Summary:

- Rivian Automotive presents a mixed investment opportunity despite a strong brand presence and partnership with Volkswagen, facing operational and financial challenges.

- The US economy shows signs of a soft landing, with the EV market experiencing growth but facing challenges such as high interest rates and inadequate charging infrastructure.

- Rivian’s Q2 results show progress in production and financial operations, but the company remains unprofitable with significant cash burn and modest production growth.

Justin Paget

Investment Thesis

Rivian Automotive (NASDAQ:RIVN), despite its innovative strides and strong brand presence in the EV market, presents a mixed investment opportunity. While the company has secured a crucial partnership with Volkswagen and maintains a solid cash reserve with short-term investments of $7.9 billion, it continues to face significant operational and financial challenges. Rivian’s ongoing cash burn, modest production growth, and distant prospects for profitability highlight the risks. In this article, let’s use the Top-Down approach to have a full picture of the situation. We will first look at briefly the current economic cycle and macroeconomic expectations, then the EV sector, and finally, how the company is doing.

The current state of the US Economy

I will focus on the US economy, since RIVN currently sells its cars to US consumers.

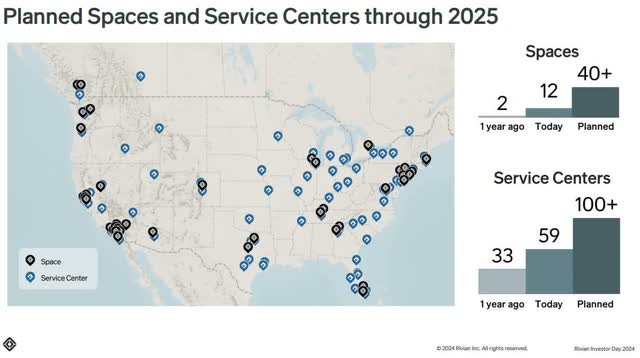

Rivian spaces (Rivian Investor Day 2024)

The prospects for a U.S. economic soft landing have recently improved, as reflected in the rebound of the S&P 500, which has climbed more than 8% since August 6. This optimism is fueled by favorable economic data, including positive retail sales, inflation, and producer price reports, which have alleviated fears of a recession sparked by earlier weak employment figures. The likelihood of the Federal Reserve implementing large rate cuts in September has diminished, with futures now showing only a 25% chance of a 50 basis point cut. Goldman Sachs analysts believe the U.S. economy is on track for a soft landing despite recent market volatility, which they attribute more to investor positioning than underlying economic fundamentals. Encouraging data on jobless claims, inflation, and retail sales support this outlook. I also believe that fears of a recession are overblown, and the focus should remain on continued economic expansion and small rate cuts. This will help RIVN’s position because slow but moderate growth can help the company grow, especially if they come up with the cheaper EV options that they have in their pipeline.

