Summary:

- Rocket Lab’s Q3 results show 55% revenue growth and raised guidance, but the company remains unprofitable, posing risks for investors.

- Despite QoQ revenue decline, RKLB’s stock surged due to optimistic Q4 guidance and strong market sentiment.

- The space industry is poised for growth, with RKLB well-positioned as the second-best company, despite competitive pressures from SpaceX.

- Valuation is challenging, but RKLB’s potential profitability by 2027 and strong balance sheet suggest significant upside, though short-term pullbacks are possible.

John M Lund Photography Inc

Thesis Summary

Rocket Lab (NASDAQ:RKLB) just reported its Q3 results, and the stock is up around 20%. In fact, RKLB is up over 100% in the last month alone, and over 230% in the last year.

This lesser-known player in the space sector is taking the industry by storm thanks to its revolutionary technology.

The proof is in the pudding, with revenues up 55% and increased guidance. However, the stock remains unprofitable, so investors may have to watch out for it.

Arriving at a clear valuation is hard for such a young company but with the current market sentiment and the founder of SpaceX, Elon Musk, now officially running the Department Of Government Efficiency, this could be the start of a great run for RKLB.

Q3 Results

RKLB has pleased investors with their latest earnings, growing revenues by 55% and raising guidance.

But, before we get into that, what does RKLB do exactly?

RKLB provides launch equipment, manufacturing and other services within what we could call the space industry.

RKLB is actually second only to SpaceX in terms of number of launches. Its signature product is the Electron, the third most launched rocket in 2024. However, the Neutron is the next big thing.

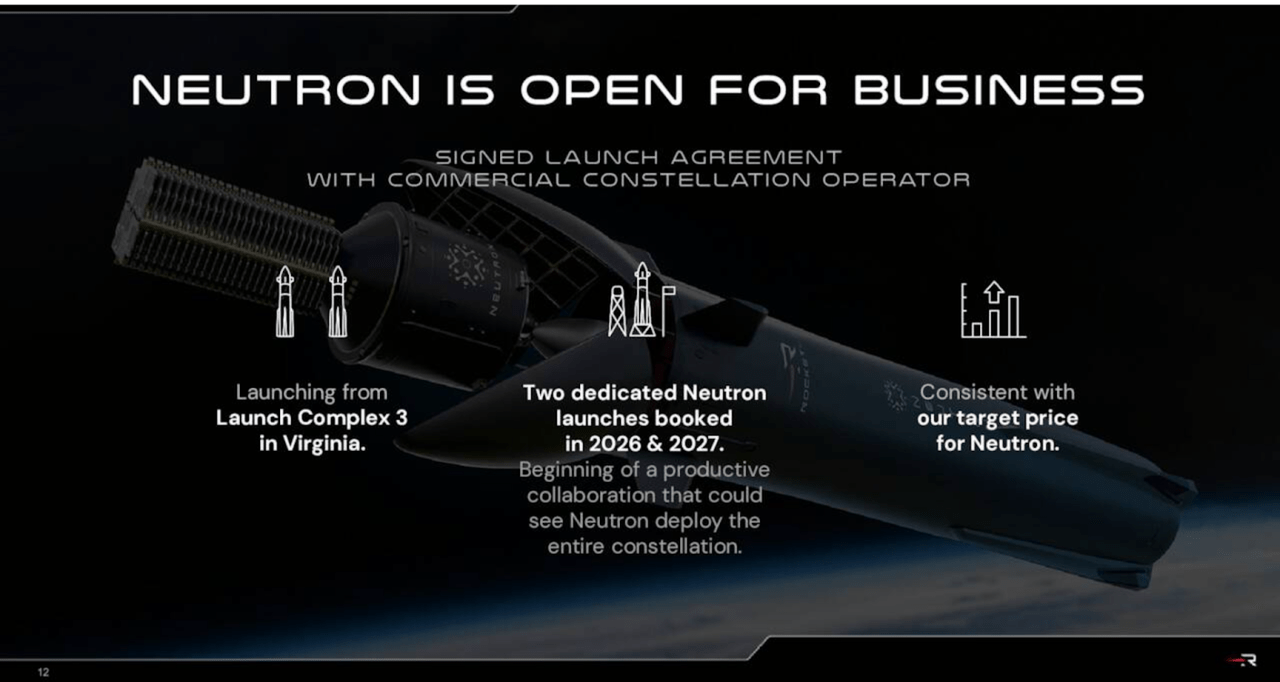

Neutron (Investor Slides)

Now that we know a bit about what the company does, let’s focus on the actual financial results.

