Summary:

- Rivian’s partnership with Volkswagen is expected to drive significant changes for both automakers, focusing on software development and operational discipline.

- Volkswagen’s investment in Rivian is set to transform Rivian’s business lines and execution capabilities, with a focus on electric vehicle architecture.

- The partnership between Rivian and Volkswagen presents a unique opportunity for revenue generation through software integration, potentially leading to significant upside potential for Rivian’s stock.

RoschetzkyIstockPhoto/iStock Editorial via Getty Images

Investment Thesis

Rivian’s (NASDAQ:RIVN) recent partnership with Volkswagen AG (OTCPK:VWAGY), which received regulatory approval from Germany’s Bundeskartellamt in July 2024, is expected to drive changes for both automakers, but maybe not in the ways you’d expect. Heading into earnings Tuesday, this is the first quarter since the announcement of this partnership, and I believe it’s highly significant for Rivian’s direction and, moreover, operational discipline.

I believe Volkswagen’s investment of up to $5 billion in the company is expected to launch a fundamental transformation in Rivian’s business lines and execution capabilities. As Volkswagen takes a 50% stake in the joint venture, this collaboration will help develop the German auto giant’s electric vehicle architecture. It’s in this benefit I think we are set to really see the power of this partnership: it’s a software play.

Rivian has historically faced challenges with production efficiency and cost management. What they have not struggled with is designing innovative software and EV platforms that will change auto. Volkswagen’s experience is going to complement that, with their expertise in scaling vehicle production and managing supply chains expected to crystallize a more steadfast approach at Rivian.

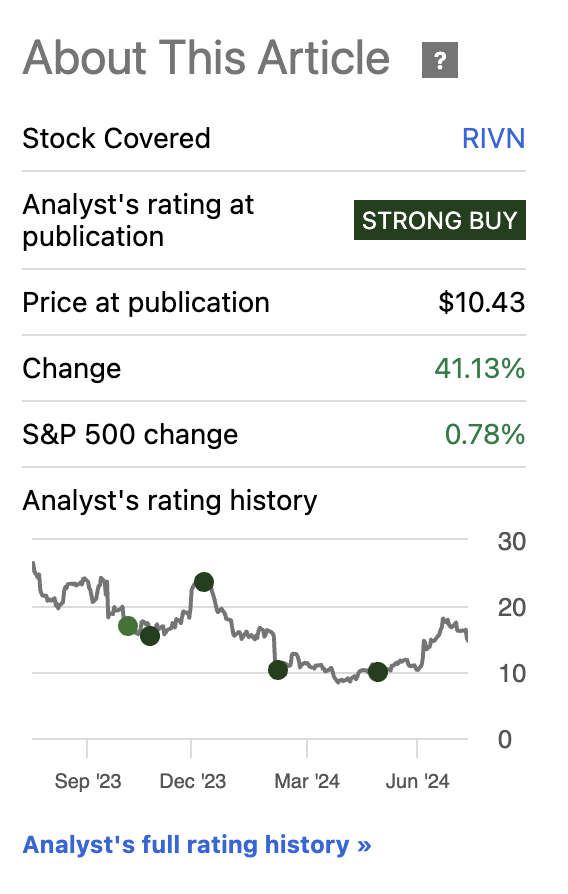

Despite the recent run-up in Rivian’s stock price and the excitement going into earnings, I remain a strong buy on their shares. On the whole, a slightly bearish outlook from some analysts (especially post VW deal) leads me to believe we are in for more room for the stock to grow. I think we have a more attractive valuation setup here. With the backing of Volkswagen, Rivian is now even better set to overcome production challenges. I am optimistic on the EV startup going into earnings.

Why I’m Doing Follow-Up Coverage

Since my last coverage in May, Rivian shares have risen 41.13%, beating the market. Much of this jump has been supported by the ongoing turnaround and the strategic partnership with Volkswagen.

