Summary:

- When it comes to investing in small companies successfully, investors need to be ready to go through periods where improvements to company fundamentals will yield little to no returns.

- Rocket Lab’s stock has declined despite promising developments, including a $515 million government contract and a new deal with Synspective for 10 Electron launches.

- Rocket Lab’s pipeline is strengthening with new contracts, and the company’s Space Systems business is expected to drive growth.

- Rocket Lab’s fundamentals are improving, with revenue expected to accelerate to over $430 million this year and high double-digit growth projected for the next five years, potentially leading to profitability by 2027.

gorodenkoff/iStock via Getty Images

When it comes to investing in small companies successfully, investors need to be ready to go through periods where improvements to company fundamentals will yield little to no returns in the market. This is especially true for small companies that operate in hyper-growth sectors, where investor expectations are often sky-high. As an investor with a focus on small-caps, I have come to terms with this phenomenon, which helps me remain patient with my investments.

Last December, I upgraded Rocket Lab USA, Inc. (NASDAQ:RKLB) after the company won a government contract worth $515 million as I thought the company’s expansion from small payload deployments to large-scale deployments would improve profit margins meaningfully. Despite promising developments ever since, which I will discuss later in this article, RKLB stock has disappointed investors by declining more than 12% since my previous article.

As recently as last week, Rocket Lab announced that it had secured a new deal with Synspective, a Japanese Earth observation company, covering 10 Electron launches. This is the largest Electron deal in the company’s history. This new deal is important not only because of its sheer size but also because it signals that Rocket Lab is a reliable launch solutions provider, as the company has been the sole launch provider for Synspective since 2020. Last March, Rocket Lab successfully completed a launch for Synspective, and two other launches are scheduled for later this year in addition to the newly announced 10 launches.

After revisiting the company, I am more convinced than ever of Rocket Lab’s potential to dominate the small satellite market in the long run, rewarding shareholders handsomely.

The Pipeline Is Strengthening

When it comes to investing in small companies, nothing is more important than revenue visibility. Earnings will dictate terms over the long-term market performance of any company, but during the early stages of a company, focusing too much on earnings-related financial metrics may prove futile.

Rocket Lab’s pipeline has strengthened in the recent past, with the company securing new deals. A few days ago, Rocket Lab completed its 50th Electron launch by launching the first of five contracted launches for IoT company Kineis.

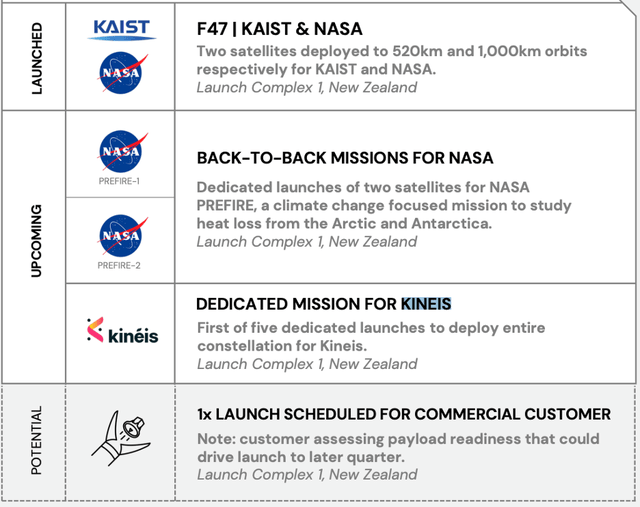

Exhibit 1: Launch schedule for Q2 excluding the two satellites launched for KAIST and NASA

In April, Rocket Lab secured a $14 million deal with the U.S. Space Force, building on the previous government contracts it won last year. In my opinion, these contract wins are not isolated wins anymore; they follow a clear pattern where the USSF and the Department of Defense are increasingly becoming confident of Rocket Lab’s launch capabilities.

At the end of Q1, Rocket Lab’s backlog stood at just over $1 billion after decreasing 3% sequentially. This backlog decrease came on the back of an acceleration in revenue recognized in Q1 in both the Space Systems and Launch businesses. Encouragingly, 42% of the $1 billion in backlog is expected to be recognized as revenue by Q1 2025, which suggests the company has secured near-term contracts with substantial value.