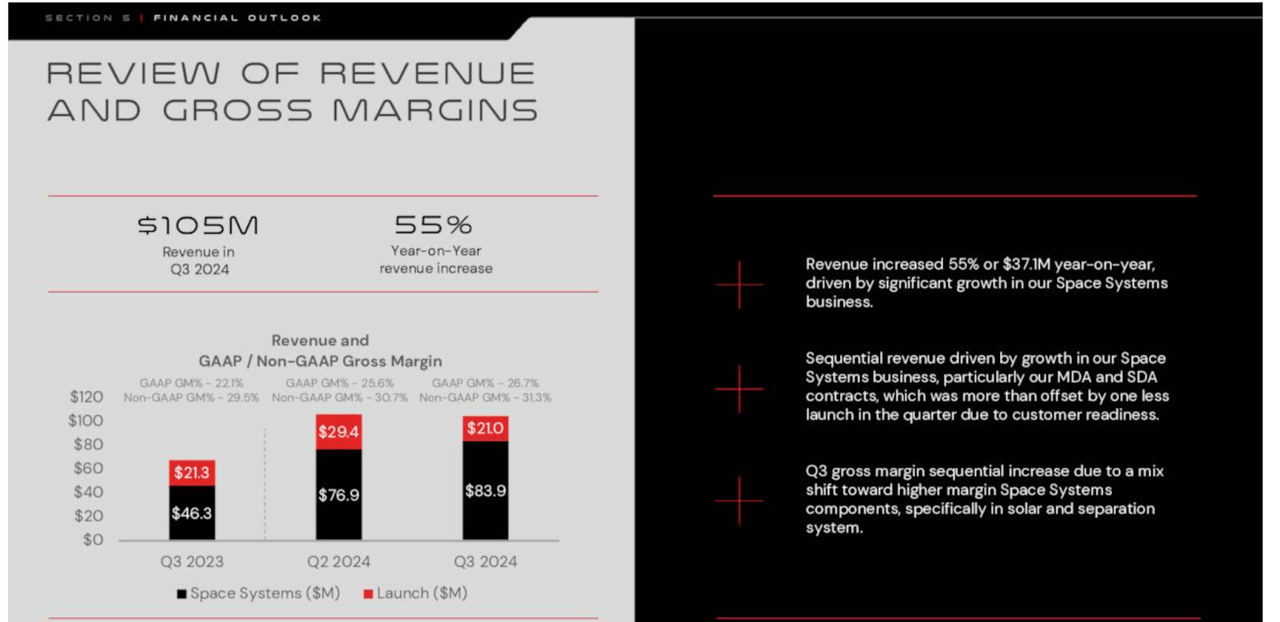

Revenues and gross margins (Investor Slides)

Revenues were up 55% YoY, while margins were marginally slightly improved from last quarter thanks to more Space Systems revenues. However, it is worth pointing out that QoQ revenues actually fell.