The EV Marketplace at the moment

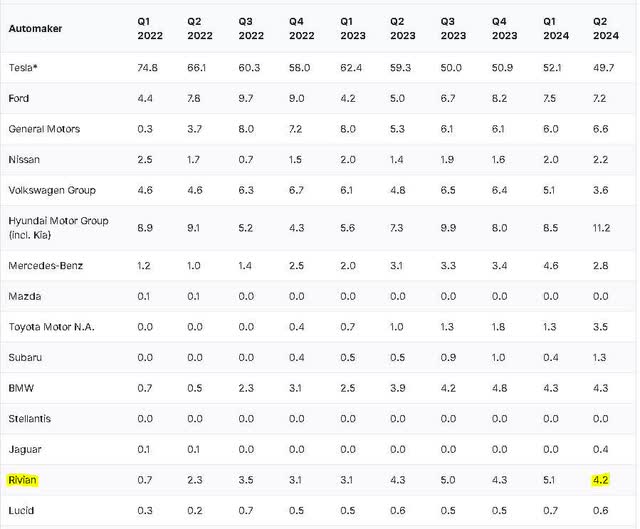

In the first half of 2024, the US and Canadian EV markets showed moderate growth, with sales increasing by 10% compared to the same period in 2023. Although the market had a slow start, the second quarter saw improvements, with companies like GM and Ford increasing their BEV sales by 34% and 18%, respectively. Additionally, new models like Honda’s Prologue SUV contributed to the market’s growth. Production ramped up, particularly in Mexico, where GM produced nearly 60,000 BEVs in H1 2024. What do I think about its future growth prospects? The future trends of the EV market show strong regional disparities. China’s market is expected to continue its robust growth, driven by increasing sales of both BEVs and PHEVs. In contrast, Europe may struggle to meet ambitious growth targets unless corrective measures are taken, as the region’s growth has slowed significantly. The U.S. market is likely to experience moderate growth, with improvements seen in the latter half of 2024. Battery demand is expected to continue rising, particularly driven by the stationary storage market. This growth is supported by federal incentives that provide substantial tax credits. Tesla (TSLA) continues to dominate with almost 50% market share, but competition is intensifying, especially from Hyundai-Kia, which now accounts for 11% of U.S. EV sales while Rivian stands at 4%.

Rivian EV market share (CarEdge)

To support this growing demand, the U.S. government aims to install 500,000 public chargers by 2030, ensuring the infrastructure keeps pace with the increasing number of EVs on the road. The future trajectory of the market will depend heavily on continued policy support and the rapid expansion of charging infrastructure. The U.S. electric vehicle market is experiencing a plateau in demand and sales due to several factors, including high interest rates, inadequate charging infrastructure, and economic uncertainties that have heightened concerns about affordability and range. Although these challenges have slowed growth in the near term, long-term projections remain positive, with battery-electric vehicles expected to account for 50% of U.S. vehicle sales by 2033. The EV market is expected to show an annual growth rate (CAGR 2024-2028) of 18.20%, resulting in a projected market volume of US$161.6 billion by 2028 which, I believe, is a bit optimistic at the moment. Interesting to see that due to the current market conditions, the deadline of 2030 was pushed back to 2033 by Ford, so there are clear signs of a slowdown. The average transaction price for an electric vehicle in July was down 1.5% Y/Y to $56,520. Notably, the average incentive package offered with a new EV in July was over 12% of the transaction price, the highest level in more than three years. So, in a nutshell, short-term challenges in the EV market with long-term positive momentum.

Rivian Q2 results

In the second quarter of 2024, Rivian made notable progress in its production and financial operations, but in my opinion, they are still years away from actual profitability. The company produced 9,612 vehicles and delivered 13,790, resulting in $1.2 billion in revenue, though it still faced a gross profit loss of $451 million. This loss was attributed to ongoing investments in their second-generation R1 platform and plant retooling. Despite these challenges, Rivian remained optimistic, anticipating substantial cost reductions in the latter half of 2024, and reaffirming their 2024 production target of 57,000 vehicles. The company also highlighted the importance of its joint venture with Volkswagen, which is expected to bolster its financial position and support long-term goals of achieving positive gross profit by Q4 2024 and significant free cash flow by 2026. The management aims to achieve a 25% gross profit margin, but I think that is at least 2-3 years away.

Rivian vehicle production

The good news is that the management has been communicating their goals clearly. In the first quarter, Rivian’s management expected to maintain their 2024 production guidance of 57,000 vehicles, with slight growth in deliveries compared to 2023. The company anticipated significant improvements in gross profit, particularly in the second half of the year, driven by reductions in material costs, enhanced manufacturing efficiencies, and increased production line rates. They also planned to begin production of the R2 platform in 2026, with expectations to scale up production capacity and reduce capital expenditures by leveraging existing facilities. If we compare these expectations with Q2 results and comments, we can see the consistency of the management.

During the second quarter of 2024, Rivian produced 9,612 vehicles and delivered 13,790 vehicles. Production was impacted by plant downtime due to a retooling upgrade. Despite this, Rivian achieved strong delivery numbers by selling through most of its first-generation R1 inventory. They also maintain their 2024 production guidance from the first quarter. The company expects third-quarter deliveries to be slightly lower than the second quarter but anticipates production volumes to align with first-quarter levels as they continue ramping up their second-generation R1 vehicles. Rivian’s R2 platform is poised to be a crucial element in the company’s strategy, with expectations to launch in 2026. This platform will enable Rivian to scale production and tap into new market segments, further driving growth. Additionally, the strength of Rivian’s brand continues to be a significant asset, with the company receiving high praise from consumers and media alike. As CEO RJ Scaringe noted:

“The strength of what we’ve built bodes really well for what’s to come with R2.”

