Summary:

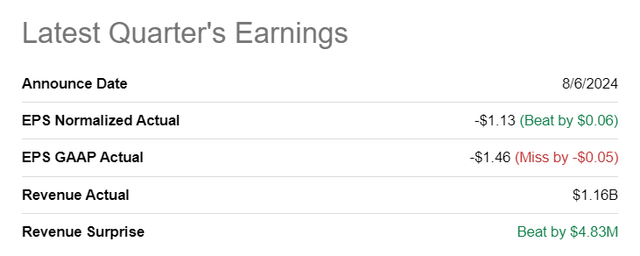

- Rivian beat Q2 expectations last week, generating better-than-expected earnings and top-line results.

- The company narrowed its gross losses in the second quarter, with a significant improvement in the gross margin per unit metric.

- RIVN is currently undervalued compared to other U.S. electric vehicle manufacturers, making it a strong investment opportunity with high potential upside.

RoschetzkyIstockPhoto/iStock Editorial via Getty Images

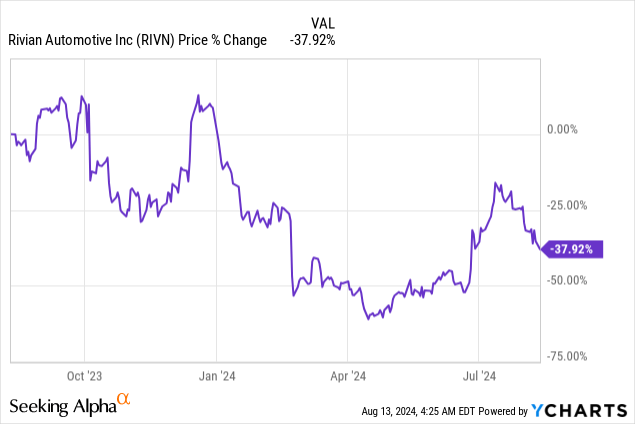

Rivian Automotive (NASDAQ:RIVN) reported better than expected Q2 results on both the top and the bottom line and posted narrower losses as well as improving unit economics for its EV operations. The solid earnings report for Q2 came on the heels of the Rivian-Volkswagen partnership deal that was announced during the second-quarter, which caused new excitement for Rivian’s shares. Unfortunately, this excitement didn’t last and shares of Rivian have trended down again lately, mostly due to general market weakness and growing fears about a recession. In my opinion, the drop is a clear buying opportunity for investors as Rivian is set to gradually improve its profitability profile.

Previous Rating

I rated shares of Rivian a strong buy in June — Volkswagen Deal Is A Game Changer — after the EV maker announced a strategic equity investment of Germany-based Volkswagen. In the second-quarter, Rivian continued to make progress in terms of lowering its losses, especially on a gross profit per-vehicle basis and although the firm remained deeply in the red in Q2’24, the EV company is set to roll out newer, more affordable products that could further help Rivian lower its losses going forward.

Rivian Beat Expectations

The EV maker reported better than expected earnings for the second fiscal quarter last week. Although the company’s EV production dropped Q/Q, Rivian managed to deliver better unit economics. Rivian generated $1.13 per-share in adjusted losses, beating the consensus by $0.06 per-share. The top line came in at $1.16B, topping the consensus estimate by ~$5M.

Confirmed Delivery Target, Improving Unit Economics

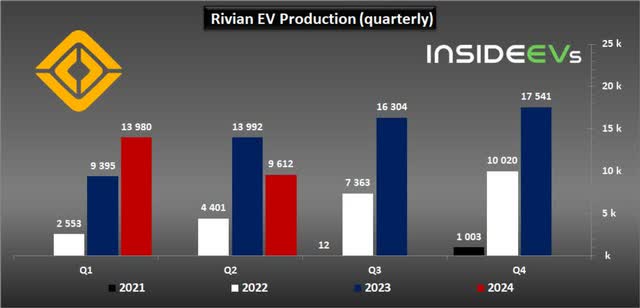

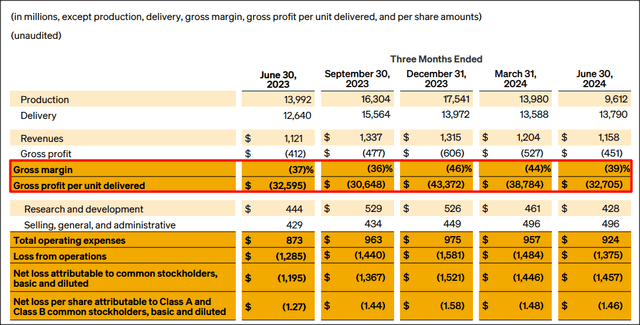

In the second-quarter, Rivian produced 9,612 vehicles at its manufacturing facility in Illinois, compared to 13,980 in the quarter-earlier period. This means that the company achieved 41% of its full-year production target and needs to produce another 33,408 electric vehicles in the second half of the year. Rivian set a production target of 57,000 electric vehicles earlier this year, which management confirmed on the Q2 earnings call. The production guidance seems reasonable to me and I would not be surprised to see Rivian exceed its full-year manufacturing target considering that deliveries are ramping up: Rivian delivered 13,790 electric vehicles in Q2’24, showing 9% year-over-year growth.

