Summary:

- Rivian revealed that it had approximately 114 thousand reservations in the US and Canada for its EV products as of November 7, 2022.

- Rivian made progress with its production ramp in the third quarter.

- However, Rivian’s valuation already reflects a sizable production increase.

hapabapa

Rivian Automotive (NASDAQ:RIVN) grew its third-quarter production to 7,363 electric vehicles and the EV company is making good progress on the delivery front as well. However, Rivian reported weaker than expected revenues despite a significant production ramp in the last quarter and the company has said that it will push out some capital expenditures into FY 2023. The EV manufacturer also confirmed its FY 2022 production goal of 25 thousand electric vehicles. Despite progress regarding production and deliveries, I believe that Rivian is fully valued in the market and that shares have very limited upside potential!

Investors no longer appreciate EV companies

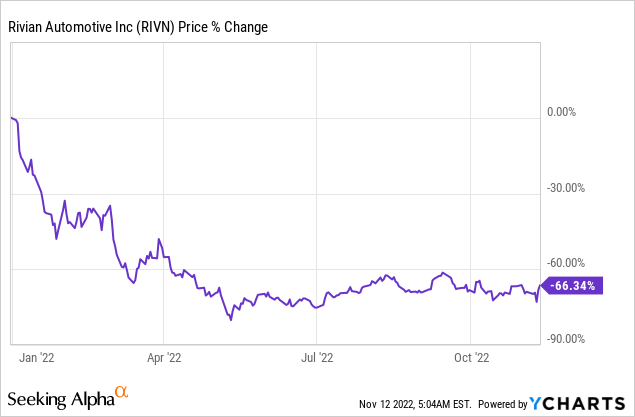

The share price of Rivian has fallen about 66% this year as investors recognized their mistake to price low-output EV companies excessively after the company’s IPO. Rivian’s valuation, as we will see further below, is still widely overvalued based off of the company’s revenue potential.

Rivian’s Q3’22 production growth

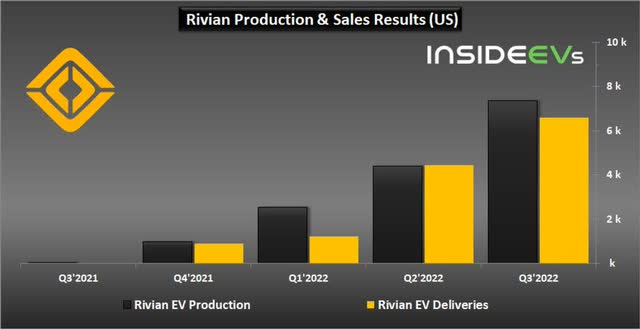

The biggest accomplishment for Rivian in the third-quarter related to the firm’s strong production growth. In Q3’22, Rivian achieved record production and delivery volumes: the EV company produced 7,363 electric vehicles in Q3’22 and delivered 6,584 electric vehicles to customers. In total, Rivian has now produced 14,317 EVs and delivered 12,278 electric vehicles this year. With a full-year production goal of 25 thousand EVs – which the electric vehicle start-up just confirmed – Rivian will have to produce approximately 10,683 electric vehicles in the fourth quarter to meet its guidance. The implied production goal for the fourth-quarter implies 45% quarter over quarter growth.

Rivian also said that its reservation in the US and Canada have increased to 114 thousand, showing an increase of 16 thousand since the end of June when reservations were reported at 98 thousand.

Another expected Q3’22 loss

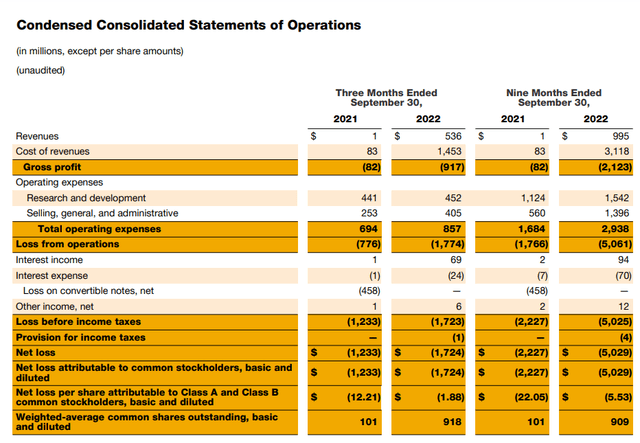

Rivian generated a loss of $1.7B on revenues of $536.0M and the electric vehicle manufacturer missed the consensus estimate by $551.6M. Since Rivian is still ramping up production and has a relatively low factory output level – total production so far has been just about 15 thousand electric vehicles – Rivian should be expected to remain unprofitable for the foreseeable future. According to Seeking Alpha provided estimates, the consensus is that Rivian will continue to generate losses until at least FY 2027.

Forecast and valuation

Rivian confirmed its production target of 25 thousand units for this year and also confirmed its adjusted EBITDA target of $(5.45)B. However, Rivian lowered its forecast for capital expenditures from $2.00B to $1.75B as the electric vehicle start-ups plans to push $250M in capital expenditures into the next fiscal year.

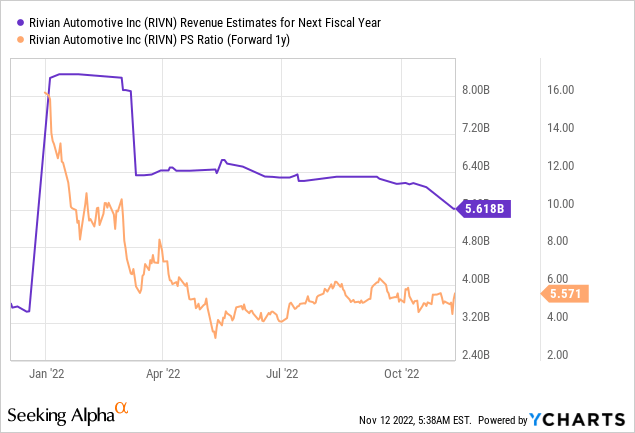

Based off of $5.62B in revenues projected for FY 2023, shares of Rivian are currently valued at a P-S ratio of 5.6 X. I believe this is a very high valuation for a company that won’t make any profits for at least half a decade. Despite a near-70% down-ward revaluation this year, the market may still be too optimistic regarding the company’s expected output next year.

Risks with Rivian

Rivian ended the third-quarter with cash resources of $13.3B which gives the EV start-up a long liquidity runway and practically ensures the ramp of the R1T, R1S and the EDV-branded commercial van. Rivian has the best balance sheet in the EV sector and has no immediate need to raise capital and dilute shareholders. For those reasons, Rivian also has the lowest production risks in the industry.

However, what I see as a risk factor for Rivian is a potentially slower production ramp for its R1T and R1S electric vehicles. A delay in production in FY 2023 could hurt Rivian’s potential in the electric vehicle market and there are also risks related to recent recalls which have the potential to hurt Rivian’s reputation before it is serving customers at scale. What would change my mind about Rivian is if the EV company were to submit a very strong production forecast for FY 2023 in which case Rivian’s shares could revalue to the upside.

Final thoughts

Rivian’s shares, I believe, are more than fully priced and the company’s production potential is properly reflected in the company’s valuation. Rivian did confirm its FY 2022 production outlook and the third-quarter production ramp indicates that Q4’22 production will jump close to 50%. However, Rivian is not generating any profits and won’t generate any profits for years to come. Considering that Rivian has the best funded balance sheet in the entire electric vehicle industry and that production risks do exist, I believe shares of Rivian are only a hold!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.