Summary:

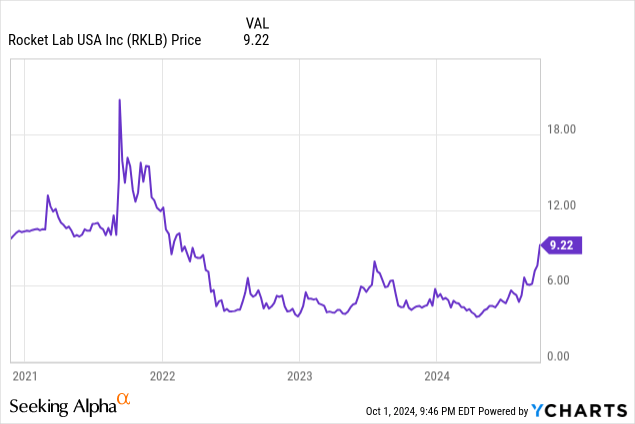

- Rocket Lab’s stock surged over 100% in the past year due to growing investor optimism over the company’s future.

- Neutron is on the horizon and the backlog continues to grow.

- Despite some risks, RKLB looks like an interesting long-term play.

peepo/E+ via Getty Images

Rocket Lab (NASDAQ:RKLB) stock has had a breakout performance over the last 12 months, rising over 100% on investor excitement over a growing order backlog, improving margins, and encouraging progress on the company’s vision of becoming an end-to-end space services company. Though there are some risks with companies like Rocket Lab with lumpy revenue, inconsistent profitability metrics, and potential launch failures, an investor might do well to have a speculative position in this innovative business in a promising sector to diversify their portfolio.

As a quick overview before we get to the analysis, Rocket Lab has two main lines of business: launch services and space systems. Under launch services, the company currently provides custom, timely, and consistent launches using its Electron rocket to customers that want to put small payloads in orbit. Rocket Lab is also currently developing a medium-lift rocket called Neutron, which is expected to make its debut in mid-2025, contingent on flight qualification and successful testing.

The space systems segment covers custom-built spacecraft that Rocket Lab designs for various commercial and government customers like NASA, Globalstar, and a large $515 million contract with the Space Development Agency for an eighteen satellite order.

CEO Peter Beck has a grand vision where these two segments will eventually become a pipeline that leads to becoming a fully integrated, end-to-end space services company. Here’s how he described it on the most recent earnings call:

If you break up the industry, launch is about a $10 billion TAM, spacecraft is about $20 billion. And then services from orbit is about a $320 billion TAM. So if you have the first two, then your ability to compete in the second one becomes incredibly strong.

So to become a complete space services company, Rocket Lab will need to be successful at both launching and building spacecraft first. So, how are they doing?

Succeeding On Two Fronts

The company’s Electron launch vehicle has been a resounding win since its first flight in 2017. The rocket accounted for 64% of all non-SpaceX U.S. launches in 2024 as of early August and pulled in $141 million in contract value in that time. For Q2 2024, the most recent quarter, launch services reported $29.4 million in revenue, up 30% YoY, mostly from Electron launches for small-lift customers. But these results are simply a prelude to 2025 when Neutron is expected to launch. But first, a little background.

The value proposition for Electron is largely that Rocket Lab can tailor a launch to a specific customer’s needs. Without a rocket to fill the gaps between medium-lift and heavy-lift launches, companies that want to launch their small payloads into orbit have to “rideshare” their payloads on the larger launches of others. This means, for example, if a heavy-lift launch is delayed because a customer with a large payload on the rocket needs to delay timing, the company with the small payload just hitching a ride will be delayed as well through no fault of its own. In steps, Electron: customers can now have a dedicated launch for their small payloads that runs on whatever schedule they choose without being at the mercy of other dependencies. This is a valuable niche, but fairly low margin.

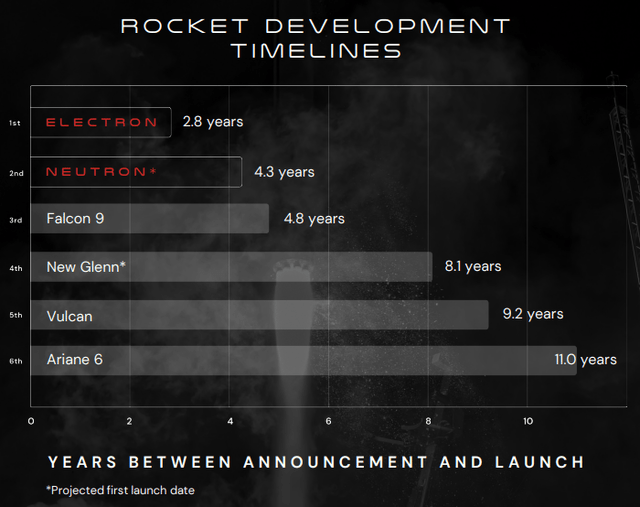

The next stage in development for Rocket Lab is Neutron, a medium-lift launch vehicle with higher margins, higher addressable market, and bigger potential payloads. Initially announced with a mid-2025 completion date, the company confirmed this timeline and announced in its Q2 report that it had completed a successful hot fire test of the Archimedes engine that will be propelling the new launch vehicle. The speed at which the company has gone from the design to testing to production phase has been extremely impressive. Here’s a chart from the investor deck demonstrating just how quickly this development has been:

