Summary:

- Rivian Automotive recently reported Q2 2023 delivery figures that surpassed analyst expectations, producing 13,992 vehicles and delivering 12,640 units.

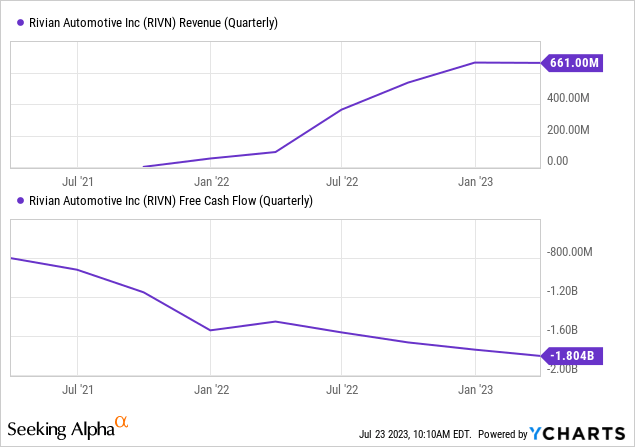

- The company could see increased cash losses as it ramps up factory output, and investors should monitor Rivian’s capital pool.

- Rivian faces competition from Tesla’s Cybertruck and traditional automakers entering the electric vehicle market, potentially impacting demand and margins.

3alexd

Up-and-coming electric vehicle company Rivian Automotive (NASDAQ:RIVN) recently released delivery figures for its 2023 second quarter that exceeded analyst expectations.

It’s a step in the right direction, but investors should remember that it represents just three months in a multi-year journey to establish the company in one of the most challenging industries.

Financial results are out in the coming weeks, and I’ll walk you through what to look for. Here is what you need to know about Rivian stock moving forward.

Building the machine that makes the machine

The automotive industry is fascinating. Not only are today’s vehicles remarkably complex machines packed with technology, but the factories making them must also be exceptional.

Tesla (NASDAQ:TSLA) CEO Elon Musk has referenced that the real challenge Tesla faced was building the machine that makes the machine. In other words, nailing the manufacturing process and technology that can make such complex products efficiently.

Rivian competitor Lucid Group (NASDAQ:LCID) has experienced this challenge firsthand. While the company’s flagship model, the Lucid Air, won MotorTrend’s Car of the Year award, the company has struggled to get mass production off the ground.

Rivian’s 2023 Q2 production came in at 13,992 vehicles, and deliveries of 12,640 units beat analyst estimates. The company also reaffirmed its 50,000 unit guidance for 2023. Make no mistake; these numbers pale compared to Tesla, but that’s unimportant. What matters is that Rivian is figuring out how to ramp production successfully; Q2 was a good sign.

What to expect from Q2 financials

The company will follow up with financial results in a couple of weeks. Investors should expect cash losses to increase as the company increases its factory output.

You can see below that Rivian likely needs to dramatically increase its output before there’s an inflection point where revenue begins outrunning production costs.

This is not a sign that Rivian is a lousy business; this is normal in the automotive world. Factories cost a ton of money to operate and must run at nearly full capacity to run profitably.

The big thing to watch for is Rivian’s ongoing capital pool to ensure investors aren’t diluted too heavily throughout this process. Rivian exited Q1 with approximately $12 billion in total cash. Annualizing Q1 burn of $1.8 billion means the company could run low on cash within 18 months, probably sooner as volumes and losses increase.

What risks does Rivian face?

The path forward for Rivian is straightforward; the company must grow its production as efficiently as possible. However, there are risks to this progress.

Rivian’s electric truck, the R1T, faces looming competition as Tesla prepares the Cybertruck to hit the market. The company recently celebrated its first unit built at its factory in Austin, TX.

Additionally, legacy automotive companies are battling for their piece of the electric truck market. Ford (NYSE:F) announced a $10,000 price cut on the F-150 Lighting. Rival General Motors (GM) is sprinting to bring electric models to market to complement its existing Hummer EV.

Rivian faces potential demand and margin pressures at a time when it’s financially vulnerable. Tesla has already crossed the threshold to become profitable and has the flexibility to cut prices. Legacy autos have traditional combustion autos to help offset the losses of their electric efforts.

Investors need to watch these dynamics over the next several years, so while a quarter of solid deliveries is a good sign, the war is nowhere near over.

How should investors approach the stock?

Rivian remains a very speculative stock. Investors should approach it appropriately as such. The business is now generating revenue, but the stock remains very hard to value because its revenue and earnings outlooks are virtually impossible to forecast accurately.

Investors should consider accumulating shares slowly, preferably evaluating quarterly. If investors accumulated shares every quarter that Rivian showed sufficient manufacturing progress, one could likely build a position by the time Rivian’s financial outlook becomes more certain.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.