Summary:

- It appears the RIVN stock has already found a new bottom, triggered by the uncertain macroeconomic outlook and the recent banking crisis.

- Given the Fed’s projected terminal rate of 5.25%, we reckon the automaker may face more financing headwinds through 2023, if not 2024.

- While RIVN guides for positive gross margins by 2024, it remains to be seen when it may achieve positive GAAP EPS, due to its difficulty in ramping up thus far.

- While Q1’23 deliveries may have beaten estimates, its quarterly production of 9.39K remains unimpressive, lagging behind the 50K annual guidance for FY2023.

- Therefore, the RIVN stock remains highly speculative, only suitable for investors with higher risk tolerances and a long-term investing trajectory.

Edin

RIVN Remains A Speculative Play: This Is Why

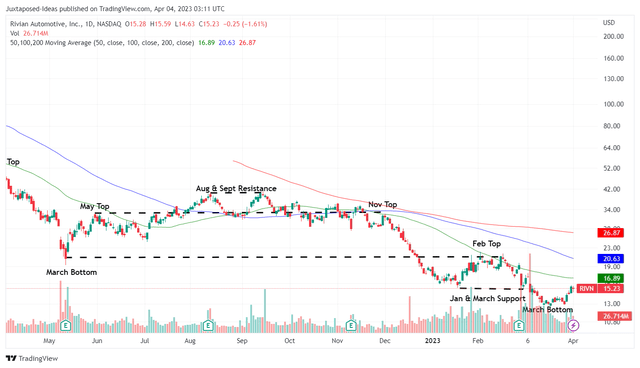

RIVN 1Y Stock Price

At the time of writing, Rivian Automotive, Inc. (NASDAQ:RIVN) has recently recorded a new 52-week low of $12.58, suggesting a drastic plunge of -64.2% from its recent November top. Otherwise, by -7.17% since our previous January 2023 article and -47.86% since June 2022.

The pessimism is likely attributed to a few factors, to be discussed in-depth below:

1. A Lower Than Expected Production Output In 2023

Firstly, RIVN guided for a 50K production output in 2023. While the number suggested an increase of +105.44% YoY from the 2022 output of 24.33K, this was far below the designated annual capacity of 150K vehicles in its Normal factory.

For now, the company has attributed the lower outputs to the supply constraint of power semiconductors, severely limiting its ramp-up against the consensus’ bullish estimates of 62.79K output in 2023.

In addition, RIVN only recorded a Q1’23 delivery of 7.94K (-1.3% QoQ from 8.05K) vehicles and production of 9.39K (-6.2% QoQ from 10.02K), compared to the ambitious FY2023 guidance. In our opinion, the automaker’s actual execution was vastly different from the previous commentary by Claire McDonough, CFO of RIVN, in the previous earnings call:

Today we have 65,000 units of R1 capacity in the plant at Normal, and we’re increasing that capacity so that 55% or call it, 85,000 units will become R1 capacity as we re-rate the lines midyear next year. (Seeking Alpha)

This suggests that its FY2023 guidance and internal 2023 target of up to 62K vehicles might be overly ambitious, on top of the missed FY2022 numbers.

Furthermore, RIVN’s long-term partnership with Amazon (AMZN) had been perceived as key to its potential success ahead, given the exclusive contract for the delivery of 100K electric vans through 2030. Unfortunately, recent reports suggested that the e-commerce giant only placed orders for 10K electric vans in 2023, below the previously agreed sum.

While AMZN’s reduced orders might be attributed to the ongoing cost restructuring and the optimization of its capex for the fiscal year, the recent development had created more uncertainties for the auto company, given the potential miss in the latter’s deliveries in 2023.

Perhaps that was why RIVN had been supposedly keen to end the exclusivity contract, in order to scale up its electric van production output for other customers.

Then again, General Motors (GM) had reported great success with BrightDrop, the electric delivery van segment, with a FY2023 revenue projection of $1B and FY2030 revenue projection of $10B/ profit margin of 20%. This was naturally attributed to the robust demand for its EV commercial vehicles, expanding by +44% YoY in FY2022.

At the same time, Ford (F) had been ramping up E-Transit as well, with deliveries expanding by +677% YoY in February 2023. This suggests intense competition in the electric van segment, triggering further headwinds in RIVN’s adoption ahead.

