Summary:

- Rocket Lab has a strong investment case due to the growing market for small satellite launches and the advantages of its Electron rocket.

- Despite an increase in launch activities, there has been no significant positive impact on gross margins.

- Rocket Lab is diversifying its customer mix, expanding its launch capabilities, and booking solid progress, making it a good stock to buy.

Olemedia

In November 2023, I covered Rocket Lab with a buy rating, and while I am bullish on the prospects of the company, we saw Rocket Lab (NASDAQ:RKLB) stock gain less than 2% compared to a 16.7% for the S&P 500. That is not the return that I am looking for on investment opportunities, but I believe that the stock had plenty of positives since my November coverage, and in this report, I am revisiting the prospects of Rocket Lab.

The Investment Case For Rocket Lab

The growth drivers for Rocket Lab seem rather clear. There is a huge market for small satellite launches and the Electron rocket decouples smaller satellite launches from ride-sharing launches on the bigger payload rocket, where the smaller satellite would be a secondary payload. This decoupling is important as it decouples the secondary payload from risks of schedule slides on the primary payload. Furthermore, the Electron rocket is optimized for smaller payloads, which also brings the launch costs for smaller satellites down compared to launch costs as a secondary payload. With commercialization trends in space and a growing number of small satellite launches, there are significant opportunities ahead for Rocket Lab to capitalize. For Rocket Lab, scaling up its launch activities will provide better gross margins and will eventually allow the company to reach a break-even and march towards profitability.

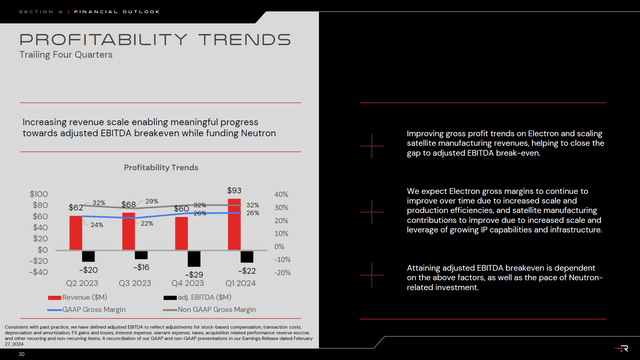

Rocket Labs: A Lot Of Good News

Looking at the results, we see that sequentially, there is an improvement in GAAP gross margins but non-GAAP gross margins are relatively stable. So, we are not quite seeing any positive impact from higher launch activities. In Q2 2023, there were two launches followed by three in Q3 (of which one failed mission) and Q4 had one launch. So, six launches from Q2 through Q4 2023, and in Q1 2024, there were already four launches, but we did not quite see any positive impact on the margins even though sequentially there was an increase in launch revenues from $8.5 million to $32.7 million.

So, perhaps in terms of gross margins the upside on the current scaling is not huge, but it should be noted that in Q2, there are 4 launches of which one already occurred. For the full year, there are 22 missions sold. Eight are planned or executed in H1, which would leave another 14 for the second half of the year, although we expect a slide in some launches driven by the challenging environment for satellite production. Even if only half of the H2 launches materialized, we would still get to 15 launches for the full year, and I believe that will eventually provide better fixed cost absorption.

It is also important to note that the company is currently developing the Neutron rocket, which will have a significantly higher payload capability. Launches of that kind will provide significantly higher revenues to Rocket Lab, with operational capability expected in 2025. Rocket Labs is absorbing the costs for that now as seen in the elevated EBITDA losses, but I view it as a positive that as Electron mission launches increase and provide better cost absorption, Rocket Lab is already working on adding to its launch capabilities.

Furthermore, the company has a Space Systems segment that saw revenues increase 16.5% to $60 million driven by its agreement with MDA and the company was awarded a $0.5 billion contract by the Space Development Agency to design and build 18 Tranche 2 satellites. So, we see the company also active as a prime contractor for the government, as well as providing up to $150 million worth of solar cells to another space prime contractor.

Putting it all together, we see that Rocket Labs is diversifying its customer mix between civil and defense applications, it is working on expanding its launch capabilities while Electron launch activity is on the rise. While the SDA contract is a fixed price contract, transferring risk of cost overruns to the contractor, I believe Rocket Lab is expanding its activities and customer pool in a way that should help the company grow significantly in the years ahead.

Is RKLB A Good Stock To Buy?

|

2024 |

2025 |

2026 |

2027 |

|

|

Revenues |

$437 |

$616 |

$889 |

$1,160 |

|

Shares outstanding |

494.0 |

494.0 |

494.0 |

494.0 |

|

Revenue per share |

$0.88 |

$1.25 |

$1.80 |

$2.35 |

|

P/S=7.7x |

$6.83 |

$9.63 |

$13.89 |

$18.13 |

|

Upside |

54% |

117% |

212% |

307% |

|

P/S=6.1x |

$5.40 |

$7.62 |

$10.99 |

$14.35 |

|

Upside |

23% |

72% |

147% |

222% |

|

Average |

$6.11 |

$8.62 |

$12.44 |

$16.24 |

|

Upside |

38% |

94% |

180% |

264% |

Valuing Rocket Lab is tricky, the company has no positive EBITDA, so the first method to value the stock is based on the median and minimum P/S-ratio mapped against the revenue projections for Rocket Lab. Averaging this out gives us a $6.11 price target, representing 36% upside. Wall Street analysts have a $7.57 price target for Rocket Lab, which closely resembles the averaged targets for 2025.

An EV/EBITDA valuation in line with industry peers would suggest that the stock is fairly valued at current prices.

Conclusion: Rocket Lab Value Is Hard To See, But The Company Is Booking Solid Progress

With negative EBITDA, it is hard to see what the value of Rocket Lab is and that is not solely because the business is unprofitable at present or in the coming years but also because there are many positives that are translating to the company’s results. Some translate faster than others. Overall, I do like the business. It is unreasonable to expect the company to be profitable in the near future, but we see a lot of strong elements that should pave the way for a bright future.

The Space Systems segment is one of them with a contract with MDA, which I previously covered. Furthermore, Rocket Lab was selected as the prime contractor by the Space Development Agency, Electron launches are scaling up, and Neutron development is underway. Those are all positives that are expected to materially improve results with scaling in the second half of the decade. Based on these growth drivers, I am maintaining my buy rating for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.