Summary:

- EV stocks, including Tesla and Rivian Automotive, Inc., have been hit hard in 2024 due to concerns over softening consumer demand and charging network availability.

- Rivian is putting its head down and focusing on production. In its most recent quarter, Rivian boosted unit production volumes by 17% quarter-over-quarter.

- The end of its enterprise exclusivity agreement with Amazon opens the door to more enterprise orders in the future.

- Rivian also still trades at a much lower revenue multiple for Tesla, signifying an “early stage” entry point for investors willing to bear a bit more risk.

Justin Sullivan

2024 has proven to be an ugly year so far for electric vehicle (“EV”) stocks. Tesla, Inc. (TSLA) and Rivian Automotive, Inc. (NASDAQ:RIVN) are both taking it on the chin, as numerous reports spin headlines of softening consumer demand. Concerns over China demand as well as domestic buyers’ nervousness that charging networks aren’t well-distributed enough across the U.S., as well as Hertz’ recent decision to unload its EV fleet, have severely dented the short-term outlook in the space.

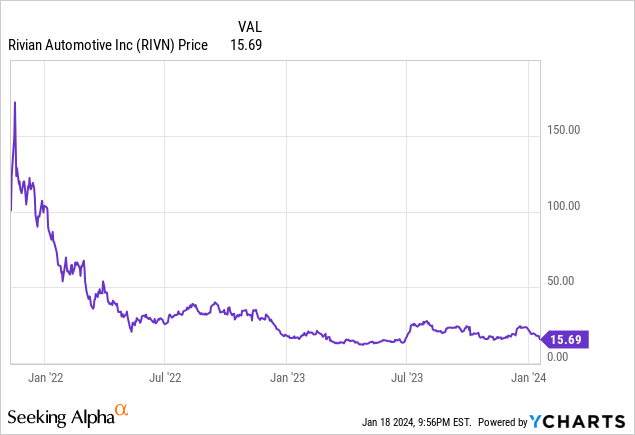

Yet with billions of dollars in market value being wiped from automakers’ stocks, I think it’s a particularly great time for investors to reconsider the long-term bull case: especially for Rivian, which is down more than 25% year to date.

I last wrote a bullish article on Rivian in September, when the stock was trading closer to $23 per share. I made the case at the time that though much smaller than Tesla, Rivian operates in a massive global auto market that still has very low penetration rates for EVs (especially in the U.S., where EV adoption lags both Europe and China). Thus far in its short lifespan, Rivian has been gated by its production capacity, which keeps going up (also helping the company drift toward breakeven gross margins).

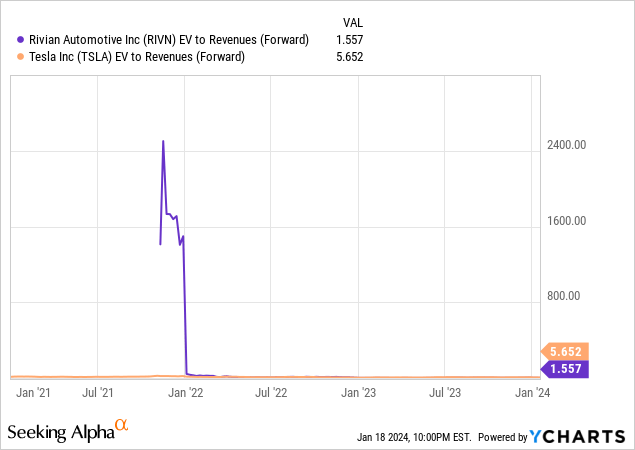

I also really gravitate toward the fact that Rivian trades at a much lower revenue multiple than Tesla, a fact that still holds true today:

Tesla and Rivian are, of course, two companies at different stages of their lifecycles. Tesla generates a positive GAAP net income, while Rivian is still losing money on each car sale – but Rivian is making progress, and the opportunity to invest in this name at relatively early stages and low multiples is still very appealing to me.

