Summary:

- GameStop’s stock surges 80% in pre-market trading after Keith Gill, aka Roaring Kitty, shares a screenshot of buying $100 million in stock and call options.

- GameStop’s annual report shows reduced operating loss and $2 billion in cash and marketable securities.

- The company’s store count is decreasing, but it has a growth multiple despite shrinking core operations.

- The rally could easily continue, despite lacking a clear fundamental case.

Dennis Diatel Photography

Things are really heating up at GameStop (NYSE:GME). The (in)famous WallStreetBets darling surged 21% yesterday (~100% in the premarket even). According to Seeking Alpha the rally appears to be the result of Keith Gill, aka Roaring Kitty, sharing a screenshot buying ~$100 million in stock and 120,000 June 21 $20 call options.

Keith Gill is known as the original WSB trader to start pursuing GameStop. He had actually made quite a few YouTube videos about his fundamental investment process and reasons for initially investing in GameStop at a point where it was quite reasonable to argue it undervalued even though its primary business of selling game related hardware is challenged.

As the crazyness is starting again, and it is becoming a common topic of conversation, I checked in with the fundamentals of GameStop as well as some technicals that I expect important.

Over the years, there’s been so much news around CEO’s, activist shareholders and pivot plans that the first thing I looked at is their current plan. I actually like that it is pretty concise. There is some typical meaningless corporate stuff in there like “We aim to be the leading destination for games and entertainment products through our stores and ecommerce platforms,” but there’s also the simple, clear and more realistic:

Achieve Profitability. During fiscal 2023, we continued to optimize our cost structure to align with our current and anticipated future needs. We will continue to focus on cost containment as we look to operate with increased efficiency.

And then they want to leverage their brand. I don’t love that as a strategy. In my opinion, a brand is something to utilize in order to reach strategic goals or that happens in the pursuit of strategic goals. I don’t think it should ever be pursued for the sake of itself. Yet, at the same time, it is a good thing GameStop leadership is aware of their brand equity and that it may be possible to repurpose or to extend to activities beyond their core shrinking market.

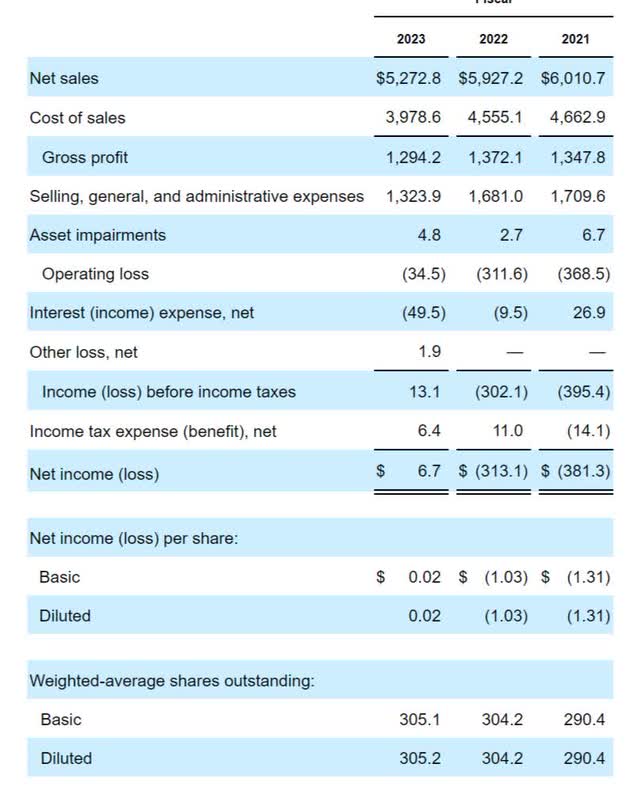

The last annual report shows the company’s operating loss is very modest and significantly reduced compared to prior years:

GameStop earnings (GameStop 10-K)

The company opportunistically sold shares into the initial 2024 frenzy and raised $900 million at around ~$20 per share. This means it should have around $2 billion in cash and marketable securities about now.

