Summary:

- Rivian has seen a significant rise in short interest, with more than 85.6 million shares now short, a 53% increase over the past year.

- Over the last six months, analysts have cut their revenue estimates through 2030 quite significantly.

- Another capital raise may be needed in the next year, as the company’s financial picture is not expected to improve dramatically until 2024.

DrDjJanek

Back in early May, I detailed how electric vehicle maker Rivian (NASDAQ:RIVN) was showing signs of turning a corner. The company maintained its full year production forecast, and although margin figures were deep in the red, they were showing some improvement. However, with large cash burn continuing and competition growing by the quarter, it seems not everyone is totally convinced of the story here.

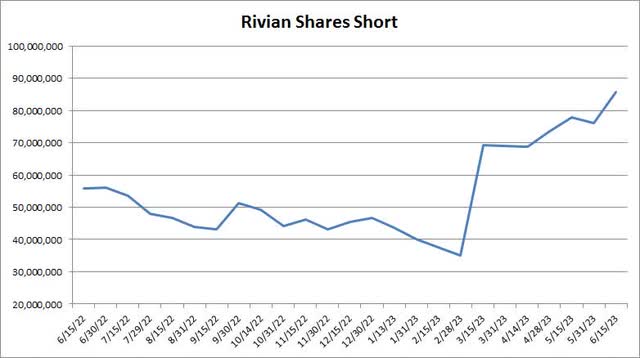

After the bell on Tuesday, NASDAQ released its twice a month report on short interest. For Rivian, the number came in at more than 85.6 million shares short. As the chart below shows, the amount of bearish bets against the name is up more than 53% in the past twelve months to a new high. Based on the late April share count provided in the company’s most recent 10-Q filing, this means that a little more than 9.5% of the late April outstanding share count was short at the mid-June update. Finviz data puts this name at the 27th most shorted in terms of float when looking at more than 800 US stocks with a market cap over $10 billion.

Rivian Short Interest (NASDAQ)

You may notice in the chart that there was a huge spike in short interest earlier this year. It was in early March that Rivian announced a convertible bond offering, with the company selling $1.5 billion in green bonds to continue its growth plan. Some of the bond holders may have shorted the stock as a hedge, while others may have seen the need for additional capital as a negative for the company. In just the past three months, the number of shares short has risen by almost 24%, and that’s on top of the spike seen in the first half of March.

Over the longer term, there are a couple of more traditional factors that may have contributed to the rise in short interest. First, like most early stage companies, Rivian has reported a large amount of stock based compensation. In the past year, the outstanding share count had risen by about 40 million to the late April update. At the same time, major early investor Ford (F) has sold a great deal of its stake. Between sales from Ford and other early insiders, that has also led to a faster rise in the float for Rivian, potentially allowing more shares to be shorted.

At the moment, one of the biggest concerns for Rivian is getting production to scale. Initial guidance for this year was a bit disappointing, but there are hopes that the company can produce more than 50,000 vehicles this year. If you look at analyst revenue estimates below, you’ll notice that the longer term trend shows a lot of red. While in the past few weeks most numbers have started to level off, every year through 2030 has seen its revenue average drop significantly over the past 6 months, and even more if you go back even further.

Rivian Annual Revenue Estimates (Seeking Alpha)

There are two main competitors I’m watching closely in the short term. Ford is in the midst of its own electric truck production ramp, aiming to be at a run rate of 150,000 units by the end of this year. At the same time, electric vehicle giant Tesla (TSLA) is getting ready to launch its Cybertruck in the second half of the year, with mass production slated for 2024. There are also some other legacy automakers looking to build out their EV truck platforms, but none that are very impressive offerings just yet.

The average price target on the street is currently almost $23, so analysts see a great deal of upside from here. However, I should point out that that average has come down another $3 plus since my earnings article, and let’s not forget that the street saw this name as worth around $140 when it went public. Unless Rivian raises its guidance at the Q2 report, it would not surprise me to see the average target end up in the teens at some point this year or in 2024.

As for my personal opinion, I do think Rivian has a future in this space but I wouldn’t be a buyer right now. Despite ending Q1 with more than $11 billion in cash, the company is still burning well over a billion dollars per quarter right now. It would not surprise me to see another major debt or equity offering in the next year, and that could add more pressure to shares. We aren’t likely to see dramatic improvement in the company’s financial picture until sometime in 2024, so I will evaluate my stance again in the coming quarters.

In the end, short interest in Rivian hit a new high at the mid-June update, with more than 85 million shares now short. This is just a stone’s throw away from Rivian having more than 10% of its outstanding share count short. At the moment, investors seem to be focusing on longer term expectations coming down, as well as the potential need for more cash in the next year or two. The company may have a nice story to tell, but it’s a hard name to own right now as it goes through its growing pains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.