Summary:

- Rivian stock has surged following today’s R2 unveil event.

- The R2 offers an alternative for a niche buyer pool.

- Rivian’s financial performance leaves much to be desired.

KanawatTH

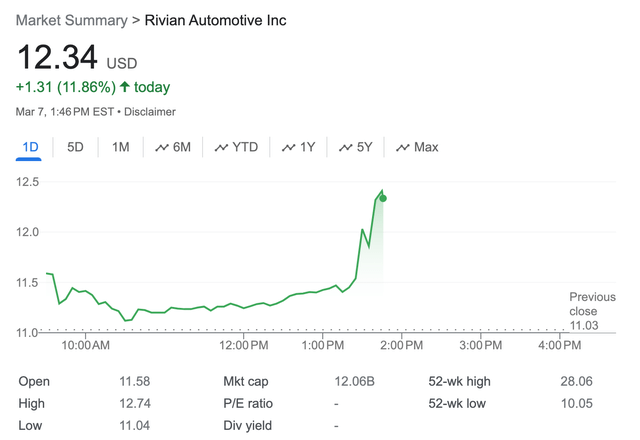

Rivian Automotive, Inc. (NASDAQ:RIVN) has captured numerous headlines, raised tens of billions of dollars in financial capital in multiple stages and various forms, and a material amount of mind share since its IPO in late 2021, and the electric vehicle manufacturer’s stock price has surged following today’s R2 unveil event:

With questions swirling around Rivian’s production targets, competition, and profitability, investors are looking for a clearer picture of Rivian’s future.

This article will dive into the latest developments surrounding Rivian, analyze its financial performance, and make a recommendation at the end.

Looks Aren’t Everything

Rivian has been hyping up today’s R2 unveil event, as it should, taking a page from Tesla, Inc.’s (TSLA) book, and here’s the sneak peek that Rivian published on X (formerly Twitter) yesterday, one day before today’s unveil event:

Rivian on X/Twitter

It looks nice, as all Rivian vehicles do, but looks aren’t everything. The following are the specs of the R2 SUV that Rivian unveiled today:

- Starting price $45,000.

- Range 300+ miles.

- 0 to 60 in 3 seconds.

- Seats 5.

Let’s see how the announced and leaked specs of R2 compare to those of Tesla’s Model Y, the best-selling vehicle overall in the world:

| Spec Category | Rivian R2 | Tesla Model Y | Advantage |

| Starting price | $45,000 | $43,990 | Tesla |

| Range, max | 300+ miles | 310 miles | Tesla |

| 0 to 60 mph | 3.0 seconds | 3.5 seconds | Rivian |

| Seats | Up to 5 | Up to 7 | Tesla |

| Clearance | 9.8 inches | 6.6 inches | Rivian |

| Approach angle | 25 degrees | 11 degrees | Rivian |

| Departure angle | 27 degrees | 10 degrees | Rivian |

Rivian’s upcoming R2 offers a competitive alternative for a certain segment of the population that wants the optionality of being able to take an electric SUV off-roading but may not be able to or prefer a Tesla Cybertruck at this time.

One challenge that faces Rivian, however, is that Tesla plans to decrease the price of the Cybertruck to $60,990 as it scales production in the coming years:

Rivian’s R2 SUV finds itself in a tight spot. The Model Y from Tesla, with a starting price thousands of dollars lower, offers a compelling range and performance in a similar-sized package.

On the other hand, the Cybertruck boasts a futuristic design and seemingly unmatched functionality. This puts pressure on the R2, which needs to carve out its own niche by emphasizing its unique blend of luxury, off-road prowess, and potentially a more comfortable ride compared to the radical Cybertruck.

