Summary:

- This is the first time in the history of my RIVN coverage that I am withdrawing my Sell rating.

- In terms of cost management, Rivian is definitely moving in the right direction.

- RIVN’s liquidity problems appear to have been resolved, with over 77% of its market capitalization sitting in cash.

- However, when evaluating revenue-related metrics in absolute terms, the stock still appears too expensive to me, especially considering the associated risks.

- The company plans to invest billions more in the coming years and has yet to establish itself in a market where competition is only getting stronger.

Mario Tama

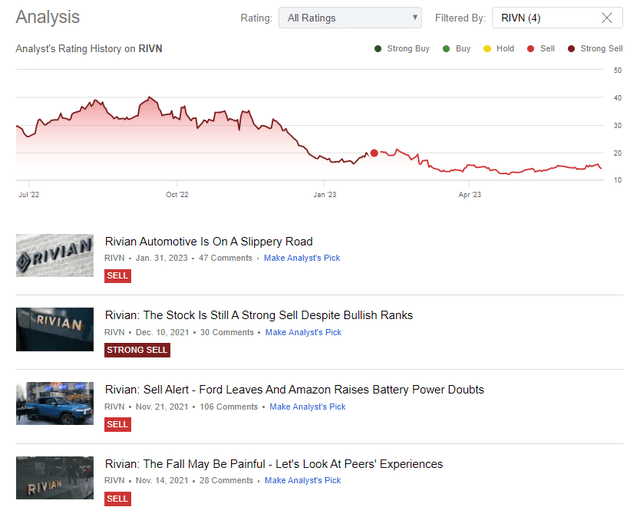

I was bearish on Rivian Automotive, Inc (NASDAQ:RIVN) when the stock was worth $130.8/share, $123.88/share, $114.66/share, and even $19.4/share, and each time the stock continued hitting lows.

Seeking Alpha, my rating on RIVN

However, the analysts of the largest banks disagreed with me. To this day, this contradiction between us has not been resolved, as we can see from the example of Morgan Stanley’s Bull-Bear spread, updated just recently [proprietary source]:

Morgan Stanley [June 22, 2023 – proprietary source]![Morgan Stanley [June 22, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/23/49513514-16874946040921571.png)

Perhaps now is the time for me to change my thesis from Sell to Buy or at least Neutral? By starting to read this article, you already know the answer to that question. Let me explain why I think so.

Rivian And Its Old Problems’ Improvements

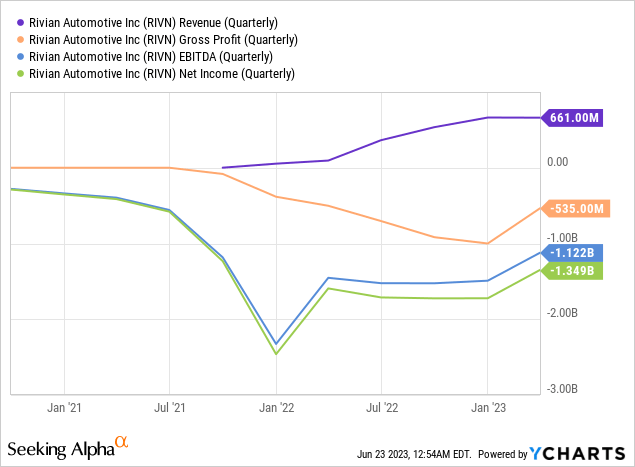

In Q1 FY2023, the company produced 9,395 cars and delivered 7,946 – down -6.24% and -1.34% QoQ, respectively. Hence, the slight -0.3% drop in sales for the quarter. What caught my eye, however, was the sharp quarter-over-quarter increase in gross profit, which reduced the burn rate by almost two times:

So Rivian experienced a 17% improvement in gross profit per delivered vehicle compared to the previous quarter. Why did it happen? The CEO explained during the Deutsche Bank Global Auto Industry Conference [June 15, 2023]:

-

Reductions in material costs: The introduction of LFP (Lithium Iron Phosphate) and Enduro materials helped lower the production costs of Rivian vehicles. These materials are likely more cost-effective compared to previous materials used, leading to improved gross profit margins.

-

Freight benefits: Rivian benefited from reductions in freight costs during Q1 compared to the previous quarter. The overall freight backdrop improved as supply chains became more efficient, resulting in lower transportation expenses for Rivian. This reduction in freight costs positively impacted gross profit margins.

-

Increased average selling prices: Rivian saw an increase in the average selling prices of its vehicles. This increase was primarily driven by a significant shift in product mix towards the R1S, an all-electric SUV. The R1S accounted for a larger proportion of the vehicles delivered in Q1, and as SUVs generally have higher price points compared to pickup trucks, the shift towards the R1S contributed to higher average selling prices and improved gross profit.

