Summary:

- Rivian’s stock has plunged to all-time lows following its Q4 2023 report and bleak production guidance for 2024.

- Tesla CEO Elon Musk warned of potential bankruptcy for Rivian, causing the stock to enter a tailspin.

- Rivian’s numbers paint a grim picture, with negative gross margins, a high cash burn rate, and the need for additional funding to avoid bankruptcy.

Mario Tama

Introduction

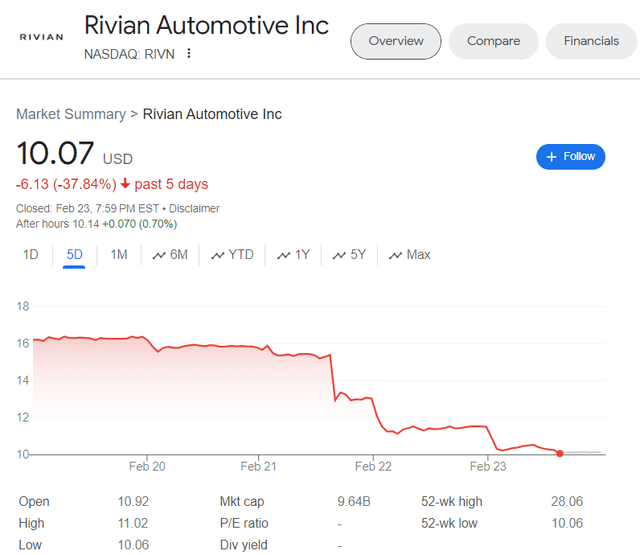

Last week, Rivian Automotive, Inc. (NASDAQ:RIVN) plunged -38% to new all-time lows in the aftermath of its Q4 2023 report, wherein the EV manufacturer beat quarterly estimates but presented disastrous production guidance for 2024 with frightening macro commentary from its leadership team.

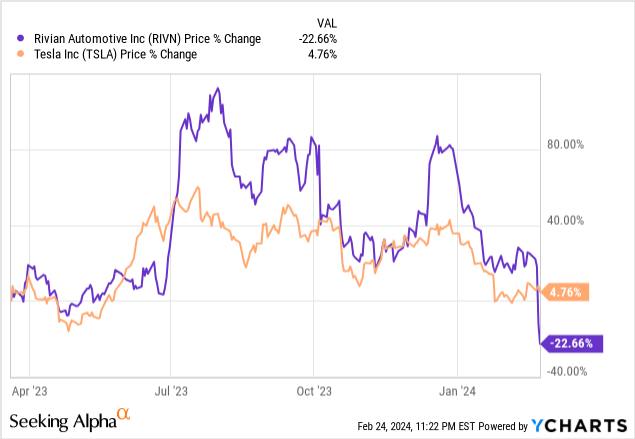

In “Tesla Vs. Rivian: 2 Popular EV Makers, 1 Winning Stock” I highlighted Rivian’s bankruptcy risk as a reason to avoid RIVN stock despite its strong upside potential. Here’s what I wrote back in March 2023:

Tesla and Rivian are two of the most exciting and innovative players in the EV industry. While Tesla has an established presence and a robust margin profile, Rivian is still in the early stages of scaling up and investing heavily in R&D and infrastructure.

As we noted in today’s article, Rivian & Tesla’s product lineups have little overlap, and both of these companies can co-exist in the massive auto market. Now, Tesla is unlikely to be a ~10x investment from current levels in the next decade; however, investors buying in here at ~$180 per share could conservatively expect a 5-year CAGR return of ~15% from TSLA stock.

On the other hand, Rivian could be a ~10x or ~20x investment from current levels if it avoids bankruptcy and scales up production successfully. However, given the competitive environment and macro conditions being vastly different in 2023, Rivian’s chances of emulating Tesla [of 2015] do not look great to me. Plus, Rivian is starting from a much worse-off position due to its deeply negative gross margins. With its current cash burn rate, I see Rivian burning through its cash balance in the next 18-24 months. And if RIVN fails to raise additional funding in what will be much tighter financial conditions, it may easily end up in bankruptcy!

The macroeconomic environment is highly uncertain, and this is not the time to be a hero. Given the long-term risk/reward on offer, I strongly prefer buying Tesla, Inc. over Rivian Automotive, Inc. right now.

Key Takeaway: I rate Tesla stock a “Buy” at ~$180 per share and Rivian an “Avoid” at ~$13 per share.

By late summer of 2023, Rivian stock had nearly doubled [and massively outperformed Tesla’s (TSLA) stock] from the publication of my first and only “Avoid” rating on RIVN stock. While I have received a good bit of flak for my cautionary view on Rivian over the last several months, the market is once again pricing RIVN for bankruptcy, which is where I think Rivian is headed in the absence of a massive miracle.

