Q1 2024 of -$1.48 billion which was slightly less than the -$1.43 billion loss at the same time last year. This translated to a negative cash flow from operations of -$1.27 billion. Combined with capital expenditures of $254 million resulted in free cash flow of $1.52 billion for Q1 2024.

This is quite concerning in my opinion as the company ended the quarter with only $7.86 billion in cash and cash equivalents. The company noted that it has an additional $1.19 billion in an asset-based revolving credit facility which gives it roughly $9 billion in total liquidity. Note though that revolving credit is not 100% reliable as lenders can pull out the facility should the company see itself in real trouble. This implies that Rivian has at max about 6 quarters or a year and a half of “runway” before it could run out of cash. Therefore, it is imperative that Rivian reduces the losses per car generated something that the company intends to do with its new manufacturing facility.

Rivian’s Path to Profitability Outlined

To achieve profitability Rivian’s management has introduced several key initiatives. The first is a slew of new cheaper vehicle models built upon new production lines. These two new mid-size offerings namely the R2 and R3/ R3X are designed to penetrate the mass consumer market not unlike Tesla’s (TSLA) Model 3. The R2 is a midsize SUV and the R3 is a midsize crossover both designed with performance and capability in mind. The premium version of the R2 and R3 battery can achieve over 300 miles of range and offer acceleration to 60 mph acceleration in under 3 seconds. These specifications and the price tag of $45,000 and under are comparable with the current list of electric SUVs in the market such as the Hyundai Ioniq and the Kia EV.

Should Rivian be eligible for the $7,500 federal EV tax credit, the car would be even more appealing to the mass market. Already car enthusiasts have given the design raving reviews, especially for the R3 model. According to the website Inside EVs, the R3’s design invokes feelings of nostalgia to classic designs.

Across social media, the R3 immediately elicited comparisons to the first-generation Volkswagen Golf hatchback, sold in the U.S. from the mid-1970s to the mid-1980s (as the Rabbit). Both cars share the same generally boxy silhouette, sharp angles and crisp edges. “It’s really an iconic shape,” said Paul Snyder, chair of the transportation design department at Detroit’s College for Creative Studies. “And I think there’s an association made for, maybe, a happier past, subconsciously.” In a time of rampant nostalgia for 1980s cars, the R3 was bound to resonate with people, said Matteo Licata, a former car designer and design history professor at Italy’s IAAD (Istituto d’Arte Applicata e Design)

Apart from the new launches management is also attempting to make its current R1 production more efficient. In April 2024, the company shut down its Normal Factory in Illinois for improvements and to introduce new technologies. These improvements are expected to improve efficiency by about 30% and is expected to result in over $2.25 billion in cost savings. According to management in its latest earnings call;

We continue to move closer to making money on every vehicle we sell. We expect to see meaningful improvement in our gross profit during the second half of this year and believe we will reach a positive gross profit for the fourth quarter.

Our confidence is underpinned by the actions we have taken within our control. Specifically, we expect the recent completion of the tooling upgrade in normal result in meaningful cost improvements in R1 and the manufacturing line. The upgrade includes the integration of R1 engineering design changes and newly negotiated supplier components that will drive significant cost reductions in our bill of materials.

Weakness in Overall demand for EVs could hurt Rivian

While costs are one factor of the profitability equation, the other is demand for Rivian’s products. First, let me start with the good news. Analyzing the company’s delivery and production figures we can see that for the last 4 quarters, Rivian has maintained consistent delivery of about 14,000 units. According to the company, its flagship R1S model was “fourth best-selling electric vehicle in the US was the fourth best-selling electric vehicle in the US during the first quarter of 2024, the best-selling electric vehicle in the US above $70,000, and the best-selling large luxury SUV in California across both electric and combustion engine vehicles”. Taking these claims at face value and given the excited response to the design of the R3, I can reasonably assume that there is demand for the company’s products.

Not only that but Rivian still has that commitment from Amazon (AMZN) to purchase 100,000 electric delivery vans (“EDV”) by 2030. As of late last 2023, Amazon has already purchased 10,000 of these vehicles from Rivian. Furthermore, this deal is no longer exclusive, paving the way for Rivian to sell its electric delivery vans to other logistics companies.