Financial Challenges Persist

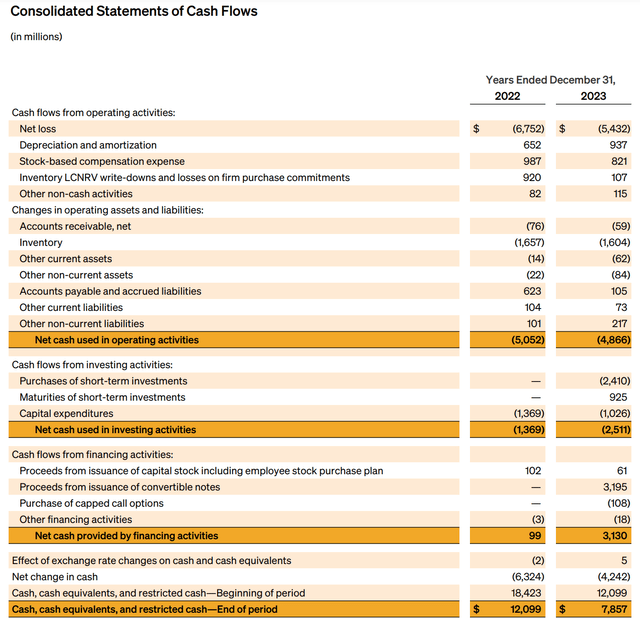

Although Rivian raised tens of billions of dollars and still has billions of dollars of cash on hand, it has been burning through its cash pile at a high rate:

Rivian Q4 2023 Investor Letter

The above table illustrates that Rivian used $5B in operating activities in 2022 and 2023 and additionally spent more than $1B in capital expenditures in each of the two years. Most importantly, Rivian showed little financial improvement and no material improvement in its cash burn from 2022 to 2023.

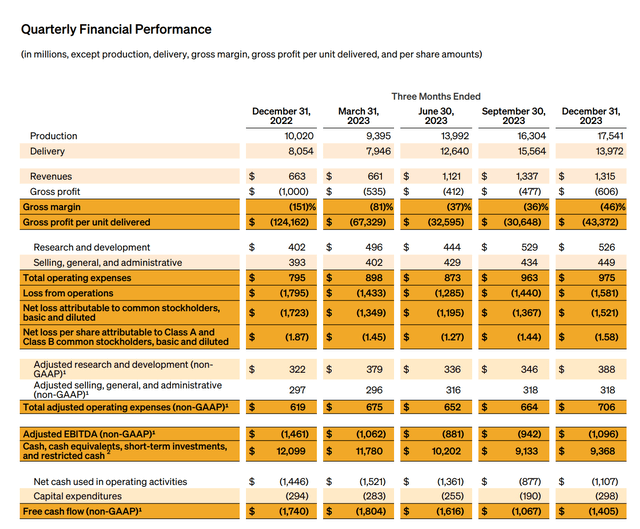

Zooming into Rivian’s quarterly results in the last year, I note that the improvement in Rivian’s negative gross margin was in part offset by an increase in operating expenses (more detail below):

Key takeaways from the above table:

- Rivian’s negative gross margin has increased from negative 151% in Q4 2022 to negative 81% in Q1 2023 to negative 37% in Q2 2023 to negative 36% in Q3 2023 before deteriorating to negative 46% in the latest fiscal quarter; but

- In the same period, Rivian’s quarterly operating expenses have increased despite layoffs from $795 million in Q4 2022 to $975 million in Q4 2023; and

- Rivian’s quarterly free cash flow has shown no material improvement in the last five quarters.

Risks To My Thesis

The following are two possible risks to my thesis:

- Raw material prices have been declining and any potential benefit to Rivian’s profit margins could be reflected in the coming quarters; and

- The short interest in RIVN was elevated at 17% as of February 15, 2024, creating a potential risk of a short squeeze.

Conclusion

I believe that Rivian will likely try to raise more cash following today’s R2 unveil event, and even though the new R2 vehicle will likely command a respectable, niche following, it will not come to market until 2026 per today’s announcement and I don’t expect the sales volume to be enough for the company’s downward trajectory to change. I recommend that investors sell the stock after today’s unveil event.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.