Summary:

- Rivian investors experienced a surge last week, but the gains were mostly lost as sellers took profit.

- Despite not being overvalued, there are too many red flags for investors to consider adding positions in Rivian.

- Intensifying competition and a weak outlook from Tesla’s backlog and inventory could worsen the situation for fledgling EV makers like Rivian.

Justin Sullivan

Rivian Automotive, Inc. (NASDAQ:RIVN) investors saw a massive surge last week as the company reported its first-quarter earnings. The robust update even encouraged Barclays (BCS) to call out that “the worst has passed” for the fledgling EV maker.

However, that surge saw sellers taking profit, as RIVN lost most of the gains, falling back near to the levels where it closed the week before its earnings week.

As such, investors who bought into the Street’s optimism (consensus Buy rating) have likely been “fooled” by these sellers. I assessed that some momentary short-covering could have occurred last week, as RIVN saw more than 12% of outstanding shares sold short at the end of April.

With RIVN pulling back toward the $13 zone, should investors who didn’t chase the momentum spike consider adding positions now?

While I think RIVN likely isn’t overvalued at the current levels, there are too many red flags to consider adding here. Moreover, even if I were to consider a speculative set-up, I require a much lower valuation that provides me with an appealing risk/reward profile.

Therefore, adding RIVN at the current levels isn’t attractive. Moreover, last week’s weak close suggests that dip buyers who bought the recent lows likely weren’t willing to hold on to their positions long enough, taking advantage of surges to close them out.

Hence, investors need to ask themselves whether they think CEO RJ Scaringe and his team have what it takes to successfully fulfill their production ramp through 2026, with the projected launch of their lower-priced R2.

There are constructive takeaways from Rivian’s Q1’23 update, which likely spooked some weak short-sellers into covering their positions. Rivian highlighted that it managed to reduce its gross loss per vehicle, even when excluding the positive impact of lower inventory charges.

Accordingly, CFO Claire McDonough stressed that Rivian achieved a “17% improvement” in QoQ gross profit metrics for FQ1. Hence, Rivian has demonstrated its ability to rein in costs with a more cost-efficient Enduro platform, coupled with using LFP batteries in its production.

Therefore, it forebodes well for Rivian as it attempts to scale further, capitalizing on its fixed cost leverage while benefiting from even lower inventory charges moving ahead.

Management accentuated that it anticipates “positive gross profit for 2024”, while expecting “no significant LCNRV charges or losses on firm purchase commitments for production at the Normal plant” by the end of FY24.

Therefore, Rivian needs to continue ramping up its production, meeting its deliveries, and managing its inventory and supply chain well to minimize disruptions. After that, things could fall into place for Rivian to meet its long-term financial targets.

If only it were that straightforward. At its recent annual meeting, Tesla (TSLA) highlighted that it “plans to start delivering Cybertrucks this year, targeting an annual delivery range of 250,000 to 500,000 units.”

In my opinion, CEO Elon Musk seems ready to explore more opportunities to boost Tesla’s revenue growth (despite sacrificing profit margins), as Tesla’s growth has stalled. Tesla is even contemplating advertising, which would have been highly unlikely just two years ago.

Does it make sense? Probably. I gleaned a recent report from Troy Teslike, suggesting worrying demand and inventory trends on the leading EV maker. Global backlog is down below 28 days, with backlog data in the US, China, and Europe below average.

Hence, I expect Tesla to continue leveraging its dynamic pricing strategies while ramping up its opportunities through Cybertruck, intensifying its competition against Ford (F) and Rivian. Therefore, Rivian investors must be highly cautious as the demand outlook is not pretty.

Given that Rivian is expected to burn about $10.4B in free cash flow or FCF through the end of FY24, it will likely put more pressure on its execution. Moreover, with cash and equivalents of about $11.8B, Rivian could be forced to tap external financing again if the competition proved more intense than expected.

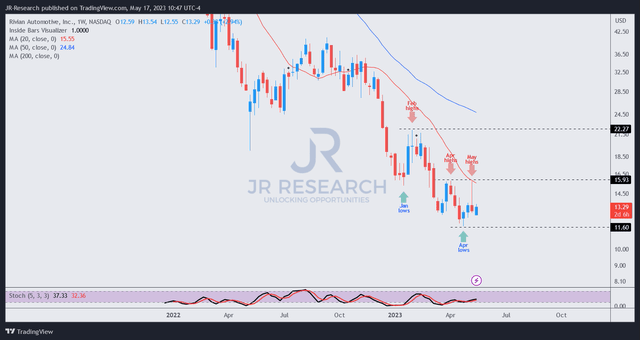

RIVN price chart (weekly) (TradingView)

RIVN’s $16 level looks like a solid resistance zone that attracted significant selling pressure, with buyers cutting exposure or short-sellers reloading their bets.

Hence, high-conviction buyers could capitalize on last week’s steep pullback to add more shares, as the buying sentiments seem to have stabilized. If RIVN’s April 2023 lows hold robustly, another surge to re-test the $16 level is possible.

However, I assessed that the competitive dynamics could worsen further for Rivian, coupled with a weak outlook from Tesla’s backlog and inventory. As such, fledgling EV makers like Rivian could be in for more pain, sending even more buyers fleeing.

Rating: Hold (Reiterated). See additional disclosure below for important notes accompanying the thesis presented.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!