Summary:

- Rivian’s stock has outperformed its EV peers and the broader market this year.

- Solid outperformance in profit margin expansion and vehicle production ramp-up in Q2 has increased visibility and confidence in the company’s growth prospects.

- However, impending execution risks continue to cast a shadow on the durability of the stock’s premium at current levels.

Mario Tama

Rivian’s stock (NASDAQ:RIVN) has consistently outperformed its EV upstart peers and the broader market this year. The steep uptrend in recent months has largely been fuelled by solid improvements to the underlying business’ cost structure, alongside positive progress on ramping up both R1 and EDV vehicle productions during Q2. The company’s fundamental progress observed during 1H23 has built confidence that it may have finally turned a corner from previous company-specific and industry-wide challenges, spanning component shortages and other supply chain constraints that have hampered volumes.

Specifically, Q2 improvements to profit margins and vehicle output volumes collectively increase visibility into the company’s forward prospects. This includes management’s aggressive guidance for positive gross margins by 2024 with expansion towards 25% over the longer-term, which implies achievement of sustained operating leverage. We expect the continued flow-through of lower-cost dual-motor R1 variants integrated with the in-house Enduro Motor from start of productions (“SOP”) in Q2 to deliveries and realized sales in 2H23 and beyond to become more evident and complement ongoing margin expansion efforts going forward. And looking into the longer-term, impending factory upgrades next year to graduate annual R1 production capacity from the current 65,000 to 85,000 units will also be an incremental tailwind to achieving scale and operating leverage.

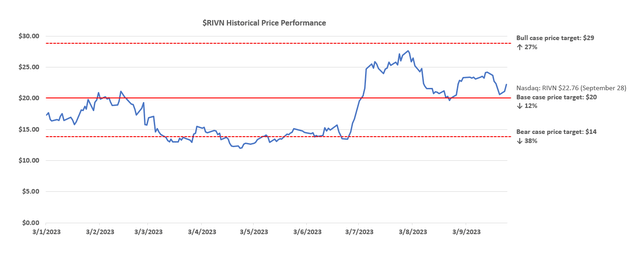

Although the company continues to operate under deep losses, management’s consistent outperformance on aggressive operating priorities – spanning margin expansion and production ramp up – over the past two quarters is commendable. Admittedly, the EV sector continues to trade at a premium to the broader market, likely driven by the cohort’s secular growth tailwinds that continue to offset some of the near-term weakness to long-duration cash flows. While we agree that Rivian’s long-term fundamental prospects are looking better than previously expected, we think its current valuation remains too rich, especially given the ongoing overhang of near-term macroeconomic uncertainties and their implications on the broader market’s performance. Considering Rivian’s consistent outperformance in Q2, which we view as a positive inflection for the company’s longer-term growth roadmap, we are upgrading our rating to hold on the stock with a price target of $20.

Increasing Visibility to Profitability

We see Rivian’s solid Q2 outperformance as an inflection point, as the company turns a page from its previous reputation for production delays and under-delivery on guided figures. The company’s substantial sequential improvement to per vehicle gross profit by ~$35,000 during Q2 (or ~80% y/y cost improvement) reflects positive results to management’s strategic prioritization over disciplined spending while ramping up production volumes. The efforts are further complemented by aggressive cost-cutting initiatives implemented in recent quarters. They include a 6% reduction to Rivian’s workforce and the elimination of the low-trim Explore variant for R1 vehicles implemented earlier this year. The results are collectively reflected in the -43% q/q (-25% y/y) reduction in Q2 stock-based compensation expenses and consistently narrowing operating losses.

The latest string of outperformance effectively reinforces confidence in the achievability of Rivian’s near- and longer-term financial targets, which include positive gross profit in 2024 with further expansion towards 25% over the longer-term. We see three key impending cost tailwinds in support of these prospects: 1) increasing realization of Enduro Motor cost efficiencies; 2) increasing ASP with a greater mix of higher-priced R1S delivery volumes; and 3) improving scale to output volumes post-retooling of R1 production line.