Stay long here, especially as Rivian’s most recent updates showcase traction against many key metrics, which we’ll cover in the following sections:

Production boost

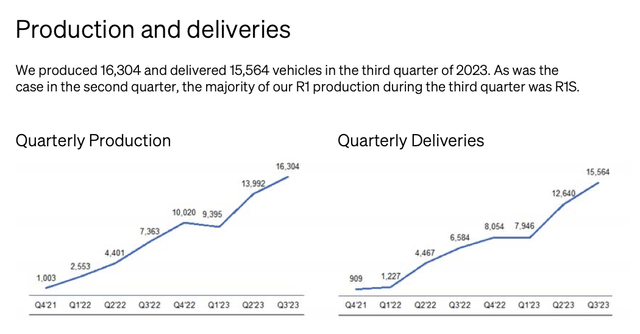

First and foremost: alongside its Q3 earnings, Rivian boosted its FY23 unit production target to 54,000 cars, up from a prior view of 52,000 units. It’s worth noting as well that the company produced a record 16.3k units in its most recent quarter, including the new R1 Max Pack vehicles (which are extended battery-range variants of Rivian’s core vehicles), putting the company at a 65k annual production run rate.

Rivian production and delivery (Rivian Q3 shareholder letter)

It’s also worth noting that Rivian appears to still be fully supply-gated, as its quarterly deliveries keep pace with its production. Production grew 17% quarter-over-quarter in Q3, and deliveries grew 23%. If demand is softening in the EV space (which I believe to be temporary rather than long term), it may be affecting Tesla’s mass-market models, but it doesn’t seem to be impacting Rivian’s smaller and higher-end customer base just yet (Rivian’s standard model, the R1S, starts at roughly $80k – nearly double the entry price for a Tesla Model 3 or Y). It’s worth pointing out as well that Rivian, with its more customizable and adventure/outdoor-oriented vehicles, caters to a slightly different market than Tesla, which is aiming to be the everyman’s EV.

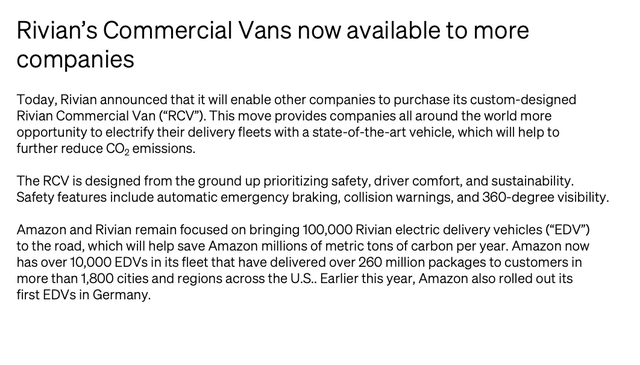

We also like the fact that in November, Rivian announced the end of its exclusive agreement to supply Amazon (AMZN) with electronic delivery vehicles (EDVs), after having delivered 10k units under this contract.

Rivian commercial update (Rivian Q3 shareholder letter)

Enterprise delivery is a huge market for Rivian that Tesla has not yet tapped, and I can only see this space poised to grow as more companies embrace sustainability targets and green initiatives. And unlike initially feared, Amazon is not pulling out of its long-term 100k unit order, and Rivian’s CEO RJ Scaringe noted that the company is still working with Amazon to deliver more units. Per his remarks on the Q3 earnings call:

I wanted to touch on an important new development, which was just released. We have amended our Amazon agreement with terms and conditions, which provide the opportunity to sell commercial vans to other customers, helping more companies reduce their CO2 emissions.

With more than 10,000 EDVs on the road and 260 million delivered packages, we are already seeing meaningful impact from our initial rollout. We are excited to continue our work with Amazon to deliver on their initial order of 100,000 vehicles, along with a diverse set of new commercial customers.”