Throwing around the “B-word” is not something I enjoy at all; however, Rivian is a money-burning furnace, and Elon Musk [Tesla CEO] seems to agree with me on this one.

Musk’s Warning And Rivian’s Acknowledgment

While the initial reaction to Rivian’s Q4 result was negative, Musk chiming in on a potential bankruptcy for Rivian was what sent RIVN stock into an absolute tailspin late last week. In a dire warning for investors, Musk hinted that Rivian could end up in bankruptcy within six quarters in a post on X (Twitter):

They need to cut costs massively and the exec team needs to live in the factory or they will die

Despite slashing its workforce by 10% and slowing vehicle production in a worsening demand environment for EVs, Rivian’s management sees current cash balance of $9.4B only lasting the business through the end of 2025! Here’s what Rivian’s CFO Claire McDonough said during the earnings call:

While the incorporation of new design changes impacts near-term production, we are confident it better positions Rivian to be more profitable and competitive over the long term. We expect 2024 EBITDA to be negative $2.7 billion as we focus on continuing our go-to-market infrastructure buildout and the development of R2, while also optimizing our cost, driven by the integration of key new engineering technology and design changes, negotiated supplier cost downs, and a more efficient operating expense structure.

Recently, we have taken measures to rationalize our capital expenditures due to a greater focus on our core business. Capital expenditures in 2024 are expected to be $1.75 billion, driven by additional investments in our production facilities, next-generation technologies, and the continued buildout of our go-to-market operations.

We remain confident that our cash, cash equivalents and short-term investments can fund our operations through 2025. We aim to maintain a strong balance sheet position by continuing to drive cost efficiencies and improve our vehicle unit economics, while opportunistically evaluating a variety of capital markets available to Rivian ranging across the capital structure.

In the rest of this note, we will assess Rivian’s numbers and its future outlook.

Numbers Paint A Grim Picture For Rivian

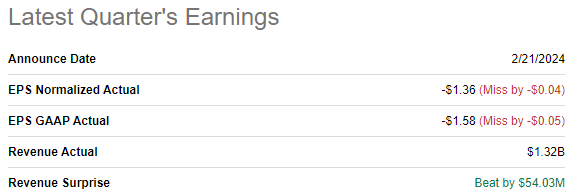

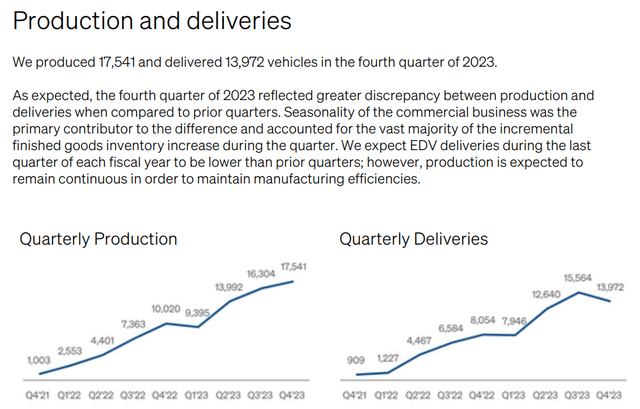

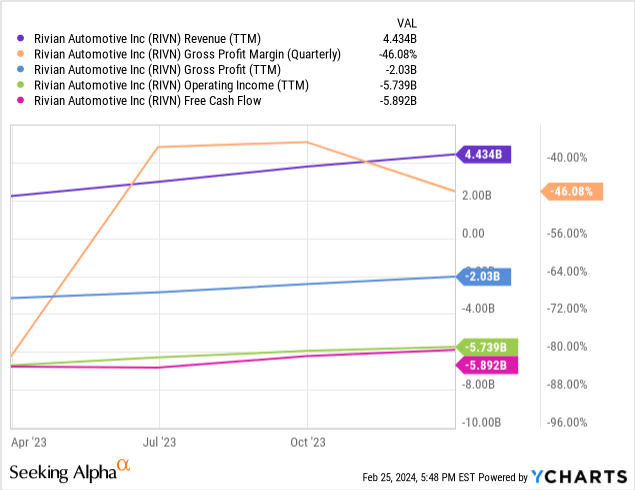

In Q4 2023, Rivian generated revenues of $1.32B, beating street estimates by $54M, on the back of delivering nearly 14K vehicles. However, Rivian missed earnings estimates, with normalized EPS coming in at -$1.36 per share, as gross margins deteriorated to -46% in Q4, with quarterly production outstripping deliveries.

