Summary:

- EV demand slowdown is attributed to depreciation concerns, election uncertainty, and charging infrastructure issues, all of which can be addressed in the next decade.

- Rivian is well-positioned to take advantage of the second wave of EV demand, with improving battery technology and plans for mass production.

- Upside potential is huge with reasonable risk as the company has almost $13 billion cash after its agreement with Volkswagen.

Sundry Photography

It’s no secret the EV market is slowing down, demand has slowed as a result of the higher cost of EVs. This in part was attributed to the rise of hybrid vehicles and its economic advantage. In fact, Goldman Sachs estimates the payback period for Hybrid vehicles is just over 3 years, compared to 5-6 years for EVs. In addition, early signs show that depreciation is slower in the HEV (Hybrid Electric Vehicle) and PHEV (Plug-in Hybrid Electric Vehicle) compared to EVs. Ultimately, however, many analysts that the future is ultimately electric.

Sales of HEVs and PHEVs have been accelerating amid the slowdown in EVs. In the US, growth has outpaced EVs over the past several months. As a result, we believe global HEV sales could exceed the outlook by 1 to 2 million vehicles. While HEVs are viewed as a transitional technology, we look for increasing focus on them to help reduce CO2 while maximizing earnings and supporting investment in EVs for automakers.

-Goldman Sachs

The research group lists 3 underlying issues for the recent EV demand slowdown: depreciation causing concerns over pricing, elections causing uncertainty over government policies, and driving range along with charging infrastructure. I think these issues can all be addressed within the next decade, and why Rivian Automotive, Inc. (NASDAQ:RIVN) is in a prime position to take advantage of what I call the second wave of EV demand and beat the market.

EV is the Future – Because it’s Better

According to analysts, EV growth was in part fueled by the excited early adopters, who bought the vehicle despite its high pricing, but it is failing to appeal to the “early majority”. In order to reach this audience, EV needs to solve the 3 problems Goldman Sachs pointed out.

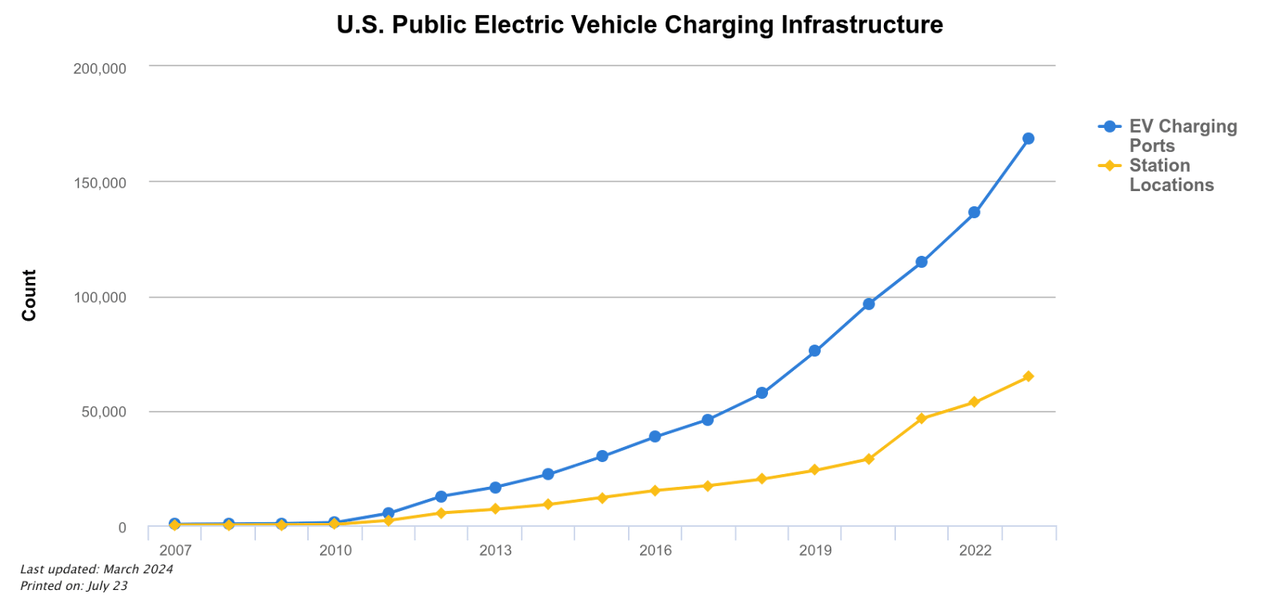

The most straightforward part is the charging infrastructure. According to the US Department of Energy, there are around 64,700 EV charging locations and 170,000 charging ports. While charging reliability is an issue, data shows that the number of charging ports has more than doubled between 2018 and 2022. In addition, EV has less reliance on public charging networks as it could be done at home, so typically charging is only needed on long road trips. In addition, 63% of Americans live within 2 miles of a public EV charger, with this number expected to further increase as charging infrastructure continues to increase at an exponential rate.

