Summary:

- Rivian faces intense competition in the EV market and struggles with supply chain issues, resulting in selling vehicles at a loss.

- The company is not expected to report positive gross margins until the end of 2024, making it a risky investment at the moment.

- Rivian’s valuation is difficult due to negative cash flow, and we recommend staying away from the company for now.

jetcityimage/iStock Editorial via Getty Images

Rivian (NASDAQ:RIVN) is an electric automotive company based in the United States. The company currently produces 3 types of vehicles- the truck (R1T), the SUV (R1S), and the van (EDV700). Currently, the van is exclusive to Amazon’s (AMZN) use, but whether that will remain the case remains speculative. The official S-1 document suggests that the contract is exclusive, but there are reports Rivian is looking to expand its fleet business beyond Amazon. Amazon was a 20% shareholder in Rivian prior to its IPO release. However, for the purposes of this article, I will focus on the prospects of Rivian’s publicly available models and why I think there is trouble ahead for the new electric car company.

Earnings

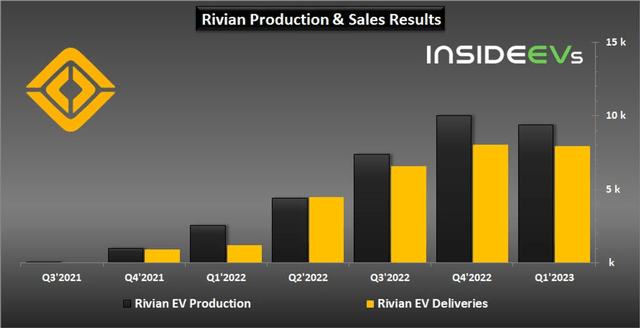

In Q1, Rivian fell short of revenue estimates but surpassed earnings estimates by 20%. The biggest news came in that the company decided to maintain its 50,000 vehicle goal for FY 2023, which came partly as a surprise considering tough supply chains. Similar EV companies like Lucid (LCID) and Fisker (FSR) had to cut their production guidance due to these issues. I’m not convinced by Rivian’s guidance, as in FY2022, Rivian cut its production goal by half and still missed guidance in Q4. In fact, we can see Rivian’s production and delivery actually decreased QoQ.

InsideEVs

While Rivian says it expects the majority of the production to come in the latter half of the year, Rivian does not have a good track record of keeping this promise.

As for earnings, the company generated a negative gross profit of $535 million and a net loss of $1,349 million. The company aims to achieve a positive gross profit by the end of FY2024. The market actually reacted positively to these reports, and the stock went up aftermarket by 13%.

Good Products, But Not Great Enough

Rivian’s products are some of the best in its niche. The R1T is named the best electric truck for 2023 by Car and Driver, and the R1S is also beloved by reviewers. However, just a good product may not be enough for Rivian.

This is Elon Musk’s advice on a good company: “If you’re entering anything where there’s an existing marketplace, against large, entrenched competitors, then your product or service needs to be much better than theirs. It can’t be a little bit better, because then you put yourself in the shoes of the consumer… you’re always going to buy the trusted brand unless there’s a big difference.”

For Tesla (TSLA), there wasn’t much of an existing electric vehicle market, but the narrative has completely changed for Rivian. And both the electric truck and SUV space have been filled with big-name brands, all looking to ride the wave of the impressive forecasted 17.3% CAGR until 2030 for the EV market. Out of the many, I will use Tesla and Ford (F) to demonstrate how competitive the EV market has become.

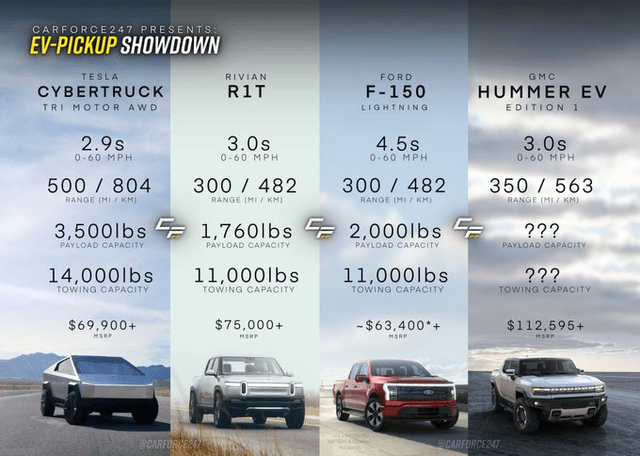

Ford

Compared to the electric SUV market, much fewer players have entered the truck market. However, the competition is nothing to scoff at, notably the Ford Lightning model. The Ford Lightning originally had an MSRP of $40,000 but continued its price hike up to just over $60,000 where it sits today. This is not good news for Rivian, as it demonstrates how difficult and expensive the supply chain has become over the anticipated amount. The base model Rivian MSRP at $73,000, and the problem for Rivian is that it’s nearly impossible to raise the price any higher. Last year, when Rivian tried to charge 20% more for pre-orders, customers reacted aggressively, threatening to cancel their orders. Rivian then took back their words and accepted the fate of losing money for every vehicle it produces.

