Summary:

- Rivian’s Q1 earnings show negative operating income and a widening net loss, leading to a sharp decrease in cash reserves.

- The company’s gross loss per vehicle delivered improved but is still a significant weakness compared to competitors like Tesla.

- Rivian’s valuation is likely overvalued based on Price/Sales ratios and discounted cash flow simulations, with a high level of uncertainty.

RoschetzkyIstockPhoto

Investment thesis

My previous bearish thesis about Rivian Automotive (NASDAQ:RIVN) aged well as the stock tanked by 56% since September 2023. The company recently issued its Q1 earnings, and today I want to share my insights and explain why I believe that RIVN stock is still a “Sell”. The company’s gross margin is still deeply negative, and its operating income profile deteriorated even despite a strong 82% revenue growth in Q1. This factor makes it quite difficult for RIVN to compete with Tesla (TSLA) and already fierce competition continues intensifying with more iconic American-made vehicles appearing in electric versions. Moreover, Rivian’s valuation cannot be called attractive even when aggressive assumptions are implemented.

RIVN Q1 earnings review

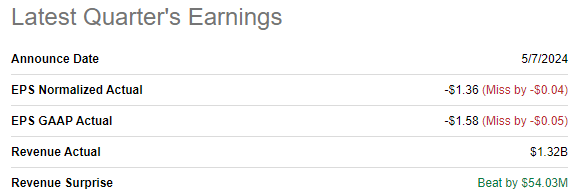

Rivian’s latest earnings release is the major development which I want to focus on in my analysis. The company released its Q1 earnings yesterday, delivering a positive revenue surprise but missing on the bottom line estimates. The adjusted EPS declined from -$1.25 to -$1.36 despite a strong 82% YoY revenue growth.

Seeking Alpha

The biggest warning sign to me when I look at RIVN’s latest P&L is the operating income dynamic. Loss from operations was about flat YoY despite an 82% revenue growth. In a sound business model, the operating margin should demonstrate improvement when revenue demonstrates such a massive growth. As a result, Rivian’s net loss widened on a YoY basis.

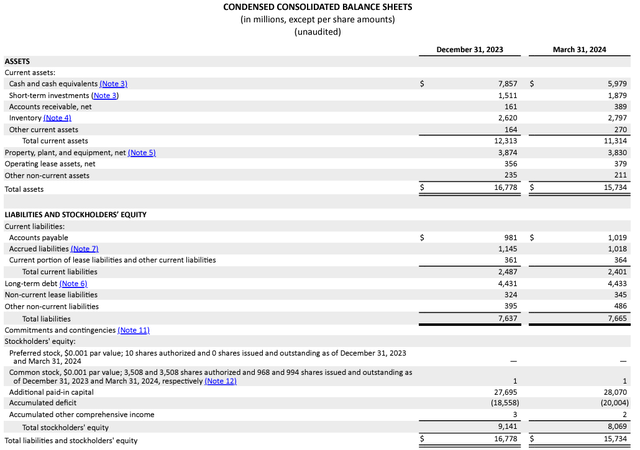

RIVN’s latest 10-Q report

As a result of weak bottom line performance, the company’s cash balance decreased by $1.9 billion in Q1. If this dynamic persists, RIVN will deplete its cash reserves by the end of FY 2024. That said, Rivian’s balance sheet is poised to deteriorate significantly by the year-end, as the company will highly likely be in need of raising more debt finance.

RIVN’s latest 10-Q report

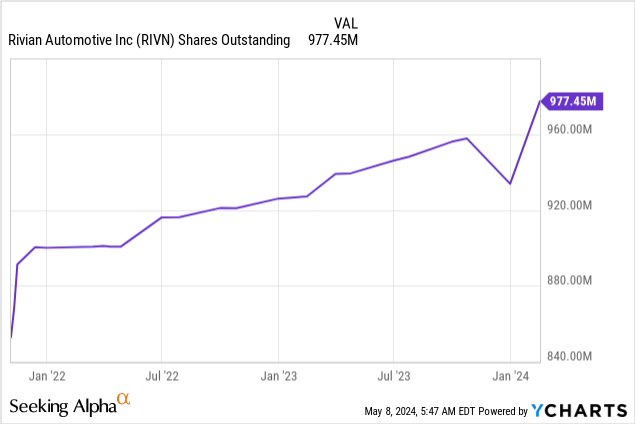

I also expect the outstanding share count to continue expanding, which means more dilution for RIVN’s investors. This could happen for different reasons, like the company offering more shares to the public, expanding its stock-based compensation to employees, or using convertible debt. This constant dilution of ownership is not good news for RIVN’s investors because it will likely lower the value of their investment.