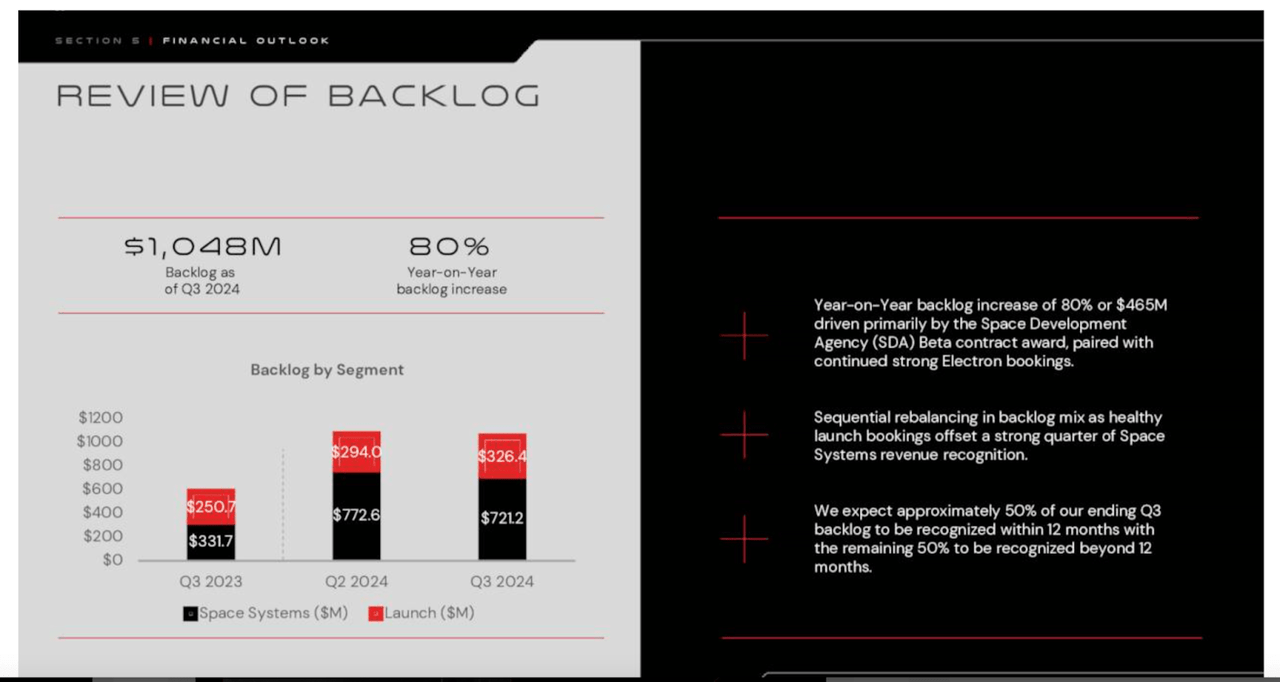

Backlog (Investor slides)

Similarly, we can see bookings grew healthily YoY, but were actually down QoQ. If we break it down further though, we see that Space Systems booking fell, while Launch booking increased. This is actually the reverse of the trend in revenues.

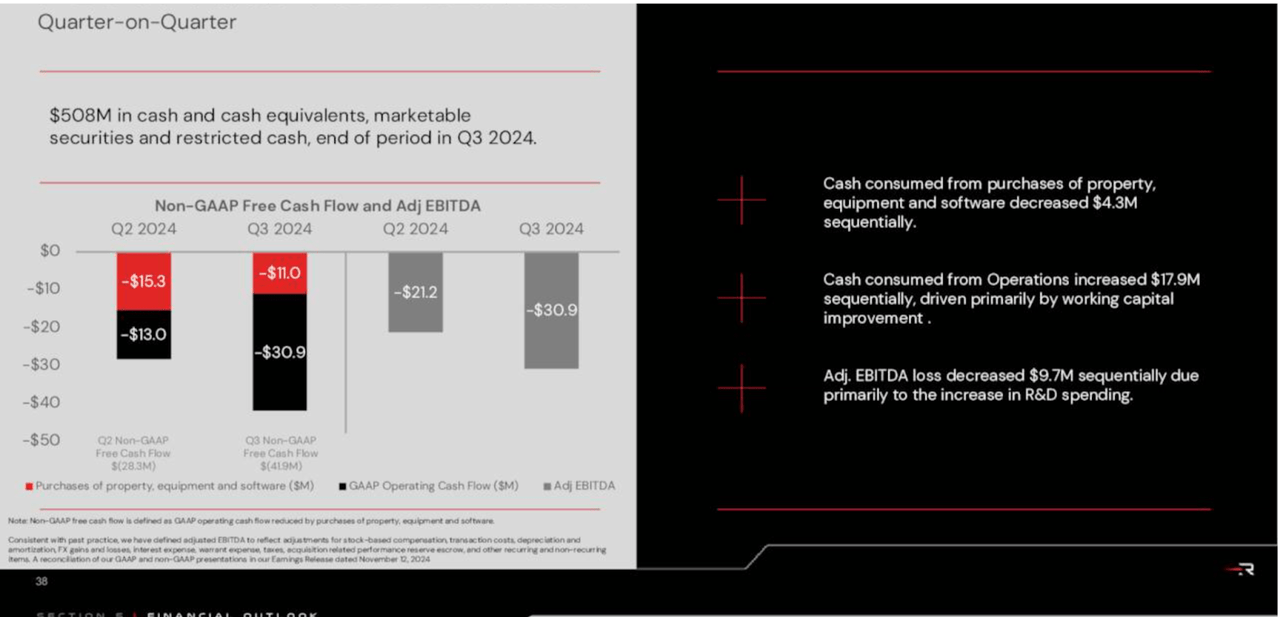

Cash flow and EBITDA (Investor slides)

Overall, the company actually posted a larger loss than last quarter, due primarily to increases in R&D. But of course, earnings are not what the market is looking at right now.