Press Release (Rivian) Press Release (Rivian)

A bullish case can be made that the launch of the R2 and R3 could be a turning point for Rivian similar to how the Model 3 turned around Tesla’s fortunes. However, there are a couple of headwinds that go against this thesis. The first is that Rivian’s new products are launching into a completely different industry environment. Apart from economic uncertainties weighing down demand for the more expensive electric vehicles, there are warning signs that US consumers may have turned against EVs in general. According to the J.D. Power U.S. Electric Vehicle Consideration Study released new-vehicle buyer consideration for electric vehicles has dropped compared to a year ago. More worryingly the study mentions that EVs could have less demand than from younger consumers than anticipated.

Additionally, the competition is much more fierce now than when the Model 3 launched. As mentioned above, US traditional car manufacturers have already launched their equivalent electric SUV offerings. Furthermore, there is the looming threat of cheap Chinese EVs flooding the US market. The Biden administration has vowed to combat that with tariffs but the cost differential could be so wide that it might not be enough. Cheap Chinese EVs also hamper Rivian’s chance at international expansion. There are two scenarios. It’s either a foreign country that would allow cheap Chinese EVs making it difficult for Rivian to compete. Or countries, like in Europe, would move to protect their own industry and possibly extend tariffs to US manufacturers as well. These factors make me wary of overly optimistic projections of R2 and R3 sales.

Valuation

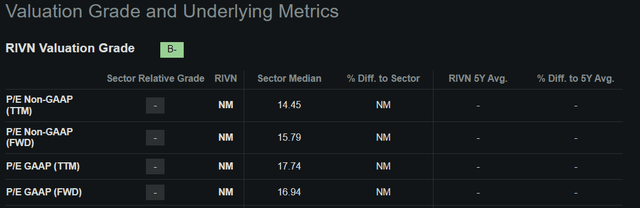

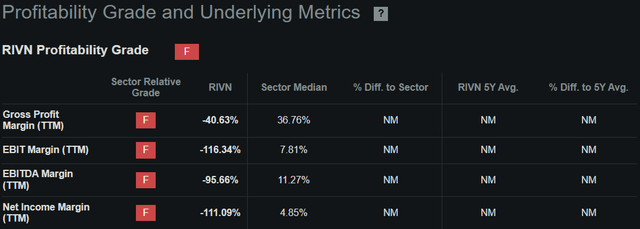

Looking at valuations, it’s impossible to pin down a value on Rivian’s stock without making a few key assumptions. Like valuing all growth companies such assumptions are unfortunately necessary as past data isn’t indicative of Rivian’s potential. So let’s do the math.

Rivian’s Normal factory in Illinois has an expected capacity of 215,000 units annually across all its product lines. Assuming revenue per unit sold of $45,000. In Q1 2024 Rivian’s revenue per unit sold was approximately $88,300. However given that the new models are much cheaper, I believe that this is a reasonable assumption. For reference, Tesla’s revenue per vehicle is $44,926. Let’s assume that Rivian is operating at full capacity and is able to sell 90% of all its units produced. This translates to $8.7 billion in revenues.

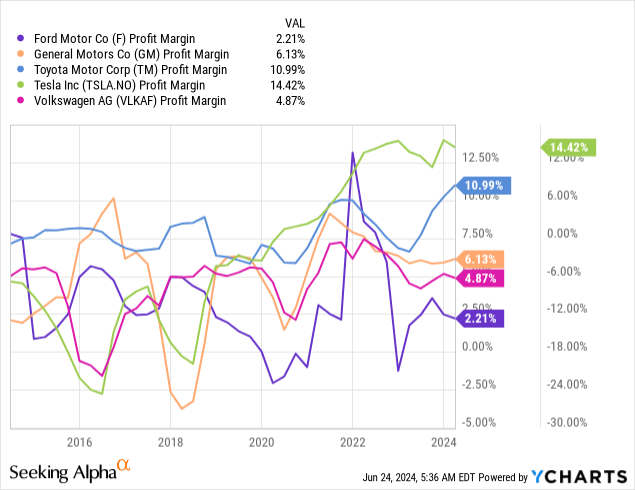

Assuming a Net Income margin of 5% and using its diluted shares outstanding of 995 million gives me an EPS of $0.44 per share. Note that I looked at comparable car companies and the sector median to arrive at the margin assumption. At the sector TTM P/E ratio of 18x this gives me a share price of $7.87. This is about 24% lower than the current share price of $10.32. Now using this methodology I am sure bulls can make the case for a Buy at these levels. However, in my view, Rivian would have to execute its operations perfectly and fend off vast competitive threats just to reach my valuation assumptions. It is because of this I have to take a pass at Rivian.

Quant data (Seeking Alpha) Quant data (Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.