Rocket Lab Q2 Earnings Presentation

Of course, faster development means lower costs, which is crucial for a company like Rocket Lab that is still in its nascency and needs to be as efficient with its financial resources as possible. Faster isn’t always better in the sense that less testing and refining can mean a worse overall product, but the success of Electron would indicate that, even at this breakneck pace, this might not be an issue with Neutron.

Electron was always going to be a stepping stone to Neutron (and perhaps Neutron will be a stepping stone to a heavy-lift successor?) as the larger launch capacity will provide a higher revenue per launch and increased margins, but the iterative approach to first fill the small, low-margin niche and use that experience to build a larger, more lucrative launch vehicle is paying dividends. For just one example, Electron was designed as an expendable rocket, but since its first launch, work has gone into making it reusable so data and experience from those attempts can be implemented to make Neutron reusable, likely saving millions in costs.

But while launch vehicles get most of the headlines, spacecraft design is actually a much larger part of the current revenue mix. For Q2 2024, space systems reported $77 million in revenue, which was up 94% YoY and represented 73% of total revenue. The interesting part of the current and future timeline for Rocket Lab is that developing the launch vehicles is by far the most capital-intensive part of creating an end-to-end space services company, but there’s not really much to show for it revenue or profit-wise until the big picture can be realized.

By contrast, designing and operating satellites is the “easy” part (in quotes because it’s still extremely difficult), in that it’s less complex, requires less capital, has shorter development times, and can yield revenue within a much shorter timeframe. This makes space systems the perfect bridge to establish customer relationships, gain experience in spacecraft design, and recognize revenue while the rocket science progresses. In fact, space systems represents most of the $1.07 billion backlog the company reported as of the second quarter as revenue from multi-year satellite deployment contract trickles in each quarter contingent on achieving milestones, while customers usually don’t have to book Electron launches all too far in advance.

The arrival of Neutron is when we’ll see operating results really pick up and possibly even positive free cash flow, according to CFO Adam Spice (assuming another capital project doesn’t come down the pipe). This launch vehicle will allow the company to compete with the likes of SpaceX for larger contracts and will get the company closer to the fully integrated supply chain for space services that Beck envisions and that it currently lacks. For example, NASA’s Mars ESCAPADE mission uses a Rocket Lab bus but is launching from Blue Origin New Glenn heavy-lift launch vehicle. The company wants the flexibility to control the launch, the spacecraft that goes into orbit, and eventually, the services provided by that spacecraft. Neutron is a big step towards achieving that goal.

Investor Takeaway

The company’s balance sheet is surprisingly healthy for a company with this little cash generation, at $500 million in cash and short-term investments and $400 million in long-term debt. Equity offerings are always a risk with companies like these that might need to raise capital for investing in the future of the business that might not be available from the debt markets, which is typically okay with me as long as the amount and frequency of secondary offerings are reasonable.

One constant theme throughout this article has been the future and the potential Rocket Lab might have. That’s because, financially speaking, there isn’t much to analyze yet. Neutron will usher in a major new revenue stream and vertical integration that will add the company’s value significantly, but it’s still at least three quarters away and will have to clear many hurdles before it can be deemed a success or a failure. Most signs point to a well-run company with exciting prospects, but there are still risks.

The major one, of course, being that Neutron is either delayed or does not live up to expectations. Rocket development is hard and things go wrong. So far, the company and its engineers have demonstrated an impressive combination of competency and speed that allays my fears of this risk somewhat, but investors should be aware. Other risks include day-to-day share price volatility as lumpy revenue, potential launch failures, (which are almost guaranteed for a completely new launch vehicle) possible stock offerings, and continued cash burn spook investors in the near term.

Despite these risks, I think Rocket Lab’s future is bright with Neutron on the horizon, the company’s experience in designing and deploying high-functioning spacecraft for commercial and government clients, and the imminent vertically integrated supply chain to compete for the growing space services market. RKLB is a speculative stock to be sure, but for those with high risk tolerance and a long-term investing horizon, I rate it a Buy.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.