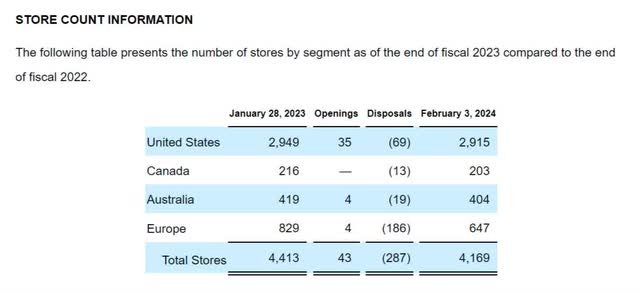

The store count is decreasing, especially outside of the U.S. where the company doesn’t have the same scale:

store count GameStop (GameStop 10-K)

This is often wise if you’re a loss-making retailer. Especially if reselling. Theoretically, you’d want to close the unprofitable locations and retain the profitable ones. In practice, lease terms also play a role, and often it is best to close stores at the end of a lease. Alternatively, in tough real estate markets, it may be possible to renegotiate upcoming leases which can swing an unprofitable location towards profitability.

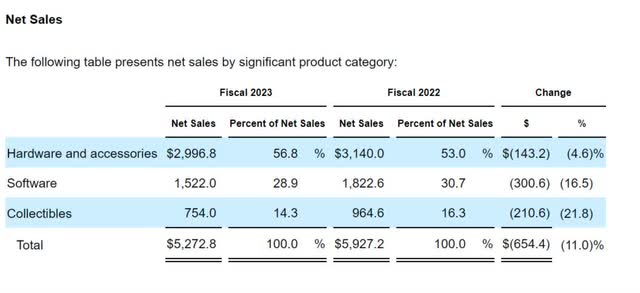

The company doesn’t break out sales in a way that makes it feasible to see whether there are interesting segments or business lines that are early stage but growing. Basically all their segments look bad, although hardware (the most important) is doing relatively well:

sales segmentation GameStop (GameStop 10-K)

I also reviewed the most recent earnings call, and it was exceptionally brief, with no analysts on the call and no Q&A. I like this part, and this appears to be jibe with what I’m seeing in the recent fundamentals:

Rather than standstill, we pivoted last year to cut costs, optimize inventory and focus on enhancing the customer experience. We found efficient ways to improve shipping times, integrate online and in-store shopping experiences, and establish a culture of increased incentivization amongst store leaders and tenured associates. This pivot obviously included headcount reductions as we streamlined operations and cultivated a fast-paced intense operating environment geared toward cost containment, efficiency and profitability.

It also resulted in the most recent quarter having a green bottom line with net income of $48.2 million. A vast improvement to the year previous loss of $147.5 million.

Given most of this profit comes on the back of what is a declining core operation, it seems hard to justify the current valuation of ~$8 billion (jumping to some $14.4 billion pre-market). The company is sporting a growth multiple while it is actually shrinking. Possibly, there are attractive growth segments hidden within the awkward legacy segmentation, but as of, yet, I don’t see it.

Having said that, the company doesn’t have a meaningful amount of debt (just leases) and should have around $2 billion in cash and marketable securities after the latest raise. It also has a bit over $500 million worth of net-operating-loss carry forwards that can be valuable under the right circumstances.

I get that this may not be traded on fundamentals. I just wanted to see what’s actually going on. Originally, the story around GameStop involved hedge funds having focused positions shorting the retailer and getting squeezed out of their positions by the frenzy. When a company can issue shares into a squeeze it actually gets to raise money of short sellers who are often forced buyers (for risk management reasons) and this can temporarily push a share price far beyond what any market observer considers a reasonable fundamental value.

