Summary:

- Rivian stock gained ~80% since May due to high sales growth and a substantial cash balance, alongside a $5B Volkswagen deal for next-gen vehicle platforms.

- Rivian aims for gross profitability by Q4 2024 via cost cuts, efficient production, and strategic investments, but risks remain high due to heavy competition and market uncertainty.

- I upgrade RIVN to Buy with a small portfolio allocation (~2.5%), expecting a potential CAGR of 40% over 5.5 years, yet it remains a speculative high-risk investment.

hapabapa/iStock Editorial via Getty Images

I last covered Rivian (NASDAQ:RIVN) in May; at the time, I put out a Hold rating, and since then, the stock has gained around 80% in price. Largely, this can be attributed to high sales growth, and a substantial cash balance. Rivian has also announced a new deal with Volkswagen, where it received $1B and is in agreement to receive a total of $5B over the next few years for a joint venture in developing next-generation software-defined vehicle platforms. From my research, this could be a direct play against Elon Musk’s Tesla (TSLA), and while I think the short-to-medium term is likely to be tough for Rivian to break even, the long-term growth trajectory is intact, with Volkswagen (OTCPK:VWAGY) and Amazon (AMZN) both having sizeable stakes in the firm. Rivian remains somewhat of a speculative growth investment at this early stage, but the outsized rewards could be significant because it is an EV company with strong future potential at a price-to-sales ratio of just 3.4. Based on my further research, I have upgraded my rating to a Buy, but I believe it deserves a small allocation of no more than 2.5% of portfolios due to the high-risk and uncertain nature of its future success.

Operational Analysis

Rivian announced a multibillion-dollar partnership with Volkswagen to develop next-generation software-defined vehicle platforms. The aim of the deal is to enhance both firm’s technology capabilities while bolstering Rivian with capital to sustain it toward long-term profitable growth.

Notably, the company has also made efforts to integrate with Tesla’s Supercharger network, which is part of an effort for the firm to address charging reliability. This should help to boost demand by making its EVs more practical.

Management has also been implementing cost-cutting strategies to reduce its cash burn and improve its financial position. For example, it has retooled its Illinois plant to increase efficiency and pause the construction of a new facility in Georgia. Furthermore, it is taking measures to reduce the number of parts in its vehicles and streamline its manufacturing process, which is expected to help on its path to profitability by saving material costs and time. This again reminds me of Tesla—however, one has to wonder whether RIVN is mimicking Tesla by choice or by necessity. Tesla has gained a reputation for attempting to undercut its competitors in China and domestically, forcing more stringent operational measures for smaller EV firms to stay alive.

Reuters | RIVN Company Statements

Rivian is also planning to deliver 100,000 electric delivery vans (EDVs) to Amazon and expand its presence in the broader commercial vehicle market. I do believe in the long-term viability here, and there is clearly something that Amazon and Volkswagen see in Rivian at this early stage. That being said, the investment remains a rather speculative venture-style allocation, and retail investors should consider the higher risk that this entails. In the comments in my previous thesis, one reader quite rightly mentioned that if Amazon decides Rivian is no longer tenable long-term, the loss is barely noticeable to the conglomerate; depending on how retail investors allocate, the same might not be able to be said.

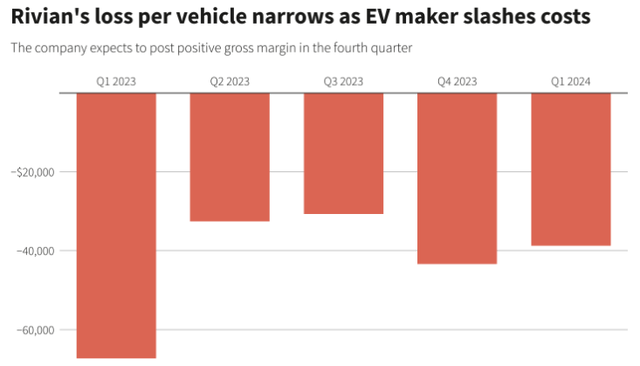

Rivian is focused on achieving a modest gross profit by Q4 2024 through cost reductions, increased production efficiency, and strategic investments. Furthermore, management is working to reduce operating and capital expenditures to extend its cash runway. However, I think there is still the distant possibility of bankruptcy here if the company does not manage to scale its business effectively to drive a profit. At the moment, it is clearly in the investment phase, but even the cost of revenues is far exceeding total revenues at the moment—this in itself is troubling and represents the need for significantly cheaper manufacturing and raw materials sources.

