Summary:

- Rivian Automotive has made significant progress in the EV space, with a recent rally in stock price due to a deal with Volkswagen AG.

- The EV company is focused on turning limited production into a profitable business, with plans to launch R2 and R3 models in early 2026.

- The VW investment of up to $5 billion positions Rivian for significant growth and profitability in the future.

- The stock is cheap based on the potential sales and profit picture for 2030.

Teka77

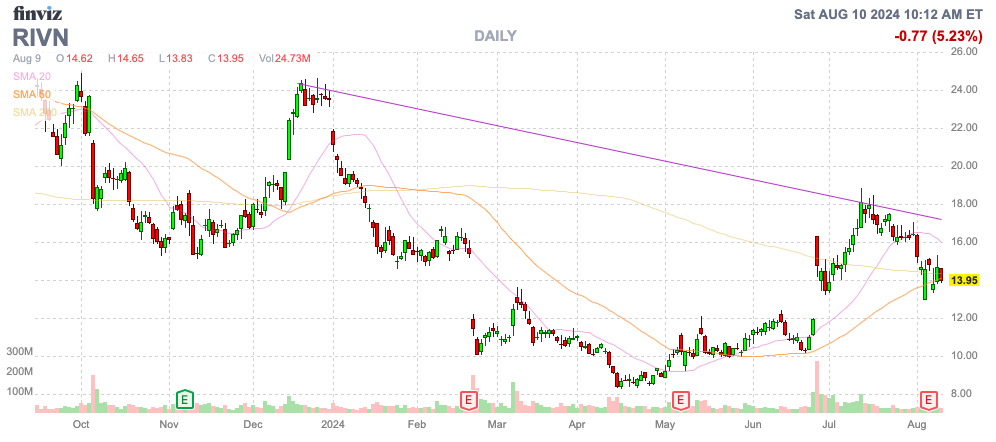

The EV space has been rough the last year, but Rivian Automotive, Inc. (NASDAQ:RIVN) has made a ton of progress over the last year to become a leading EV manufacturer in the U.S. The stock recently rallied on a deal with Volkswagen AG (OTCPK:VLKAF) setting up the company to survive and thrive the difficult period here in 2024. My investment thesis remains ultra-Bullish on the stock after the recent dip, while Rivian positions the company for a promising EV future.

Source: Finviz

Path To Profits

While the domestic EV market has stalled in the short term, Rivian is in a crucial period to prove the company has a sustainable future. The EV company already has a successful R1 vehicle line, but those EVs have average selling prices above $80K with a starting ASP of nearly $70K.

The key is turning this limited production line into a profitable business while the R2 and R3 launches in early 2026 becoming major catalysts for future growth. By all accounts, Rivian had a successful June quarter, whether visible via financials or not, as follows:

Execution during the quarter was strong with the success of the retooling upgrade in Normal and the launch of our second generation R1 which is more capable and offers new technologies, while also significantly reducing material costs and improving manufacturing efficiency.

Rivian shutdown the Normal, IL plant in order to retool the manufacturing plant for more efficient production. The 2nd generation R1s now have 65 fewer parts and nearly 1,500 fewer joints.

The EV manufacturer can now produce 30% more vehicles from the plant, increasing the production capacity from 150K to 215K. The capacity increase is huge, allowing Rivian to build the R2s and R3s at the existing plant before needing to construct the large plant in Georgia, completely changing the financial equation by delaying capital outlays until the concept is more proven and demand increases.

In the process, Rivian has cut the material costs by 20% via commercial cost improvements from scale production, along with fewer parts. When combined with the 30% production efficiency improvement, the company forecast reducing the gross profit loss per vehicle to ~$5K.

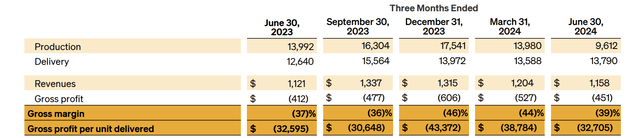

The gross profit per unit delivered dipped to $33K in Q2 from $39K in the prior quarter, but the major gains won’t be realized until the 2H. The new second-generation R1s will benefit from the lower costs going forward along with the higher efficiency rates, with 2-lines producing an annual rate of 56K R1s.

