Summary:

- Rocket Lab USA, Inc. has significant growth potential with its Electron and Neutron rockets, targeting small and medium-lift satellite markets and deeper space projects.

- Despite negative EBITDA and cash burn, Rocket Lab’s future looks promising with a $1 billion backlog and increasing space system contracts.

- The stock is currently fairly valued against FY24 and FY25 sales, but future growth opportunities are not fully reflected, presenting an investment opportunity.

- Cash burn is manageable, and Rocket Lab’s proven track record should allow it to borrow funds, reducing the risk of shareholder dilution.

Alones Creative/iStock via Getty Images

In May, I covered Rocket Lab USA, Inc. (NASDAQ:RKLB), and the stock has surged 70% since then. It reached the price target based on FY25 revenues at an industry P/S-ratio. In this report, I will be discussing whether there is additional upside from here.

The Opportunities And Risks For Rocket Lab

The growth drivers for Rocket Lab seem rather clear. There is a massive market for small satellite launches and the Electron rocket decouples smaller satellite launches from ride-sharing launches on the bigger payload rocket, where the smaller satellite would be a secondary payload. This decoupling is important as it decouples the secondary payload from risks of schedule slides on the primary payload. Furthermore, the Electron rocket is optimized for smaller payloads, which also brings the launch costs for smaller satellites down compared to launch costs as a secondary payload. With commercialization trends in space and a growing number of small satellite launches, there are significant opportunities ahead for Rocket Lab to capitalize. For Rocket Lab, scaling up its launch activities will provide better gross margins and will eventually allow the company to reach a break-even and march towards profitability.

Rocket Lab

Additionally, the company is developing the Neutron rocket tailored for medium-lift capability, allowing the company to penetrate a new launch market segment. Rocket Lab estimates that by the end of the decade there will be demand for more than 10,000 satellites to be launched, and the company believes it can disrupt the current market with its Neutron launch vehicle.

A third driver of opportunities for Rocket Lab is that it is delivering products for exploration and observation deeper into space. An example is the delivery of Mars-bound satellites.

So, we have growth along the small satellite volume axis, growth in the form of the penetration into higher payload weight launches and deeper space projects. So, this provides growth opportunities and demonstration of capabilities along three axes. The company currently has a backlog of over $1 billion, of which 44% is expected to be delivered in the coming 12 months.

The risks for Rocket Lab include mission or technical failure, as seen earlier this month, which could delay future launches and an inability to scale the business. Adverse weather on launch location, cost overruns and an inability to penetrate new launch segments with new products also belong to the risks for the company. However, these are the common risks with many small space companies.

Rocket Lab Revenues Soars, Neutron Development Underway

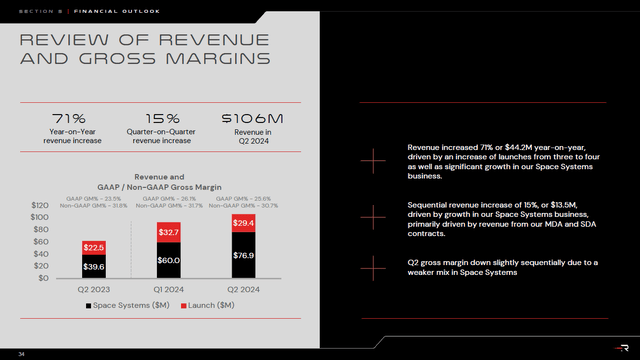

In the second quarter, Rocket Lab facilitated four launches, compared to two launches in the same period last year. While launches doubled, we did not see launch revenues double. Instead, the launch revenues increased 30%. It should be noted that while generally higher launch volumes should result in higher revenues, the growth in revenues does not necessarily need to be proportional to volume growth. This is due to the simple reason that each launch incorporates different customer specifications, and some launches are sold as multi-launch deals, on which Rocket Lab provides a more appealing price to the customer.

The space systems segment is what currently is providing most of the growth, with revenues nearly doubling year-on-year for an overall increase of 71% in total revenues. It should be kept in mind that Rocket Lab is not just a launch service provider. It develops the launchers and launch pads and also provides the launching service. However, it is also more and more involved in developing products to be launched in space. Eventually, this could result in product offerings where Rocket Lab develops a satellite for customers and also launches that satellite on launchers that it developed itself as well, providing a fully integrated solution for customers.

Gross margins increased from 23.5% to 25.6% year-on-year while adjusted EBITDA remained stable sequentially, declining from improving from a $21.7 million loss to a $21.2 million loss. It should be noted that EBITDA losses are currently elevated as the company is also spending money on development of its Neutron launch vehicle. Absent of the Neutron development costs, results would have likely improved, but we don’t know by how much since Rocket Lab does not detail the spendings on Neutron development.

Upside Remains For Rocket Lab

|

2024 |

2025 |

2026 |

2027 |

|

|

Revenues |

$424.6 |

$596.5 |

$886.6 |

$1,170.0 |

|

Shares outstanding |

496.64 |

496.64 |

496.64 |

496.64 |

|

Revenue per share |

$0.86 |

$1.20 |

$1.79 |

$2.36 |

|

P/S=11.2x |

$9.57 |

$13.44 |

$19.98 |

$26.36 |

|

Upside |

26% |

77% |

164% |

248% |

|

P/S=6.1x |

$5.18 |

$7.28 |

$10.83 |

$14.29 |

|

Upside |

-32% |

-4% |

43% |

88% |

|

Average (P/S=8.65x) |

$7.38 |

$10.36 |

$15.40 |

$20.32 |

|

Upside |

-3% |

37% |

103% |

168% |

Valuing Rocket Lab is tricky, the company has no positive EBITDA, I am utilizing a P/S-valuation using the median and minimum ratio mapped against the revenue projections for Rocket Lab. Averaging this out gives us a $7.38 price target, indicating that the stock is fairly valued against FY24 sales and valued at the minimum P/S ratio for FY25 sales. Wall Street analysts have a $7.39 price target for Rocket Lab. So, Rocket Lab currently seems to be valued fairly with FY25 sales at a 6.1x P/S-ratio in mind. However, upside in the years ahead most definitely is not reflected at the minimum P/S-ratio let alone the averaged ratio and that provides an investment opportunity for the years ahead.

Conclusion: Rocket Lab Is Gearing Up For The Future

With negative EBITDA and free cash flow burn of $50 million in the first half of the year, it is difficult to see any current fundamental value in Rocket Lab. However, this is a stock that many look to for their future results, and that future is looking bright with thousands of satellites to be launched by the end of the decade. Rocket Lab can service that with its Electron launcher but also with the Neutron rocket, assuming no delays to service-entry, and it is also receiving more contracts to supply space system architecture. That is something I absolutely like about the company, since it allows the company to provide everything from launch to satellite to customers.

The cash burn is not a major concern of mine, since the company is proven and, as a result, should be able to borrow money when needed, mitigating the risk of shareholder dilution. As a result, I do believe that this is a nice name to be invested in now, and any share price below $7.28 would make the entry point even more compelling.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.