Still, the R1T does not have a product “much better” than Ford’s. Customers still have to decide if the $13,000 is worth the expense. In addition, Ford aims to produce over 200,000 lightning, well above the 50,000 forecasted for Rivian.

Comparable vehicles to the R1T (Carforce247)

While Rivian produces a very pretty car, it will likely find the market filled with competitors by the time it scales enough to be profitable on a per-vehicle base. Its competitors have the ability to generate profits early and scale up fast, while Rivian cannot as a result of being a smaller company.

Tesla

Tesla comes as an anomaly in the EV market as they appear to cruise through the supply chain issues every other manufacturer is experiencing. In fact, Tesla has been decreasing vehicle prices several times already this year, not to mention the upcoming $25,000 hatchback.

The large consensus is that the future of Rivian- the R2 models- will be cheaper vehicles that will fit the price range of a larger group of customers.

However, I have a hard time imagining how Rivian can generate profit or appeal to customers with Tesla already so far ahead.

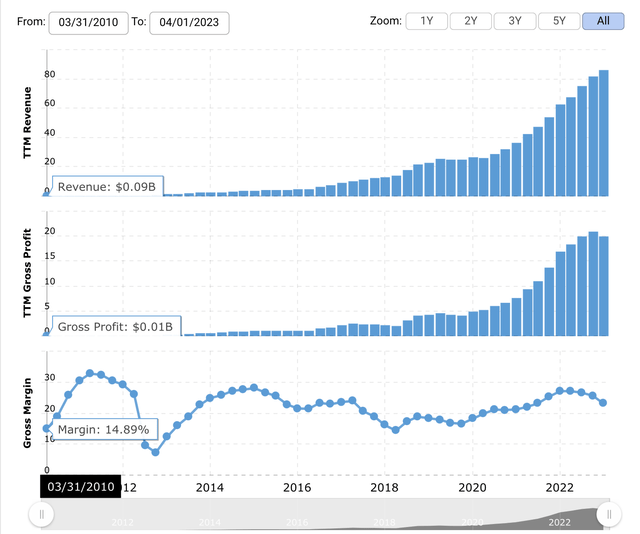

The market for Rivian is very different from Tesla. While Tesla also started by producing higher-end models, it was able to achieve positive gross profit from the get-go because there was little competitive pressure to lower prices.

Tesla gross margin over the years (MacroTrends)

In Rivian’s case, there is no sign of positive gross profit for at least another 6 quarters, and I don’t think the same model is sustainable for the R2.

Price Trouble

After Tesla and Ford cut prices on some of their vehicles (specifically the Mustang Mach-E), there were worries that demand could remain strong for the company. Of course, the company cannot afford to cut prices as CEO RJ Scaringe emphasized “We must focus our resources on ramp and our path to profitability”.

Rivian appears to be unfazed about the demand trouble.

Given the data that we have on customer behavior, the aggregate result we see is a continued upward shift in ASPs (Average Selling Price)

Now, in certain locations, orderers of Rivian can receive their vehicle in as few as 14 days, as some configurations are readily available. This may be a sign of decreasing demand or improved delivery methods, but it is difficult to say for sure that the high pricing has not hurt demand.

Financials

Rivian has $12 billion in cash and cash equivalents, which is very healthy. However, when considering its $1.35 billion in losses this quarter, it becomes apparent there is no way this cash is sustainable. The last capital-raising round of $1.3 billion was successful on a financial standpoint, but it came at a cost of tanking the stock 7% post-market.

Rivian is not expected to report positive earnings until 2028. I estimate there will be another round of capital raise in 2025. I got this estimate assuming a linear increase in earnings until 2028, estimating $5 billion lost this year, $4 billion next… With this model, I estimate the capital raising round to be at least $3 billion, even larger than the last round.

What Will Change My Mind

I believe the right point for entry is going to be the end of 2024 when the EV-maker is forecasted to have positive gross margins. Only then can we see how significant of a role this will play on the cash flow situation, as it means a reduction of lower cost or net realizable value charges.

The exception is that the company exceeds its 50,000 vehicle guidance this year. As this could mean improved supply chains so it will be easier to reach positive gross margins. However, I think this is unlikely given that company like Lucid had to decrease forecasts and Ford had to increase prices.

As for a valuation, it is very difficult to do one since the negative cash flow means many valuation methods will signal the company to go bankrupt. As for P/S or EV/S, the company is well above the sector median, but that is expected of a new, fast-growing company.

It is difficult to stress on the immense risks an investor is willing to put in if they were to invest today, so I’d recommend staying away from the company completely for now.

Conclusion

It is a pity that Rivian is entering the EV market when it is getting the most intense. The company has to resort to selling vehicles at a loss and deal with difficult supply chains. The company is far too risky to invest in currently, and I do not see many economic moats, so I would rate Rivian stock a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.