RIVN Stock Price History (Seeking Alpha)

Stock markets are known to be leading indicators, and so I think this sharp uptick in shares is a sign that the company has finally turned a corner. The collaboration with Volkswagen, particularly in software and electrical architecture, will further improve their financial performance, in my view.

For Volkswagen’s part, their broader strategy to regain market share in the EV sector, particularly in the U.S. and China, will be supported since they have been struggling against competitors like BYD since last year.

This partnership is a game changer for both the cash infusion and the software Rivian is now providing. With this, I wanted to dive into the value of this partnership, and what it means in the long run for Rivian.

Partnership Deep Dive

In their 2Q 2024 earnings call, Volkswagen emphasized the importance of their investment in the partnership with Rivian. On the call, CEO Oliver Blume noted:

…[we’re now focusing] on our new partnership with Rivian, where we recently announced our intent to establish a joint venture. Here we will jointly create the next generation of electric electronic architecture and software for electric vehicles. The vision of the software- defined vehicle is becoming reality in a short period of time -Q2 Call.

The new activities with Rivian will complete our smart partnership ecosystem across all technologies and regions. Volkswagen Group together with XPeng, Mobileye, Horizon Robotics and others is a powerhouse of automotive software development. We will continue to reshape our software company carried for us is and remains an important part of Volkswagen Group’s software strategy. We will combine [the] expertise of partners with our own know-how and our capabilities for global scaling and industrialization -VW Earnings Call.

At the heart of the drive behind this collaboration is Volkswagen’s core push to improve their software arm, CARIAD. I believe the division has encountered operating challenges in developing a cohesive software strategy, which can now be accelerated thanks to Rivian’s talent pool and technology.

CEO Blume added (commenting on current performance):

CARIAD continued to roll out software to a growing vehicle park which resulted in an increase of sales revenue of 30%. Operating result came in at minus €1.2 billion. Reported net cash flow stood at a negative €0.4 billion or minus €1.5 billion if you adjust for intergroup income tax refund. -Earnings Call.

To be clear, these are fairly large losses (even for VW). I expect these to consolidate, with Rivian providing more high-value software for them to license.

Unlike traditional hardware or battery partnerships, software integration offers a unique angle for revenue generation for legacy auto. Embedding sophisticated software systems into vehicles can enhance user experience and create new revenue streams through software services and subscriptions. This software-centric model is a shift in the automotive industry, which emphasizes the value of digital over purely mechanical advancements. VW is serious about this strategy.

On this note, it’s also important to note that Sanjay Lal, who previously led Rivian’s infotainment and middleware development, now heads this initiative at Volkswagen. The partnership will benefit the two companies as they develop a unified platform that enhances the functionality and connectivity of Volkswagen’s vehicles.

Earnings Expectations

Rivian is set to release their earnings report for the second quarter Tuesday, post-market. Consensus estimates for earnings per share (EPS) stand at -$1.19, indicating a slight drop-off in losses year-over-year, or a decline of 9.81%. Expected revenue for the quarter is set at $1.15 billion, which represents a modest year-over-year increase of 2.87%.

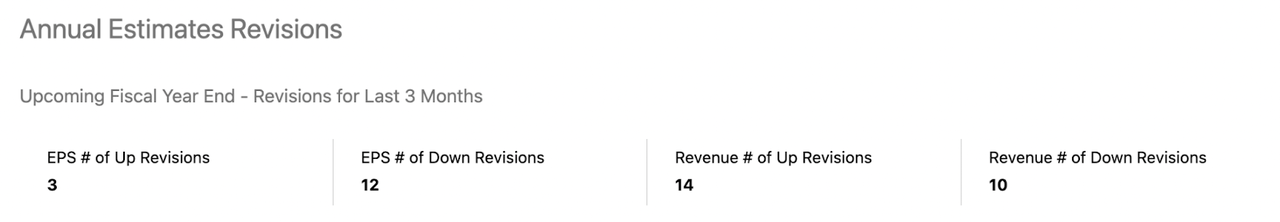

While the partnership has been heralded as a necessary lift for the EV startup, recent months have continued to see a downward revision in earnings estimates for Rivian, highlighting the cautious stance many Wall Street analysts hold.

