Summary:

- Despite our original skepticism about RIVN’s ability in meeting its ambitious FY2023 production target, it seems that we have been proven wrong after all.

- With the gap in its production and delivery narrowing, the management’s enhanced demo drive programs are working beautifully, on top of the expanded showroom/ experience centers.

- Assuming that RIVN is able to sustain this cadence, we believe that its previously leaked “production master plan” of 62K vehicles in FY2023 (+154.8% YoY) is not impossible.

- Investors must also note that the CEO has previously communicated its aggressive plan of 1M in FY2030 production output, expanding at a CAGR of +115.21% from FY2021 output of 1.01K.

- With EV adoption to further accelerate to comprise ~36% market share by 2030, we may have a potential value play in RIVN, if one previously dollar cost averaged aggressively.

phototechno/iStock via Getty Images

RIVN Delivers After All

We previously covered Rivian Automotive (NASDAQ:RIVN) in May 2023, ending the article with a speculative buy rating, thanks to the improved risk reward ratio with the stock nearing its all-time lows at that time.

The management had also made the strategic choice to improve its supply chains and consequently narrow its losses, potentially achieving positive gross margins by FY2024. Combined with its eventual entry to the mid-ranged EV market through lower-priced variants, the stock appeared interesting then.

Despite our original skepticism about RIVN’s ability in meeting its ambitious FY2023 production target, it seems that we have been proven wrong after all. However, due to the overly optimistic run-up post FQ2’23 deliveries and the potential volatility from the elevated short interest, we prefer to rate the stock as a Hold here.

For now, the automaker has successfully produced 13.99K vehicles in FQ2’23 (+48.9% QoQ/ +217.9% YoY), while delivering 12.64K (+59.1% QoQ/ +183.4% YoY) in FQ2’23. With the gap in its production and delivery narrowing, with 6.8K of vehicles undelivered thus far, it seems that the management’s enhanced demo drive programs are working beautifully, as intended.

This is on top of the second showroom/ experience center in Manhattan, building upon its existing location in Los Angeles, further expanding its outreach.

Assuming that RIVN is able to sustain this cadence, we believe that its previously leaked “production master plan” of 62K vehicles in FY2023 (+154.8% YoY) is not impossible indeed, compared to the annualized FQ2’23 output of 55.96K.

In addition, the management has previously highlighted that H2’23’s output may further ramp up nearer to its annual production capacity of 150K vehicles in the Normal factory. Ambitious indeed.

RIVN has also successfully delivered ~1K electric vans to Amazon (AMZN) in the EU, building upon the latter’s existing fleet of ~5K vans of in the US. With it also reporting progress in opening up the exclusive contract, we believe the automaker may actually succeed in the long-term after all the uncertainties.

While it may face intense competition from other automakers, such as Ford’s (F) E-Transit vans and General Motors’ (GM) BrightDrop, we believe the market is nascent enough for multiple players. This is especially since the two legacy automakers only expects to produce an annualized sum of 150K electric vans in 2023 and 50K in FY2025, respectively.

In addition, many RIVN van drivers have highlighted the expanded cargo space, compared to those offered by Mercedes-Benz Group AG’s (OTCPK:MBGAF; OTCPK:MBGYY) Sprinter and F’s Transit vans.

This is on top of the other upgrades such as light bars for improved cargo illumination, embedded wide-screen tablet with optimized delivery routing technology, advanced driver assistance systems with external cameras/ sensors, and automatic braking capabilities, among others.

With AMZN still committed to 100K electric vans by 2030, likely to replace the majority of its existing gas-powered vans at approximately 110K by January 2023, we believe RIVN’s prospects appear to be very bright, for so long that it is able to achieve economy of (production) scale and sustainable profitability moving forward.

Investors must also note that the CEO has previously communicated its aggressive plan to achieve 1M in annual production output by FY2030, suggesting a CAGR of +48.77% from FY2023 projection, otherwise a CAGR of +115.21% from FY2021 output of 1.01K vehicles.

This ramp up remains highly speculative for now, due to RIVN’s relatively inexperienced leadership compared to those from legacy automakers such as F and GM. Then again, perhaps this is also why it may be interesting to bet on the highly motivated CEO and the resulting best rated electric truck, R1T, easily winning legacy offerings such as F-150 Lightning and GMC Hummer.

While RIVN remains unprofitable for now, as discussed in-depth in my previous article, its cash burn rate has slowed dramatically, with the current balance sheet remaining more than healthy.

Therefore, with EV adoption to further accelerate to comprise ~36% of the vehicle market share by 2030, compared to the previous 2021 projection of 15%, we may have a potential value play in RIVN.

So, Is RIVN Stock A Buy, Sell, or Hold?

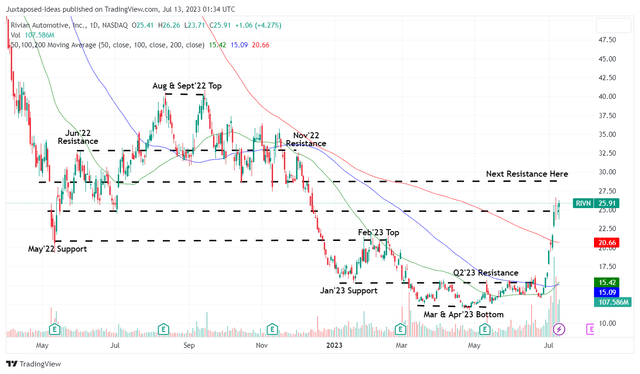

RIVN 1Y Stock Price

Then again, due to the optimistic FQ2’23 deliveries, the RIVN stock has also unnaturally rallied to new heights, thanks to the 13.97% of short interest at the time of writing. We are uncertain if these levels may hold in the near term, due to the over baked optimism and uncertain macroeconomic outlook through 2024, if not 2025.

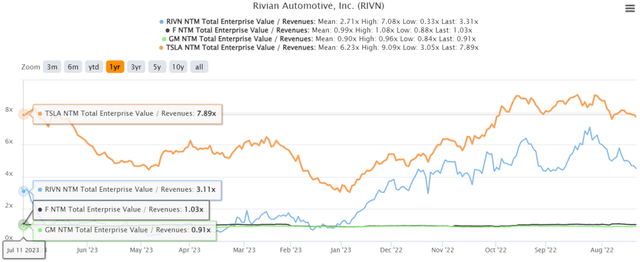

RIVN Valuation

The RIVN stock is also trading at a premium NTM EV/ Revenues of 3.31x, compared to its pre-rally valuation of 1.05x and its automaker peers, such as F at 1.03x and GM at 0.91x, though still moderated compared to Tesla’s (TSLA) at 7.89x.

Therefore, traders that have previously bought in two months ago may consider taking their gains here, since the stock is likely to face immense resistance at $30 from what I see.

Naturally, serious investors should continue holding on to RIVN if they have dollar cost averaged aggressively in the previous Q1’23 bottom. However, we do not recommend anyone to add here, due to the potential volatility in the near term.

They may consider adding after the rally is moderated, with the stock likely to retrace to its previous support level of $21, if not $15, in the near term. There is no need to chase here, since there are a few more weeks to go before its FQ2’23 earnings call on August 08, 2023.

Patience is prudence here, especially since the macroeconomic outlook remains uncertain through 2024, if not 2025, with Powell still signaling two rate hikes through 2025.

This cadence naturally increases the borrowing costs, with the average interest rate for auto loans on new cars at 6.87% by May 2023, compared to 2019 averages of 4.63%. As a result, demand for EV may further moderate, triggering headwinds to RIVN’s sales and deliveries.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.