Margins continuing to scale

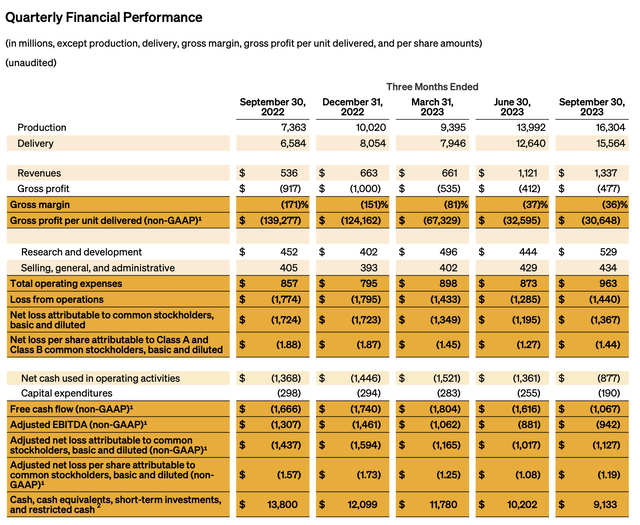

Economies of scale and greater unit volumes, needless to say, are core to Rivian’s success. In its most recent quarter, gross margin scaled to a record -36%, one point better than in Q2 and substantially better than -171% in the year-ago Q3, a quarter in which the company produced and delivered roughly 7k vehicles (versus 16k now).

Rivian Q3 results (Rivian Q3 shareholder letter)

Rivian raised its adjusted EBITDA loss target for FY23 to -$4.0 billion, versus -$4.2 billion in its prior update. In its shareholder letter, Rivian also noted that it expects to continue seeing progress on per-unit costs:

We expect to see continued benefit going forward due to further improvements in R1 material cost per unit from the reduction in commodity costs, introduction of new technologies, and ongoing negotiated supplier price reductions.”

The fact that this is a company with substantial long-term backlog (90k+ commercial vehicles from Amazon to start, not including the unknown balance of unfilled customer orders and potential orders from new enterprise buyers), leaves plenty of hope for continued economies of scale.

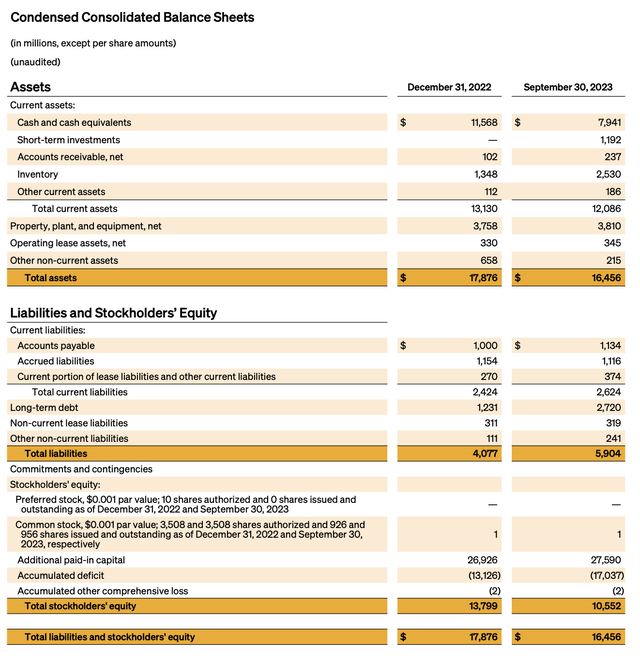

Well-cushioned balance sheet

Lastly, we point out that even though Rivian is still unprofitable, it is quite well capitalized to weather itself through a period of low stock prices and high interest rates (which make it punishing for a company to try to raise capital right now).

Cash and cash equivalents on Rivian’s most recent balance sheet tallied up to $9.1 billion, against just $2.7 billion in debt. We note that nearly half of Rivian’s ~$15 billion current market cap sits in its $6.4 billion net cash position.

Rivian balance sheet (Rivian Q3 shareholder letter)

Rivian’s free cash flow burn was -$1.1 billion in its most recent quarter; a figure that will likely slim down as margins and revenue continue to scale. Even at current burn rates, Rivian is liquid enough for ~2 years at its current loss profile (more than enough time, in my view, for sentiment in the EV space to improve).

Key takeaways

Overblown pessimism has pushed Rivian stock down substantially from its December highs. As usual, short term-ism is taking over the stock, while the long-term outlook for EV adoption and greater enterprise orders is still quite appealing. Rivian is putting its head down and continuing to focus on production boosts, which is what will secure its long-term profitability. Investors who are able to shoulder some short-term volatility can benefit tremendously at this Rivian Automotive, Inc. entry point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.