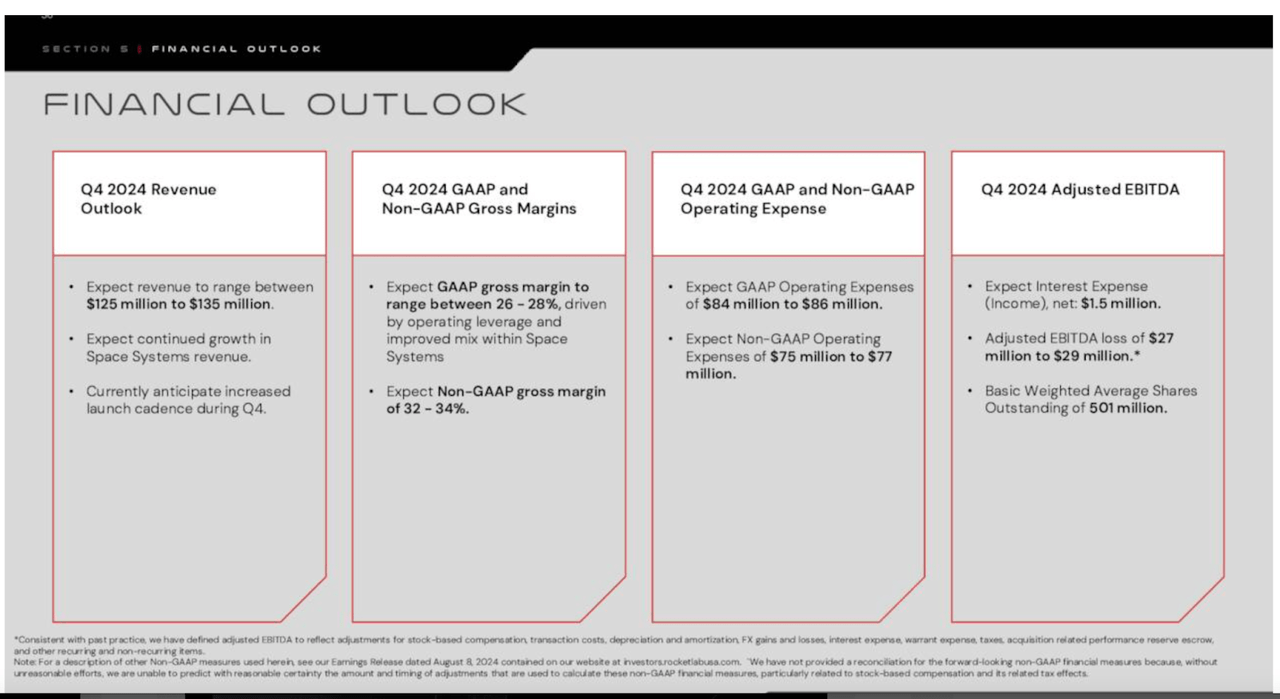

Outlook (Investor slides)

Now, given that revenues actually decreased QoQ and the company is losing money, this rally may surprise you. However, it all makes sense once we take into account the guidance the company laid out for Q4.

RKLB expects revenues of $135 million, roughly a 30% QoQ increase, led by Space Systems revenue, while GAAP gross margin should slightly improve to 26%-28%.

The stock is poised for some explosive growth, and it’s easy to get excited, especially given the current climate.

What’s Next For RKLB?

That’s the question on everyone’s mind. Rocket Lab has shown impressive growth and trajectory. What happens next, will likely depend on how the next few Neutron launches perform.

So I think we’ve been pretty clear about what we expect for Neutron’s launch cadence to be. So obviously, one test flight in the following year three, and then five, and then continue to seven and beyond. And that’s following pretty much the same scaling rate as we saw that we could do with Electron and quite frankly I mean if you look back through history, it’s pretty difficult to see any examples of a scaling rate faster than that.

Source: Earnings Call

Of course, these things take time, but RKLB is rolling this out as quickly as it can.

Overall, this could be an exciting time for the Space Industry. Back in 2019, Trump created the Space Force, the newest branch of the military.