The other part of the issue is mainly related to cost and range factors. If EV can be objectively the better choice, government policies wouldn’t matter. This would also allow EVs to move from the early adopters to the early majority phase.

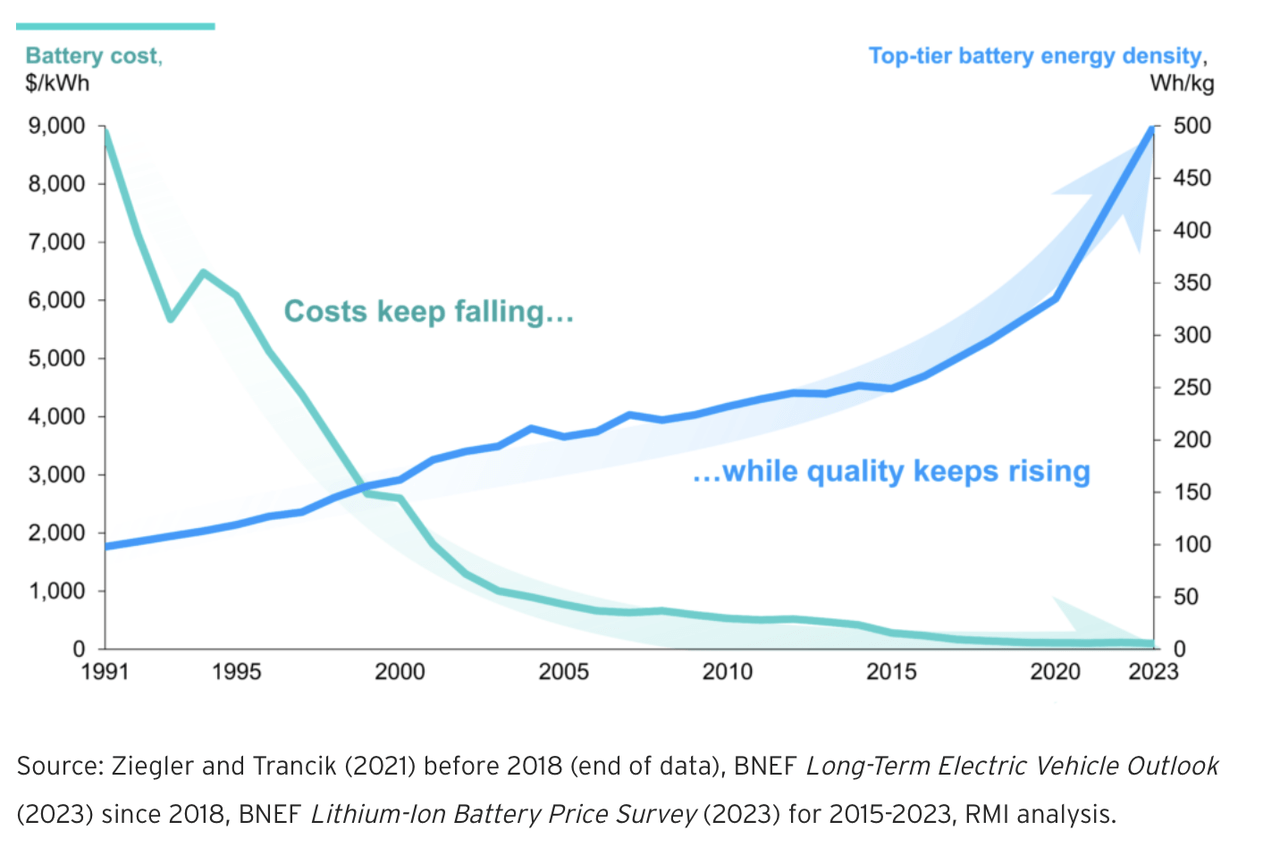

The good news is battery technology is moving forward at a rapid pace. On paper, the electrical vehicle is much more efficient than a combustion engine, as typical combustion engines are around 12-30% efficient due to loss in heat and other forms of energy, while EVs are around 77% efficient. However, batteries contain nowhere near the energy density of fossil fuels. That’s why it is more efficient to convert energy from fossil fuel to a battery than use it. However, this is all changing.

