Summary:

- Rivian’s stock has plummeted over 80% from its highest valuation of $100 billion to about $11 billion due to supply chain issues and slowing EV demand.

- Limited top-line growth due to paused factory construction and production constraints may hinder revenue growth.

- Unsustainable margins, flagging EV demand, and a difficult macroeconomic environment pose challenges for Rivian’s future success.

Editor’s note: Seeking Alpha is proud to welcome Vivek Shah as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

hapabapa

Perhaps no company better exemplifies the market’s fickle behavior towards electric vehicles than Rivian Automotive, Inc. (NASDAQ:RIVN). After its IPO in late 2021, Rivian was valued at over $100 billion despite having a revenue of just $55 million in FY2021, which gave it a price-to-sales ratio of over 1800. The stock has been unable to maintain that astronomical valuation and has since fallen over 90% in value to reach its current market cap of about $11 billion. This extraordinary collapse was caused by a mix of factors including a general downturn in electrical vehicle demand, high interest rates, supply chain issues, and flaws with their vehicles. Nevertheless, Rivian remains financially viable and, in recent days, they’ve made some notable achievements. Volkswagen AG (OTCPK:VWAGY) recently announced that they’re investing $5 billion in Rivian over the next three years (at least $3 billion will be an equity investment, and the other $2 billion will be a mixture of debt and an investment in a joint venture) to benefit from Rivian’s EV expertise. Rivian also finished retooling their Normal, Illinois factory for greater production capacity and lower production costs.

They boast impressive cash and short-term marketable balance of $7.9 billion (which is over 75% of its market cap) against about $5 billion in debt, a delivery rate of 95% in the past couple of quarters, and is gearing up for a much-awaited launch of its cheaper line of R2 SUV’s in early 2026. Given the stock has fallen so much from its highs, it may look attractive to investors looking for exposure in EV startups. However, I’d caution against buying the stock for 4 main reasons:

- Limited top-line growth

- Unsustainable margins that are unlikely to correct soon

- Flagging EV demand globally amid high competition

- Unconducive macro environment

Limited Top-Line Growth

In December 2021, Rivian announced the proposed construction of a massive factory in Georgia. This factory was supposed to be a game-changer. Rivian currently only has one factory in Normal, Illinois which has a production capacity of 150,000. The Georgia factory would have a capacity of 400,000 vehicles per year and was intended to be the main production site for the R2 SUV. Nevertheless, it paused the construction of the factory due to slowing EV sales and cash flow issues. Instead, Rivian decided to retool their Normal, Illinois factory to increase its capacity to 215,000 vehicles per year and to enable it to produce the R2 SUV.

Rivian’s CEO, RJ Scaringe, reaffirmed his commitment to the Georgia plant by saying “our Georgia site remains really important to us,” yet the company had not started building the factory before it paused the project and has offered no further timeline for the construction of the plant. While the decision to halt the development of the new factory was fiscally prudent, it’s indicative of the fact that Rivian itself doesn’t believe there’s enough demand in the EV market for Rivian to produce 400,000 vehicles in the near future and the company will have to be satisfied with producing at much smaller scales. This is problematic as Rivian’s limited potential to increase production directly translates to a limited potential to increase its revenue.

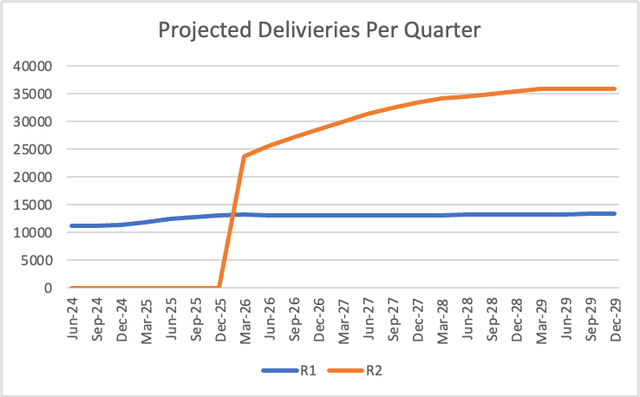

Rivian management has indicated that they expect the retooled Normal, Illinois plant to produce 55,000 R1 SUV’s and 155,000 R2 SUVs per year. Rivian already produces about 50,000 R1 vehicles, so the proposed increase in its production over the next few years is extremely limited. This means that Rivian’s top-line growth will almost exclusively be driven by the R2 vehicle.