SeekingAlpha Rivian Q4 2023 Shareholder Letter

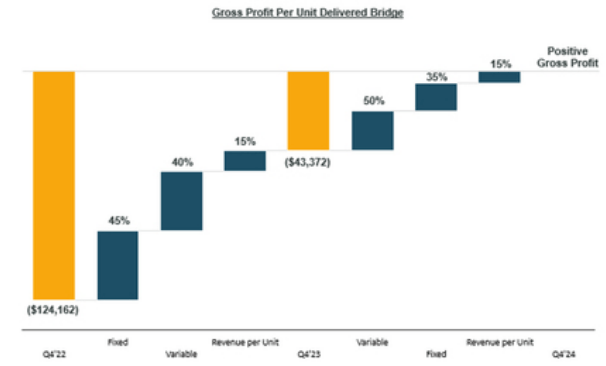

Based on total gross profit (loss) of -$606M, Rivian’s gross profit per vehicle was -$43K last quarter! While Rivian’s Q4 gross margins were impacted by costs associated with a planned 2024 shutdown [$70M (or $5K per vehicle)] and seasonality of its commercial business, the EV maker’s unit economics are still deeply negative.

With quarterly production outstripping supply, inventory and demand concerns are naturally rising. According to Rivian’s press release, the primary driver of this inventory buildup is the seasonality of its commercial business, due to Amazon not taking as many EDV deliveries during the holiday quarter. While I understand the seasonality factor, leadership’s commentary about the current macro environment renders these investor concerns totally valid:

Our business is not immune to existing economic and geopolitical uncertainties. Most notably, the impact of historically high interest rates, which has negatively impacted demand. In this fluid environment, we appreciate the expressed interest in demand visibility from the investment community. The conversion of orders to sales can be impacted by several factors, including delivery timing, location of order, monthly payments, and customer readiness.

Our order bank has notably reduced overtime as deliveries have more than doubled in 2023 versus 2022 along with the impact of cancellations due to both the macroenvironment and the customer factors I just referenced. For 2024, we expect our total deliveries to be derived from our existing backlog as well as new orders generated during the year. Our key focus is on increasing demand to achieve our 2024 delivery targets.

– RJ Scaringe, Rivian CEO

After producing 57K vehicles (+135% y/y growth) in 2023 [ahead of the 50K vehicle production guidance], Rivian’s management has guided for “no growth” in vehicle production in 2024 as they look to introduce cost savings to the R1 platform:

Turning to our business outlook for 2024. We remain focused on driving greater cost efficiency across the company. We are guiding to 57,000 total vehicles produced for the year. Compared to 2023, we anticipate consumer and commercial vehicle deliveries to grow by low-single digits.

As we discussed on last quarter’s earnings call, we expect to shut down both the consumer and commercial lines in our [normal] (PH) plant for several weeks during the second quarter to introduce cost savings, in-vehicle technologies to the R1 platform. We believe these changes will meaningfully reduce our material costs and position Rivian to exit 2024 with a much improved margin profile. While the direct downtime will be over a portion of Q2, we anticipate this to impact all four quarters of output, as we prepare the facility for the work and then individually ramp each vehicle variant, as well as our supply chain following the shutdown.

As for the first quarter of 2024, due to managing changes in our supply chain associated with the introduction of new materials, we expect to factory gate approximately 13,500 units for the quarter. We expect that there will be a few thousand more vehicles, which are built but not factory gated as they wait an updated part we expect to receive in April. We anticipate the first quarter total deliveries to be approximately 10% to 15% below the fourth quarter of 2023 deliveries.

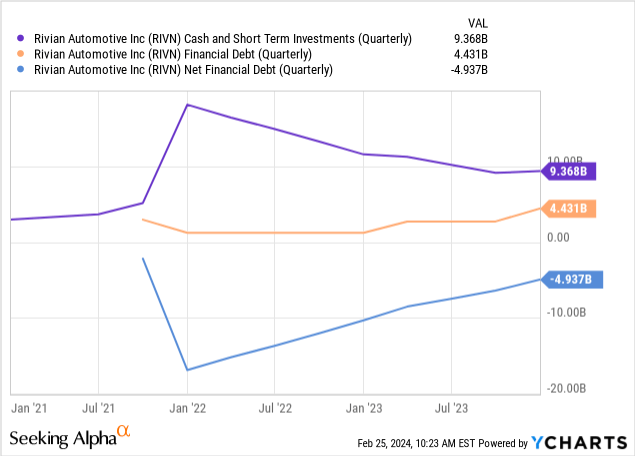

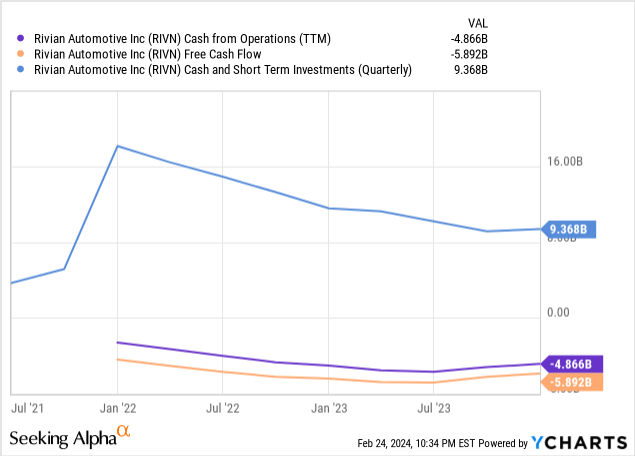

Over the last twelve months, Rivian burned through roughly $5.9B despite considerable improvements in gross margin and reductions in operating expenses. As of Q4 2023, Rivian’s cash and short-term investments stood at $9.4B. Considering Rivian’s current cash burn rate, it would run out of money within 6-8 quarters in the absence of additional capital raises or cost cuts.

