Summary:

- Rivian posted a Q3 double beat, with improving production ramp and adjusted EBITDA being key focus areas.

- The company’s expansion of its EDV availability to other companies beyond Amazon also reinforces confidence in its longer-term growth trajectory.

- However, the EV demand environment is starting to show structural signs of a slowdown, which could potentially impact Rivian’s topline growth prospects.

- As a result, investors are likely to increase focus on Rivian’s ability to expand margins and potentially achieve adjusted EBITDA breakeven before the end of 2024.

Mario Tama

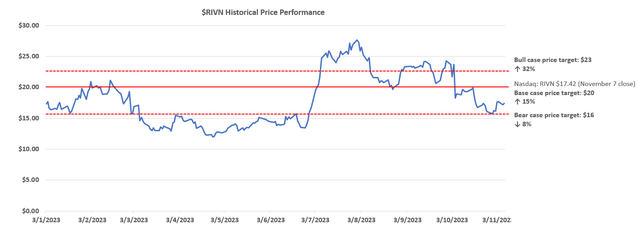

Rivian Automotive, Inc.’s (NASDAQ:RIVN) stock has lost more than a third of its value since early October before paring some of the declines earlier this month in response to the Fed’s seemingly dovish pause on rate hikes. Despite posting better-than-expected Q3 results this evening, the stock has yet to fully recover the losses that followed investor aversion to Rivian’s conservative full year production guidance provided in earlier October prior to the latest upward adjustment, as well as share dilution risks stemming from the company’s $1.5 billion convertible bond issuance last month.

Although Rivian has delivered consistent positive progress in scaling productions and vehicle sales this year, which effectively lessens concerns over the achievability of its set guidance, the company remains susceptible to a slowing EV demand environment ahead of ongoing macroeconomic uncertainties. We believe the stock is fairly priced at current levels to reflect the company’s capital structure and risk profile relative to the elevated normalized risk-free Treasury benchmark. Further upside potential is likely to remain limited in the near term as Rivian’s growth prospects based on management’s reiterated guidance have already been priced in, while investors also adjust to a tempered EV demand environment due to persistent inflationary pressures and surging borrowing costs that continue to weigh on the consumer.

Limited Visibility on Rivian’s Growth Trajectory

Rivian’s improving production ramp-up in recent quarters has allowed it to start realizing a bigger portion of pent-up sales on its order book. Specifically, current orders on the R1S model can expect delivery in early 2024, which is consistent with our understanding that Rivian has been allocating the majority of its production capacity to the SUV model in recent quarters. Meanwhile, current orders on the R1T pickup truck can expect delivery in as little as weeks depending on the configuration.

Yet visibility on growth thereafter has been clouded by increasing uncertainties to the pace of EV adoption across Rivian’s core U.S. passenger vehicle market. Specifically, the EV industry has been experiencing increased weakness across the U.S. Europe and China – three of the largest and fastest-growing auto markets in the world. In the U.S., EV sales growth has slowed to 6% q/q in Q3, decelerating from 14% q/q observed in Q2.

In addition to the emerging impact of ongoing macroeconomic challenges, the EV industry is also starting to see a structural shift in demand as penetration among early adopters nears completion. This has accordingly shifted penetration to the broader mass market, which is more sensitive to evolving macroeconomic conditions spanning inflation and surging borrowing costs. Competition is also stiffening in the EV industry, as “more companies debut long-planned [models] into a less-receptive market”. Specifically, available EV inventory has grown to 88 days on average, far exceeding the 56 days currently observed for ICE models, 43 days for the broader automotive sector, and the 80-day historical average. This implies a potential need for further price cuts within the foreseeable future to retain demand, which poses as an imminent headwind for EV start-ups like Rivian that are still trying to scale productions towards breakeven.

