Summary:

- Rivian’s Q3 results show an improved production ramp and upgraded full-year production guidance to 54K units.

- The company aims to reduce COGS per vehicle and achieve a positive contribution margin by the end of 2023.

- Rivian still faces challenges in meeting long-term guidance of 10% FCF profitability and needs to address underlying demand issues.

- Given substantial production and demand headwinds, I argue why high-conviction investors need to question whether they should continue holding the bag.

- While selling pressure has subsided, RIVN still looks far from a Buy at the current levels.

Mario Tama

Rivian Automotive, Inc. (NASDAQ:RIVN) has significantly underperformed the S&P 500 (SPX) (SPY) since my previous update in September, as I cautioned holders to “slam on the brakes.” I reminded investors that Rivian’s no-moat business model gives me little confidence about its ability to scale up profitably, even as it showed improvement in Q2.

The company’s third-quarter or FQ3 earnings release in early November suggests the production ramp has improved, as Rivian upgraded its full-year production guidance to 54K units. In addition, management indicated that it has plans to retool its production line to improve its efficiencies, as Rivian aims to reduce its COGS per vehicle.

Accordingly, the company expects its R1 platform to hit a positive contribution margin by the end of 2023. In addition, Rivian also expects its gross profit trajectory to continue improving as it scales its production. The company highlighted that barring the LCNRV charges, it could have improved its gross loss by $16K. Accordingly, Rivian expects to exit most of its LCNRV headwinds by the end of 2024, bolstering a significant positive inflection toward its target of reaching positive gross margins.

However, investors still need to balance the improvement in scale efficiencies in its Illinois facility with its planned Georgia expansion. Management stressed that it has confidence in leveraging the keen insights from its current facility for its second plant. Accordingly, Rivian anticipates applying “these learnings to its new manufacturing facility in Georgia to achieve a significantly lower cost structure.”

Despite that, Rivian is still not expected to achieve free cash flow or FCF profitability through the FY27 forecast period. Furthermore, the company anticipates ramping CapEx from FY24 as it undertakes the need to expand production to achieve improved fixed-cost leverage. Analysts’ estimates suggest significant increases to CapEx, reaching $2.4B in FY24.

As a result, Rivian still faces substantial challenges in trying to meet its long-term guidance of 10% FCF profitability. It’s one thing to set a goal and another to meet it. While the company has been able to continue raising funds to meet its near-term needs, it still needs to address the underlying demand issues.

Therefore, the ability of the company to develop its R2 platform expeditiously could be critical for it to assure investors that it could expand its TAM with its entry into the more affordable market. In addition, while Rivian has untethered itself from its exclusive contract with Amazon.com, Inc. (AMZN) for its EDV, it’s not expected to see a lift with other commercial partners in the near term.

Management reminded investors that these companies require a pilot testing phase before obtaining a firm commitment. Therefore, it could be at least FY25/26 before seeing a growth inflection in that segment. As a result, Rivian must continue scaling up on its R1 platform to improve and reduce its COGS markedly while building up the underlying demand for its R2 and EDV in the medium term.

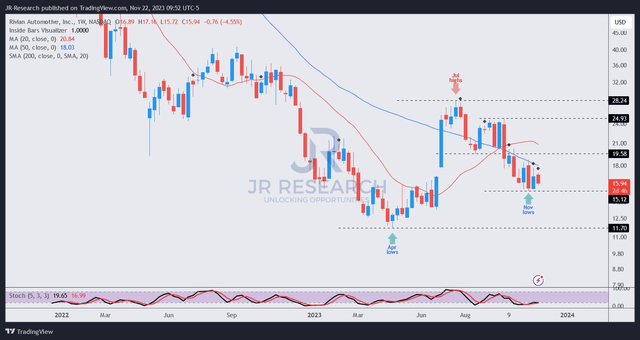

RIVN price chart (weekly) (TradingView)

The critical question likely facing RIVN investors is whether its April 2023 low ($11.70 level) could hold. The July 2023 level has been validated as a significant resistance zone that looks unlikely to be breached in the near term.

RIVN has also fallen back into a downtrend following the rejection at the $28 level, suggesting investors must be careful about chasing its upward surges. I expect RIVN’s $19.6 zone to continue offering robust resistance against further buying sentiments. As a result, I believe I was too cautious in not assigning a bearish thesis on RIVN in my previous update.

However, given its recent consolidation, the selling pressure has abated, relieving some pain from the bag holders. Despite that, RIVN’s lack of profitability and unconstructive price action suggest a buy thesis isn’t appropriate.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!