Not only has battery energy density significantly improved rapidly, but more importantly, battery cost is decreasing at a rapid pace to meet conventional engines. According to Goldman Sachs, the price of batteries per Kilowatt is expected to drop from $151/kWh in 2023 to $91/kWh in 2025. That’s equivalent to a $4,500 decrease in cost on a Tesla, Inc. (TSLA) Model 3 long range with 75 jWh capacity – within 2 years! So despite the rising raw commodity cost some EV critics are skeptical of, the reality is, that battery technology is improving much faster than the price of raw materials could catch up.

Thus, it is clear the trend is falling in favor of EVs. In the near future, energy density (range) and cost will be better on battery electric vehicles than combustion engine vehicles. At that point, the market will move to the early majority- a group with about 3x the number of buyers compared to early adopters, according to traditional Diffusion of Innovation theory.

Rivian Will Be Prepared

Hopefully, I have made my point that the future is inevitably electric, and to look past the current slump, why am I favoring Rivian the most, and more importantly, why now? For starters, the market appears to really like Rivian. Not only is Rivian the best-selling EV in the US above $70,000, but average selling prices actually increased YoY despite operating in a market where EV prices were trending downward. Also, the fact the Rivian R1S was the 4th best-selling EV in the US in Q1 proves that Rivian is more than just a truck with one trick. It is clear Rivian offers vehicles people actively want, and the way it has found its customers despite the general headwind is a great promise of how demand will grow once the majority starts going electric.

In addition, Rivian is readying up its R2 by 2026, which should be sufficiently early enough to catch the waves of mainstream adopters. Rivian says it is planning to produce 215,000 vehicles annually in its Illinois factory, including 155,000 R2, and the rest split into R1 and its commercial van. This for comparison is around Tesla 2018 levels, at which time the market cap was triple that of Rivian today (at $57B) and 7% of the market cap Tesla is at today.

So if profitability is still at least 2 years around the corner, why invest right now? Well, I think the market has still not properly adjusted the price to Rivian’s risk-reward. When the next wave of demand arrives, I think Rivian will have no problem finding buyers. And from the way it’s looking, Rivian will have ample time to reach gross profit and enter mass production. 2024 is a major transitional year for Rivian as it purposely slowed down production to invest and upgrade the factory. In Q2, only 9,612 vehicles were produced compared to 13,980 in Q1, but its guidance for 57,000 vehicles for the year is reaffirmed. Deliveries for the Q2 actually improved from 13,588 to 13,790. A major milestone for the company this year is to reach gross profit in Q4, which the company planned over a year ago and has reaffirmed in Q1. Compared to a year ago, the company value decreased by over 30%. Following the near-term upgrades to the factory expected in Q2 and Q3, Rivian should provide much more accurate forecasts for its production and profitability, so I think now is a critical stage in how Rivian will be priced, and I would rather place my bets before the market starts moving significantly.

Money No Issue

A large part of the risk associated with Rivian of course is the fact that the company is losing billions every quarter. This time, though, the money situation looks manageable as Volkswagen Group and Rivian have announced plans for a joint venture. This includes plans of a total expected investment of $5 billion from Volkswagen- a lot for a company whose market cap is only $17 billion. This along with the current $7.8 Billion in cash and short-term investments make it very manageable for Rivian to continue to upgrade its factory in preparation for R2.

I dare say this big risk factor of Rivian is no longer one of the near-term concerns. Instead, the biggest concern right now is whether Rivian can successfully undergo manufacturing improvements. Just ask Elon Musk, who said many times that mass production is one of the most difficult aspects of a business. Again, this will be all revealed in the next few months, but I think even if the upgrade experiences issues, the result will just be delayed mass production like what happened with the Tesla Model 3, and the short-term potential turbulence doesn’t deter me from the great long-term potential.

Conclusion

Though Rivian is still a few years from making a profit, I believe that it will be prepared when the next wave of EV buyers arrives from a cost and mass-production standpoint. It is a very delicate time for Rivian as they’re transitioning for profitability and scale, but I don’t think the market has responded properly to the heavy reward potential. In fact, in part helped by their $5 billion deal with Volkswagen, I can buy into the vision that the company will successfully reach mass production.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.