Summary:

- Rivian is benefiting from less competition in the EV space as other automakers pull back from EV production.

- The company has hit its EV production targets and should have a key shift to profit gross margins later this year.

- The stock is cheap in comparison to peers, especially considering the forecasted higher growth rates topping 40% through 2027.

Justin Sullivan

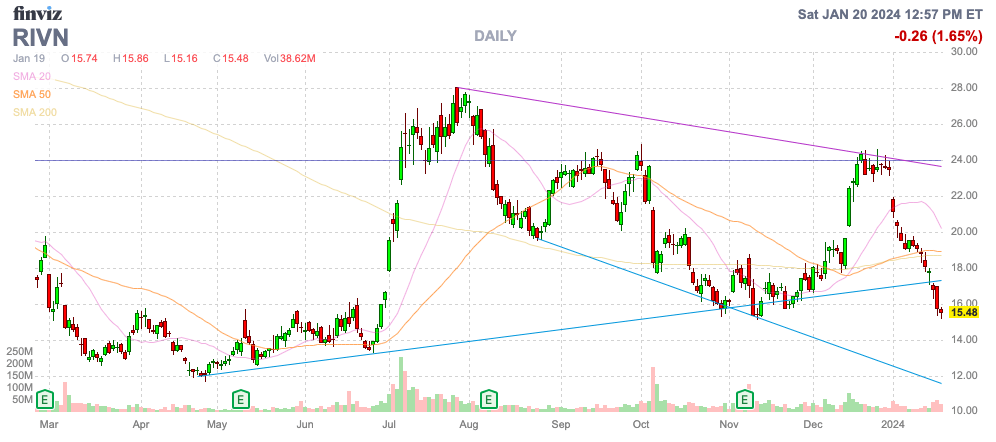

As some automakers pull back from producing EVs, Rivian Automotive (NASDAQ:RIVN) should be a beneficiary of less competition. Oddly though, the stock is slumping due to the current negativity on the EV space. My investment thesis is even more Bullish now that the stock has slumped due to fears on EV demand while Rivian has hit EV production targets.

Source: Finviz

EV Demand

While Rivian and Tesla (TSLA) continue pushing forward with ever-increasing production, Ford (F) and other automakers have announced plans to pull back from EV production. In fact, Ford just announced plans to cut the F-150 Lightning EV production by 50% to only 1,600 vehicles per week.

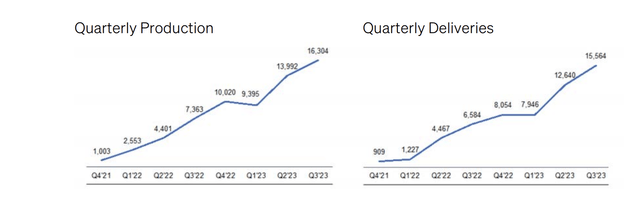

The news is far better for Rivian considering the company is more reliant on the R1T truck versus Tesla, which just came out with the futuristic Cybertruck. Anyone looking at a quarterly production and delivery chart would see Rivian isn’t facing the same issue with demand as Ford.

Source: Rivian Q3’23 shareholder letter

In addition, the company recently announced producing 17,541 vehicles at its manufacturing facility in Illinois during Q4’23 and delivering 13,972 vehicles during the same period. For 2023, Rivian produced 57,232 vehicles and delivered 50,122.

The production amounts easily exceeded management’s most recent 2023 production guidance of 54,000 vehicles and reached a record topping the Q3 level by 1K units. These numbers were achieved despite a planned week of downtime to prepare for the bigger retooling shutdown during Q2’24.

The vehicle deliveries were down in Q4 primarily due to Amazon (AMZN) not taking electric van deliveries during the busy holiday season. As with last year, vehicle deliveries will rebound during early 2024.

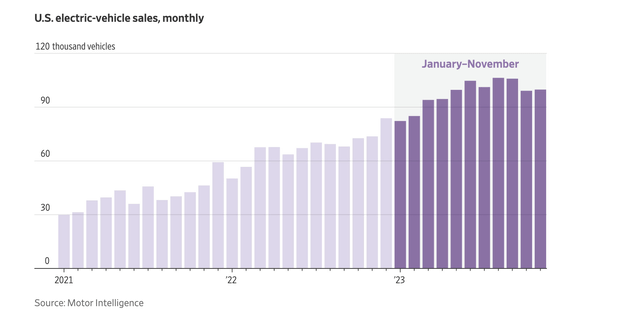

A lot of emphasis is being placed on EV buyers wanting a Tesla or Rivian, not an offering from a legacy automaker. Whether reality or not, the numbers continue to suggest the leading domestic EV makers aren’t struggling with demand as much as Ford and others which has led to overall EV industry monthly sales stalling while the sector leaders are still ramping up.

Source: WSJ

Tesla now produces nearly 500,000 vehicles a quarter globally and is on path to top 2 million EVs produced this year. With Rivian only a fraction of the Tesla production, the demand fears shouldn’t exist, especially considering a large portion of their production is vans for Amazon.