Fleet demand, which is a key growth driver for Rivian’s commercial business, is also showing signs of weakness. Recall that investors had previously been optimistic about Rivian’s longer-term prospects on realizing pent-up opportunities stemming from the commercial sector’s transition to electric. Specifically, Rivian has demonstrated a tangible first-mover advantage in commercial EV sales achieved through its partnership with Amazon.com, Inc. (AMZN). The e-commerce giant has taken delivery on 10,000 Rivian EDVs to date, and has completed more than 260 million product deliveries with the electric vans, providing validation to the EV maker’s technological competency in this foray. Rivian has also officially announced availability of its customized commercial vehicles to other companies today.

However, we expect tempered prospects on related growth opportunities for Rivian outside of the Amazon partnership due to the impact of ongoing macroeconomic uncertainties on the enterprise spending environment. Car rental company Hertz Global Holdings, Inc. (HTZ), which has been a notable EV buyer in the fleet environment, has also highlighted “high repair costs” as a reason for its decision to slow related purchases. This also underscores the TCO disadvantage during the early stages of EV adoption due to the wide distance from achieving price parity with ICE models still, which exacerbates the broader affordability challenge currently experienced in the automotive market.

Growing Focus on Margin Expansion

Given the challenging demand outlook for Rivian, investors are likely to divert their attention to the company’s ability in expanding margins and potentially achieve EBITDA breakeven before the end of 2024. The expectation is consistent with the pace of meaningful improvements to adjusted EBITDA realized in recent quarters, driven primarily by continued “operating expense rationalization”.

Recall from our previous discussion that Rivian is also expected to realize incremental production cost savings starting in the back half of 2024. Said cost improvements will come at the expense of temporary disruptions to production in mid-2024 in order to retool R1 production capacity up from the current 65,000 unit run rate to 85,000 units, and reroute the production line to simplify the manufacturing process. But taken together with the continued progress observed in ramping up the integration of Rivian’s proprietary Enduro Drive unit into the R1 and EDV vehicles, the company is expected to realize a 30% reduction to its bill of materials once the new production strategy ramps. The related progress is already evident in the pace of margin expansion observed at Rivian in Q3 following three quarters of ramping both EDV and R1 models produced on the Enduro Drive unit, with gross losses improving by 108 bps from Q2 (or $2,000 per vehicle cost improvement from 3Q22).

Continued improvements on the cost front are likely to partially offset some of investor concerns over return-on-capital compression risks, particularly amongst EV pureplay start-ups that are running capital-intensive operations via vertically integrated production strategies like Rivian’s.

Fundamental and Valuation Considerations

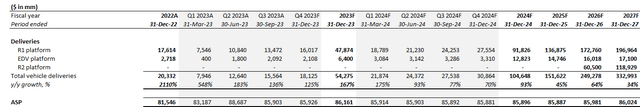

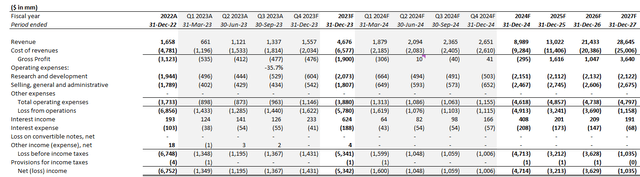

Adjusting our previous forecast for Rivian’s actual Q3 performance and forward fundamental outlook, we expect full year 2023 revenue to expand 182% y/y to $4.7 billion with deliveries of 47,874 R1 vehicles (+172% y/y) and 6,400 EDVs (+135% y/y). Although continued production ramp-up improvements are expected, barring the temporary disruptions stemming from the planned production line rerouting at the Normal facility slated for mid-2024, Rivian’s prospects for both R1 and EDV sales are likely to start tempering in the back half of next year as the initial reservation backlog gets realized while its order book also starts to slow in tandem with increasing softness observed in the broader EV demand environment. We are also expecting pressure on vehicle ASPs in the near term in response to intensifying market competition as observed in elevated EV inventory levels in recent months coupled with decelerating demand.

The topline challenges are expected to be partially offset by various cost improvements stemming from changes in the vehicle manufacturing process and parts competition, workforce consolidation, and scale realized through the ongoing ramp of R1 and EDV productions. Taken together, we expect Rivian to start realizing nominal gross profitability in the middle of next year, which will be critical to enabling adjusted EBITDA breakeven thereafter.

