Summary:

- Rivian stock plummets 20% after underwhelming delivery outlook.

- Tesla did not provide updates on its Cybertruck.

- Rivian recently told its employees it’s expected to beat deliveries by 24%.

- Rating changed to buy.

jetcityimage/iStock Editorial via Getty Images

Just a few weeks ago, I wrote an article explaining why my position on Rivian (NASDAQ:RIVN) was a hold. In short, I thought Rivian’s production ramp-up was too slow, and I was worried about their competition, specifically the Tesla (TSLA) Cybertruck. In the recent earnings report, one of my worries came true as they provided disappointing delivery updates. However, the Tesla investor day has passed, and I now have a better view of Rivian and its competition. While I went against the bulls consensus before, I now am against the general bears consensus on Rivian’s 2023 outlook. I believe the market has overreacted to their delivery updates and Rivian will provide good news in the next few quarters.

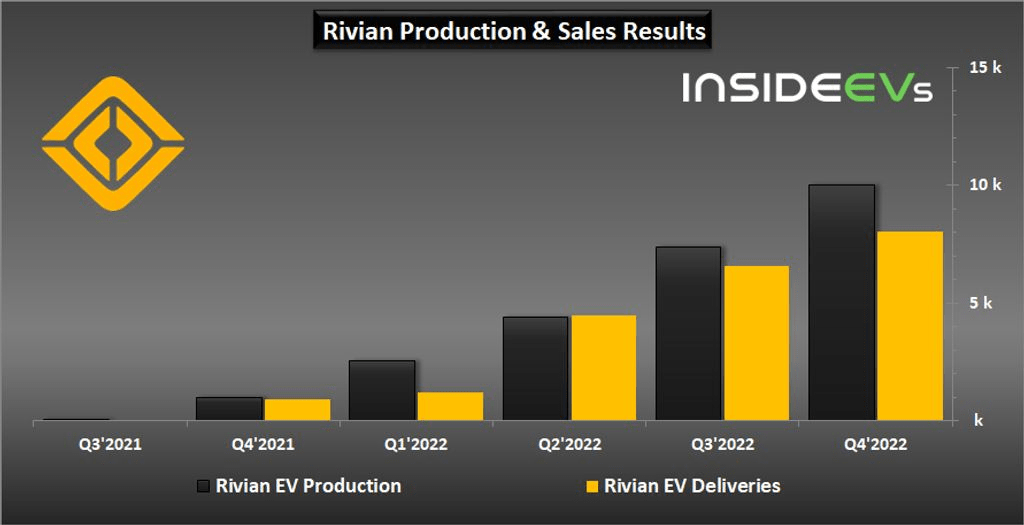

In my article, I stated that I believe Rivian will “match revenue expectations and outperform earnings by about 7%”, whereas, in reality, Rivian missed revenue expectations by 9% and exceeded earnings by 11.4%. In quarter 4, Rivian produced 10,020 vehicles and delivered 8,054, the supply chain being the main limiting factor. Rivian’s 50,000 vehicle production outlook for 2023 tanked RIVN stock, as it was well under Wall Street’s estimates of 62.2K. I was certainly disappointed, as I estimated 40-50K R1T alone to be produced for 2023.

All that said, I expect Rivian to easily pass its 50k production goal and choose a very conservative target instead as a result of lowering its production goal several times and still not reaching it last year. Before I explain my reasons for my positive production outlook, I’ll first address their competition.

Regarding Competition

One of my concerns was Rivian’s competition. The electric truck market is still relatively new, so I felt the need to know what Tesla offers in order to better understand the competition. Tesla’s investor day went by covering their “masterplan 3”, with few quantitative qualities investors look for. There wasn’t much update to the Cybertruck other than reaffirming that production starts this summer. They did briefly mention that the truck is comparable to the competition, which tells me what I need – that Tesla will most likely not meet the specs it laid out in 2019.

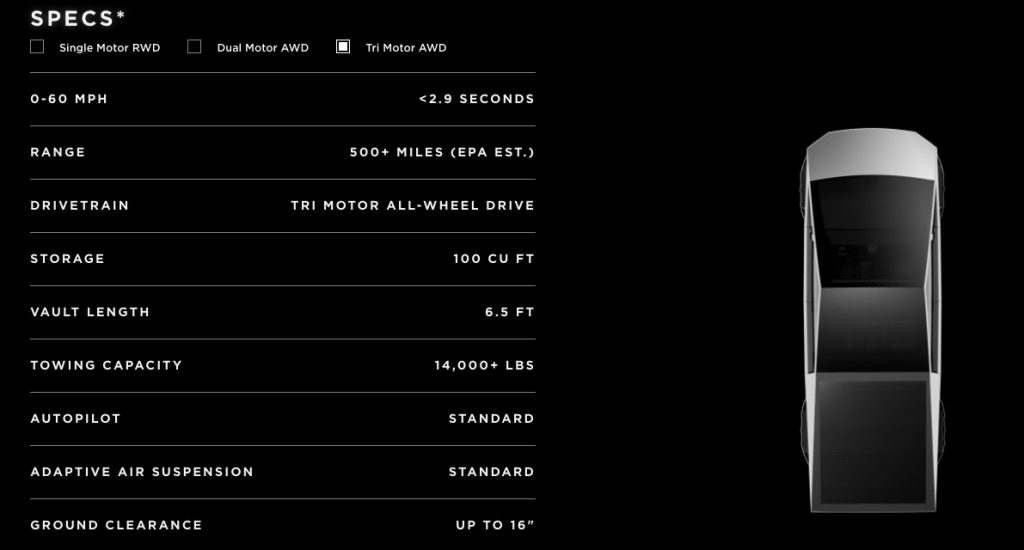

Cybertruck Specs (Tesla)

