Summary:

- Rocket Lab recently shared positive updates about the development of its upcoming Neutron rocket.

- This article examines these updates more closely, and considers the potential financial impacts of successful Neutron development.

- Overall, I maintain a strong buy rating for RKLB stock.

ZargonDesign

Rocket Lab (NASDAQ:RKLB) reported Q2 earnings earlier this month, when it also shared updates about the development of its upcoming medium-lift Neutron rocket. In this article, I take a closer look at these Neutron updates, which are quite encouraging and suggest good odds that Neutron could see its first test flight in 2025 (as currently planned by Rocket Lab). I also discuss some ways in which successful execution of the Neutron development program could impact Rocket Lab’s financials in the coming years. Overall, I maintain a strong buy rating for RKLB stock.

Q2 Neutron Updates

In my view, in the earnings call and results presentation, Rocket Lab shared two updates about Neutron development (both of them positive) that are critical for investors to note.

First, Rocket Lab reported that the Archimedes engine, which is to power the Neutron rocket, has successfully undergone a slew of tests culminating in a successful hot fire test at 102% power. Management also reaffirmed that the engine being tested is not an early prototype but rather a flight-ready design. CEO Peter Beck stated:

We also made a very conscious and strategic decision right from the outset to design a flight engine and put something on the engine test stand that was designed to be flight ready. It’s fairly common to see downscaled engines or early stage prototypes used for a couple of years before companies actually move into putting something on the stand that could fly. But we didn’t do that.

Rocket Lab Archimedes Engine Update (Rocket Lab Q2 2024 Earnings Presentation)

Rocket Lab Archimedes Engine Update (Rocket Lab Q2 2024 Earnings Presentation)

When Rocket Lab was gearing up for the Archimedes test campaign a quarter ago, here is what I had written:

The Archimedes test campaign should give investors further clarity (one way or other) about Neutron over the next couple of months. The engine is the most difficult part of a rocket, so if Archimedes performs reasonably well during testing, then Rocket Lab could have a good shot at launching Neutron next year. Of course, if Archimedes does not perform sufficiently well, then there could be further delays.

Based on the recent update about Archimedes, it appears that testing has gone well. Management also reaffirmed the mid-2025 target for the first launch on the earnings call. Given that the engine was the biggest risk for timely Neutron development, the success of the Archimedes test campaign suggests that the most significant risk of delay in the Neutron development timeline is now greatly diminished (although not zero, since new issues could potentially arise that have not yet been identified in testing).

Of course, developing the rest of the rocket is certainly not a trivial task, so there is still some risk that Neutron’s inaugural flight could be delayed if Rocket Lab encounters a problem with some other element of the rocket.

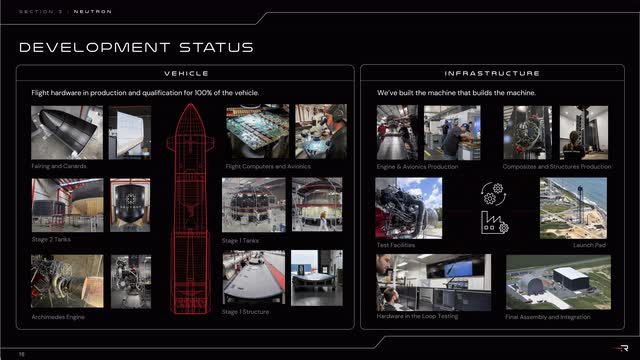

Which brings us to the second critical update about Neutron: Rocket Lab informed investors that the entirety of Neutron is now in production and qualification, as shown in the slide below.

Rocket Lab Q2 Neutron Development Update (Rocket Lab Q2 2024 Earnings Presentation)

Readers can compare this quarter’s update against last quarter’s (shown below), when only some of the larger structures for Neutron were in production.

Rocket Lab Q1 Neutron Development Update (Rocket Lab Q1 2024 Earnings Presentation)

Here is what CEO Peter Beck had to say on the topic:

I’m pleased to confirm we’ve largely progressed past the design phase and we’ve moved swiftly into production and qualification of flight hardware for 100% of the vehicle. With flight articles now coming together, we’re on track to first launch for mid-next year.

Again, this update seems to be very positive in terms of suggesting that Rocket Lab can launch Neutron sometime next year. Given Rocket Lab’s years of experience with the Electron rocket, the company does have a good track record with carbon fiber manufacturing, flight computers, software, etc. As such, I would say that these elements of Neutron’s design and production are somewhat less worrisome than the (totally new) engine design. Of course, there are a lot of pieces to the puzzle and Rocket Lab could still run into problems here, but for now, they seem to be on track to meet their target of a 2025 launch.

