Summary:

- Rivian’s Q3 report disappointed with higher-than-expected losses and production issues, but management remains optimistic about achieving positive gross profits in Q4.

- The EV manufacturer has a substantial cash balance and a $5 billion investment from Volkswagen, aiming for positive free cash flow without needing additional capital.

- Rivian’s long-term potential includes scaling production to over 500K units by 2030, with a valuation target of $67 per share based on future financials.

hapabapa

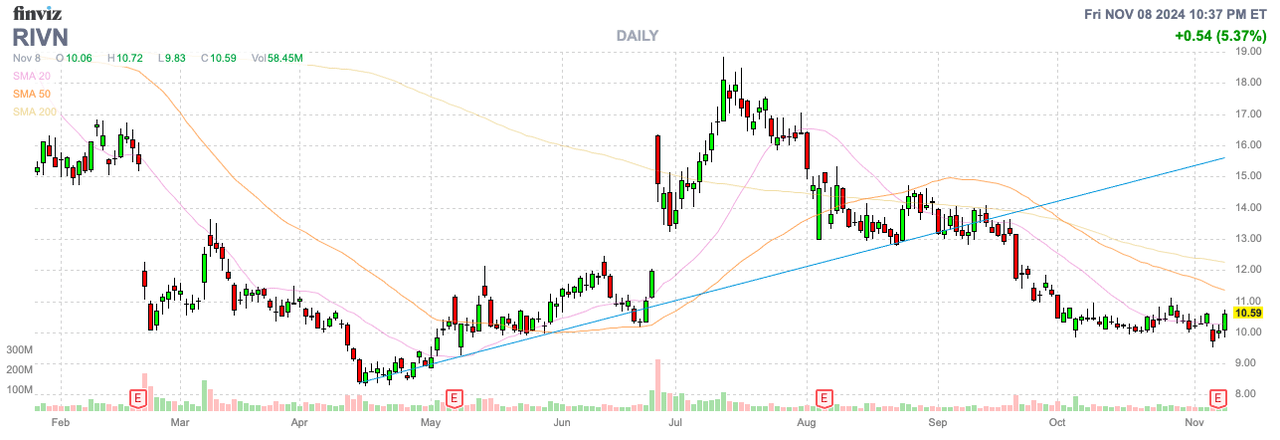

The stock market went into the Rivian Automotive, Inc. (NASDAQ:RIVN) earnings report expecting to see the company highlight large reductions in costs. Instead, the EV manufacturer continued down a path of confusing earnings reports, causing a lot of investors to question the future viability of Rivian. My investment thesis remains ultra-Bullish on the stock due to the massive opportunity in EVs.

Source: Finviz

Wacky Quarter

The big hope at the start of the September quarter was for Rivian to report a ton of financial improvements during the period. The EV manufacturer retooled the Normal, Illinois plant to improve production efficiency and to strip out material costs from the R1s via the 2nd generation models.

The end results were a near total disaster. Rivian ran into a part supply issue limiting production during Q3 and the company wasn’t as forthcoming about short-term higher costs from moving to new suppliers, accounting for up to 50% of vehicle material costs.

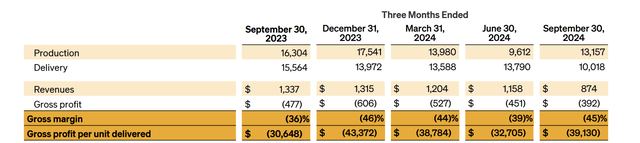

Rivian ended up reporting a Q3 gross loss per unit delivered of $39K, actually up from the $33K in the prior quarter. The company ended up only delivering 10K units during the quarter due to the lower production levels after the re-start of the plant making the Gen 2 versions of the R1s.

Source: Rivian Q3’24 shareholder letter

The company enters Q4 still having to prove to the stock market that the cost reduction plans remain on schedule. Rivian still forecasts producing positive gross profits in Q4, after still losing $392 million in the last quarter.

On the Q3’24 earnings call, CEO RJ Scaringe detailed some of the issues with ramping up the Gen 2 EVs during the quarter:

Now with that, we had a bunch of suppliers who brought on with the Gen 2, around 50% of the bill of materials by cost is with new suppliers or with new contracts. And with that, there’s been some challenges. And those have really impacted us in quarter. And this has been a tough quarter for us because of some of those supply chain or supplier ramp challenges. And one of those suppliers in particular has limited our production quite substantially and we’re working very, very hard to address that. This is one of our highest priorities in terms of the business.

So now, Rivian has to prove the company can ramp up production on the new more efficient product lines for the Gen 2 models with less materials and prove the bill of materials will decline 20% from the Q1 levels.