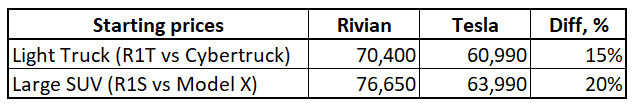

According to the management, in Q1 gross loss per vehicle delivered was approximately $39,000, which includes $15,500 of depreciation and $1,700 of SBC expense. That said, the cash basis gross loss per vehicle is around $21,800. This is a notable improvement to the previous year because in Q1 2023 gross margin was -81% compared to -44% this year. But still generating gross loss means that Rivian is unlikely to sustain a price war with Tesla, which is a significant strategic weakness. It is crucial because currently, Rivian’s offerings are around 15-20% more expensive compared to direct alternatives from Tesla.

Compiled by the author (information from official websites)

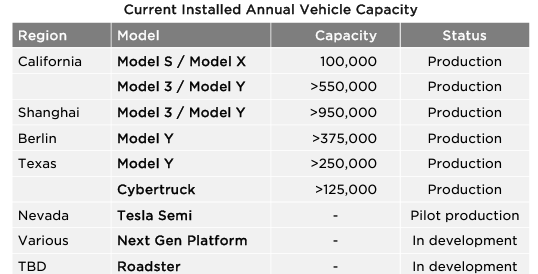

I think that it is a notable bearish sign for Rivian, especially in the current environment when interest rates are high and customers have become increasingly price conscious. Tesla’s Cybertruck is ramping up notably, according to Tesla’s latest earnings call, it currently produces 1,000 vehicles a week, which approximately aligns with Rivian’s volumes in Q1. Overall, Tesla has a 125 thousand annual Cybertruck capacity. To add contrast, according to Rivian’s latest earnings call, its R1 platform total annual production capacity is 56,000 units. That said, I expect that it will be very difficult for Rivian to compete with Tesla.

Tesla’s latest earnings presentation

It is also crucial to highlight that Rivian’s competition is not only about Tesla. For example, Ford (F) has an electric version of its iconic F-150 truck, which was the best-selling car in the U.S. for four decades. That said, the electric version of Ford F-150 has a strong potential fanbase. And Ford F-150 Lightning deliveries were robust in Q1 2024 with an 80% YoY increase. There are also other iconic American-made trucks in the race. General Motors’ (GM) electric Hummer is new to the market, but its Q1 deliveries dynamic looks optimistic. The competition in the electric trucks space is poised to intensify further as sales of the electric version of another iconic vehicle, Chevrolet Silverado, is expected to be launched this summer.

Valuation update

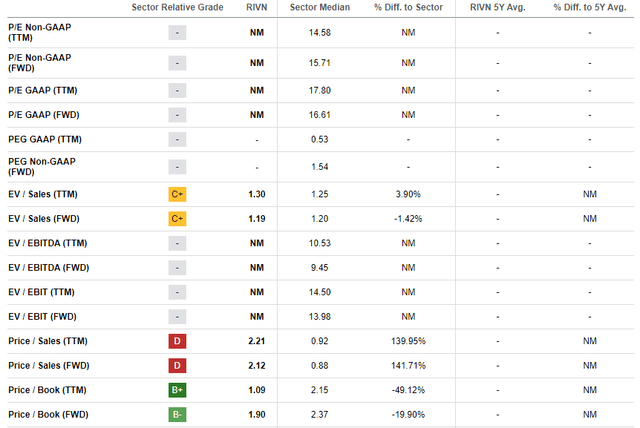

RIVN tanked by 26% over the last 12 months and its YTD performance is even worse with a 56% share price decline. Valuation ratios are mostly unavailable due to generating losses. However, Price/Sales ratios are substantially above the sector median, which likely means overvaluation. I recommend readers to ignore Price/Book ratios because RIVN burns cash with a rapid pace and its balance sheet is poised to deteriorate within several next quarters.