Of course, whether Rivian will be able to expand their production to meet the cap of 210,000 vehicles is an open question. They currently produce at about 33% capacity of their Normal, Illinois plant despite operating for over 7 years, and have had problems with supply chain issues that have forced factory closures and recalls. Furthermore, if the demand for the R2 is lackluster then Rivian is in serious trouble.

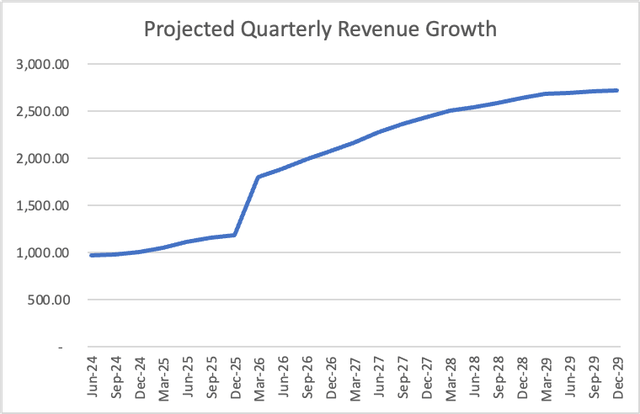

But, assuming that Rivian manages to maintain their delivery rate of 95% and can produce at capacity, they are projected to reach a quarterly revenue of $2.7 billion by 2029. While that is significant growth, it won’t be enough to justify current valuations given the low margins in the EV business. Rivian’s lack of production facilities means that their highest possible revenue is essentially capped at $10 billion until new production facilities are announced and built – which seems a long way off right now.

Rivian’s P/S of 2 is significantly higher than its competitors. Ford Motor Company (F) trades at a P/S of 0.27 and General Motors Company (GM) trades at 0.31. Rivian’s extreme premium in P/S implies that the market expects the company to grow their revenues significantly faster than companies like Ford or GM. However, Rivian’s limited increase in production capacity fundamentally hampers the chances of that type of runaway growth.

It’s worth noting that Tesla, Inc. (TSLA) has a P/S of 6.3, but that’s because many investors view it as a technology company and give it AI and robotics premiums that are less applicable to a company like Rivian.

Unsustainable Margins

The biggest problem Rivian faces is arguably their margins. Their COGS in the last quarter was significantly higher than their revenues, which meant that Rivian lost about $38,000 on every car sold. Of course, this isn’t inherently a problem: it’s a growing startup and these negative margins can simply be growing pains that have to be endured before Rivian ultimately turns a profit. Tesla faced similar negative margin problems before it eventually turned a profit, and a bull would argue that Rivian could do the same.

There are problems with this argument. Rivian is focused on investing to expand their factory and developing their cheaper R2 models. The redevelopment of their only factory and the development of a new model will likely keep COGS high for a couple more years and delay any chances of Tesla-like margin growth. Tesla also has a much higher production output that can benefit from the cost savings of economies of scale. The R&D costs for Rivian are likely to be a lot higher than the costs for Tesla, Rivian is planning to launch an R3 model that is supposed to be even cheaper afterwards. In contrast, Tesla hasn’t released a new consumer model in years apart from the Cybertruck. Furthermore, the bulk of production for Rivian will be focused on cheaper models in the coming years, and producing cheaper cars will make it harder to keep higher gross margins.

Even if we ignore all of that and assume that Rivian can reach Tesla’s margins by 2027, Rivian would still be overvalued because its limited production means that it can’t generate significant cash flows to investors even at the 18% margin Tesla currently operates at.

Flagging EV Demand

So far, my revenue projection has assumed that Rivian can maintain a 95% delivery rate while producing at capacity. If we start to question that number, the case for Rivian breaks apart even further. There are definitely tailwinds for EV demand in the US: regulations in states like California mandate that all new cars must be EVs by 2030, the current government is investing heavily in subsidizing the production of EVs, lithium prices have fallen significantly, high tariffs are applied to Chinese EVs, and there’s significant investment in battery tech to try and create cheaper batteries with longer range. Despite all of this, EV demand has been falling and is expected to continue falling.