Trump is now set to become the next U.S. President, and he has already officially appointed Elon Musk to lead the Department Of Government Efficiency.

Musk is also the founder of SpaceX and is well known for being very interested in space discovery.

And while you might argue that having RBLK’s main competitors holding a closer relationship with the current administration is bad for them, I think this will be overall great for the whole industry.

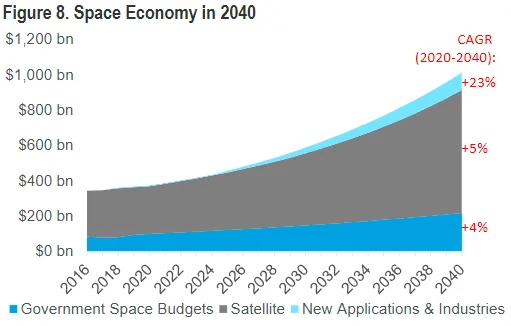

Space Economy Forecasts (Citi)

Current projections by Citi analysts suggest the Space economy could become a trillion-dollar industry by 2040 and RKLB is well-positioned to capitalize as arguably the second-best company in the industry.

Valuation

Arriving at a valuation for RKLB is not easy, but we do know this.

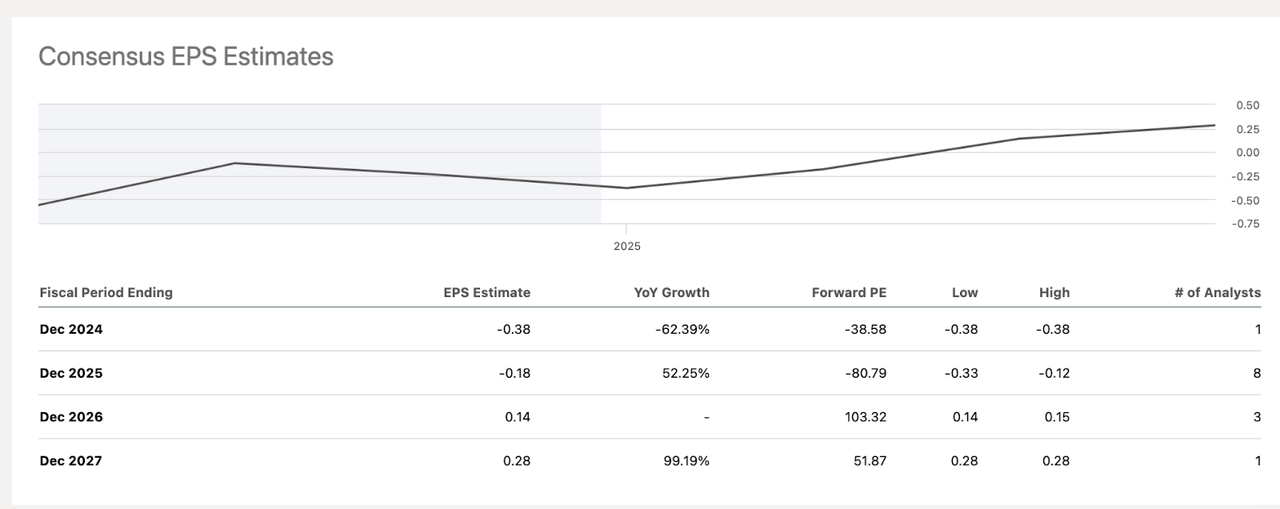

EPS estimates (SA)