Rivian is adjusting the Illinois plant for the 150K capacity to be focused on 85,000 units for the R1 platform. The company will have 65,000 units targeted at the EDVs and those volumes could be growing as the company moves on from the exclusivity of the Amazon deal.

The upcoming plant shutdown will reduce production for 2024, but Rivian has the capacity in place to more than double production going forward. The EV manufacturer plans to build a new $5 billion plant in Georgia for the R2 platform to be launched in 2026.

Focus Shifting To Margins

The Q2 plant shutdown is all about Rivian making the flip towards boosting production at lower costs. The EV manufacturer will lower both material costs and reduce production costs via lower labor requirements to complete a vehicle.

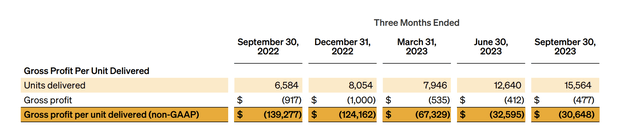

At the same time with production now topping the 65K annualized rate, Rivian will need to show the market the company is turning the corner on margins. The company still lost $30.6K per vehicle, only a $2K sequential improvement, in Q3 due in part to lingering LCNRV costs.

Source: Rivian Q3’23 shareholder letter

Rivian forecasts these costs to disappear in 2024 on higher vehicle production and better contract terms going forward. In fact, management suggests nearly half the current gross loss per vehicle produced is related to LCNRV and firm purchase commitments as per the CEO on the Q3’23 earnings call:

During the third quarter, our gross loss per vehicle improved by approximately $2,000 versus the second quarter. This improvement would have been approximately $14,000 better, excluding the impact of the change in LCNRV and losses on firm purchase commitments.

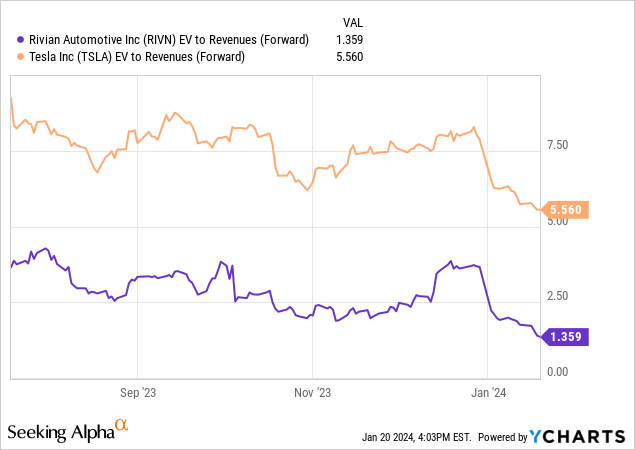

The stock still trades at a major disconnect to Tesla. Both stocks have fallen in conjunction with the recent downfall in EV hype, but Tesla still trades at 3x to 4x the larger forward EV/S multiple.

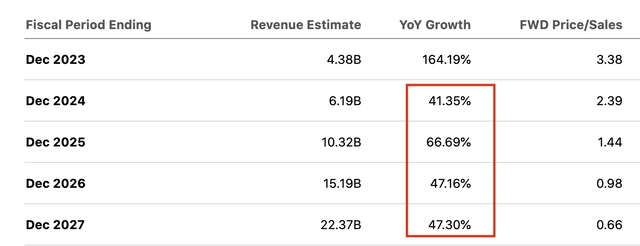

Historically, the faster-growing stocks trade at far higher multiples. Rivian is set to maintain 40%+ growth through 2027 while Tesla has already trailed off to growth rates of only 20%, though still impressive as sales are targeted to top $100 billion in 2024.

Source: Seeking Alpha

The faster-growing stock usually garners the higher multiple, especially when the growth rate is double that of the peer. The only reason to assign a lower multiple is the fear the large competitor will ultimately utilize their larger size to hamper the growth rates and this doesn’t entirely appear the case considering Tesla isn’t targeting the same EV SUV or EDV markets.

Rivian still operating with negative gross vehicle margins can be used as an excuse for paying a lower multiple, but not if an investor has a logical reason to forecast the company flipping to positive gross margins. The numbers support significant improvements in gross margins as forecast for 2H’24.

The EV company has targets for 25% gross margins leading to 15%+ adjusted EBITDA margins. Needham assigned a 20x EBITDA multiple for 2027 discounted back to derive a $25 price target, but an investor should start thinking about Rivian based on the ultimate 15%+ EBITDA targets.

With a $6.2 billion revenue target for 2024, Rivian would be on pace to generate over $0.9 billion in EBITDA. The current market cap of $15 billion is relatively cheap based on a view of normalized EBITDA targets, especially with sales growth topping 40% and over $6 billion in net cash.

Takeaway

The key investor takeaway is that Rivian still appears full speed ahead in the EV sector. The sector is definitely facing some growing pains, but the EV leaders are still plugging away while others falter, lessening competition.

Investors should use the ongoing weakness to load up on the stock here trading towards the 6-month lows around $15.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start 2024, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.