Source: Rivian Q2’24 shareholder letter

In essence, Rivian has all of the cost measures in place to close up to 80% of the loss gap. The only additional path to positive gross profits in Q4 is the release of the Tri-Motor in Q3, with a higher ASP and additional revenue opportunities to boost per unit selling prices.

For Q2, Rivian reported the sale of 13,790 units while only producing 9,612 units due to the plant downtime. The company reported sales of $1.16 billion and an adjusted EBITDA loss of $860 million.

The key really is the path to positive gross profits in Q4 based on the updates implemented in Q2. Considering Rivian generated a $451 million negative gross profit during the quarter, the market wasn’t very convinced the EV company had a real path to reaching the gross profit target despite limited to no sales growth this year.

Rivian reaffirmed 2024 guidance of 57K total units produced. The key here is establishing a platform for additional EDV sales to non-Amazon customers and the future R2/R3 sales to quadruple production from the Normal plant.

VW Deal

All signs still point to electric vehicles being the future. While Ford Motor (F), Apple (AAPL), and Toyota (TM) have all pulled back, other large firms like VW have pushed forward.

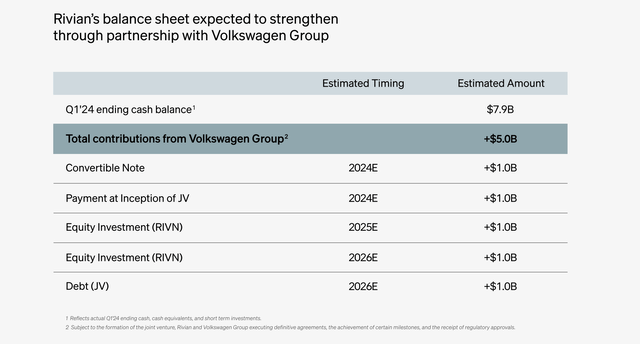

VW recently made an initial investment of $1 billion into Rivian, with up to $4 billion in planned additional investments for a total expected deal size of $5 billion. The company will see additional cost benefits and revenue potential from the deal, in addition to the investments.

Source: Rivian/VW presentation

Rivian ended Q2 with a cash balance of $7.9 billion, with total liquidity of $9.2 billion. The VW investments help bridge the gap for the EV company to reach full potential.

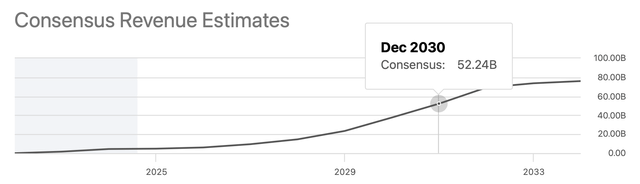

As discussed in prior research, a logical Rivian target is for $22+ billion in revenue by 2030, leading to an EV of ~$80 billion. The stock currently has a market cap below $15 billion, and naturally the VW investments will alter the equation via dilution.

The key here is an estimated stock price of $67 in 2030 is based on sales of only $22 billion. The current consensus estimates are for 2030 sales to top $52 billion. In addition, the valuation is partly based off $2.5 billion in adjusted EBITDA while the company targets higher EBITDA margins in the future where a 17.5% EBITDA margin based on the consensus revenues estimates would actually boost adjusted EBITDA to $9.1 billion.

Source: Seeking Alpha

Either way, a $14 stock has a logical path to $60+ in just over 5 years now due to the VW money and partnership to ensure production growth from R2s/R3s with ASPs of $35K to $45K. The cost reductions, efficiency gains and VW investment help ensure Rivian reaches their full potential over the decade.

Takeaway

The key investor takeaway is that Rivian is far too cheap here. The company now has the capital to lead the EV race by investing in production growth, while so many other auto manufacturers have reduced or stopped investments.

Investors should use the current weakness to load up on Rivian for the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in RIVN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.