Summary:

- Rivian faces significant challenges with President Trump’s expected policies, including the potential loss of EV tax credits.

- Short interest in Rivian has surged to an all-time high, with over 20% of the float short, reflecting skepticism about its growth potential.

- Rivian’s limited near-term revenue growth and high valuation compared to peers make it a risky investment.

JasonDoiy/iStock Unreleased via Getty Images

With just a few weeks left in the year, investors are starting to look forward to 2025. With President Trump just five weeks away from returning to the US’ highest office, we are already getting an idea of some of his expected policies. Perhaps the biggest negative will be for electric vehicle companies, as the incoming administration looks to roll back incentives and other benefits for this growing space. One name that could be hit a bit is Rivian Automotive, Inc. (NASDAQ:RIVN), and as it just so happens, short interest in the stock recently hit a new all-time high.

Previous coverage of the name:

The last time I covered Rivian was about a month ago, at which point I covered the company’s Q3 results. The company missed street estimates on the top line, and management detailed how a huge jump in Q4 margins would be mostly due to a massive amount of regulatory credit sales revenue. While the company was set to improve gross margins in 2025, it still expects to see some losses at times and the big growth story here isn’t set to occur until Rivian launches its mass market vehicle in 2026.

Over the years, Rivian’s large losses have resulted in a lot of cash burn. This has resulted in numerous debt and equity raises, although the company is getting some fresh capital currently from its partnership with Volkswagen. Still, we could see the company end up with a net debt position on the balance sheet in the coming quarters if things don’t improve rather significantly. Since I went to a sell rating on the stock back in August, Rivian shares have recorded a low-double digit percentage gain, but that has trailed the rally in the S&P 500 by a couple of points.

The rise in short interest:

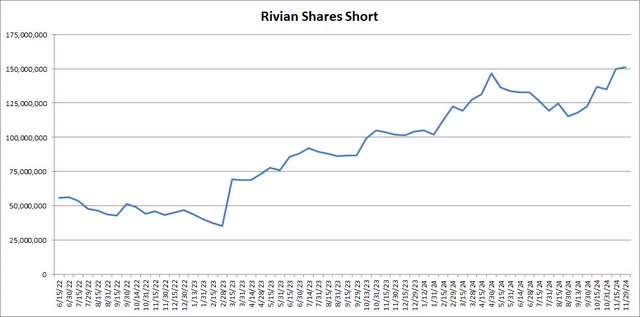

We’ve seen an increase in the number of shares short in Rivian for the better part of two years now. Part of that has been due to a rise in the number of shares outstanding, but also due to bets against the name for failing to live up to its growth potential. Since reaching a low point of around 35 million shares short at the end of February 2023, we’ve seen a nearly 330% surge in the number of shares short. As the chart below shows, the latest update from NASDAQ was a new all-time high for this number.

Over the past twelve months, short interest in the stock has jumped by more than 48%, finishing last month with over 151 million shares. While the company has just over 1 billion shares outstanding, Yahoo! Finance data reports the estimated float at just 744 million. This means that over 20% of the float is short, which according to Finviz data makes Rivian the third most shorted name with a market cap of over $10 billion. There are 875 names that meet that company size threshold at the moment.

Looking at the next two years:

Outside of Tesla, Inc. (TSLA) and the traditional large US gasoline-powered automakers, Rivian is probably the name to be most impacted by President Trump’s expected actions on electric vehicles. Rivian vehicles currently have various federal incentives available to them. US Consumers can get up to a $3,750 credit for example, on eligible vehicles, while businesses can potentially get twice that much.

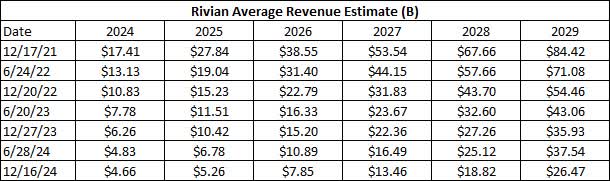

Rivian was already projected to show the least amount of revenue growth among the major EV players next year. As the table below shows, analysts have been cutting their revenue estimates on the name for about three years now. Even with the top line average for 2025 coming way down already, the number has still dropped over $1.5 billion in the last six months alone.

