Summary:

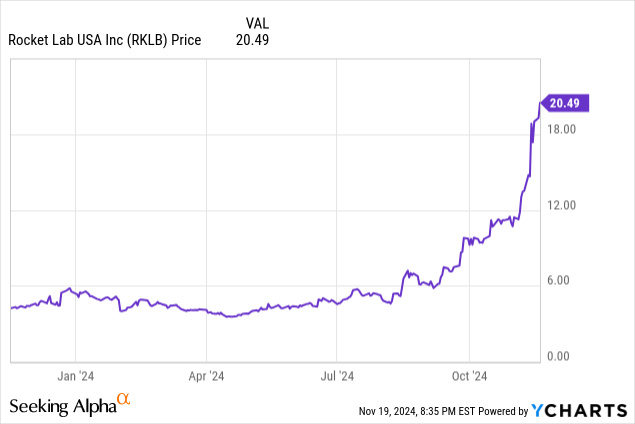

- Rocket Lab’s shares have surged 375% over the past year.

- Optimism about Neutron and strong Q3 2024 earnings have led the way.

- While the valuation is lofty, there is more potential upside here.

Alones Creative

Rocket Lab (NASDAQ:RKLB) shares have been on a scorching run lately as optimism over Neutron and an impressive earnings release have energized investors for the company’s future prospects. While this run-up necessitates caution, I believe those with a long-term investing horizon should continue to remain bullish and I’m reiterating a Buy.

Holy cow! RKLB shareholders rejoice as the stock is now up 375% over the last 12 months and up close to 115% since I wrote my last article on the company in early October just 6 weeks ago! In that piece, I recommended a Buy on account of the rapid and cost-efficient development of Neutron, the company’s upcoming medium-lift launch vehicle, and the prospects for the space systems segment, which doesn’t get as much buzz but is an equally important piece of the puzzle for RKLB’s value. That article can be read here.

My original thesis remains my current thesis, and the results of Rocket Lab’s Q3 2024 earnings report bear that out. Let’s do a quick recap:

- Revenue of $104.8 million (+54.9% YoY/Flat QoQ) and EPS of -$0.10 which is down/flat YoY and QoQ, but profitability isn’t really too relevant at this point in the company’s evolution.

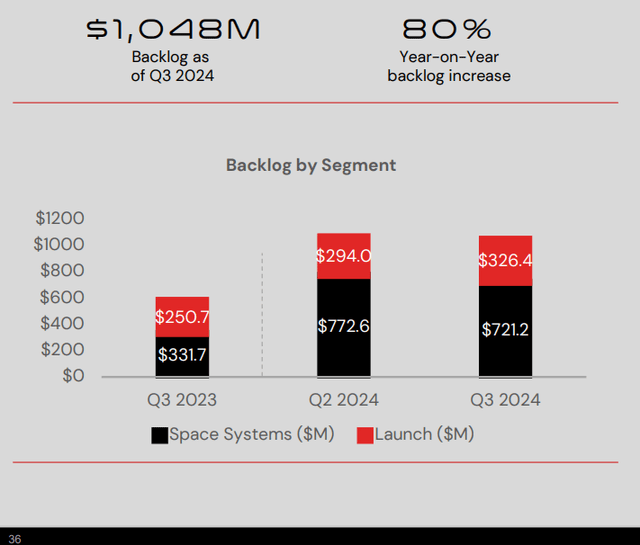

- Backlog of $1.05 billion, 69% space systems and 31% launch services, up 80% YoY. Rocket Lab typically expects 50% of the backlog to be recognized within 12 months.

- Non-GAAP gross margin of 31.3%, in line with expectations and +180 bps YoY and +60 bps QoQ.

Overall, the core financial results for the third quarter demonstrated continued strength in top line and backlog growth as Electron launches pile up, Neutron progress is well underway, and spacecraft development remains an under-the-radar growth driver.

Guidance for Q4 2024 was even more impressive with revenue expected between $125 million and $135 million (+116% YoY/+24% QoQ at the midpoint) on strength in space systems and an expected increase in frequency of Electron launches, and gross margin expected between 32% and 34%, a further boost over the already improved margin for Q3.