Rivian_-_Forecasted_Financial_Information.pdf

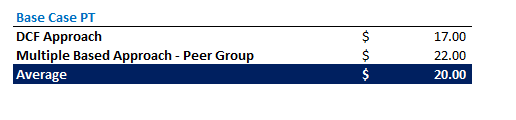

We are maintaining our base case price target for the stock at $20. Despite the increased equity risk premium relative to the higher normalized risk-free benchmark Treasury rate given the current “higher for longer” monetary policy set-up, we expect Rivian’s improving cost structure to remain an offsetting factor.

The $20 base case price target is calculated by equally weighing results from the discounted cash flow and multiple-based valuation approach.

Author

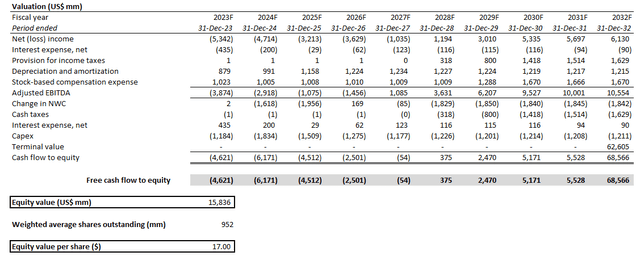

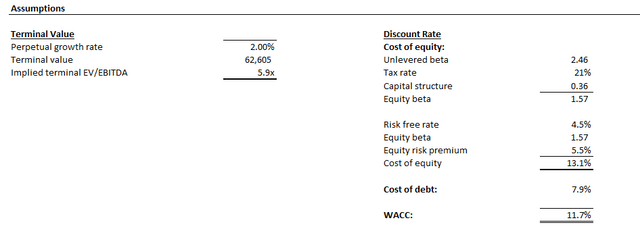

Under the DCF approach, we have considered cash flow projections taken in conjunction with the fundamental analysis discussed in the earlier section. A WACC of 11.7% in line with Rivian’s capital structure and risk profile relative to the risk-free Treasury benchmark is considered, and a 2% implied perpetual growth rate is applied on terminal cash flows at the end of the forecast period.

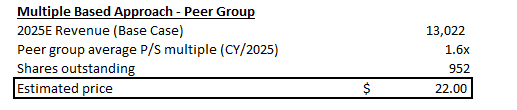

Meanwhile, under the multiple-based approach, we have applied a 1.6x ratio on Rivian’s 2025 sales projections. The multiple is in line with the broader EV peer group’s average, and holds a slight premium over Rivian’s currently traded levels, which is warranted given the consistent pace of improvements observed over its execution on ramping up production volumes and realizing cost efficiency in recent quarters.

Author

We believe the equally weighted valuation approach for Rivian is appropriate. Specifically, the DCF approach reflects Rivian’s estimated intrinsic value based on the sole consideration of its fundamental prospects and risk profile. However, the results are dependent on the stability of Rivian capital structure, which remains uncertain given an ongoing cash burn trajectory that is indicative of incremental liquidity needs in the longer term to support its product roadmap. Meanwhile, the multiple-based approach reflects investor confidence in the stock given the near-term macroeconomic and industry demand backdrop, and compensates for the uncertainties pertaining to Rivian’s longer-term capital structure in our opinion.

Final Thoughts

Admittedly, Rivian has orchestrated an impressive turnaround this year, with a consistent pace of solid improvements made to both its production and delivery volumes, as well as the realization of operating cost efficiencies. However, the company has yet to demonstrate company-specific strengths in overcoming the increasingly competitive, yet slowing EV demand environment. This is likely to increase investor focus on Rivian’s ability to achieve its ambitious vehicle BOM reduction plan in the near term and drive incremental margin expansion. But with the planned retooling of its production line at the Normal facility not expected until mid-2024, and the ensuing cost savings not realizable until productions ramp thereafter, we see limited headroom for further upside potential in the near term for the stock from current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!