Rivian generated a gross loss of $451M in the second-quarter, which was $76M lower than in the previous quarter. Importantly, Rivian’s gross loss per electric vehicle sold declined a solid $6,079 in the second-quarter to $32.7k, and that’s despite a lower total production output. This improvement in unit economics is due to the fact that Rivian has cut back on operating expenditures and instituted measures to improve efficiency at its production lines.

Further, Rivian is set to launch more affordable EVs in the future, such as the R3 and R3X, which have estimated production start dates in late 2026. The R3 and R3X are estimated to cost between $37k to $47k, depending on trim level, and given that the R3 models are expected to be cheaper than current models which have a price tag of ~$70k, the gradual shift towards the R3 production line could have a positive gross margin impact for Rivian going forward.

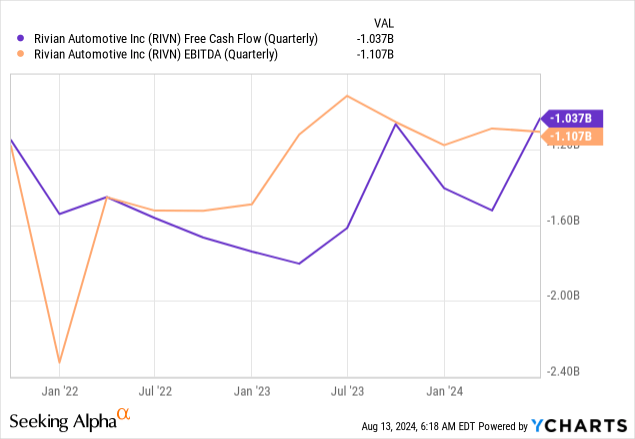

Since unit economics are still negative, Rivian also lost a ton of money in terms of EBITDA and free cash flow. Free cash flow was negative $1.04B and the trend is a positive one. However, with Rivian still losing more than $32k per vehicle sold (on a gross profit basis), investors should expect the EV maker to remain unprofitable at least for several more years.

Rivian Is A Value Deal…

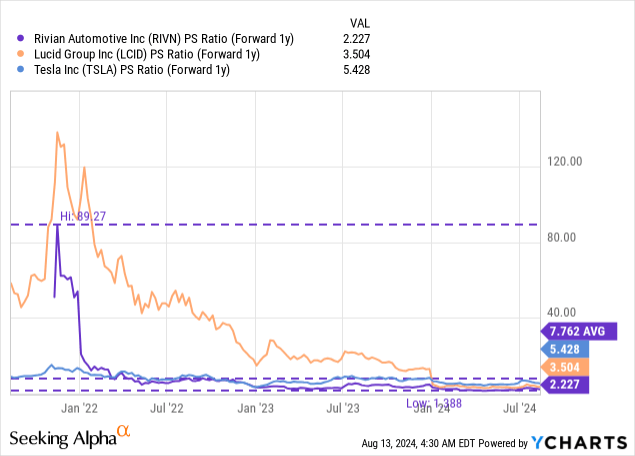

Rivian is the best deal in the large-cap U.S. electric vehicle market, in my opinion. While I like Tesla (TSLA) due to its large-scale operations and AI/robotics opportunity as a long-term investment — Avalanche Of Catalysts — Rivian is the cheapest U.S.-based EV manufacturer with a significant production and delivery volume.

The EV maker is currently trading at a price-to-revenue ratio of 2.2X, which is well below the company’s longer term 3-year price-to-revenue ratio of 7.8X. The industry group includes the most important EV players in the U.S. market, such as Rivian, Tesla and Lucid Group (LCID). The industry group average P/S ratio is 3.7X and implies revaluation potential for shares of Rivian… especially if the company can continue to grow its production/deliveries while cutting its losses per vehicle sold.

In my last work, I said that I see a fair value P/S of 3.0X, which implies a fair value of $20.50 per-share. Given that Rivian managed to lower the amount of money it loses per vehicle sold in Q2 and confirmed its full-year production target, I believe this remains a fair value price target for Rivian. Given the success Rivian had in the last year in terms of lowering losses, entering into a strategic partnership with Volkswagen, and growing its deliveries, I believe Rivian should not have the lowest P/S ratio in the industry. That is does make Rivian a value deal, in my opinion.

Rivian’s Risk

The biggest risk for Rivian is slowing EV production and delivery growth, which would negatively impact the firm’s gross margins, which, I believe, are the most important key metric for electric vehicle companies. What would therefore change my mind about Rivian is if the firm were to see lower gross margins per unit sold going forward and saw widening losses in terms of EBITDA and free cash flow.

Final Thoughts

Rivian delivered a solid set of financials for its second fiscal quarter last week as the electric vehicle maker made continual progress in terms of lowering its losses, both on a gross profit as well as gross profit per unit level. While Rivian is set to lose money for the foreseeable future as it ramps up production of lower-priced EV alternatives, the launch of more affordable electric vehicles should also have a positive effect on the company’s unit economics and gross margin trend going forward. Given that Rivian is by far the cheapest EV maker in the U.S. that has a considerable production volume (50k+ EV output annually), I believe the company is set to improve its profitability outlook and shares remain an attractive investment in the electric vehicle industry.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.