1. Enduro Motor Cost Efficiencies

Rivian’s in-house Enduro Drive unit is viewed by management as a “key enabler to near-term production performance”. As discussed in our previous coverage, the in-house developed Enduro dual-motor powertrain marks Rivian’s diversification from previous sole reliance on Bosch, its electric motor supplier for the quad-motor R1 variants. In addition to mitigating supply risks, the in-house Enduro Drive unit also boasts better economics for Rivian. This is corroborated by the 35% reduction in the BOM for Rivian’s EDV vans achieved after the first full quarter of Enduro Drive unit and LFP battery pack integration. The latest results mark a 10-percentage point improvement from the 25% BOM reduction observed in Q1 when the Enduro Drive unit and LFP battery packs were first introduced to the EDV powertrain.

Rivian expects a similar extent of cost-savings for the R1 vehicles as Enduro Drive unit integration ramps up, which would be critical to supporting management’s target for positive vehicle gross margin next year (it’s about 37 percentage points away based on cost of revenue per vehicle observed during Q2). And management’s expectations for robust demand for the dual-motor R1 variants are expected to further reinforce Rivian’s target for profit gross margin next year. Boasting up to 400 miles of range at a starting price of $73,000 for the RT1 and $78,000 for the R1S, CEO RJ Scaringe sees the dual-motor variant as a “uniquely differentiated product”, highlighting the Enduro Drive unit as an enabler of “consumer market opportunity expansion” for the company.

2. Increasing ASP with R1S Ramp Up

Accelerating progress in the ramp up of R1S volumes is another key contributor to Rivian’s near-term margin expansion efforts, given the variant sells at a higher price and captures greater profitability. Specifically, R1S production volumes overtook the R1T for the first time during Q2. And management intends to maintain a higher mix of R1S output volumes (> 70% R1S production mix) over the “next quarter or two” to better address revenue opportunities from the variant’s massive backlog, while normalizing towards a longer-term steady-state mix comprised of 70% R1S versus 30% R1T.

Based on the latest information per the Rivian sales website, current wait times for customized R1S orders are still more than six months out, with delivery expected in 2024.

This compares to a significantly shorter four-month order-to-delivery timeframe on customized R1T configurations or under six weeks for available inventory.

The extensively longer wait time for the R1S corroborates management’s indication of a “really long backlog” for Rivian’s flagship SUV still, despite its higher price tag which bodes unfavourably with the softening consumer spending backdrop. Considering increasing consumer sensitivity to auto prices, alongside an ongoing price war in the EV sector, Rivian continues to face the overhanging risk of further vehicle MSRP reductions in the near-term. This accordingly increases the urgency on realizing existing orders and pent-up demand for the higher-priced R1S variant before impending industry challenges catch up. With increasing R1S output volumes already underway to address pent-up demand in the best-selling SUV segment, we expect a favourable sales mix in favour of ASP growth. This will inadvertently contribute positively to management’s margin expansion efforts over the coming quarters, supportive of achieving positive gross profitability next year.

3. Rerouting R1 Vehicle Production Capacity

In addition to improved manufacturing efficiencies and vehicle BOM reduction, alongside impending ASP expansion tailwinds, the upcoming expansion of R1 vehicle production capacity at the Normal plant is expected to further Rivian’s ability to scale costs over the longer-term. Specifically, Rivian will be shutting down its Normal plant in mid-2024 to retool the R1 production capacity to 85,000 units per year, up from the current 65,000 unit run-rate. The upgraded production line will also facilitate the introduction of new technologies, in line with Rivian’s longer-term vision to capture incremental lifetime after-sales revenue on top of the MSRP, while also creating a unique experience and ensuring a high-performing vehicle residual value for consumers.

Getting down to the economics, we see the upcoming reroute of the R1 production line as a favourable contribution towards vehicle profitability in two ways – 1) improved operating leverage, and 2) incremental BOM reduction. In addition to increased production capacity, which is expected to improve fixed cost leverage for Rivian, the R1 line reroute will also be consolidating the number of electronic control units (“ECUs”) per vehicle. This will effectively “simplify the vehicle and remove considerable costs”. Specifically, the upgraded production line and “under the hood” changes to the R1 vehicle architecture will support a 60% reduction in the number of ECUs per vehicle, alongside a “25% reduction in wiring harness length in the vehicle”.