2. Rate Of Cash Burn Remains Unsustainable

Secondly, RIVN had been confident that its “cash and cash equivalents could fund its operations through 2025.” However, despite boasting $11.56B of cash/short-term investments by FQ4’22, the company subsequently announced a $1.3B of green convertible senior notes due 2029 at an interest rate of 4.625%.

The need to raise more capital is likely attributed to its quarterly cash burn rate of $1.65B, suggesting sustained reliance on debt and capital raises until the company achieves positive cash flow. Even then, we reckon the interest on those debts may be momentarily higher due to the continuous Fed rate hikes, significantly worsened by the recent banking crisis triggering Silicon Valley Bank’s (OTC:SIVBQ) collapse.

It remains to be seen when we may see RIVN achieve positive GAAP numbers as well, due to its FY2022 gross margins of -188.4% and FCF margins of -387.3%. For now, the company expects to improve its margins once it delivers its post-March 1, 2022 pricing over the next two years.

However, we are not certain about the 2024 guidance of positive gross margins and long-term target of 25% in gross margins/ 10% in Free Cash Flow margins. These numbers seem rather ambitious in our view, in comparison to the global EV leader, Tesla (TSLA), at 25.6%/ 9.3% in FY2022, respectively.

Even GM reported margins of only 13.5%/ -3.3% in the latest fiscal year, with F similarly recording margins of 10.9%/ 0%, despite their highly profitable ICE and Credit segments. Market analysts do not expect RIVN to record positive adj. EPS through FY2027 either, suggesting an elevated COGS and inefficient scale of production, potentially triggering further headwinds to its stock prices.

3. Intensifying EV Truck Market

Thirdly, the EV truck market competition is likely to intensify moving forward, with F already recording massive success with its F-150 lightning and TSLA’s Cyber Truck / GM’s Silverado about to enter mass production by the end of 2023.

While reviews of RIVN’s R1T had been stellar in comparison to the F-150, the price difference was tremendous as well for their base models, at $74.8K and $59.97K, respectively. Even the Cyber Truck’s base model might only be priced from $40K onwards. On top of that, the February CPI recorded a notable deceleration in new truck sales at 0.2%, compared to January levels of 0.2% and December levels of 0.6%.

Combined with the tightened discretionary spending and elevated costs for financing a new car at $6.7K for down payments and $8.4K for loan interests, it remained to be seen how its existing pre-orders might be impacted, despite Robert Scaringe’s, CEO of RIVN, optimistic commentary thus far:

The demand backlog that we have is very robust. It gives us a clear line of sight until well into 2024… One of the biggest complaints, in fact our customer team tells me this every week, is around delivery timing. How can I get my vehicle sooner? Is there a way to get ahead in the line? (Seeking Alpha)

So, Is RIVN Stock A Buy, Sell, or Hold?

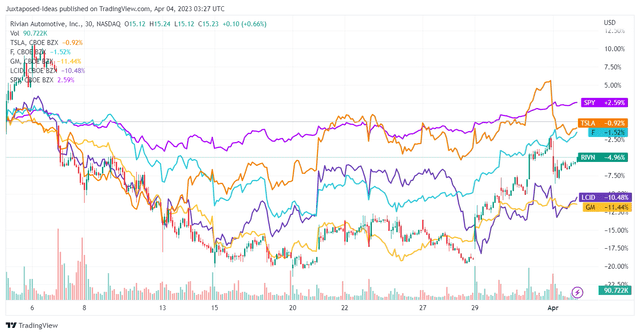

EV Stocks Over The Past Two Weeks

It was no secret that the past four weeks had been rough on the stock market, attributed to the SIVB collapse, triggering further pessimism in the banking sector and other sectors alike. Even the automotive sector had not been spared, with RIVN finding a new bottom.

Then again, this cadence might have resulted in RIVN being oversold by March 20, 2023, with the overall market sentiments lifting afterward, triggering its impressive stock recovery by +17.5% over the past few days. Assuming that these levels hold, we reckon that investors with higher risk tolerance and long-term investing trajectory may add here.

With the market already pricing in a terminal interest rate of 5.25%, we reckon the worst may be behind us, with only a 25 basis points hike in May 2023. Therefore, while RIVN is not expected to record adj and GAAP profitability over the next few years, market sentiments may have bottomed in our view.

However, we prefer to prudently rate the RIVN stock as a Hold here, since the macroeconomic outlook remains uncertain in the near term, providing investors with more chances to add at the March 2023 support of $13. Do not chase this rally, especially given its unimpressive Q1’23 delivery numbers thus far.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.