Summary:

- I initially rated Rivian as “Sell” in 2021, and upgraded to “Buy” in July 2024. I admit I was early and wrongdoing that.

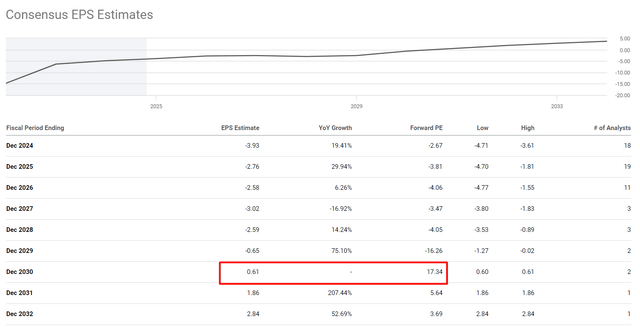

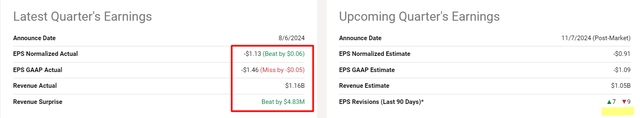

- Rivian’s Q2 2024 results showed significant gross profit losses and production disruptions, with Wall Street lowering future earnings estimates.

- Despite a strong cash position from the VW deal, Rivian’s continuous cash burn and deferred break-even projections raise concerns.

- Rivian’s growth and profitability challenges, coupled with increasing EV competition, make it difficult to maintain a bullish stance.

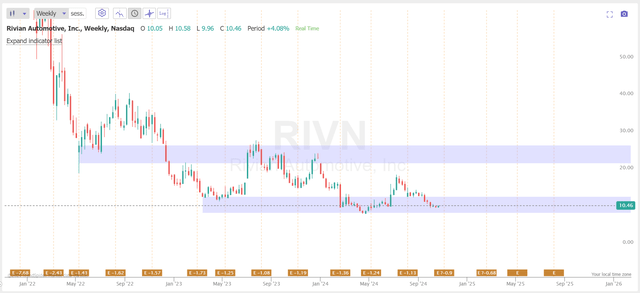

- I can’t rule out a nice bounce from today’s prices based on technicals. But I can’t keep my bullish stance on technicals alone when fundamentals don’t support it. Hence, my downgrade to “Hold” today.

hapabapa

Intro & Thesis

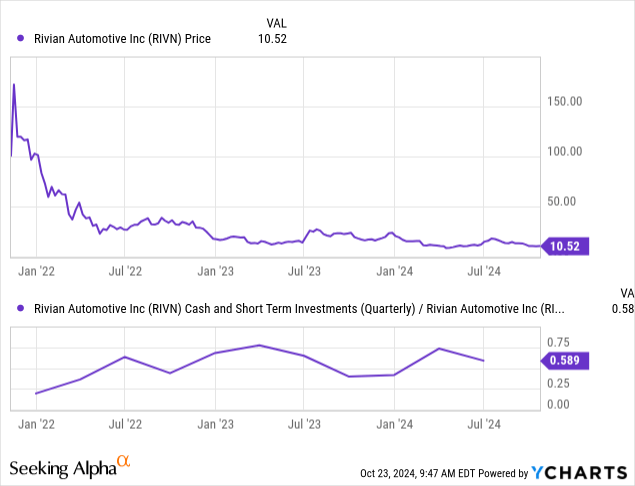

The first time I wrote about Rivian Automotive, Inc. (NASDAQ:RIVN) stock here on Seeking Alpha was in November 2021 – that was an IPO analysis where I concluded that the stock had been overvalued to a great extent at the very beginning of its public journey. I held my “Sell” rating until June 2023 when I upgraded RIVN to “Hold”, thinking that the company’s situation was improving at the time as its margins were showing clear signs of growth; nevertheless, I couldn’t assign a “Buy” rating due to its high valuation and strong competition risk. But on July 02, 2024, I decided to upgrade my rating to “Buy” as I considered Rivian’s partnership with Volkswagen (OTCPK:VWAGY) as a major catalyst that should provide strong backing for Rivian’s balance sheet and growth prospects. The stock surged over 26% since that call but then quickly gave up all the gains and even managed to lose almost 1/3 of its market cap since the beginning of July:

TrendSpider Software, RIVN daily, notes added

Now I look at my decision and realize that perhaps I was too early – recent corporate developments and financials clearly show that I was too optimistic. I still think RIVN stock could go up – now probably for technical reasons – but I have decided to revert to my “Hold” rating today. I see Rivian’s longer-term challenges outweighing any potential upside – the risks buyers are taking today are too great to ignore.

Why Do I Think So?

In Q2 FY2024, Rivian’s $1.2 billion in sales came from deliveries of 13,790 cars, even as the company experienced production disruption due to plant shutdowns for retooling upgrades. As the management explained on the call, this downtime was required “to roll new technologies and material cost-reduction improvements into the R1 vehicle platform that should enhance production performance and cost savings.” The retooling is one element in Rivian’s wider plan to improve profitability through vertical integration and cost reduction as they continue to scale second-generation R1 vehicles and build out the R2 platform.