While Rivian’s management has blamed macro (demand) for its production guide for 2024, I think this is a deliberate attempt to slow Rivian’s journey to bankruptcy and hopefully find a miracle (fresh capital infusion) to survive!

Economic and geopolitical uncertainties and pressures, most notably the impact of historically high interest rates, have informed Rivian’s expectations for 2024. With these market conditions, the company expects to produce 57,000 vehicles in 2024, in line with 2023 production. For 2024, the company is guiding towards capital expenditures of $1,750 million and an Adjusted EBITDA* of $(2,700) million. Rivian will continue its company-wide cost transformation program, which to date has resulted in meaningful reductions in total unit costs for both the R1 and EDV models through engineering design changes, commercial cost downs, and manufacturing efficiencies. Today, Rivian also announced it is reducing its salaried workforce by approximately 10%.

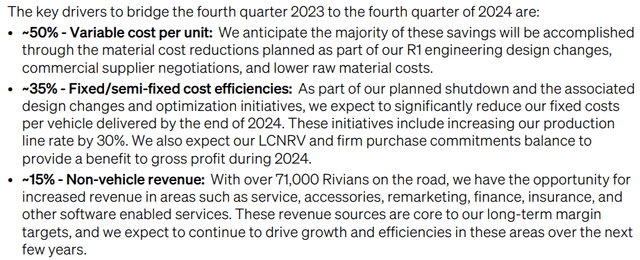

In an attempt to affirm Rivian’s long-term viability as a business, management is aiming for positive gross profit margins by the end of Q4 2024 – with most of these gains coming from a reduction in variable costs via material cost reductions and lower raw material costs. Additionally, Rivian believes the R1 production line rate will be boosted by 30% after the shutdown in Q2. Lastly, Rivian also sees its growing vehicle fleet as a significant revenue and gross profit opportunity.

Rivian Q4 2023 Shareholder Letter Rivian Q4 2023 Shareholder Letter

Given persistent macroeconomic uncertainties, boosting gross margins to positive territory will require a Herculean effort from Rivian’s management team and a lot of luck in terms of consumer demand, raw material pricing, etc. In my view, this is precisely what Musk asked Rivian to do when he expressed the need for its executives to sleep on the factory floor.

Concluding Thoughts: Rivian May Be Headed To Bankruptcy, Stay Away

Now, even if Rivian achieves positive gross profits by the end of this year, it still has a funding crunch coming its way. As per management’s guidance, Rivian looks set to burn approximately $4.5B in 2024, which is roughly half of its total cash balance of $9.4B as of the end of Q4 2024.

On 7 March 2024, Rivian will be releasing details about its R2 platform and product lineup, and I am sure all eyes will be looking at what a $45-55K vehicle from Rivian has to offer. While Tesla hit the bullseye with the Model 3 (after skirting with bankruptcy fears for a good while), Rivian’s prospects of replicating Tesla’s success seem bleak right now. Why? Because for the R2 platform to be wildly successful, Rivian will have to survive until at least 2026 [when the first R2 platform vehicles are expected to be delivered].

Trading only slightly above its cash balance, I think it is fair to say that Rivian is once again priced for bankruptcy. Unfortunately, that’s exactly where Rivian may be headed in the next year or two if management fails to raise additional capital for the EV maker. Amid tough macro [demand] conditions, Rivian is cutting costs and slowing production growth to elongate its runway; however, if the economy were to suffer a hard landing, Rivian may very well run out of money within 6-8 quarters in the absence of fresh capital infusion.

Since we are no longer operating in a zero-interest rate world, I am not at all confident about a money-burning furnace such as Rivian being able to get additional funding in its current form. Therefore, I still think Rivian’s bankruptcy odds are pretty elevated.

If you’re thinking – “Well, Rivian is already down so much; how much lower can it go from here?” – the simple answer is 100%. If bankruptcy can be avoided, RIVN stock could be a ~10x or ~20x investment from here; however, Rivian going bankrupt is a far likelier outcome.

Key Takeaway: I continue to rate Rivian Automotive, Inc. an “Avoid/Hold/Neutral” at current levels.

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.