Keep in mind the model shown had an MSRP of $69,900 in 2019. In comparison, R1T has a $73,000 starting price for a dual motor with an estimated 260 miles of range. Indeed, Tesla will not meet their 2019 estimates and is expected to raise prices or drop specs or a combination of both for the models to be “competitive”.

I expect that the Rivian will continue to be one of the best electric trucks the market offers, and I’m no longer worried about their competitive landscape.

Regarding Production

Another criticism I had was that Rivian was ramping up productions too slowly. For reference, the Ford lightning is set to produce 150,000 units this fiscal year. Compare that to estimates of around 40,000 for the R1T. The supply chain continues to be the main problem for Rivian. However, my optimism for their production comes from 2 sources: rumors and the shareholder letter.

The rumor is from a recent article by Bloomberg, where “Rivian Tells Staff EV Output May Be 24% More Than Forecast”. Keep in mind the “forecast” stated was 50,000, translating into 62,000 units which falls within the range of Wallstreet’s original estimates. The sources of this information were kept anonymous for leaking private meeting information.

Personally, I think the leaked numbers are quite plausible. It aligns with what Wall Street and myself had in mind. Given the 10,020 vehicles that were produced in Q4 and given their production increase QoQ, 50,000 for the year seems too low.

Rivian Production increase QoQ (InsideEV)

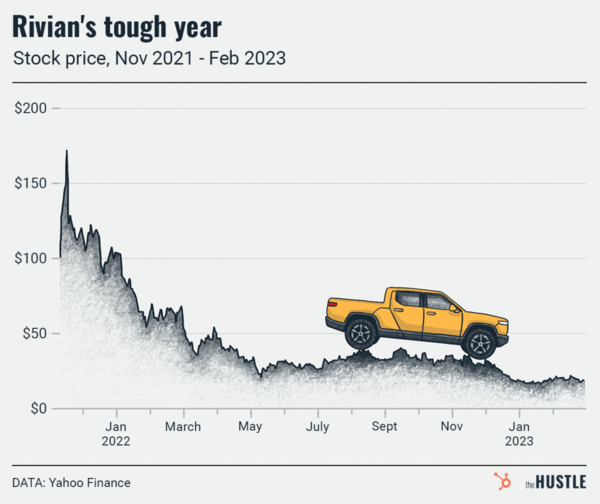

Now, why would Rivian set such a low bar for itself? They could be holding back to “beat expectations”, it’s one of the oldest tricks in the book. However, it’s not really beating expectations if the actual numbers just about line up with Wall Street estimates. And it’s not worth it to let their market capitalization tank so much just for such sake. What I think is more likely is that Rivian is playing conservatively because their delivery updates thus far have been disappointing. Last year, they missed their production goal due to a variety of issues, and the stock plummeted 71% in the same period. It is very possible Rivian is providing the “worst-case scenario” not to disappoint investors in case the same catastrophe happens. It is perhaps wiser in their mind to underpromise and overdeliver.

Rivian stock price plummets (The Hustle)

However, I think there are several reasons why this worst-case scenario wouldn’t happen. CFO Claire McDonough stated in the management commentary that Rivian today has “65,000 units of R1 capacity in the plant at Normal”. He then commented that Rivian believes supply constraints will alleviate in the second half of the year.

One interesting thing I noticed was that Rivian talked a lot about their high expectations for 2024. They’re planning to “re-rate” their facility, going as far as taking their plant down for a few weeks mid-year (2024) to achieve their desired capacity of 85,000. This demonstrates confidence in resolving their silicon supply chain issue, and Rivian stated vaguely they’re confident in figuring it out. They plan to see a positive gross profit by the end of 2024, meaning no more LCNRV inventory charges and losses on firm purchase commitments.

Thus, it is possible Rivian has recently figured out supply chain issues ahead of schedule, thus now they can exceed expectations.

Conclusion

Within less than three weeks, two of my biggest concerns- competition, and production- were addressed. If Rivian officially updates its production outlook, it only makes sense the stock will go back to its pre-earnings report level. Equity should not be too much of a concern in the short term as they have an asset-to-liability ratio of 4.4, and they have Amazon (AMZN) supporting them. There are some topics, such as R2 models that I didn’t want to touch on because of their uncertainty. In my previous article, I took a deeper dive into Rivian’s business model as a whole.

With these in mind, the rumor behind the improved production outlook seems legitimate as several people “familiar with the matter” did confirm it. If all goes well, Rivian is a company set up for success not just in the short run, but for years to come. I think the hold is over, and I would feel comfortable investing as Rivian trades at its all-time lows.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.