Summary:

- While Rivian is making progress on cost cutting efforts, overall growth is rather muted at the moment.

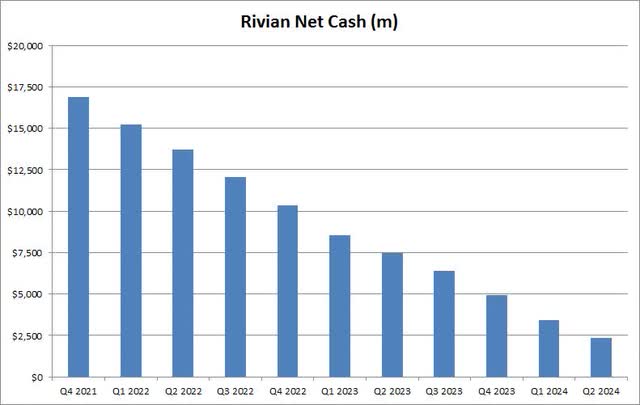

- The company burned over a billion dollars in cash during Q2, leaving its net cash pile at its lowest levels in years.

- With the potential for another capital raise on the horizon, investors may want to consider selling this premium valuation name for now.

hapabapa

Last week, we received second quarter results from Rivian (NASDAQ:RIVN), seen in this shareholder letter. While the company did make progress on some of its cost cutting efforts, production guidance for the year was only maintained and cash burn remained high. With some potential tough times still ahead, investors might want to consider selling this premium valuation name for now.

Previous coverage on the name:

When I last covered the stock, Rivian had just announced its major partnership with Volkswagen (“VW”). Although the news was certainly good for long term investors, the sharp immediate rally gave me a little pause. Just like earlier in the year with its R2 reveal event, the sharp initial gains were faded, and the stock has bounced around a bit since.

I wasn’t fully ready to buy in to the Rivian story just yet, given its continuous cash burn and the timing and process of when VW could actually inject some capital. Rivian’s valuation also was a bit higher than a number of other electric vehicle names, a number of which are actually reporting higher revenues than the truck and SUV maker.

The Q2 report:

When the company announced its June quarter results last week, revenues were up 3.3% over the year ago period to $1.16 billion. While this was basically in-line with street estimates, the company delivered 1,150 more vehicles than in Q2 2023, an increase of 9.1%. Selling prices obviously came down a bit, although management says that trend will reverse a little in the next few periods as more expensive variants of its vehicles roll out.

With the factory shut down for a time for retooling and upgrades, all three of the company’s margin figures worsened over the year ago period. Even though Rivian expects to be gross margin positive in Q4 vs. a nearly 39% gross loss in Q2, it still has another roughly billion dollars of operating expenses that will weigh on the bottom line. In the last 2.5 years, Rivian has reported a total net loss of more than $15 billion.

Rivian maintained its production forecast for 57,000 vehicles this year. The problem is that it did just over that last year. Even with the factory shutdown, there’s not a lot of growth here, and the company is focused on the premium segment of the market. More electric trucks and SUVs are coming out each year, and Rivian is 2 years away from its more affordable vehicle launch.

In the coming quarters, for instance, Tesla (TSLA) will further ramp its Cybertruck with more comparable price points to Rivian, and Tesla will launch some more affordable vehicles on its current lines that could include a new SUV. Should the US economy enter a recession or just see a small stretch of lower than projected growth, the auto industry isn’t exactly where you want to be when you are already losing money and burning through cash.

Rivian’s factory was initially set up for 150,000 units of production. Despite being open for a couple of years now, the company remains at a small fraction of that volume. Elon Musk and Tesla initially thought they could sell well over 100,000 Model S and X luxury vehicles a year, but they never did on a consistent basis even when EV competition was much lower. At this point, Rivian can’t even get to 20,000 vehicles a quarter, and I don’t see that path being any easier in the next year or so, especially as consumers wait for the R2 platform.

Looking for another capital raise:

Like many EV startups, Rivian has burned a lot of cash in recent years, primarily from racking up large net losses. The company has been able to get by thanks to a large IPO as well as multiple capital raises since. While Q2 was its best quarter in a while in terms of negative free cash flow, the company still burned over a billion dollars. That has left the company’s net cash pile at its lowest levels in years as seen below.

Rivian Net Cash (Company Filings)

Some of the expense reductions it has talked about that are coming over the next few quarters, like reduced depreciation, won’t help the cash flow situation. This is because the reduction in the company’s net loss will be offset on the cash flow statement when depreciation is added back. Additionally, the decline in the net cash pile, a full quarter’s of interest on the VW loan, combined with the recent drop in interest rates we’ve seen, will likely further hurt the income statement. In Q2, Rivian reported net interest income of just $20 million, down from $87 million a year earlier.

Rivian did finish Q2 with almost $8 billion in cash and short term investments, but that was helped by the loan from VW in the quarter. Another couple quarters of even somewhat reduced cash burn likely will mean another billion dollars or two burned, so I wouldn’t surprise to see another capital raise coming, and this is without the rest of the help from VW. That would mean either selling shares and diluting investors some more, or hitting the debt markets which would mean more interest expenses moving forward.

The valuation angle:

Right now, Tesla goes for 5.5 times its expected sales for 2025, but the rest of the EV players all go for less than four times. As the chart below shows, Rivian now trades below the valuation of Lucid (LCID), but above VinFast (VFS), two companies that Rivian is in better shape than. Chinese players like Nio (NIO), BYD (OTCPK:BYDDF), and Xpeng (XPEV) go for way less at the moment, while Polestar (PSNY) is trading like it is about to go bankrupt. Traditional US automakers go for less than 0.3 times their expected sales in 2025, meaning Rivian goes for about 9 times that.

EV Price To Expected Sales (Seeking Alpha)

Since the VW deal was announced, there have been a number of analyst price target hikes. Thus, the average price target on the street has risen by a little more than $2, now sitting at $17.27 per share, implying a bit of upside from last week’s finish. As a reminder, however, analysts about three years ago saw Rivian worth almost $137, so the overall valuation cut here has been rather tremendous.

Final thoughts and recommendation:

Rivian’s earnings report last week was okay, but the company still has a bit of work to do in the near term. While gross margins are expected to improve, losses and cash burn will likely remain high for at least the next few quarters. The company isn’t really boosting production of current models at the moment, and competition is going to increase later this year and into 2025. It would not surprise me if Rivian goes out and raises more capital in the near term, especially if management is uneasy about the US economy or potential changes in EV tax credits due to this year’s election.

At this point, I am downgrading Rivian to a sell again. The valuation is a bit rich in my opinion compared to some of the other EV names, especially with Rivian not having a great growth profile currently. I need to see the company improve its balance sheet a bit, and we have to see if demand picks up in the next couple of quarters. With Rivian already telegraphing how its margin progress should look, I don’t think there’s too much of an upside surprise to come. Should the company show an ability to produce a decent amount of growth before the R2 platform launch in 2026, I will look at the rating again.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.