Summary:

- The 8x forward sales multiple takes into account Rocket Lab’s promising growth prospects and substantial backlog of contracts.

- Despite the current volatility in revenue growth, the company’s strong balance sheet provides stability for future investments.

- Rocket Lab’s advancements with its Neutron rocket and expanding capabilities contribute to its long-term value.

- The 8x multiple reflects a balance between the risks and opportunities inherent in the company’s growth trajectory.

ZargonDesign

Investment Thesis

Rocket Lab (NASDAQ:RKLB) is making all the right moves, growing its revenues, and working hard to contain its losses. That being said, the stock isn’t particularly cheap at 9x this year’s sales, particularly when we consider that predicting what its revenue growth rates will be like in 2025 is a challenge.

Will investors still be as keen to pay 8x forward sales when in 2025 its revenue growth rates significantly decelerate relative to 2024?

On the other hand, the business has a strong balance sheet that will allow it to continue to invest in its future prospects.

Altogether, this is a tepid buy.

Why Rocket Lab? Why Now?

Rocket Lab is more than just a rocket launch company. It operates across several key areas in the space industry.

Initially, Rocket Lab’s Electron rocket offers small, flexible launch services for various satellites. They’re expanding into medium-sized launches with their Neutron rocket to challenge existing market monopolies.

Beyond launching, Rocket Lab also builds and delivers spacecraft and associated systems, including critical components and software, supporting both commercial and government missions.

Their goal is to leverage their end-to-end capabilities to control both launch and space systems, ultimately providing valuable data and services from space, which they see as the most lucrative part of their business.

Next, Rocket Lab is showing strong growth, driven by a rise in launches and an expanding space systems business. Their backlog of contracts exceeds $1 billion, indicating strong future revenue potential.

Additionally, Rocket Lab is making significant progress with its Neutron rocket, expected to launch mid-next year, positioning them well to tap into the growing demand for medium-sized launches and further disrupt existing market dynamics.

And yet, Rocket Lab faces challenges in reaching profitability. The company must navigate the inherent volatility of the launch business, where its revenue is recorded irregularly when the rocket is launched. This unpredictability of its revenue growth rates can compress the multiple that investors are willing to pay for the company.

Moreover, building and scaling new rockets like Neutron requires substantial investment in production and infrastructure, which puts pressure on the company’s finances.

Now, with this balanced background in mind, let’s discuss its fundamentals.

Rocket Lab Could Grow at More than 30% CAGR

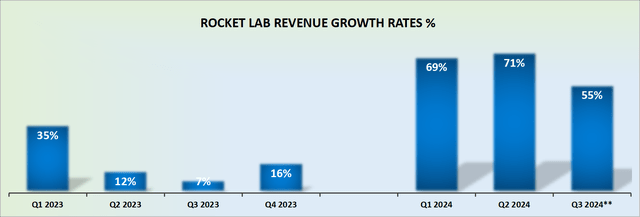

RKLB Revenue Growth Rates -Author’s Work

The graphic above echoes my previous contention that Rocket Lab’s revenue growth rates are challenging to forecast.

What’s more, as noted in its SEC filing, Rocket Lab’s revenue growth can be quite volatile because it relies on long-term contracts, plus project-based work.

Revenue from these contracts can sometimes be recognized when a project milestone is completed. This means that if there are delays, cost changes, or issues with contract performance, it can significantly impact when the revenue is recorded, leading to fluctuations in reported revenues and associated profits from period to period.

In short, I would caution investors from reading too much into these growth rates of more than 50% and extrapolating them too far into 2025.

RKLB Stock Valuation – 8x This Year’s Sales

In the first instance, we’ll discuss the positive aspects of its valuation before turning to discuss the main negative aspect.

Including Rocket Lab’s long-term marketable securities, its balance sheet is in a net neutral position, meaning that its debt and cash roughly balance each other. More specifically, with more than $400 million of cash and marketable securities available, Rocket Lab is well-placed to continue to invest in its future prospects.

The negative aspect is that the business doesn’t appear to be gaining much in terms of operating leverage. Case in point: Last year’s Q3 saw its revenues reach roughly $68 million, which ended up with approximately $16 million of EBITDA losses.

While this year’s Q3 is expected to see its revenues increase by close to 55% y/y, while its EBITDA losses are expected to double y/y to around $32 million. That is not a scalable business. Or at least not yet.

Consequently, I find it difficult to be very bullish on a business that’s struggling to gain operating leverage. I know that those businesses that seek growth for the sake of growth are in favor only so long, particularly when they have an alluring narrative. But after a while, investors turn around and ask, when are you going to reach profitability? And that’s a problem.

On the other hand, one of its main costs is R&D. So, given that Rocket Lab’s revenues are climbing at more than 50% y/y, while its R&D is growing at a slightly slower rate of around 30% y/y, I believe that the business is scaling, even if less than desirably so.

In fact, note that last year’s Q3 saw its non-GAAP gross margins report at 29.5%, while this year’s Q3 is guided toward 30% to 32%, which is yet another point that reinforces that this business’ scalability is moving in the right direction. Even if Rocket Lab is still some time away from pivoting toward breakeven.

On balance, I believe that this young growth business is reasonably priced at 8x this year’s sales, notwithstanding the questions surrounding its path to profitability.

The Bottom Line

Paying 8x forward sales for Rocket Lab is reasonable because, despite its current financial volatility, the company shows strong growth potential and a solid balance sheet, with a net neutral position.

With a significant backlog of contracts and advancements in their rocket technologies, Rocket Lab is positioned to harness future revenue opportunities.

Its valuation reflects a balance between current uncertainties and future possibilities – keeping us on a steady trajectory, even if the journey involves a few bumps along the way. A tepid buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.