To date, marginality remains a huge problem for RIVN – the improvements on this front I expected previously haven’t materialized so far. The overall gross profit loss in Q2 was $451 million, a gross profit loss per vehicle of around $33,000 (including $15,000 of depreciation and amortization and $1,200 in stock-based compensation per vehicle). Rivian also spent $2,400/vehicle on cost of revenue efficiency initiatives that won’t be part of the future cost equation. On an unadjusted basis, the company missed consensus expectations in terms of earnings, even though we saw a positive surprise in terms of sales and adjusted EPS. Above all, Wall Street analysts have lowered their estimates for the coming quarter (the publication of Q3 FY2024 results is set for November 7, 2024).

Seeking Alpha, RIVN, notes added

Rivian’s management, however, said they expect modest positive gross profit for Q4 2024 and for FY2025, due to “material cost reductions, fixed cost leverage, and higher revenue per unit delivered.” On the other hand, we found out a few days after the Q2 report came out that the firm is temporarily halting production of its electric commercial van for Amazon (AMZN) because of a parts shortage (but again, they expect to recover the missed production without affecting the R1 pickup and SUV models).

In addition to that, there was a fire at Rivian’s Illinois plant that damaged several vehicles in a parking lot (but the assembly plant itself was unaffected). Also, the management stated in early October that RIVN produced 13,157 vehicles and delivered 10,018 in Q3, which was slightly below analyst expectations. These figures came due to “a production disruption from a component shortage affecting both the R1 and RCV platforms”, according to the statement. Consequently, Rivian adjusted its annual production guidance to 47,000-49,000 vehicles while maintaining its delivery outlook of 50,500-52,000 vehicles, with Q3 financial results expected on November 7, as I mentioned above already.

In light of all this, I think Rivian’s outlook from the Q2 earnings call and management’s commentary at the time are probably no longer relevant to the market – now the uncertainty is driving the stock to the lows it had before the surge due to the VW deal.

By the way, Rivian’s book grew through an initial $1 billion contribution from Volkswagen, followed by up to $4 billion in capital raisings. This alliance should develop next-generation electrical design and software architecture, giving Rivian the capital to fund R2 ramp-up and lead to positive free cash flow eventually (something I still believe in). The partnership is also expected to result in material savings and operational efficiencies, so at some point, we should see margin expansion.

The company is also planning to lower R1 costs after 2024 through a reduction in material and conversion costs, the leverage of supplier negotiations, and the Volkswagen joint venture. The new R1 platform with the new Ascent motor system, and the second-generation R1 platform are key components of Rivian’s approach to making the vehicle perform better at lower production costs.

The problem with Rivian’s prospects is that I think they’re almost always deferred. Three months ago, we saw a forecast that RIVN would break even on earnings per share (on an adjusted basis) at the end of FY2029 – now the nearest positive year for the company is set for FY2030, with the estimated bottom line number of about 52% lower than a quarter ago. Moreover, the projected figure makes Rivian quite expensive in terms of the implied P/E ratio (17.3x), considering that we’re talking about FY2030 here.

The focus on “cost savings, efficiency, and innovation” at the company sounds good indeed, but I think Rivian has to grow way more aggressively to justify its prospective valuation. The deal with VW brought a real boost to RIVN’s balance sheet liquidity – the cash on the balance sheet now exceeds 58% of RIVN’s market cap, which is hard to believe. But given that the firm keeps burning more and more cash (almost -$4.9 billion in CFO last year, -$4 billion on a TTM basis), this pile of cash should mean little to shareholders, in my opinion.

More important should be the answer to the question: “How quickly will the company stop burning cash and at least break even on an adjusted basis?” And this is where I see real problems, as competition in the EV industry is growing by leaps and bounds every year.

The Bottom Line

Overall, I think we can call Rivian a hostage to market conditions today. The company’s products have good reviews as far as I see it, but that may not be enough to somehow increase production at the current car prices. Investors can only hope for contracts with giants like Amazon, but even here there are difficulties, as we could see from the recent news about the shortage of some parts for van production.

However, Wall Street has become much more skeptical in the last 3 months and has once again pushed back its break-even forecast by a year. I remember there were times when the market expected Rivian to break even in 2027 to 2028, but that seems almost unimaginable today. I fear that with the current input data, Rivian has little chance of surprising with something very positive in early November when the third quarter results are announced. However, I can’t rule out such a possibility: perhaps we will see a nice bounce from today’s prices – the technicals on a weekly basis suggest strong support at current levels.

TrendSpider Software, RIVN weekly, notes added

On the other hand, I can’t keep my bullish stance on technicals alone when fundamentals don’t support it. Hence, my downgrade to “Hold” today.

Thank you for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!