While the partnership will take some time to pan out, in the short run, analysts have downgraded EPS estimates (vs. raising them) by a factor of 1:3, while upgrading revenue estimates by a factor of 12:5.

Rivian Estimate Revisions (Seeking Alpha)

It’s a weird setup, which means analysts are expecting the company to grow sales faster now than originally expected. Yet at the same time, they expect them to be less profitable than expected. This feels contrary, especially given the recent supply chain optimizations Rivian made in the spring to help control costs. It feels a little pessimistic on the analysts’ part if you ask me.

Valuation

Rivian’s current valuation presents a really interesting opportunity for investors. The stock’s forward Price-to-Book (P/B) ratio is actually 1.28% below the sector median, signaling that the market has not yet fully appreciated the potential uplift this partnership could bring. In essence, the market thinks that the present value on the return on equity the company has will trail the sector median. At this point, I believe Rivian has really positioned themselves to capitalize on new opportunities with their strategic partner. The market should take them as a company that’ll generate a far higher than sector median ROI in the long run, meaning their forward price to book should be higher than the sector median.

I believe a reassessment of Rivian’s valuation is needed. If the stock were to achieve a more appropriate 30% premium over the sector median book value, this would indicate a significant upside potential. Specifically, if Rivian’s P/B ratio increased to align with this premium, the stock could experience upside of up to 32.09% from its current level. I see this as a more intermediate upside potential. For those who have been following my analysis for a few months, my earlier assessments of fair value ($44.24/share) still hold, I just believe these are more long-term targets.

Risks

At the heart of this tie up is Volkswagen’s need to enhance their software capabilities. Rivian’s expertise in software development is expected to help Volkswagen address longstanding issues with their electric vehicle lineup. In this lies what I think is the biggest risk: integrating a legacy automaker with an EV startup will pose unique execution issues. While Volkswagen needs Rivian for their software innovations, I have no doubt that Rivian will benefit more from this partnership given where their current condition lies. This partnership has become nothing short of mission-critical for Rivian. They will likely have to adapt and change company strategy more than once to provide for this JV. This one-eye off the wheel approach may make founder RJ Scaringe’s life more difficult.

Like other big auto companies that have tried to partner with up-and-coming EV startups before them, the bureaucratic nature of Volkswagen will likely slow down Rivian’s innovation pace at times, which then becomes an amplified problem in the space of EVs given the competition. I expect them to overcome this, given the company (and Scaringe’s) ability to adapt. They can roll with the punches.

As I mentioned before, this will mean one eye off the road, and this distraction comes at a time when Rivian is reporting slower sales growth. The company’s revenue growth is marked at a robust 123.79% year-over-year. But their forward revenue growth is expected to slow to 58.17%. On this same note, the EV company delivered 13,790 vehicles in 2Q, but this was up only slightly from the 13,588 sales in the previous quarter and this is down from the 13,972 delivered in 4Q 2023 after they temporarily closed down their Normal, IL manufacturing plant for upgrades.

In essence, this partnership will likely put pressure on growth in the short run as it naturally distracts. But this doesn’t mean that is bad. Rather, the software side has an impressive runway to scale as they help VW. Software tends to have higher margin and more stable. I expect Rivian to make good use of this code sharing in a way that will increase long run margins or the EV player.

Bottom Line

While market conditions have become more volatile, I believe Rivian’s shares remain a strong buy despite the recent run-up. In essence, I believe there is still more room for revenue and EPS growth due to this transformative partnership with Volkswagen.

I’m looking forward to the upcoming earnings call, which will really help shed light into Rivian’s strategic direction and what financial prospects will really mean as the EV company begins to share their innovative automotive software with one of the world’s most entrenched legacy auto manufacturers. I believe the upside still remains for Rivian. I am excited to see what management has to say.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.