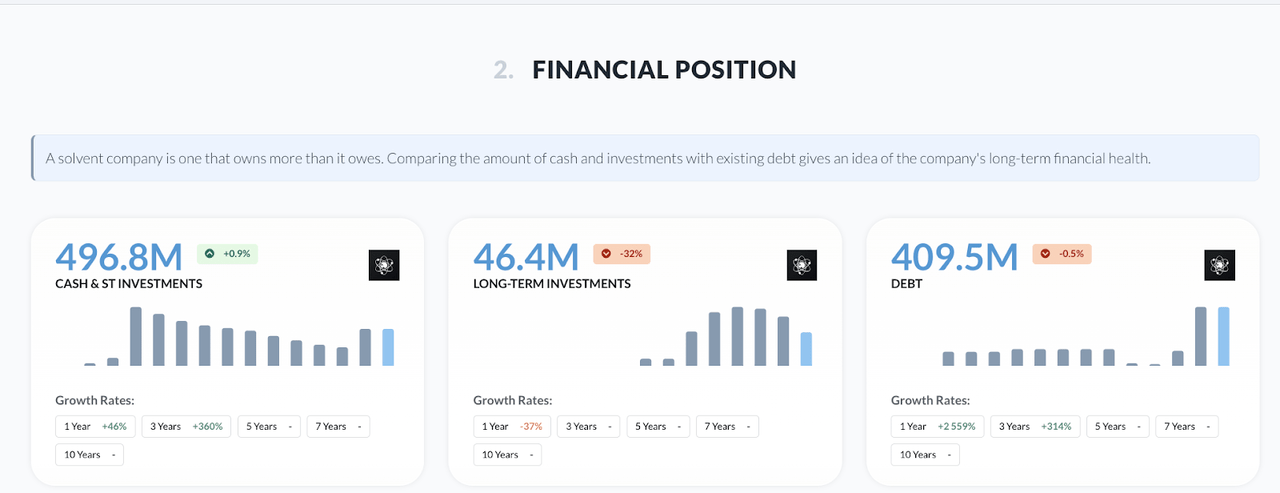

The company is expected to turn a profit by 2027. Paired with its reasonably strong balance sheet, negative net debt and D/E of below 1 help us limit the downside.

Financial Position (Alpha Spread)

The company may very well have to dilute shareholders at some point in the future, but this isn’t uncommon, and many successful companies like Tesla (TSLA) have done this while growing.

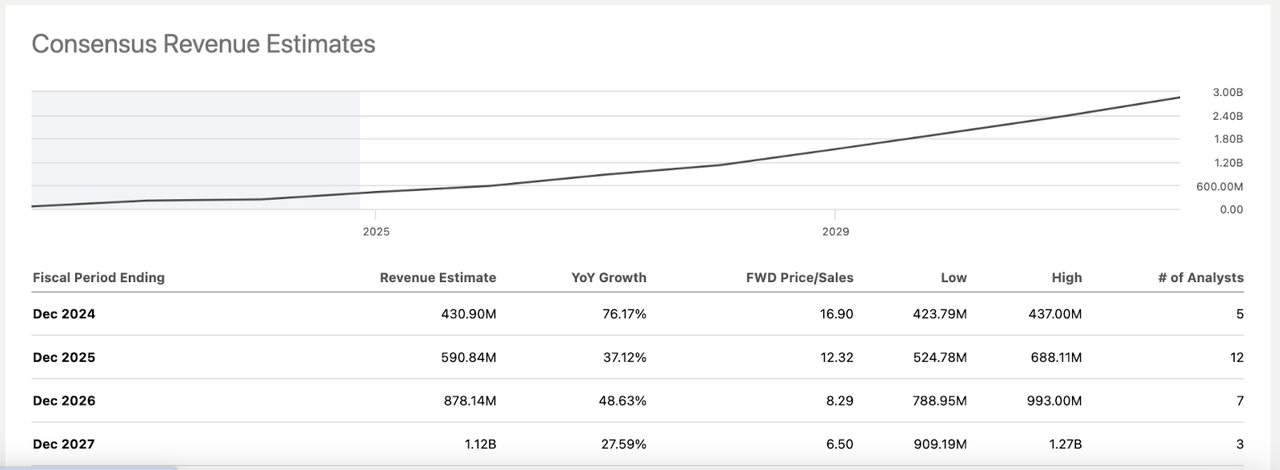

Revenue Estimates (SA)

But we can’t really value the company on earnings, so revenues may be our best tool. After the current rally, we’re looking at a forward Price Sales of nearly 17. However, this quickly comes down as we go out into 2026 and 2027.

If we assume RKLB can turn profitable and keep growing as analysts expect, then we could see the stock trading at least 10x revenues in 2026, if not more, showing there’s definitely some upside left.

Risks

Of course, following this big rally, the stock looks overbought, and we may experience a pullback in the short term as some investors take profit.

We must also realize that the space industry is competitive, and SpaceX has shown some incredible progress in the last year.

Furthermore, all it would take is one failed launch to really dampen investor sentiment, so there’s always that added risk with RKLB.

Final Thoughts

RKLB is doing some great work in the industry, and it’s still a very young company with tons of potential. The price may have gotten slightly ahead of itself, but this is a stock you can DCA into and hold for the next decade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video