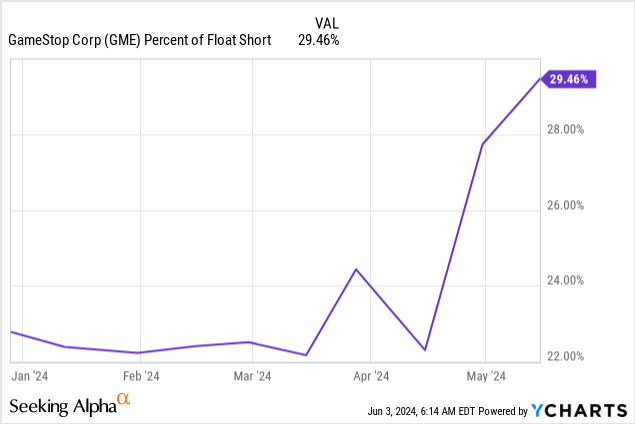

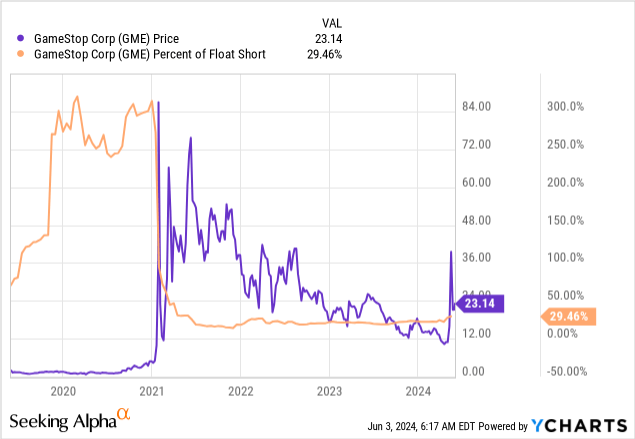

Short interest as a percentage of float had been building throughout 2024 again, although it is nowhere near the level it reached during its previous epic squeeze.

During the 2021 squeeze, the percentage was much higher:

Back then, I interviewed Lily Francus about the dynamics around these meme stock squeezes, which was somewhat enlightening. She gave me some guidelines whether memes could work, and these included:

-

A catalyst (it could be the recent turn to profitability)

-

Salience (GameStop is clearly a company that has a tremendous amount of mindshare especially relative to its trivial economic importance)

-

Humor (Roaring Kitty is bringing the humor, and mystery, back to this name).

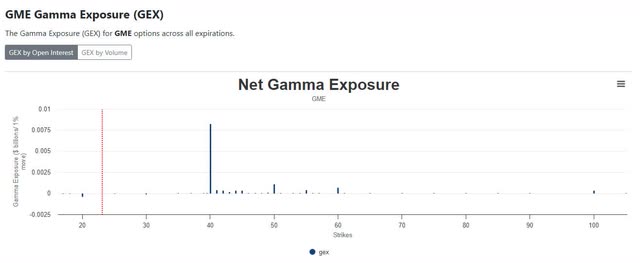

Finally, during these squeezes, option positioning can also reveal information or be important to determine where the stock is more likely to go and where it is less likely to go. The gamma profile of the option positioning suggests the stock could gravitate towards $40, but a lot depends on how the positioning evolves as well:

GameStop gamma exposure (optioncharts.io)

It will be interesting to see whether option positioning starts building towards higher strikes, as it could increase the odds of an extension of these recent moves.

Fundamentally, I don’t think there is a solid case here but, over the years, I’ve learned my lessons trying to short meme stocks. From the option positioning, I’d say it is more likely $40 is a soft ceiling in the short term.

Yet, everyone who wanted to short this probably already did. But the attention and price action could entice traders to try their luck again on the long side. Continued action would be somewhat reflexive in the sense that the high stock price makes the company issue shares, which dilutes the upside but also increases its cash cushion. The earlier people establish positions, the more they benefit from fundamentally questionable rallies and subsequent capital raises.

I’m not inclined to participate on the long side. It is too volatile and unpredictable for my liking, and I don’t have enough confidence the rally is likely to continue towards $60. What I did do is to sell a small amount of short-dated out-of-the-money puts. Their pricing reflects the very high volatility in the name. I can imagine the stock giving up most of the gains, but possibly option markets overestimate the likelihood it will fall below $10 given the cash raised through fresh stock issuance and the optionality of that being repeated.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GME either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm exclusively long through short-selling a very small amount of short-dated puts.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign up here for a 14-day free trial of my weekly premium trade & investment ideas. Discover the best things I can find in this market. Unique and hard-to-find ideas, selected based on the presence of edge, outstanding risk/reward and being uncorrelated or being less correlated to the S&P 500.