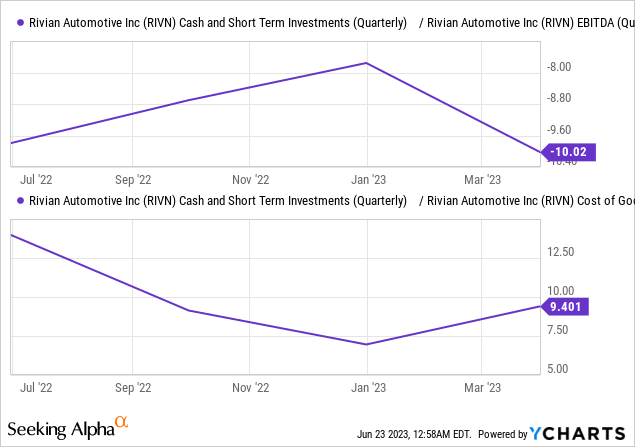

Total cash & ST investments on the balance sheet are down 2.8% QoQ, but thanks to cost reductions, RIVN has significantly improved its liquidity needs – the COGS coverage [name provided by the author] is now just over 9 quarters instead of ~7.5 in Q4 FY22:

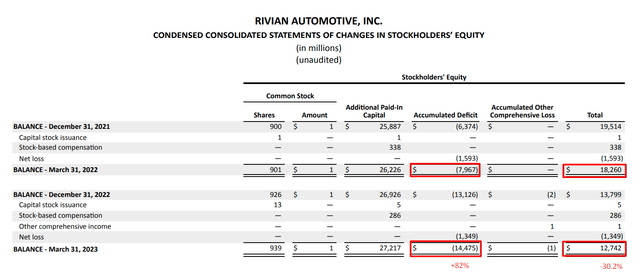

For the year, total shareholders’ equity dropped by 30.2%, and the accumulated deficit increased by 82%:

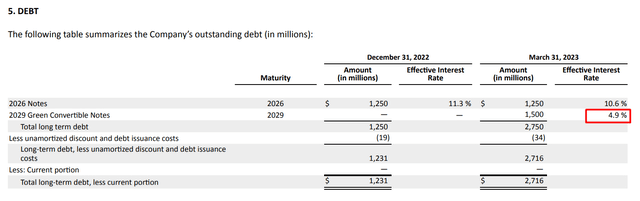

It’s nice to see that the company has started to finance its expansion not only by dilution. Debt on the balance sheet has increased by 120% QoQ, while the new financing raised will cost the company only 4.9%, which seems to me to be well below the company’s WACC.

According to the management, the company is aiming to produce ~50,000 units this year and targets a positive gross margin for FY2024. This means that RIVN will need to produce an average of 13,535 units in each remaining quarter of FY2023 to meet this target – that’s 44% more than was produced during Q1 FY23. Based on the management’s words, this sounds realistic – the Q1 numbers reflect the downtime with the EDV to introduce new technologies; they foresee a substantial acceleration of R1 production in 2H, as they now allow the introduction and production of Enduro in R1.

I already cited a report from the Goldman Sachs Equity Research team [June 1, 2023 – proprietary source] in my recent Tesla article and will repeat some of the information here. The demand side appears to be relatively weak right now, as evidenced by the increase in light vehicle incentives [+65% YoY and +14% QoQ]. At the same time, inventories are lower than they have been in decades – a fact that supports sales and pricing across the market. And what’s remarkable – SUVs continue to eat up the overall market share:

Goldman Sachs Equity Research [June 1, 2023 – proprietary source]![Goldman Sachs Equity Research [June 1, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/6/23/49513514-16875019128197641.png)

In my opinion, this fact creates a favorable environment for future R1S sales. And what’s more – the R2 should also have its share of the growing SUV market soon at relatively modest prices.

Car And Driver article [June 22, 2023]![Car And Driver article [June 22, 2023]](https://static.seekingalpha.com/uploads/2023/6/23/49513514-16875027962003832.png)

So, in summary, RIVN’s operations improved in the first quarter and the market situation, even against the backdrop of weak overall demand, should, in my opinion, allow the firm to ramp up production as planned. In addition, RIVN keeps announcing that there is a strong backlog of pre-orders through 2024.

But what about valuation?