The confidence in ensuing cost reductions are “tied to contractual obligations associated with these component changes as well as contractual obligations with [Rivian’s] suppliers built into commercial negotiations”. Taken together with the 35% BOM reduction that will be realized through the ramp up of Enduro Drive unit integration, Rivian is tracking favourably towards sustained profitability despite short-term impacts to R1 vehicle output during the scheduled outage.

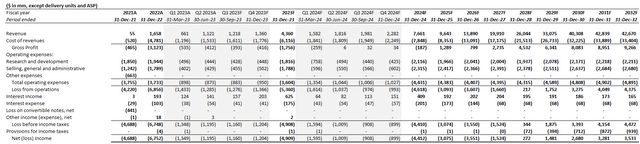

Fundamental Analysis Update

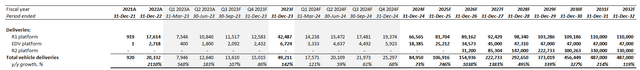

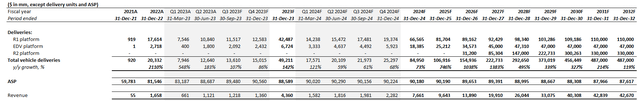

Taking into consideration Rivian’s actual Q2 performance and upward revised production guidance for the year, we expect delivery volumes to exceed 49,000 units for full year 2023. The anticipated dip in output volumes in mid-2024 due to the scheduled reroute of the R1 line is expected to slow sequential growth in delivery volumes. This is reflected through our adjusted 2024 delivery estimate to about 85,000 vehicles, down from our previous projection of about 100,000 vehicles. Expanded R1 production capacity is expected to recoup some of the lost volumes beginning in 2025, with incremental contributions from R2 SOP in 2026.

Taken together with expectations for gradual ASP expansion towards the low $90,000 range as higher-priced EDV and R1S deliveries ramp up, we expect revenue to reach $13 billion by mid-decade, up from the total sales projection of $4.2 billion in the current year. The pace of revenue expansion is expected to decelerate in 2026 given the introduction of lower-priced R2 vehicles into the sales mix. Specifically, we expect R2 demand to eventually outpace the R1, with the latter reaching steady-state delivery volumes at about 120,000 units. Meanwhile, R2 models are expected to command the majority of Rivian’s total annual sales mix and level ASP back towards the mid-$80,000 range given the variant’s lower MSRP.

Taken together with ongoing BOM reduction efforts, and the implementation of incremental cost-savings at the operating level, we expect Rivian to achieve nominal positive gross profit exiting 2Q24. Longer-term improvements to operating leverage through scale are expected to further complement management’s ambitions for 25% vehicle gross margin, a high-teens adjusted EBITDA margin, and 10% FCF margin. Our base case projections expect Rivian to achieve GAAP profitability by 2029.

Rivian_-_Forecasted_Financial_Information.pdf

Considering the disconnect between 2025 when management expects Rivian’s current funding sources to run out and the 2028 to 2029 timeframe when it is expected to become self-sufficiently operating cash positive, we expect the company to tap into incremental fundraising either through equity or debt within the foreseeable future.

Valuation Considerations

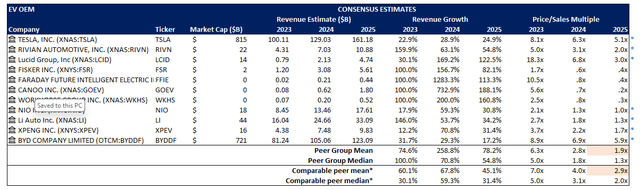

Admittedly, the EV sector continues to trade at a premium despite the cohort’s reputation for lacking profitability, and the adverse impact of an elevated rate environment on long-duration cash flows underpinning their valuations. With this consideration, we have taken into consideration Rivian’s peer valuation multiples to gauge the stock’s near-term prospects.