Overall, then, Rocket Lab seems to be executing very well on the Neutron development front. Investors should remain cognizant that rocket science is very difficult and setbacks and delays are always possible, so we will have to monitor closely how things progress in the coming quarters. But for now, the signs are quite encouraging that Neutron’s first launch is on the horizon and could take place within the next 12 months (or perhaps a little longer).

The Financial Impact Of Neutron Development Completion

There are three significant ways in which the eventual completion of development for the Neutron and associated infrastructure could positively affect Rocket Lab’s financials over the coming years.

First, Rocket Lab’s operating expenses — particularly its research and development costs — should decline as Neutron development approaches completion. At the moment, R&D costs are still increasing as Neutron development gains steam. Rocket Lab guided an $11-13 million quarterly increase in total (non-GAAP) operating costs in Q3, “driven primarily by continued Neutron investment into staff costs, prototyping, and materials.” The company also expects a further increase in Q4.

But eventually, there should be a scaling back as Neutron development reaches completion. Here is what CFO Adam Spice stated on the earnings call:

We would expect that spending would start to trail off, obviously as we start to approach first launch of the vehicle, which we are talking about middle of next year. So I think we probably still have… I’d say one quarter of kind of increased spend kind of velocity, and then perhaps it starts to kind of plateau and then trail off as we approach the first launch.

I think that this expectation makes sense. A significant proportion of current Neutron R&D spending is aimed toward fixed costs including the rocket design, capital investments for production tools, and construction of the launch facility. These costs should all tend to wind down as the design is finalized, production lines are fully operational, and the launch site and associated infrastructure are completed.

I do still expect some significant R&D costs beyond the first test flight, depending on how many attempts Rocket Lab needs to achieve success (each attempt will presumably require building a new Neutron rocket). Still, if Neutron achieves a successful flight within, say, the first 3 or 4 attempts, then I would expect Rocket Lab’s R&D spending to decrease quite substantially by some point in 2026. And as R&D spending winds down, this should move Rocket Lab closer to profitability.

Second, the completion of Neutron’s development should, of course, affect Rocket Lab’s top line. Neutron launches are expected to have a price tag around $50 million/launch, so successful completion of Neutron development could have a very significant impact on the company’s financials.

Currently, Rocket Lab’s run-rate revenue is about $400 million/year. If the company could reach a cadence of 4 Neutron launches/year in, say, H2 2026 or 2027, then that would represent 50% revenue growth compared to today. And a cadence of 8 Neutron launches/year in, say, 2027 or 2028 could represent a doubling of revenue compared to today. And so, although I do not expect any Neutron launch revenue until 2026, the potential is there for rapid revenue growth for Rocket Lab if Neutron can achieve even a fairly modest launch cadence.

Finally, third, the completion of Neutron development should allow Rocket Lab to pursue opportunities in space services. This has been part of Rocket Lab’s plan since the company went public, but the plan requires Neutron to be operational. With Neutron on the horizon, it now seems possible that Rocket Lab could start making inroads into space services in 2027 and beyond.

It is difficult to say at the moment how much revenue or profit Rocket Lab could generate on the space services front, especially as management is still “not ready to talk about what particular applications that we’re pursuing.” But Rocket Lab should at least have a cost advantage over many competitors due to its in-house launch and satellite manufacturing capabilities, so it does seem to me that Rocket Lab could potentially meet success here in a few years. As such, although there is currently too much uncertainty to say much with confidence, space services should be intriguing for long-term investors.

Conclusion

Rocket Lab continues to make significant strides in the development of its Neutron rocket. Of course, as I have discussed, the financial impact from Neutron is probably still a couple of years away (assuming development continues to progress reasonably well). However, markets are forward-looking and Rocket Lab’s share price has reached 52-week highs since the company’s Q2 earnings. I expect that the strong performance for RKLB shares is owed at least in part to the positive updates about Neutron, leading to improved investor sentiment and higher expectations for the future.

If Rocket Lab continues to execute well on the Neutron development front, I think we could see Rocket Lab’s share price continue to strengthen over the coming quarters, especially once the first Neutron rocket arrives at the launchpad for its inaugural test flight. Meanwhile, Rocket Lab’s Electron launch and space systems businesses also continue to perform very well, and Rocket Lab delivered record revenue in Q2 (up 71% year-over-year). Continued strong performance by these segments could also further bolster share price.

Given the positive updates about Neutron, as well as the continuing progress across the company’s businesses, I think there is a lot to like about Rocket Lab over the next couple of years (and perhaps beyond). The odds seem good to me that Rocket Lab stock could generate strong returns over this period. Therefore, overall, I maintain a strong buy rating for RKLB stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.