Financial & Valuation Analysis

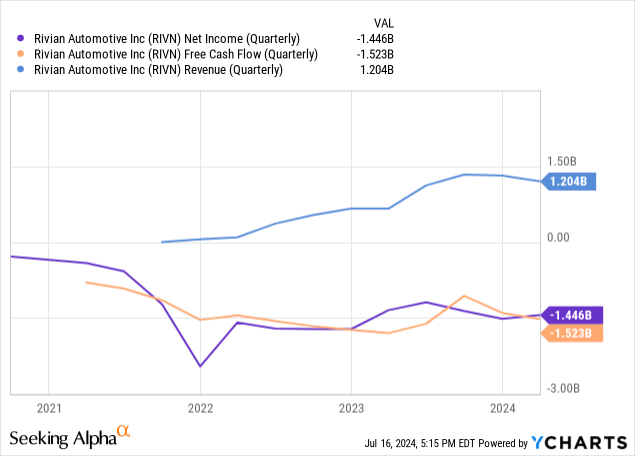

The financial history of Rivian thus far is not particularly strong, and there does not seem to be any reason to believe profitability will be achieved any time soon. That being said, the company is moving toward a net profit slowly—I believe management’s main challenge is remaining competitive with larger players like BYD (OTCPK:BYDDY) and TSLA.

While the net loss is troubling, the company’s high revenue growth estimates for fiscal 2025, 2026 and beyond bode very well. In my opinion, the investment works as a small allocation that is speculative if one is holding it over the long term. If the company works out and manages to become one of the EV and EDV leaders, the returns could be very substantial in my view.

There are certain other elements that support the company’s success over time, including a balance sheet with an equity-to-asset ratio of 0.51 and a cash-to-debt ratio, including lease obligations, of 1.53 (cash and ST investments of $7.86B). Of course, its weakness lies in its debt-to-EBITDA ratio, which is -1.21, but this can obviously be expected because the company is in the startup stage still—the issue I have is not that it is unprofitable, but that the runway looks both long and unpredictable.

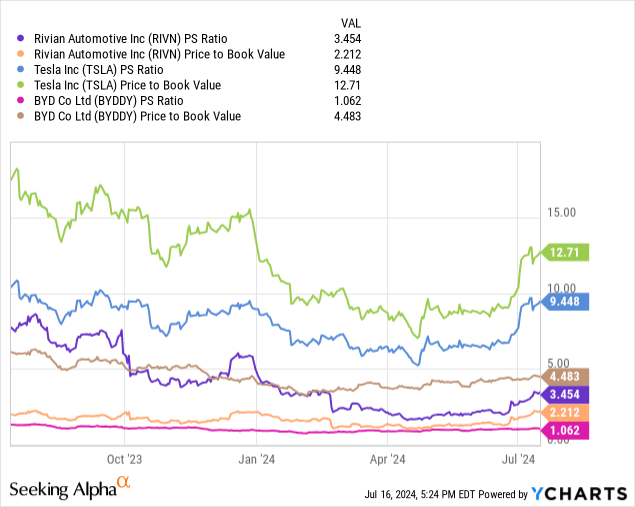

Moving to the valuation, RIVN is cheap, with a PS ratio of 3.4 and a PB ratio of just 2.15. I think it is worth comparing this to Tesla and BYD to see how high the valuation could scale if the company manages to survive to profitability and larger industry success:

The likelihood of Rivian being the next TSLA is low, in my opinion, and it is probably much more realistic to compare it to BYD. TSLA carries a heavy emphasis on AI, automation, and robotics, as well as significant goodwill in the valuation, which I believe is somewhat related to the celebrity status of Elon Musk and the sentiment surrounding future capabilities in autonomous transportation and taxis. In my opinion, Rivian is unlikely to be able to achieve anything of this scale, but I could see its PS ratio and PB ratio expand somewhat. However, its valuation is not too dissimilar to BYD right now, so there isn’t a huge undervaluation here to make the investment particularly lucrative on this measure alone.