Charging station infrastructure continues to be a problem for many consumers, there’s been an oversupply of EVs, and there are rising concerns about the high capital costs for EVs given their steep depreciation when sold as used cars. Focus has also shifted towards hybrid vehicles as climate-conscious solutions that are more practical for most consumers. Global EV sales are still expected to grow, but at a slower rate than previously expected. Goldman Sachs also reports that a bear case that the EV market will decline by 2% year-over-year is becoming more likely.

Within the EV market, Rivian will have to fight for market share as well. Most major carmakers have released EV models, and legacy carmakers have a significant advantage in production capacity as compared to startups such as Rivian. Their business strategy to focus on developing cheap EV models will run into some hefty competition. GM is revamping the Chevy Bolt, and it has promised that the new car will be the “most affordable vehicle on the market by 2025”, Stellantis is developing a $25,000 Jeep Renegade, Ford is working on making smaller and cheaper vehicles, while Tesla may eventually unveil their long-awaited cheaper Model 2. Consumers will have many options in the EV market and Rivian’s R2 will have to win them over with more than just a reduced price tag.

Difficult Macroeconomic Environment

The macroeconomic environment is also a cause for concern for Rivian. Higher interest rates will make it difficult for Rivian to raise large amounts of money from debt and make their interest payments on $3.4bn of long-term debt more expensive.

Furthermore, a Trump presidency could likely be disastrous for Rivian. He has reportedly made “bashing EVs a cornerstone of his campaign” and has indicated that he would end federal protections for electric vehicles. Geopolitical uncertainty has also wreaked havoc on supply chains for electric vehicles, a trend that may continue in the future.

Valuation

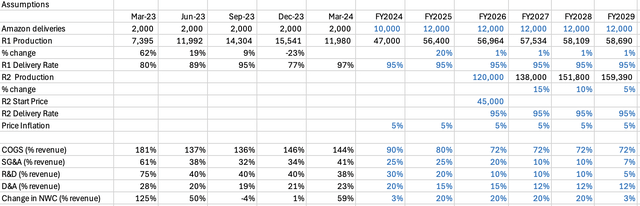

Revenue and margin assumptions for the next five years (Self)

The fair value I get for Rivian in my DCF is $10.56, which is a -21% implied return from their current share price. The projected revenue was built up using the management estimates: the yearly production of R1 SUVs stays at around 55,000 while the R2 production is about 155,000. By 2029 – the terminal year -, Rivian is producing about 210,000 vehicles a year which is about a 4x increase from last year’s production of 57,000 vehicles.

In terms of margins, I project significant improvement this year due to the new retooling and bringing down the COGS margin to 72% (of revenue), which is about Tesla’s COGS margin. The net margin comes down to 16%, slightly lower than Tesla’s net margin of 18%. I also project a $1 billion equity injection for the next four years from Volkswagen (some of Volkswagen’s $5 billion investment will be a loan rather than an equity investment).

At a 9.25% cost of capital and a 3.5% terminal growth rate, the intrinsic value of a Rivian share comes to $10.56.

Risks

There are several risks inherent in this analysis. Perhaps the biggest risk is that Rivian will decide to go ahead with their Georgia factory in the near future and be able to ramp up production at that factory to 400,000 vehicles a year. This seems unlikely, though, since Rivian recently decided to pause plans for the factory – before any construction had even begun – and instead opted to invest in retooling their existing factory. Another risk is that Rivian could continue retooling their factory and achieve a net margin considerably higher than the 16% I’ve projected in the future. Nevertheless, given that Rivian’s net margin in their latest quarter was -80%, I don’t foresee them being able to have industry-leading margins (especially since Tesla is known for their high level of automation, and they operate at an 18% net margin). Finally, it’s possible that more companies such as Volkswagen may invest in Rivian to benefit from its EV expertise.

Conclusion

Rivian’s gone through a lot recently. Its survival as a company is by no means guaranteed, but it’s highly feasible it’ll stick around for a while – especially if the R2 launch is a success. But, looking at its financials, it’s clear that Rivian still trades at a premium that is unsustainable. Rivian’s revenue is constrained by production capacity and its net income is restricted due to low margins, which makes it incredibly difficult for it to live up to its $11 billion dollar valuation. I still think it’s a company with potential and I’d be interested to reevaluate its prospects in 2-3 years if it manages to find a way to produce at scale with high margins. In the meantime, though, now is not the time to buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.