Summary:

- Rivian is poised to benefit from the next up-cycle in EV demand as competitors like Apple and Ford exit the market or push back plans.

- The EV company is moving full speed ahead with new vehicle models, including the R2 and R3 while scaling back competitors to create a less competitive market.

- The company is on track to reach positive vehicle gross margins this year and has a strong lineup of SUVs, trucks, and work vans.

- The stock trades at only 1x EV/S targets, far below an EV peer.

Justin Sullivan

The EV sector has had a tough year with waning demand. The EV manufacturers surviving the slump like Rivian Automotive, Inc. (NASDAQ:RIVN) are poised to benefit from the next up cycle in EV demand without competitors like Apple (AAPL) in the market. My investment thesis is ultra Bullish on Rivian with the company moving full-speed ahead with new vehicle models while the competition disappears.

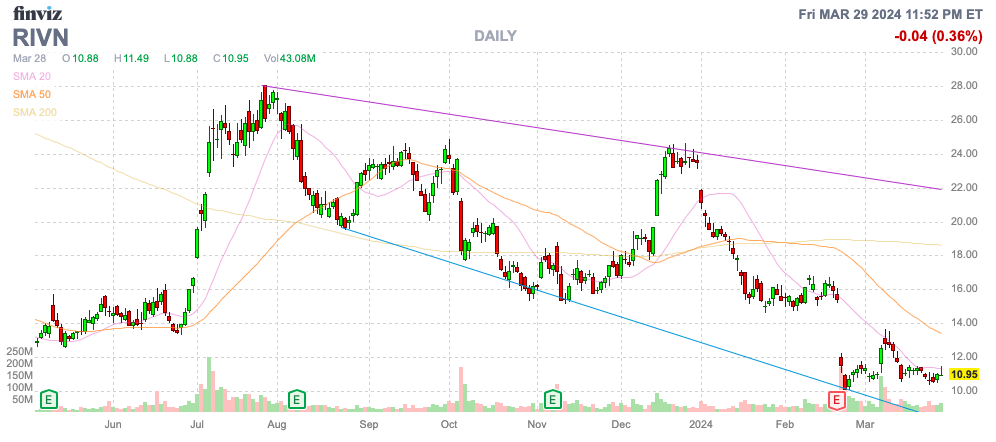

Source: Finviz

Apple Car Terminated

As Rivian moves full speed ahead with the new R2 models, competitors continue to scale back in the EV market. The latest company to exit the EV market never officially entered the market.

Apple was long rumored to be working on a self-driving EV going on the way back to 2014 in “Project Titan”. The tech giant announced last month the intention to terminate the development of an EV in favor of pushing generative AI work. The Apple Car project included 2,000 employees reassigned to AI or laid off.

The company spent years and billions of dollars working on the Car project. The fear of any EV entrant was that Apple would use billions in operating cash flows to fund a dominant entrant into the space with an infotainment system integrated with iPhones and other Apple hardware and software.

Now, the tech giant has already exited the space, likely due to issues with finding a manufacturing partner and troubles with scaling EVs set to top $100K each. Apple turned a cell phone into a computer in your pocket warranting higher and higher ASPs for the smartphones, but most consumers have no financial ability to afford a high-end vehicle.

As discussed in the previous article, Ford (F) pulling back on EV development is a bullish development for Rivian. Now Apple has exited the market before starting to set up a grand scenario where Rivian has far less competition when the EV market fully develops down the road.

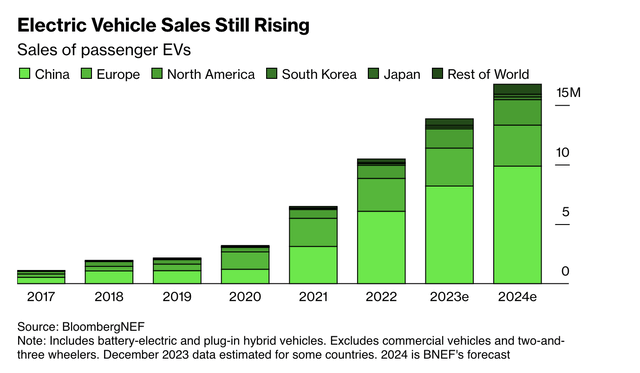

U.S. EV sales topped 1 million units for the first time in 2023 for ~7% of the market. EV sales are even forecast to reach 1.9 million units this year to reach 13% of total vehicle sales while global EV sales are set to top 15 million due to China having a thriving EV market with lower end options.

Source: Bloomberg

Rivian is on path for reaching positive vehicle gross margins this year while feared top competitors are exiting the market.

Full Speed Ahead

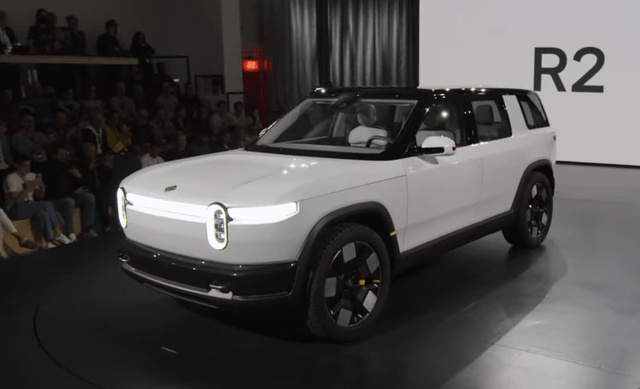

Just a few weeks back, Rivian unveiled both the R2 and R3 vehicles. Due to the slowdown in the EV market and the reduced competition, the company has been able to delay the massive cost of a new manufacturing facility in Georgia in favor of building the lower cost R2 models at the current plant with a starting price of $45,000, pulling forward the release date.