The Space Systems Business Makes Rocket Lab Whole

Rocket Lab may be more popular as a small payload launch solutions provider but the company’s Space Systems business, which is expected to account for the bulk of Q2 revenue ($79 million out of $107.5 million at the midpoint of the guidance), will play a massive role in the coming years in boosting the growth potential of the company. Rocket Lab, through this business segment, offers a one-stop solution for customers where it builds, manufactures, and manages the spacecraft even after launch. The company is targeting customers of all scales and sizes with this business, including commercial customers and government customers.

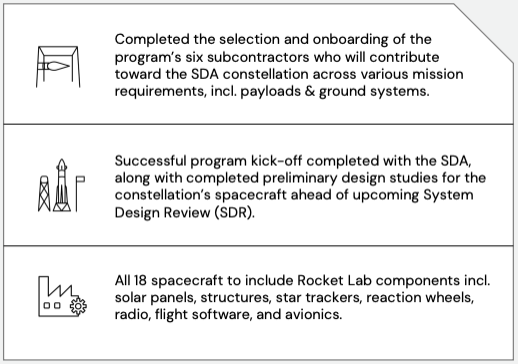

Providing an update on the $515 million SDA contract, which the company secured last year, the company revealed last month that it onboarded six subcontractors for this program in Q1 and completed preliminary design studies for the spacecraft as well.

Exhibit 2: SDA Constellation program highlights

Investor presentation

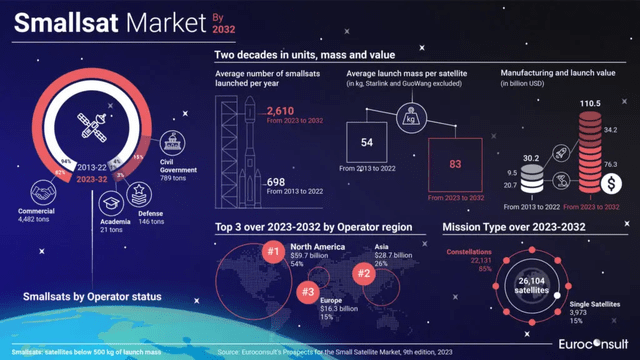

Securing this government contract and delivering it on time will position Rocket Lab as a reliable services provider in the space systems domain, which will open new doors to grow with the demand for specialized small satellites expected to grow exponentially through 2032. According to Euroconsult, the average number of small satellite launches per year between 2013 to 2022 was just 698, which is expected to grow to 2,610 for the 10 years from 2023 to 2032. This stellar growth will create strong demand for not just launch services but also for manufacturing, and Rocket Lab will be able to capture a meaningful share of this market if it continues to execute as expected.

Exhibit 3: Small satellite market statistics

Given the growing addressable market opportunity in the space systems sector, I will keep a close eye on Rocket Lab’s progress in meeting the deliverables for its contracts with the Space Development Agency.

Profitability Is Not A Mirage

Rocket Lab is continuing to secure new business with both existing and new customers, showcasing the value proposition offered by the company in the space sector. Within the small satellite market, the company’s launch service business and space systems business are well-positioned to grow in the next few years. Total revenue, which grew from $48 million in 2019 to $245 million in 2023, is on pace to see a meaningful acceleration to over $430 million this year, and I believe high double-digit growth will be the base-case scenario for at least another five years. Both operating and net income margins have improved in the last couple of years alongside the growing scale of the company, and a further expansion in margins will pave the way for Rocket Lab to inch toward profitability by 2027. The company is certainly not cheaply valued in the market at a forward P/E multiple of 5, but I find Rocket Lab attractively valued given the long runway for growth in a fast-growing industry.

Takeaway

Rocket Lab’s progress in recent quarters has been commendable, but Mr. Market has turned a blind eye to this impressive performance. Investors may have to weather unusual volatility in stock prices for much longer, but I believe RKLB, at these stock prices, offers long-term investors a favorable risk-reward profile.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.