Seeking Alpha

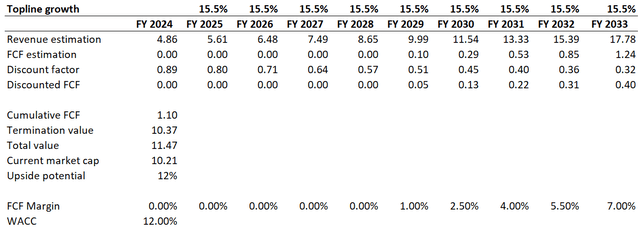

Looking only at multiples is never sufficient for me, and I want to proceed with a discounted cash flow [DCF] simulation. I use a 12% WACC, which aligns with the recommended range from Finbox. I rely on consensus estimates for FY 2024 revenue and project a 15.5% CAGR for the next decade. I do not expect Rivian’s FCF margin to become positive earlier than FY 2029, the year when consensus estimates project the adjusted EPS to become positive. I expect FCF margin expansion after FY 2029 to correlate with revenue CAGR, which means a 150 basis points yearly expansion. I ignore RIVN’s substantial net cash position because I expect it to be depleted given the company’s significant cash burn rate.

Author’s calculations

The business’s fair value is $11.5 billion, according to my DCF simulation. This indicates a slight 12% undervaluation, but I want to emphasize that the level of uncertainty is extremely high. Therefore, a 12% upside potential does not look attractive given all the risks and uncertainties.

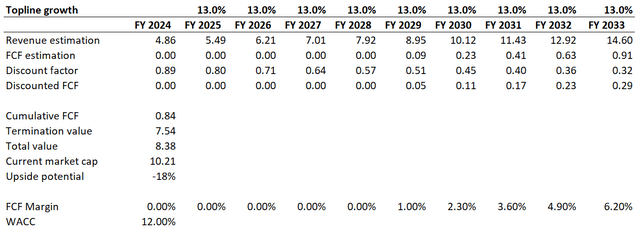

Moreover, a 15.5% revenue CAGR is the expected U.S. EV industry growth rate for the next decade. Given all Rivian’s strategic risks, there is a substantial probability that RIVN might lag behind the industry. For example, if I implement a 13% revenue CAGR and 130 basis points yearly FCF expansion, the fair value of the business diminishes to $8.38 billion. Therefore, I cannot conclude that RIVN is attractively valued.

Author’s calculations

Risks to my bearish thesis

RIVN is an extremely volatile stock, and it swings sharply in both directions. For example, after I wrote my initial bearish thesis about the company a year ago, the share price was $12.58. Just a few months after my first thesis was published, RIVN demonstrated a massive rally and the share price spiked by more than two times. Therefore, investors should be aware that the stock might demonstrate sudden spikes in the share price, which might be caused by some positive headlines. Rivian’s investors might also enjoy a short squeeze, since there are almost 19% of the company’s shares shorted, according to Fintel. That said, there is a notable potential for a short squeeze if positive news or developments cause the stock price to spike suddenly.

Let us also not forget that Rivian has a prominent investor, Amazon (AMZN), behind its back. Therefore, there is also a probability that Amazon might increase its stake in RIVN, place some large orders for Rivian’s vehicles, or share technologies which can be useful for Rivian. Having such a strong partner means there is always a possibility of a turnaround from Rivian.

Bad news from competitors might also be beneficial for Rivian’s share price and could work against my bearish thesis. For example, if news suggests that Tesla fails to ramp up its Cybertruck production, or there are new mass recalls of the Ford F-150 Lightning, it might be absorbed quite positively by RIVN investors.

Bottom line

To conclude, RIVN is still a “Sell”. The stock is unattractively valued, especially in light of the weak Q1 report. I also expect the competition in light EV trucks industry to intensify, which will likely adversely affect RIVN’s revenue growth pace.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.