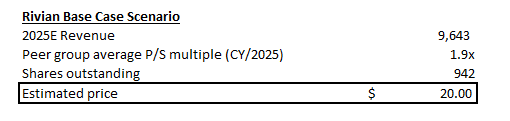

Our base case price target of $20 applies the broader EV peer group’s average price/sales ratio of 1.9x on Rivian’s projected 2025 revenue. Specifically, the EV peer group average takes into consideration Tesla’s leading ~5x price/’25 sales multiple, which includes a premium attributable to its unmatched volumes at scale. We believe that a multiple in line with the broader EV peer group inclusive of Tesla is warranted given Rivian’s recent progress in ramping up productions of three variants at once while effectively reducing costs, which differentiates its emerging strengths from rival upstarts.

Author

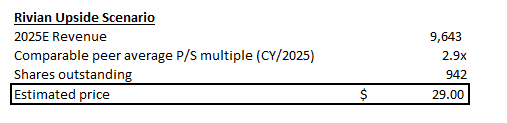

In the upside scenario, our $29 price target applies a 2.9x 2025E price/sales ratio for Rivian, which is closer to the average of its EV peers with more comparable growth prospects. The assumption applied is more weighted towards expectations for a sustained valuation premium to the EV sector, particularly to names that are already ramping up production and delivery volumes. However, we still see significant execution risks to Rivian’s growth and profitability roadmap that could potentially preclude an uptrend towards the upside price target. Key catalysts to supporting upside potential towards $29 apiece would include positive reception of the R2 launch scheduled for early 2024, as well as positive contributions towards near-term profitability targets (e.g. cost-savings realization, ASP increase, production ramp up, etc.).

Author

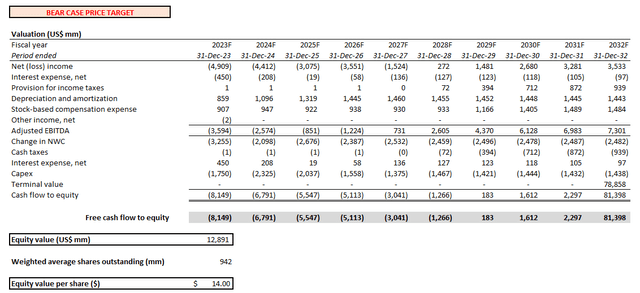

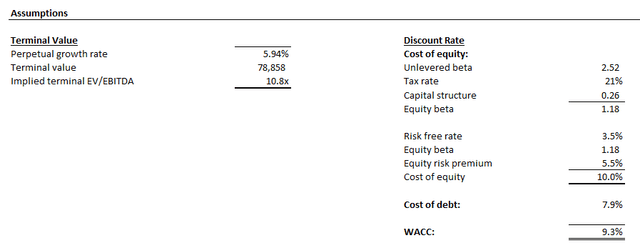

In the downside scenario, our $14 price target solely considers Rivian’s fundamental prospects. While a multiple-based valuation approach accounts also for market sentiment on the stock, the DCF valuation approach applied in the computation of our bear case price target is a reflection of Rivian’s prospects under a steady long-term capital structure. The DCF analysis is performed on projected cash flows taken in conjunction with the foregoing base case fundamental considerations. A 9.3% WACC in line with Rivian’s capital structure and risk profile is applied to discounting the projected cash flows. The analysis also applies an exit multiple of 10.8x, which is computed as a function of cost of capital to reflect the steady-state value of long-term cash flows.

Final Thoughts

Rivian has turned a page from its previous existential crisis, reinforced by consistent positive progress in ramping up productions and improving profitability in recent quarters. However, the stock remains expensive at current levels relative to Rivian’s peers with a similar growth profile. Taken together with expectations for incremental fundraising requirements within the foreseeable future to support Rivian’s longer-term growth roadmap amid a high capital cost environment, we remain conservative about the stock’s near-term prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!