This brand strength is expected to translate into a strong market reception for future models. However, my problem is that the company is still in the red with no chances of near future profitability, so it is still a very risky investment despite the positive signs. In addition, the company temporarily paused production of the electric commercial van it makes for Amazon due to a parts shortage, beginning in early August. CFO Claire McDonough indicated that Amazon will see fewer vehicle deliveries in Q4, consistent with seasonal patterns. Rivian has also started pilot programs with non-Amazon customers and if that program succeeds Rivian can diversify its van customer base.

Valuation

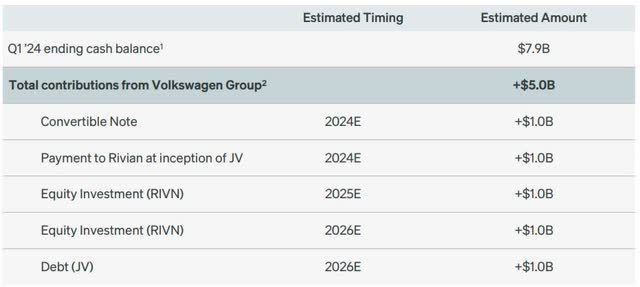

If you bought RIVN in 2021 you bought it at a monstrous $150 billion valuation. If they could hold a P/E ratio of 20 in the long run, the earnings need to be around $7.5 billion in a year to make it a fair investment. Hopefully, you did not join in the unjustified hype back then. Today, its valuation is much more modest, with a roughly $14 billion market cap, but I still believe that investors who buy this stock face a tremendous amount of risks. Rivian’s valuation remains a point of concern to me due to its significant cash burn and modest production growth. Despite a recent boost from its partnership with Volkswagen, Rivian’s financials are still under pressure. It took Tesla 18 years to make its first quarterly profit and Rivian is 15 years old, so even if they can follow the same trajectory, net profitability is still years down the line. The company trades at a premium compared to many other EV manufacturers, with a Price-to-Sales ratio higher than several peers, including traditional automakers who trade at less than or at around 0.3 times forward price to sales (Volkswagen: 0.16, Ford: 0.26, General Motors: 0.31). Rivian’s current valuation reflects optimism about future growth, but its weak fundamentals and continued losses suggest a cautious outlook for investors. If you look at analysts’ price targets, the average is $17.97 per share and the low estimate is $13.96. However, I would disarm the concerns about RIVN’s potential bankruptcy. Despite Rivian’s significant cash burn, the joint venture with Volkswagen Group and its strong cash reserve and short-term investments of $7.9 billion make bankruptcy a highly unlikely scenario.

Rivian cash balance (Rivian Investor Day 2024)

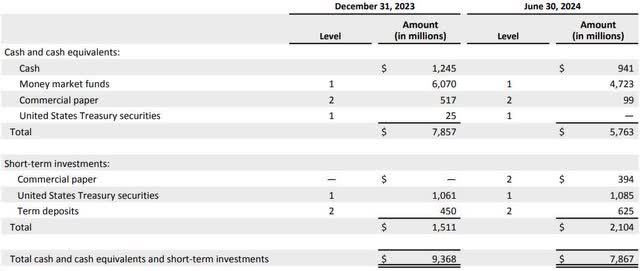

RIVN Q2 cash and short-term investments (QUARTERLY REPORT)

Soros Fund Management’s Rivian Notes

Rivian launched 4.625% green convertible senior notes in 2023 for $1.3 billion. In the first quarter of 2024, billionaire George Soros’ investment firm, Soros Fund Management LLC, added $154.16 million in principal amount of Rivian’s 4.625% convertible notes to its portfolio. In the second quarter, they boosted this position to almost $200 million, so they believe in a higher share price in the long run. (Otherwise, they would have just bought US short-term treasury bills for a better interest return). The notes represent an initial conversion price of approximately $20.13 per share of common stock, which is quite far from the current $14 share price and also far from current analysts’ estimates.

Summary

Rivian Automotive is facing several challenges in 2024 and will face the same ones in 2025, including production delays due to parts shortages and significant financial losses. While the company made strides in production and secured a joint venture with Volkswagen, it remains unprofitable, with a $451 million gross profit loss in Q2 2024. Rivian’s valuation remains a concern to me due to ongoing cash burn and modest production growth. Although the company has a strong cash reserve and backing from investors like Soros Fund Management, the investment remains risky, especially considering the uncertain market conditions surrounding EV stocks. Consequently, given the unattractive risk/reward ratio, the uncertain market sentiment, and its high-risk nature, I rate the stock Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.