Summary:

- Rivian’s stock has experienced significant volatility over the past six months, but has risen since my last upgrade.

- Recent financials show negative gross profit and adjusted EBITDA, but the company raised funds and terminated exclusive delivery agreements with Amazon. A revenue boost seems likely.

- Rivian aims to achieve profitability through sales growth and cost-cutting measures, but its valuation is still a concern even compared to other high-growth companies in the industry.

- The company’s pursuit of profitability in FY2024 is ambitious, and while long-term targets are optimistic, the recent Q4 deliveries miss underscores the inherent uncertainties.

- So I cannot upgrade RIVN today, even though I like the direction taken by the management for faster, high-quality business expansion. The RIVN stock is still a ‘Hold/Neutral’, in my opinion.

Mario Tama

Introduction

I have covered Rivian Automotive, Inc. (NASDAQ:RIVN) on Seeking Alpha since November 2021. Initially, I gave it a ‘Sell’ rating and was confirming my bearish thesis until June 23, 2023, when my article “Rivian Stock: It’s Getting Better Now (Rating Upgrade)” was published. Fortunately, I managed to catch the stock at its lowest point, and since my last call, it has risen significantly and has not returned to that price zone.

Seeking Alpha, author’s coverage of RIVN stock

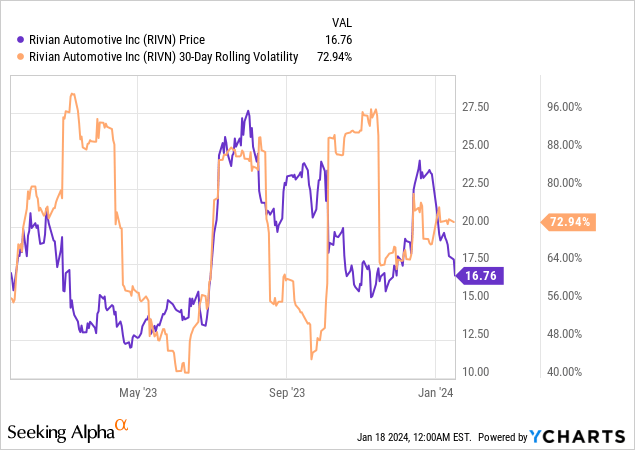

Almost six months have passed since I last wrote about the company. During this time, the stock experienced strong volatility: first RIVN rose from ~$12.5 to $27.5, then fell to ~$15.3, and at the time of writing this article, 1 share costs $16.76.

I am now taking a look at recent corporate events, the company’s financials, and the stock’s valuation to assess how my ‘hold/neutral’ thesis has changed over the past six months.

Recent Financials And Corporate Developments

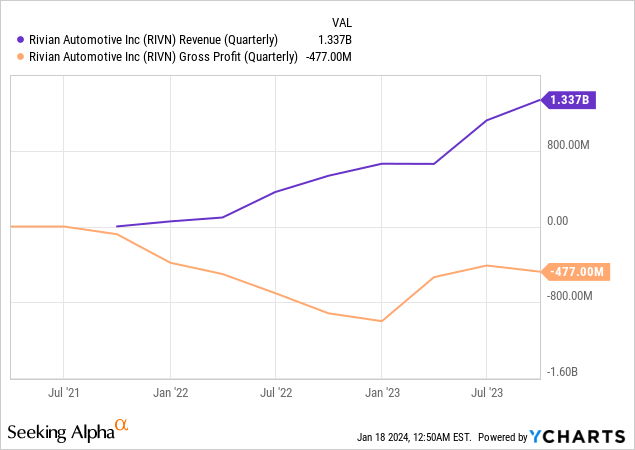

In Q3 FY2023, Rivian reported producing 16,304 vehicles and delivering 15,564 vehicles, generating $1.3 billion in revenue. The total gross profit for the quarter was negative $477 million, with a focus on improving gross profit per vehicle delivered. According to the CFO’s commentary on the earnings call, the gross loss per vehicle improved by ~$2,000 QoQ, which sounds good, actually. But on an absolute basis, gross loss grew by ~16% QoQ against a backdrop of 19.3% QoQ sales growth – in this respect, I don’t think Rivian has shown anything outstanding.