Source: R2 Reveal presentation

Rivian predicts the R2 will launch in 1H’26. The company will have the R1S, R1T, EDV and the R2 providing a solid lineup of SUVs, trucks, and work vans.

The R3 crossover EV and the premium R3X version will shortly follow the R2 production start. The company projects saving $2.25 billion in capex and product development costs via starting R2 production in the Normal plant.

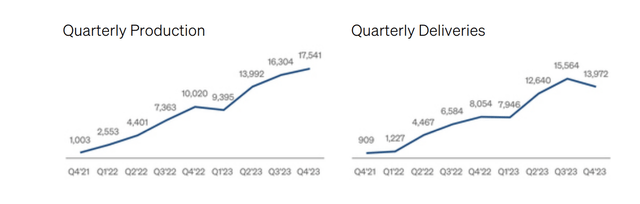

The company has already been able to ramp up quarterly production to over 17K vehicles before plant modification during Q2 will help speed up production and drastically cut out fixed costs. The current plant has the capacity to produce 150K vehicles annually providing Rivian with plenty of growth behind the 2023 production levels before needing the new manufacturing plant costing several billion to build. The new plans is for production at the Normal, Illinois plant to expand to 215K units.

Source: Rivian Q4’23 shareholder letter

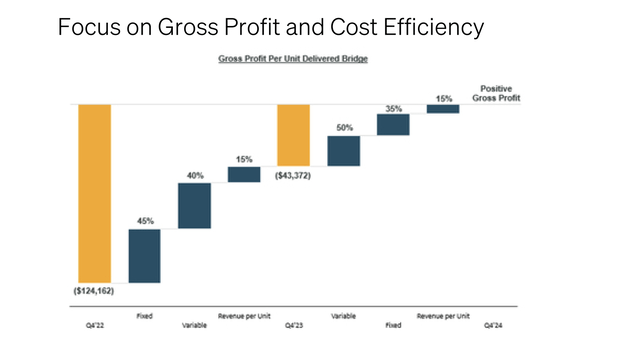

The stock has slipped due to a combination of EV demand dynamics and fears Rivian won’t ever generate a profit with the lower demand environment. The company lost $43K per vehicle in Q4, though a huge improvement above the prior year levels.

Source: Rivian Q4’23 shareholder letter

The losses are still massive considering Rivian is in essence selling vehicles at around $80K and the costs are above $120K each. The company expects to cut 50% of those losses via a reduction in variable costs from R1 engineering design changes, commercial supplier negotiations, and lower raw material costs. The plant shutdown during Q2 will cut fixed costs reducing 35% of the vehicle losses and bridge the gap towards positive vehicle gross profits.

Rivian ended 2023 with a cash balance of $9.4 billion providing the funding to make material progression to reach positive gross profits. As the EV company builds a full suite of EV models and a manufacturing base, other competitors are pulling back on electrification plans.

The company has definitely hit some speed bumps with demand for R1s hitting a wall considering their average price of ~$80K. The news of pulling forward the R2 with a starting cost of $45K and expanding the production capacity in Illinois was a huge positive, but the stock trades at the lows.

Rivian is on the pace of a nearly $5 billion sales rate for 2024. The company has huge upside with the R2 launch in 2026 where the Normal plant capacity alone would produce nearly $10 billion worth of sales based on just selling $45K vehicles while the R1 sales are at far higher prices.

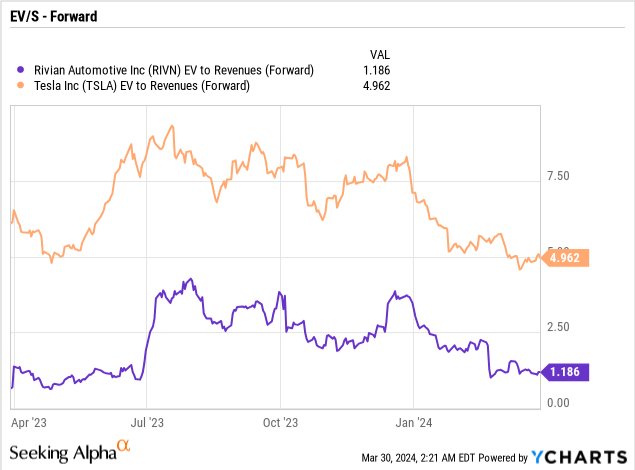

The stock only has a market cap of just above $10 billion now. Even with the recent weakness of Tesla (TSLA), the stock is far cheaper trading at a major discount with EV/S multiple of 1x while Tesla still trades up at 5x.

Investors have to be careful with the upcoming Q2 numbers due to the plant shutdown. Any unwarranted weakness would provide a great opportunity to own Rivian considering the plant shutdown will boost R1 line rate production by 30% while reducing costs per vehicle. The company is on pace to reach a positive gross profit during Q4 while other EV manufacturers are quitting the game or pushing out plans setting up Rivian as a survivor.

Takeaway

The key investor takeaway is that Rivian is set to survive and thrive the EV downturn. The company is moving full speed ahead while the industry is pulling back despite the long-term trends shifting towards EVs.

The stock is cheap here trading at a major discount to Tesla while any weakness in Rivian over the course of the Q2 plant shutdowns and lower output would provide a massive opportunity to buy the stock on weakness.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to end Q1, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.