Rivian Revenue Estimates (Seeking Alpha)

Even if Rivian loses just a couple percent of sales due to the expected loss of the EV credit, it could really impact the margin and cash burn situation. When we get the Q4 report, probably sometime in February 2025, management may have to be a little more conservative with some of its projections. As a reminder, current street estimates call for just 5% revenue growth this year, so it’s not like Rivian’s lack of percentage growth next year is due to a massive jump in sales for 2024.

Where things get really interesting is in 2026, when Rivian is expected to launch its R2 SUV. With a starting price of around $45,000, this vehicle was expected to dramatically increase Rivian’s unit sales and revenues as it appealed more to the mass market than its current luxury vehicles. The potential loss of the tax credit here could be a major blow for consumers who were waiting for this launch and other cheaper Rivian vehicles.

Another question is about Rivian’s second factory to be built in Georgia, where it recently received conditional approval for a major loan. If somehow that funding goes away due to the new administration’s policies, Rivian’s plans to significantly increase its production capacity may require the company to locate some new major sources of capital. As a point of reference, that $6.6 billion loan currently equals about 40% of Rivian’s market cap.

For those betting against the name, there remain two major risks at the moment. The first is that markets just continue to rally into and through next year, and a rising tide lifts all boats. Rivian shares have soared more than 50% from their post-election low, as investors have seemingly been able to shake off potentially bad news for the EV space. The other big risk here is that the partnership with Volkswagen expands greatly moving forward, or even that VW decides to buy out all of Rivian to increase its longer-term EV ambitions. While I don’t see a buyout as very likely in the short term until these two really start to work together over the next couple of years, it’s not something that I would completely dismiss happening eventually.

A look at current valuations:

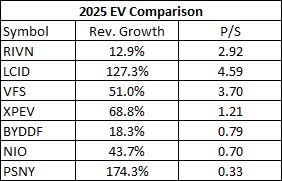

Since most of the electric vehicle names are not profitable, price-to-sales is the best valuation metric to compare them on. Thus, I’ve looked at each name’s market cap about its current street estimate for 2025 revenues. My comparison group includes Lucid Group, Inc. (LCID), VinFast Auto Ltd. (VFS), XPeng Inc. (XPEV), NIO Inc. (NIO), BYD Company Limited (OTCPK:BYDDF), and Polestar Automotive Holding UK PLC (PSNY). As a reminder, traditional US automakers trade at even lower multiples. The table below shows how these names are valued based on current analyst revenue estimates for 2025, along with how much revenue growth the street expects.

EV Company Valuations (Seeking Alpha)

Rivian is currently projected to see the least amount of revenue growth next year among these seven names. Still, it is the third most expensive name of the bunch. As a point of reference, the non-weighted average of the other names is for more than 80% revenue growth and a price to sales ratio of 1.89 for 2025. That means that Rivian trades at a roughly 55% premium to the average of the rest of the group, despite its limited short-term growth profile.

Interestingly enough, we’ve also hit an interesting point in regard to the analyst community. On Monday, Rivian shares rallied above the average price target on the street in the low $15 area. The last time that Rivian was above the analyst average was back in July, and the stock then dropped significantly over the next couple of months.

Final thoughts and recommendation:

After President Trump won his bid to get back in the Oval Office, short interest in Rivian climbed to a new high in November. Rivian now has more than 20% of its float short, making it one of the most shorted large-cap names in today’s market. Over the past couple of years, shorts have piled in as the company’s revenue growth has not met longer-term expectations, resulting in large losses and cash burn that have led to multiple needed capital raises.

With the expectation that the EV tax credit will be axed rather shortly, I’m going to keep a sell rating on Rivian for now. The stock is just too expensive in my opinion given its limited near-term growth profile. With the potential for another round of longer-term analyst estimate cuts based on reduced US EV sales, this name could be set up for a tough 2025, and perhaps even more short sellers will be jumping on this train.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.