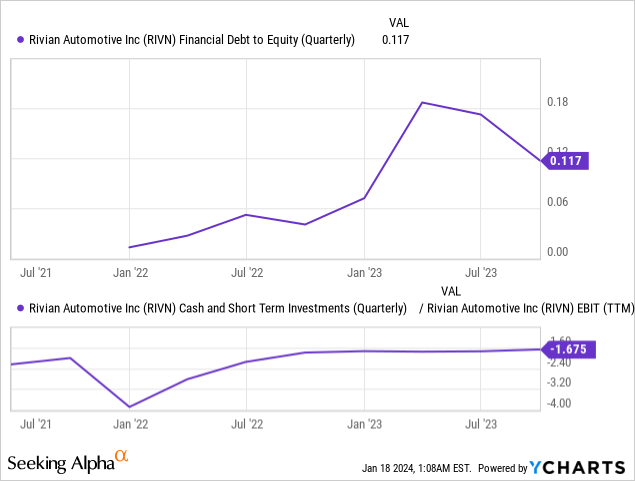

Despite a negative adjusted EBITDA of ~$942 million, Rivian raised $1.75 billion in a green convertible note in October, strengthening the balance sheet ahead of the expected construction start of the Georgia plant in early 2024. RIVN’s financial position looks good: The debt-to-equity ratio is only ~0.12, and the cash on the company’s balance sheet can theoretically cover operating losses for more than a year and a half. This means that RIVN has enough time to move further towards break-even, as the company can raise additional debt capital when needed.

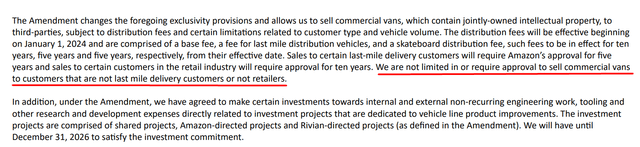

In a strategic move disclosed in their recent financial report, Rivian’s management has opted to terminate exclusive delivery van supply agreements with Amazon (AMZN), allowing other companies to engage in purchasing Rivian vehicles.

While only 10,000 out of the contracted 100,000 delivery vans have been supplied to Amazon, the revised agreement terms are already proving beneficial. This change has prompted AT&T (T) to announce plans to incorporate Rivian vans and trucks from the R1 platform into its fleet starting in the early months of 2024, with the exact volume of procurement yet to be disclosed. I think these developments signify Rivian’s pivot towards a more diversified customer base, potentially mitigating risks associated with dependence on a single major client.

Rivian’s recent participation in the Barclays conference showcased a positive outlook, with expectations set on achieving positive gross profitability in FY2024 (despite what we saw above). As a reminder, Rivian has long-term targets of a 25% gross margin, high-teens adjusted EBITDA margin, and approximately 10% free cash flow margin.

The company aims to realize profitability through a dual strategy of boosting sales and implementing cost-cutting measures. Plans include the reconfiguration of production lines and streamlining battery assembly, with an added optimistic note on the anticipated continued decline in lithium prices, a crucial element in their batteries. Regarding the planned boost in revenue, we can already see that this will most likely be possible with the current dynamics and the possibility of cooperation with companies other than Amazon.

Goldman Sachs [December 13, 2023], proprietary source![Goldman Sachs [December 13, 2023], proprietary source](https://static.seekingalpha.com/uploads/2024/1/18/49513514-17055607564508953.png)

Bank of America analysts [December 6, 2023 – proprietary source] forecast very active growth in Rivian’s sales in 2024 (the highest growth rate along with Hozon EV’s). In 2026, however, growth is only expected to be 3%, which I think is underestimated given the tailwind from potential new contracts.

While achieving net profitability may take time, Rivian’s recent strides in cost reduction, coupled with sustained high demand driven by technological superiority, a backlog of orders exceeding production capabilities, and a demonstrated ability to meet strategic goals, position the company favorably for a promising future, bolstered by the support of major players like Amazon and AT&T.

But what has changed regarding RIVN’s valuation?

Rivian’s Valuation Analysis

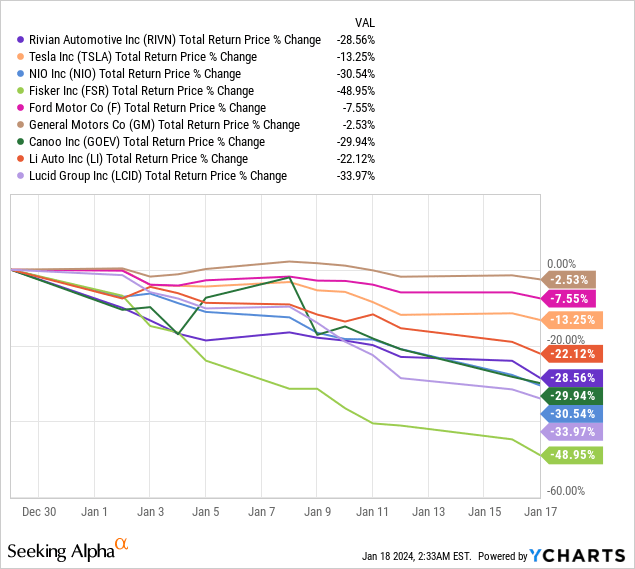

Since the beginning of 2024, RIVN stock has fallen by 28.56%, which is very impressive, but not as bad as the performance of NIO (NIO) or Fisker (FSR). On average, RIVN’s YTD momentum looks like a natural consequence of the industry-wide correction:

Due to the negative EBITDA and especially the net earnings, we cannot value RIVN using many conventional valuation metrics such as EV/EBITDA, P/E, P/FCF, etc. We can only focus on sales-related multiples such as EV/sales and price/sales or book-related ratios (P/B, P/TBV). But the P/B ratio isn’t representative in my opinion, so I’ll just focus on revenue.

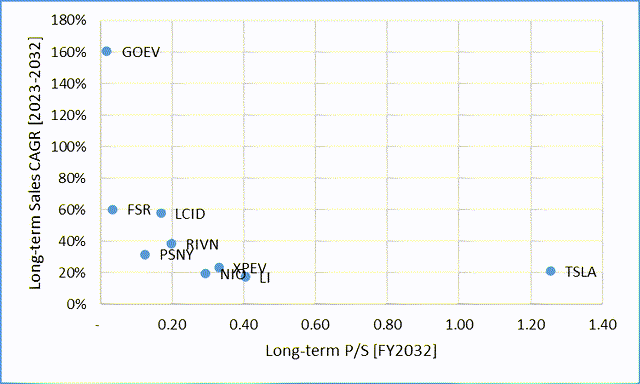

Rivian’s sales are expected to grow at an average compound rate of 38% until the 2032 financial year, which at first glance seems to be a very good figure. But I don’t see anything remarkable in RIVN’s valuation when I compare its long-term implied P/S ratio with the industry‘s ‘normal’ sales growth rates. It is clear that most of these consensus predictions will not materialize: This is why we see such a high premium on the valuation of Tesla (TSLA). Due to its relatively high price-to-sales ratio with a long-term sales CAGR of more than 1000 basis points below the industry median, TSLA is in the very right side of the graph. RIVN, on the other hand, is inferior to companies such as Lucid (LCID), Canoo (GOEV), and Fisker:

Author’s work, YCharts and Seeking Alpha data

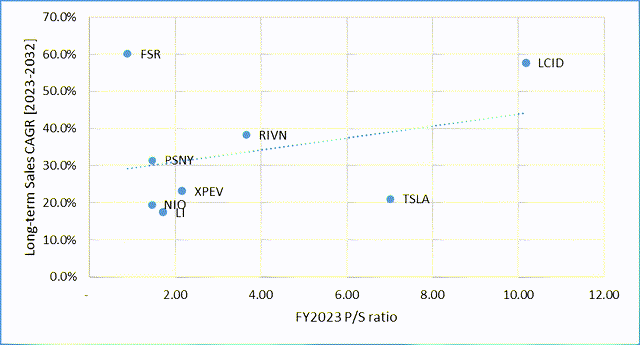

The same relative “overvaluation”, so to speak in this case, is observed when we make a transition to the P/S figures for FY2023 for the x-axis (the long-term sales CAGRs for the y-axis remain untouched). RIVN no longer appears to be overvalued compared to LCID, but its overvaluation relative to Fisker is increasing sharply:

Author’s work, YCharts and Seeking Alpha data

Note: GOEV was removed from the sample due to its P/S [~97x] being an outlier in nature

Here, too, there is no doubt that in future everything will depend on the punctuality of individual companies’ delivery schedules: The market apparently expects more risk from Fisker than from Rivian in this regard. But I find that if you buy RIVN stock today, you get absolutely no discount for the risk you take.

The Bottom Line

Investors must grapple with the juxtaposition of Rivian’s promising future, marked by cost reduction efforts, strong demand, and strategic achievements, against valuation concerns and industry dynamics. The company’s pursuit of profitability in FY2024 is ambitious, and while long-term targets are optimistic, the recent Q4 deliveries miss underscores the inherent uncertainties.

I think investors considering Rivian should weigh factors like the company’s expensive current valuation, weakening competitiveness in the industry, and potential demand challenges predicted by broader macroeconomic factors in the evolving electric vehicle landscape. For this reason, I cannot upgrade RIVN today, even though I like the direction taken by the management for faster, high-quality business expansion.

The RIVN stock is still a ‘Hold/Neutral’, in my opinion.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

![BofA [proprietary source]](https://static.seekingalpha.com/uploads/2024/1/18/49513514-17055613392504516.png)