I think it’s apparent that Electron has been a highly successful venture in its own right, but especially as a bridge both from a revenue standpoint and from sandboxing standpoint — the revenue from these launches has helped to finance the development and refinement of Neutron, and the expertise Rocket Lab engineers have gained from Electron’s successes (and failures) has contributed to the rapid development timeline of Neutron and will assist in implementing vital features like rocket re-usability.

On that front, all lights appear to be green for Neutron as key milestones are achieved, and the Rocket Lab remains on track for an inaugural launch before year-end 2025. The company’s previous success and design proficiency have also led to the procurement of early contracts, as stated in the Q3 earnings call:

We’ve signed a launch agreement with the Constellation operator, which encompasses two very early launches on Neutron. Thanks to our proven track record with Electron, the space industry has come to expect high-performing reliable launch vehicles from Rocket Lab. Because of this, we have worked with a lot of different customers for Neutron’s first few missions, but we’re in the fortunate position to be able to choose who flies first and have made a careful and considered strategic decisions around that.

This is a major vote of confidence for Neutron and Rocket Lab as a whole, and bodes well for the company’s ability to compete for the plethora of government contracts and private interests that will require medium-lift launch services. For more details on these contracts and Neutron’s development, I highly recommend reading the Q3 earnings call transcript, which can be read here. Rocket Lab provides one of the most in-depth investor calls you’ll find anywhere in the market, and CEO Peter Beck’s passion for the business really shines through in his informative reviews.

Last but not least, space systems continues to thrive as Rocket Lab has been selected for several new contracts, including a cost-cutting study for NASA’s Mars Sample Return mission. This division remains a stalwart revenue base and, as Beck has stated many times, is one of the two vital pillars that will enable the company to offer end-to-end space services. That is, Rocket Lab’s ultimate vision is for the company to build the satellites/spacecraft, launch them on its own re-usable launch vehicles, and then operate them for customers. I included this quote from Beck in my previous article, but it bears repeating in order to demonstrate where the company is trying to go, so investors can evaluate its progress towards that goal:

If you break up the industry, launch is about a $10 billion TAM, spacecraft is about $20 billion. And then services from orbit is about a $320 billion TAM. So if you have the first two, then your ability to compete in the second one becomes incredibly strong.

While spacecraft is a larger piece of the pie now, and you see this reflected in revenue and backlog, perfecting launch is the more important and difficult problem precisely because it doesn’t generate a ton of revenue on its own despite being extremely capital intensive.

Rocket Lab Q3 Earnings Presentation

However, the reward for accomplishing both is significantly higher than either one separately. With Neutron, and the entrance into the medium-lift launch space it provides, Rocket Lab is well on its way towards achieving Beck’s desired result.

At a market cap of almost $10 billion and with traditional valuation metrics mostly irrelevant, it’s tough to know where RKLB might go from here. Using consensus estimates from Seeking Alpha, shares are trading at around 16.6 times FY2025 expected revenue, which is quite rich. There is obvious upward momentum and upside potential here for a company still in its infancy, but with many more months to go before Neutron officially launches, I think investors should expect to see some major volatility (though for long-time RKLB holders, this will be a familiar experience).

Those with a low-risk tolerance and who have made substantial profits on this run-up should consider trimming their holdings and waiting for an entry point on a potential pull-back. As the news headlines fade, I think we might see shares gradually inch down as the momentum investors filter out — until the next big announcement, that is. For investors who don’t hold a position but are interested in the company, I think a speculative buy as part of a diversified portfolio could be a solid play, even at current levels.

Investor Takeaway

RKLB has provided an impressive return on investment in a short amount of time on upbeat earnings results and the achievement of key milestones in Neutron’s development. The company certainly has upward momentum going into the end of the year and into the expected late 2025 launch of the company’s medium-lift launch vehicle, which will put Rocket Lab on the fast track to becoming an end-to-end space services provider.

From a valuation standpoint, the stock isn’t cheap, but the total addressable market opportunity here cannot be denied. I am reiterating a Buy rating for RKLB, with the caveat that investors with low-risk tolerance and investors looking for to start an initial position might want to consider waiting for a better entry point.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.