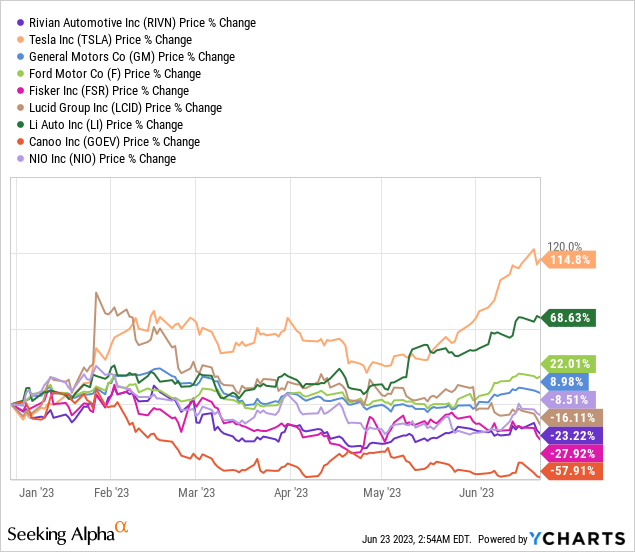

Since the beginning of the year, RIVN stock has significantly underperformed the overall market and industry, outperforming only financially inferior companies like Canoo (GOEV):

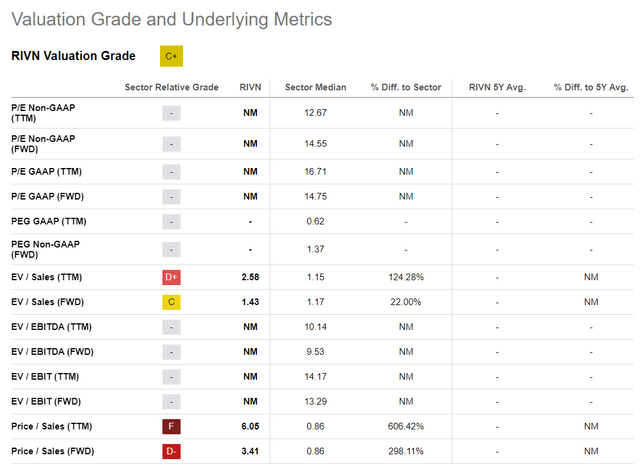

In many ways, this is not surprising – despite its “C+” Valuation grade by Seeking Alpha’s Quant System, RIVN has no earnings-related multiples, even forwarding ones:

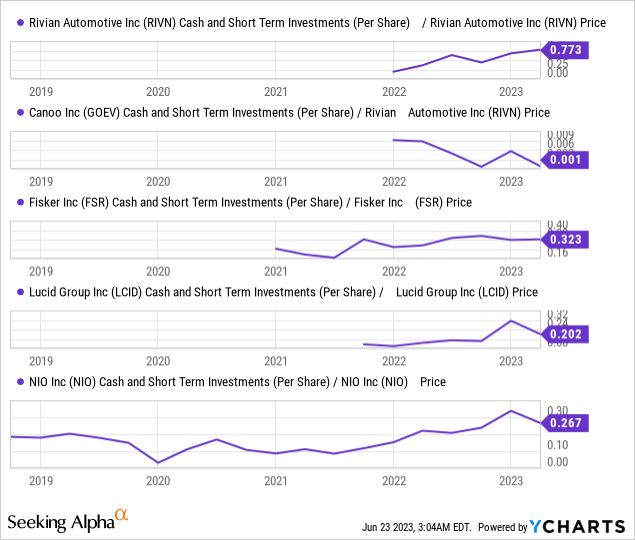

Unlike the rest of its underperforming peers, however, RIVN’s liquidity problems appear to have been resolved, with over 77% of its market capitalization sitting in cash:

Remarkably, analysts still predict that RIVN will be unprofitable up to FY2028. In the last month, the absolute EPS forecast for FY2028 has increased by 55.59% – in the same period, the EPS forecast for FY2023 has improved by 7.7%. In the last 5 quarters, the company has exceeded EPS forecasts and reported a less deep loss than expected.

The Bottom Line

In terms of cost management, Rivian is definitely moving in the right direction. Also, the market segment the company is targeting is doing better than other segments – that is definitely a good microeconomic thing for the firm.

In terms of the valuation aspect, it appears that RIVN demonstrates relatively greater stability than its peers when considering cash-related metrics. However, when evaluating revenue-related metrics in absolute terms, the stock still appears too expensive to me, especially considering the associated risks.

Macroeconomic uncertainty is also increasing – unprofitable companies, even if their funding of operations seems secure, will likely continue to face multiple contractions. If RIVN stock is underperforming amid the growing market, I think it is unlikely to be working in the opposite direction. The company plans to invest billions more in the coming years and has yet to establish itself in a market where competition is only getting stronger.

I upgrade RIVN stock from Sell to Neutral this time

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!