Instead, I think the high growth for the investment is likely to come from high revenue growth over the coming years. While some expansion in the valuation multiples is likely as a result of this, I think that it has the potential to venture into overvalued territory. In my opinion, a PS ratio of about 3 is reasonable for the company to have in December 2029, which would make the stock price $116 if the revenue is $40.58B and the company’s shares outstanding increase to $1.05B from the current $995.32M. That indicates the stock could achieve a CAGR of approximately 39% over 5.5 years, based on my estimates.

Future Earnings Expectations

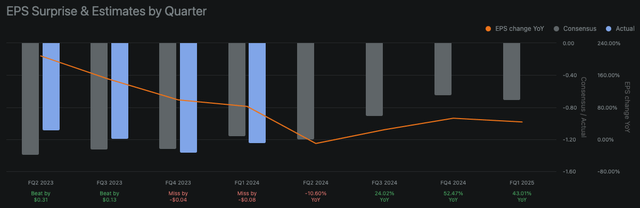

Rivian’s Q2 2024 earnings report is scheduled to be released on August 6, 2024. The company delivered 13,790 vehicles in Q2, which is slightly up from 13,588 in Q1 2024 and significantly up from 12,640 in Q2 2023. This is likely to be the last quarter of YoY EPS contraction before YoY growth begins—this should significantly support my investment thesis and potentially offer a very opportune time to invest in RIVN before management potentially reports its first gross profit in Q4.

Q2 significantly underdelivered on what vehicle production will likely be moving forward because management shut down its Normal, Illinois plant from April 5 to April 30, 2024, in an effort to upgrade it to streamline production processes, reduce costs over the long term, and improve efficiency. CEO RJ Scaringe noted that this resulted in a “messy quarter”, so the fact that the company still made growth YoY and MoM in deliveries is very promising to me. I think now the plant is up and running, we could expect an EPS estimate beat in Q3, setting a strong tone for Q4’s potential gross profit. In other words, I think the remainder of the fiscal year for RIVN stock is going to present substantial further growth in the stock price based on the results of its coming earnings. The upgrades to the Normal plant include a 30% increase in production line efficiency and a significant reduction in material costs.

Risk Analysis

There is certainly a high risk that Rivian does not manage to achieve these high revenue growth estimates, which could result from a lower demand for EVs in the coming years. I think this could particularly be true under a Trump administration because all of Rivian’s revenue is currently from the U.S., and Trump is notably less of an advocate for renewable energy than Biden. As a result, fossil fuels could begin to gain favor momentarily again over the next 4 years.

Furthermore, the growth is largely dependent on how Rivian manages its profitability strategy, not just its results in top-line growth. I think there is likely to be growing pressure from Musk and his autonomous taxi venture, which could significantly undercut the cost of transport and deter a large market of consumers from buying their own EVs. This could arguably be an existential threat for Rivian, and I think management has not yet noticed how large this threat could become. This is why I think it would be wise for Rivian to begin looking at working more acutely with Amazon and Volkswagen to develop autonomous technology that can be scaled for EDVs and consumer vehicles in partnership. A failure to do this could lead to greater market pressures that could prove insurmountable. I think it is quite underestimated how far ahead Tesla is in EVs and advanced driving, with a significant moat in FSD technology and a growing autonomy strategy that is far ahead of later organizations like RIVN and BYD. No matter which direction Tesla chooses, I think certain less prominent firms are bound to be negatively affected as it consolidates its moat in transportation. While I think Tesla is likely to pursue partnerships moving forward, I find it doubtful that Rivian would be one of these. That being said, such a partnership and the utilization of Rivian vehicles under the FSD capabilities provided by Tesla and integrated into a network with Tesla’s infrastructure for autonomous taxis could be highly beneficial and long-term accretive to both parties if RIVN can land and develop this in my opinion.

Conclusion

Rivian could be a very high-growth investment moving forward, and I am hopeful of a price CAGR of circa 40% over the next 5.5 years. For this reason, I have upgraded my rating to a Buy, but a caveat to this is that I think it should only take a small allocation in portfolios of around 2.5% because I consider it high-risk, and somewhat speculative, amid changing market dynamics and profitability pressures. The company’s valuation should be monitored regularly, and any existential threats that begin to compound would signify a reason to sell sooner rather than later, in my opinion.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.