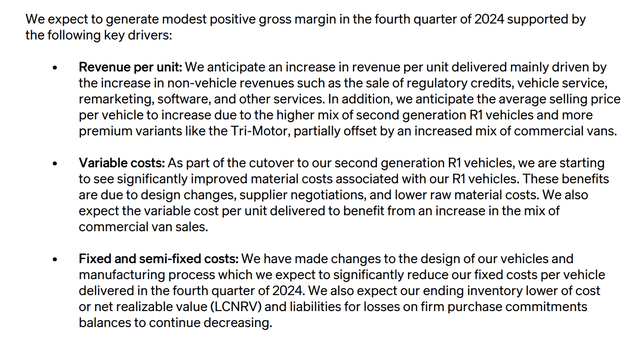

Source: Rivian Q3’24 shareholder letter

The stock rose with management apparently doing a good enough job to convince investors not only the company was still on a path to being gross profit positive in Q4, but also, Rivian has a path to further lower costs in 2025. As the CEO mentioned on the earnings call, the company expects additional cost reductions in 2026 with more volume from the R2s.

After all, in order for Rivian to obtain even 10% gross margins, the company has to cover the $39K losses in Q3 and further strip out another $8K to $10K in costs. At only 50K units of annual production, Rivian would still only produce $500 million in annual gross profits.

The company still spent $599 million in Q3 alone on adjusted operating expenses. Rivian will need substantially more production or higher margins in order to wipe out the $757 million in adjusted EBITDA losses in the last quarter.

A big question on the path to gross profits is the regulatory credits. Rivian is getting up to $275 million of credits during Q4, putting a major asterisk on the actual gross profit metric. Ultimately though, the EV manufacturer only had plans to where the Revenue Per Unit boost was only 15% of the cost reduction from the Q1 levels and a large portion of that amount is higher ASPs from the Tri-Motor and Quad-Motor, along with software and services, not regulatory credits.

Capital In Hand

Rivian ended Q3 with a cash balance of $6.7 billion, with liquidity of $8.1 billion. The company is still working on closing the JV with Volkswagen AG (OTCPK:VLKAF) to unleash the $5 billion investment from the European auto manufacturer. Along with the deal, Rivian expects to announce additional opportunities to lower parts costs.

An interesting aspect of the earnings call is that management was more forceful on having the capital on hand to reach cash flow positive. On the Q3’24 earnings call, CEO RJ Scaringe made the following statement:

And ultimately, the capital we have, plus the capital provided by the joint venture will take us through positive free cash flow.

The investment thesis changes when Rivian no longer needs to raise additional cash beyond collecting the $5 billion in the VW investment. The company had already discussed a plan of reaching adjusted EBITDA profitable when hitting production of 200K vehicles and this latest statement confirms this scenario will occur before the company runs out of cash.

Rivian burned $876 million in the quarter from operating cash flows and spent another $277 million on capex in the quarter. In total, the company burned $1.15 billion of cash in Q3, so naturally the market is fearful of unrelenting cash burn.

As previous research has highlighted, the stock would have a current valuation of $30 with a 2030 price target of $67 based on the following financials:

- Revenue – 526K units @ $45K = $22.7 billion

- Auto Gross Margin – 20%, or $4.5 billion

- EBITDA – $2.5 billion

- EV/S – 3.5x, or $79.5 billion (+/- net cash/debt balance)

This valuation practically assumes the worst outcomes for Rivian. Analysts still have the company topping those revenue estimates in 2030, though the company is only focused on a maximum production opportunity of 615K units with the full opening of the 2 lines in Georgia.

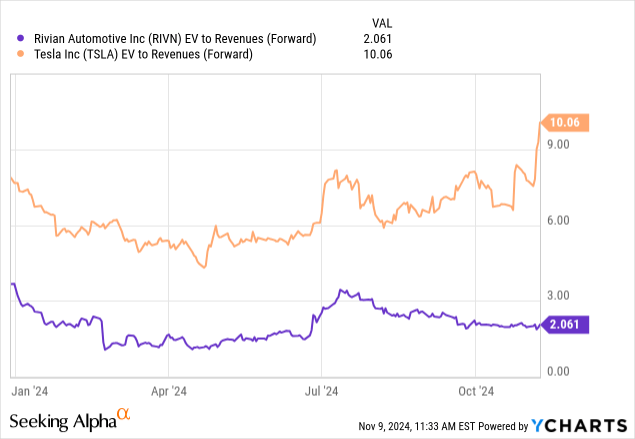

The other major opportunity is for Rivian to hit the 17.5% adjusted EBITDA target to reach $4.0 billion in EBITDA. In addition, Tesla (TSLA) now trades for 10x forward EV/S targets versus the Rivian estimate based on just a 3.5x target, a multiple more in line with the lower valuation point for Tesla.

Tesla has a huge opportunity in robotaxis and humanoid robots, likely leading to the higher multiple. Rivian might need to outline additional market opportunities in order to warrant a multiple matching Tesla now.

The ultimate risk to the story is Rivian failing to turn gross profit positive without the regulatory credits. The company having to raise additional capital at a stock price of $10 or less would be very dilutive to shareholders.

Takeaway

The key investor takeaway is that Rivian remains highly appealing at a $10+ billion market cap, while the company forecasts boosting production from just under 50K units in 2024 to over 500K units by the end of the decade. The valuation equation works out to much higher stock prices over the period, especially with Rivian already having access to the capital to reach free cash flow positive.

Investors should use the opportunity to buy Rivian near all-time allows due to the market losing faith in the growth story.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start November, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.